Markets

Financial institution of America Takes a Bullish Stance on These 2 Shares

The Federal Reserve’s FOMC committee will meet as we speak, and with the tempo of inflation all the way down to an annualized fee of two.5%, the standard knowledge expects the central financial institution to begin chopping charges. The Fed has held its key funds fee on the 5.25% to five.50% vary since July of final yr, in response to a generational spike in inflation.

Most Fed watchers are predicting that the financial institution’s governors will approve a lower of 25 foundation factors, or 0.25%. Whereas modest, that will mark the tip of a 14-month tight cash coverage.

For Financial institution of America, the Fed assembly is probably going to supply a catalyst to the markets. “This week, the Fed is anticipated to formally begin its chopping cycle after its longest maintain on the peak of a mountain climbing cycle in its historical past,” the financial institution’s fairness strategist, Ohsung Kwon, famous. “We anticipate the Fed to chop charges by a typical 25bp, however markets see a comparatively excessive chance of a 50bp lower. In our view, the info don’t warrant a 50bp lower as exercise stays wholesome. That stated, the market uncertainty over 25bp or 50bp signifies that the assembly will probably be a buying and selling catalyst…”

In the meantime, towards this backdrop, Financial institution of America analysts are bullish on two explicit shares, forecasting double-digit upside potential for every. We’ve used the to see if these picks align with Wall Avenue analysts’ views. Let’s take a more in-depth look.

Hewlett Packard Enterprise (HPE)

The primary inventory on our BofA-backed checklist is Hewlett Packard Enterprise, an organization spun off from Hewlett-Packard in 2015. HPE inherited its father or mother firm’s server, storage, and networking companies, and took them public by itself hook. The corporate now supplies a variety of options, for every thing from information assortment and intelligence, to information safety, to edge-to-cloud computing, to hybrid cloud operations. These are all providers in excessive demand from AI corporations and builders – and the growth in AI guarantees a boon to HPE.

In a transaction that’s positive to garner loads of consideration, HPE is within the technique of finishing its acquisition of Juniper Networks. The $14 billion deal is anticipated to convey benefits to HPE’s cloud and AI-native networking capabilities, and to be accretive to earnings within the first yr post-close. The Juniper deal is anticipated to finalize earlier than the tip of this yr.

Initially of this yr, HPE introduced on board a brand new CFO, Marie Myers, who had beforehand served on the agency’s father or mother firm. Myers has a fame for pushing innovation and efficiency, and her remit with HPE consists of chopping prices and enhancing effectivity.

On the monetary facet, HPE’s robust AI product traces, and an ongoing cyclical enchancment within the AI sector’s outlook, proved to be a income driver within the lately reported fiscal 3Q24 (July quarter). The corporate’s prime line was up simply over 10% year-over-year, to achieve $7.7 billion, and beat the estimates by $40 million. On the backside line, HPE realized a revenue of fifty cents per share in non-GAAP measures, a determine that was 3 cents per share forward of the forecast.

Return-minded traders ought to word that HPE has additionally declared its subsequent dividend cost, at 13 cents per frequent share. This cost, scheduled for this coming October 18, annualizes to 52 cents per frequent share and provides a sound ahead yield of two.9%.

For Financial institution of America’s 5-star analyst Wamsi Mohan, this inventory brings a number of strong benefits to the desk. In his assessment, Mohan lays them out clearly, writing, “We view shares as enticing as we see the chance for (1) Vital price cuts pushed by new CFO Marie Myers with a confirmed monitor report at HPQ, (2) Cyclical restoration throughout servers, storage and notably networking, (3) Rev and elevated price synergies with the upcoming Juniper acquisition, (4) Excessive Efficiency Compute (HPC) margin restoration from depressed ranges and (5) AI beneficiary as Enterprise/Sovereign demand will increase.”

These components help Mohan’s score improve, to a Purchase (from Impartial). His worth goal, set at $24, implies the inventory will acquire 32% within the yr forward. (To look at Mohan’s monitor report, )

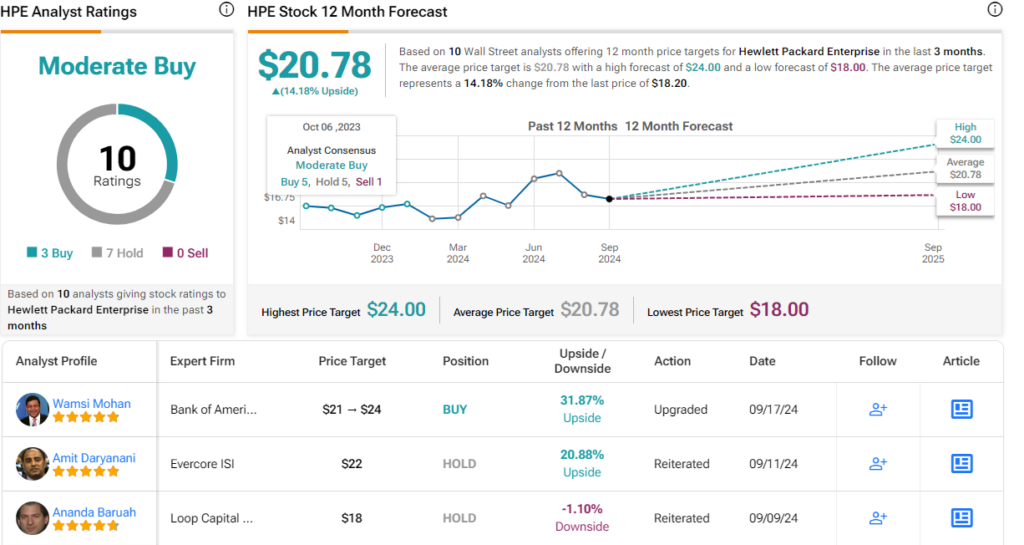

Turning now to the remainder of the Avenue, the place HPE has a Average Purchase consensus score primarily based on 10 evaluations that embrace 3 Buys and seven Holds. The shares are buying and selling for $18.20 and the common worth goal of $20.78 suggests a one-year upside potential of 14%. (See )

GE Vernova (GEV)

Subsequent on our BofA-endorsed checklist is one other firm that originated as a spin-off from a big father or mother agency. GE Vernova was fashioned as an unbiased firm earlier this yr, when the father or mother agency Normal Electrical first merged, after which spun off, its GE Energy and GE Renewable Power divisions. GE Vernova is an electrical energy firm, manufacturing and offering vitality tools, and offering help providers. The corporate has a deal with ‘inexperienced’ expertise, and has a publicly acknowledged goal of reaching carbon neutrality in its operations and amenities by the yr 2030. GE Vernova’s clients generate roughly 25% of the world’s electrical energy, placing this inexperienced tech agency ready to guide the worldwide transition to cleaner energy.

Counting again to the father or mother firm’s founding, GE Vernova can financial institution on 130 years of expertise within the area. The corporate has roughly 55,000 wind generators and seven,000 gasoline generators at present in operation, and employs greater than 75,000 folks in additional than 100 nations.

Along with its wind and gasoline turbine applied sciences and merchandise, GE Vernova additionally presents options for hydroelectric energy, nuclear energy, and even steam energy technology. All of those have contributions to make to the worldwide want for electrical energy, and every has various mixtures of attributes to suit any scenario conceivable. GEV’s hydro energy options are at present in use with greater than 25% of the world’s put in hydroelectric producing capability. The corporate’s providers enterprise has a 65% backlog, which is anticipated to supply a gentle money circulate stream going ahead.

GE Vernova has launched two units of economic outcomes since going public this previous spring. The newer of the 2, launched in July, coated 2Q24 and confirmed a prime line of $8.2 billion. Whereas this missed the forecast by $60 million, it’s essential to notice that the corporate additionally reported $11.8 billion in complete orders, a metric that bodes effectively going ahead. On the backside line, GE Vernova had earnings of $4.65 per share. The corporate’s money stability was $5.8 billion, up considerably from the $4.2 billion the agency had on the time of its spin-off.

Andrew Obin, one other 5-star analyst from Financial institution of America, believes this firm exhibits loads of underlying energy. He writes of its general potential, “We imagine GEV shares can ship beat and lift ends in many coming quarters. We see the December tenth investor occasion as a optimistic catalyst. We anticipate administration to lift its medium-term targets and probably announce a buyback, given the build-up of extra money. We argue US electrical progress is poised to speed up and GE Vernova has better US publicity relative to friends.”

Entering into extra specifics, Obin provides, “Given our larger progress and profitability estimates for Fuel Energy Companies, we elevate our 2025 adj. EBITDA estimate by $0.5bn to $3.6bn and 2026 by $1.1bn to $5.4bn. Our estimates are 16% above/27% larger than present consensus, respectively.”

In Obin’s eyes, that is one other inventory price a rankings improve from Impartial to a Purchase. He enhances that with a $300 worth goal to point out his confidence in a one-year acquire of 26.5%. (To look at Obin’s monitor report, )

General, this newly public inventory has a Sturdy Purchase consensus score primarily based on 13 current evaluations that break all the way down to a lopsided 12 Buys and 1 Maintain. That stated, contemplating the shares’ massive good points (up by 73% over the previous 6 months), the common worth goal of $238.23 suggests the inventory will keep rangebound in the intervening time. (See )

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ , a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your individual evaluation earlier than making any funding.

Markets

Skechers Inventory Tumbles as CFO Offers Warning on China Outlook

(Lusso’s Information) — Skechers U.S.A. Inc. shares delivered their worst every day efficiency since February after the footwear firm’s chief monetary officer informed an trade convention that China gross sales will likely be underneath stress the remainder of the yr.

Most Learn from Lusso’s Information

Shares slipped 9.6% Thursday to shut at $61.56, the bottom stage since early August. Footwear friends together with Nike Inc. and Beneath Armour Inc. noticed their shares briefly dip on the feedback, then rebound. The inventory of competitor On Holding AG shed 2.4%.

“We’ve undoubtedly seen worse circumstances unfold in China than we anticipated for the again half of the yr, so I’d count on the again of the yr’s going to be extra disappointing than what we had initially thought,” stated Skechers CFO John Vandemore on the Wells Fargo Client Convention. “I believe that’s a market that’s nonetheless re-forming itself submit Covid.”

China is a serious marketplace for international retailers, and considerations concerning the energy of Chinese language shopper shopping for have lengthy been a spotlight. The Asia Pacific area accounted for greater than 1 / 4 of Skechers’ gross sales in 2023, in line with a submitting.

Thursday’s droop put Skechers shares in detrimental territory for the yr. Nonetheless, Wall Avenue is bullish on the corporate.

Wall Avenue analysts give Skechers 17 purchase scores and one maintain, in line with knowledge compiled by Lusso’s Information. The typical worth goal of about $81 is greater than 30% greater than the place shares presently commerce.

–With help from Janet Freund.

(Updates inventory transfer at market shut)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Walt Disney appoints 'Moana' author Jared Bush as inventive head of animation studios

(Reuters) – Walt Disney (NYSE:) Animation Studios, in a big management shift, on Thursday named Academy Award-winning filmmaker Jared Bush as its new chief inventive officer, efficient instantly.

Bush, the inventive drive behind film hits corresponding to “Encanto,” “Zootopia,” and author of the unique Oscar-nominated hit “Moana” takes the reins from Jennifer Lee, who will return to filmmaking full time to steward the wildly profitable “Frozen” franchise.

Lee joined Walt Disney Animation Studios in 2011 as co-writer of “Wreck-It Ralph” and author of “Frozen.” After serving as CCO since 2018, she’s going to now concentrate on directing and writing “Frozen 3” and co-writing “Frozen 4” with Marc Smith.

A Disney veteran of over a decade, Bush will oversee the inventive output of the enduring animation studio, together with its movies, sequence and related tasks, Disney mentioned in a press release.

Bush is presently engaged on “Zootopia 2” and serves as the author and government producer of the upcoming “Moana 2,” that are on account of launch within the fall of 2025 and 2024, respectively, Disney mentioned. (This story has been refiled to say that ‘Zootopia 2’ will launch within the fall of 2025 and ‘Moana 2’ will launch within the fall of 2024, not 2025, in paragraph 5)

Markets

The Fed is following its 1995 playbook — and that's nice information for shares and the economic system

-

The Fed seems prefer it’s following the identical path it did in 1995, in response to TS Lombard.

-

That units the stage for the economic system to keep away from a recession because it did within the 90s, the agency stated.

-

It is also nice information for shares, because the S&P 500 greater than doubled in worth that decade.

The Fed is following a 30-year-old playbook with its rate of interest strikes — and that is excellent news for the US economic system, in response to TS Lombard.

The agency pointed to the central financial institution’s to the federal fund price this week. That was , and it might lay the groundwork for a booming inventory market and economic system, in response to Dario Perkins, the agency’s managing director of worldwide macro.

He notes that the Fed’s newest price lower has created a parallel to what central bankers did in 1995, when Fed officers eased the Federal funds price from a peak of 6% to round 4.75% over three years. That took rates of interest again to a impartial stage, stave off a recession, and in the end spark a brand new financial growth.

By 1998, GDP progress had accelerated from 4.4% to just about 5%. In the meantime, the S&P 500 soared 125% by the top of the Fed’s slicing cycle, in response to knowledge from the .

Fed officers look on observe to drag off the identical maneuver, Perkins advised, attributing this week’s jumbo-sized price lower to central bankers’ perception that they had been additional away from the impartial price than they had been a number of many years in the past.

“Our view is that this slicing cycle will most likely play out like Greenspan’s mid-course ‘re-calibration’ of coverage within the mid-Nineteen Nineties,” Perkins stated in a be aware on Wednesday. “Even when the US labour market deteriorates greater than we count on and the Fed falls behind the curve, there isn’t any actual risk of a deep recession.”

Shares soared a day after the large price lower. Regardless of wobbling within the hours after the Fed’s price transfer, the foremost indexes hit recent information in Thursday trades.

“We expect the smooth touchdown remains to be very a lot in play,” Perkins added. “And whereas the hazard of the Fed falling behind the curve is actual, we predict the repercussions could be manageable. It’s arduous to foresee something worse than a gentle recession,” he later wrote.

Some forecasters are nonetheless cautious of the Fed’s newest coverage transfer attributable to considerations that slicing rates of interest too shortly might ignite a recent bout of inflation. The market, although, has largely shrugged off that threat, with remaining simply above 2% in September, in response to Cleveland Fed knowledge.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now