Markets

Nvidia's CEO Offered Over $700 Million in Inventory. Ought to You Comply with Swimsuit?

Nvidia (NASDAQ: NVDA) CEO and founder Jensen Huang has been persistently promoting a few of his shares for months now. Despite the fact that Nvidia achieved a number of highs previously few months, he saved promoting, which can lead some individuals to imagine that as a result of Nvidia’s insiders are promoting, they know the enterprise is on the high.

So, with the top man dumping inventory, must you comply with go well with? Or is there one thing else occurring right here?

Simply because a CEO is promoting a inventory doesn’t suggest the corporate is doomed

First, let’s keep in mind a reality: These CEOs are human. They don’t seem to be robots, in order that they have wants and needs as effectively. What are some causes you might promote inventory? You might need to purchase a automotive, put money into one thing else, buy a home, or pay for a child’s faculty tuition. Or, perhaps you are nearing retirement and need to have a bigger money stability to be extra conservative. Regardless of the purpose could also be, there are many causes to promote a inventory.

Another excuse to promote could possibly be underlying points that solely the CEO is aware of about. This might even be a warning flag, however it might probably be accompanied by different insiders promoting as effectively.

When an insider begins promoting, it may be seen extra as noise relatively than a sign as a result of we do not know why Huang is promoting. However as a result of Huang offered 120,000 shares each buying and selling day since June 13 via at the very least mid-September, it is pretty apparent these are all deliberate gross sales and an effort to not overload his private funds with Nvidia’s inventory efficiency. Throughout the promoting interval, Huang offered almost 6 million shares of Nvidia inventory, which is valued at round $700 million at immediately’s costs.

That is numerous shares, however it’s solely a fraction of what Jensen Huang really owns.

As of March 25, 2024, Huang owned round 93.5 million shares of Nvidia. Though that is an outdated determine as a result of a part of his wage is inventory choices, it clues traders in that Huang is not tremendously involved about Nvidia’s future; in any other case, he’d be promoting a lot extra inventory.

However ought to traders be taught some classes right here?

Particular person traders have causes to promote, too

Nvidia’s inventory has been on a monster run for almost two years. In consequence, it could be a big chunk of your portfolio. So, the query arises: When is it time to take features?

If you end up dropping sleep, being in a foul temper on down market days, or obsessing over Nvidia’s inventory value each morning when the market opens, it could be smart to promote some shares to cut back your focus.

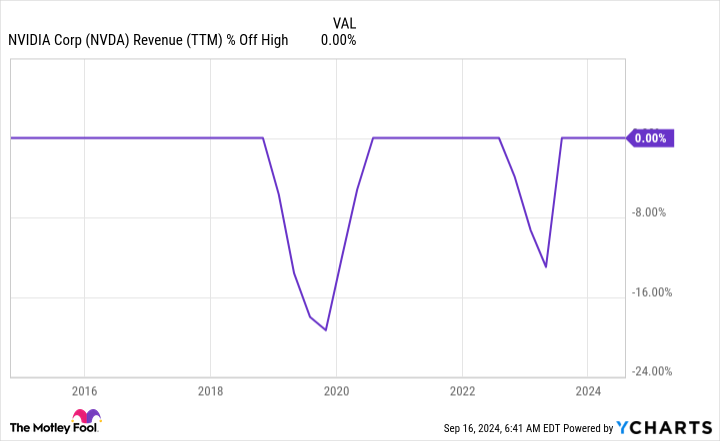

Moreover, Nvidia is thought to be cyclical. It has gone via increase and bust cycles earlier than, though it has by no means skilled as a lot of a increase as its present state. Whereas there appears to be no signal of Nvidia slowing down, demand will ultimately subside, which might result in a value drop.

Lastly, the numbers in your brokerage account do not imply something till you promote. So, till you lock in some features, all the earnings you suppose you made are simply on paper.

You’re probably sitting on huge earnings in the event you invested in Nvidia in 2023 or 2024. It is time to take stock and perhaps comply with Huang’s lead and to make sure you’re not too leveraged to Nvidia.

Synthetic intelligence investing is an enormous discipline, and can be found out there proper now.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $715,640!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

FedEx, PepsiCo, Trump Media fall premarket; Nike rises

Lusso’s Information — US inventory traded in tight ranges Friday, consolidating after the earlier session’s sharp positive aspects within the wake of the Federal Reserve’s hefty rate of interest reduce.

Listed here are among the greatest premarket US inventory movers at this time

-

FedEx (NYSE:) inventory slumped 13% after the logistics group reduce its full-year steering and reported fiscal first-quarter earnings that fell nicely in need of Wall Road expectations.

-

Nike (NYSE:) inventory rose 5.7% after the athletic attire agency introduced that Chief Govt John Donahoe is about to step down from the place subsequent month.

-

PepsiCo (NASDAQ:) inventory fell 1.1% after Morgan Stanley downgraded its stance on the gentle drinks large to “equal-weight” from “obese”, citing the danger of US income development.

-

Financial institution of America (NYSE:) inventory fell 0.4% after Berkshire Hathaway (NYSE:) resumed gross sales of the financial institution’s inventory in latest days, unloading about $900 million value of shares and dropping its stake to $34 billion, or 10.8% of the shares excellent.

-

Trump Media & Know-how Group (NASDAQ:) inventory fell 4.5%, extending the sharp losses in latest weeks fueled by worries in regards to the finish of so-called lock-up interval associated to its inventory market debut in March.

-

Apple (NASDAQ:) inventory fell 0.4% after iPhone 16 resale costs on September 20, the primary day of cargo, have “collapsed inside the first three hours of buying and selling,” based on analysts at Jefferies.

-

Lennar (NYSE:) inventory fell 2.9% regardless of the homebuilder reporting better-than-expected third quarter outcomes as new residence orders elevated amid sturdy housing demand.

Markets

Funding advisers urge shoppers away from money after Fed price minimize

By Suzanne McGee and Carolina Mandl

(Reuters) – Funding advisers are urging shoppers to dump hefty money allocations now that the Federal Reserve has begun its much-anticipated interest-rate easing, a course of they count on to restrict the attraction of money-market funds within the coming months.

Retail money-market funds have attracted $951 billion in inflows since 2022, when the Fed began its rate-hiking cycle to tame inflation, in accordance with the Funding Firm Institute, which represents funding funds. Their belongings stood at $2.6 trillion on Sept. 18, roughly 80% larger than in the beginning of 2022.

“As coverage charges fall, the attraction of money-market funds will wane,” mentioned Daniel Morris, chief market strategist at BNP Paribas Asset Administration.

On Wednesday, the U.S. central financial institution minimize the federal funds price by a larger-than-usual 50 foundation factors to a spread of 4.75% to five%, which makes holding money in deposit accounts and cash-like devices much less interesting.

“You are going to should shift every little thing … additional up within the quantity of threat you are accepting,” mentioned Jason Britton, Charleston-based founding father of Reflection Asset Administration, who manages or oversees round $5 billion in belongings. “Cash-market belongings must change into fixed-income holdings; fastened revenue will transfer into most well-liked shares or dividend-paying shares.”

Cash-market funds – extremely low-risk mutual funds that put money into short-term Treasury securities and different money proxies – are a option to gauge investor curiosity within the almost risk-free returns they provide. When short-term rates of interest climb, money-market returns rise with them, rising their attraction to buyers.

“Buyers must be conscious that in the event that they’re relying on a sure degree of revenue from that portion of their portfolio, they might want to have a look at one thing completely different, or longer-term, to lock in charges and never be as uncovered to the Fed reducing rates of interest,” mentioned Ross Mayfield, funding strategist at Baird Wealth.

Carol Schleif, chief funding officer of BMO Household Workplace, expects buyers to maintain some money on the sidelines to attend for alternatives to purchase shares.

It might take every week or extra for preliminary reactions to the Fed’s choice on Wednesday to indicate up in money-market fund flows and different knowledge, analysts be aware. Whereas the Funding Firm Institute reported an total decline in money-market holdings in its final weekly report on Thursday, retail positions had been little modified to larger and advisers mentioned it has been robust to influence that group to desert their money holdings.

Christian Salomone, chief funding officer of Ballast Rock Non-public Wealth, mentioned shoppers confronted with decrease returns on money are desperate to put money into one thing else.

Nonetheless, “buyers are caught between a rock and a tough place,” Britton mentioned, confronted with a selection between investing in riskier belongings or incomes a smaller return from cash-like merchandise.

(Reporting by Suzanne McGee and Carolina Mandl; further reporting by Davide Barbuscia; modifying by Megan Davies and Rod Nickel)

Markets

Nio launches Onvo L60, inventory to ‘rise in absolute phrases over the subsequent 15 days,’ analysts say

Nio (NYSE:) on Thursday unveiled its new electrical SUV, the Onvo L60, priced decrease than what the market anticipated.

Shares in Nio jumped greater than 7% Thursday.

“NIO’s share value ought to react positively to the superior price-performance of L60. Nevertheless, with demand seemingly much less of a doubt now, well timed demand achievement would in flip change into the important thing concern – possible a very good drawback to have,” Morgan Stanley analysts commented.

Following a greater than 20% surge in NIO’s inventory month-to-date, in comparison with a 1% acquire for the Nasdaq, expectations for order consumption have elevated considerably.

In keeping with Morgan Stanley analysts, for NIO to see additional substantial re-rating, it can require sturdy execution in scaling up manufacturing and sustaining a optimistic buyer expertise amidst the inflow of orders, which they spotlight as “essential to show NIO is structurally on the rise.”

Nio’s aggressive pricing technique ought to assist the Onvo supply goal of 20,000 items within the fourth quarter, analysts added, with the possible upbeat demand anticipated to place strain on the corporate’s ramp-up tempo.

In a separate notice, Morgan Stanley analysts stated they imagine Nio’s share value “will rise in absolute phrases over the subsequent 15 days.”

NIO launched the ONVO L60 at a lower-than-expected MSRP of RMB 206,900, which features a 60kWh battery and is RMB 13,000 decrease than the pre-sale value. The BaaS mannequin, excluding the battery pack, is RMB 57,000 cheaper, priced at RMB 149,000.

Morgan Stanley analysts imagine that this aggressive pricing, together with extra incentives similar to an early fowl low cost of as much as RMB 4,000 and an area authorities trade-in subsidy of RMB 10,000, is anticipated to drive larger order conversions and enhance gross sales.

The analysts estimate a 70% to 80% likelihood of this optimistic situation taking part in out.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024