Markets

Asian Equities Brace for Fed Impact, Yen Slips: Markets Wrap

(Lusso’s Information) — Asian equities braced for a tailwind from the Federal Reserve’s half-point fee minimize and indicators of additional coverage easing within the months forward.

Most Learn from Lusso’s Information

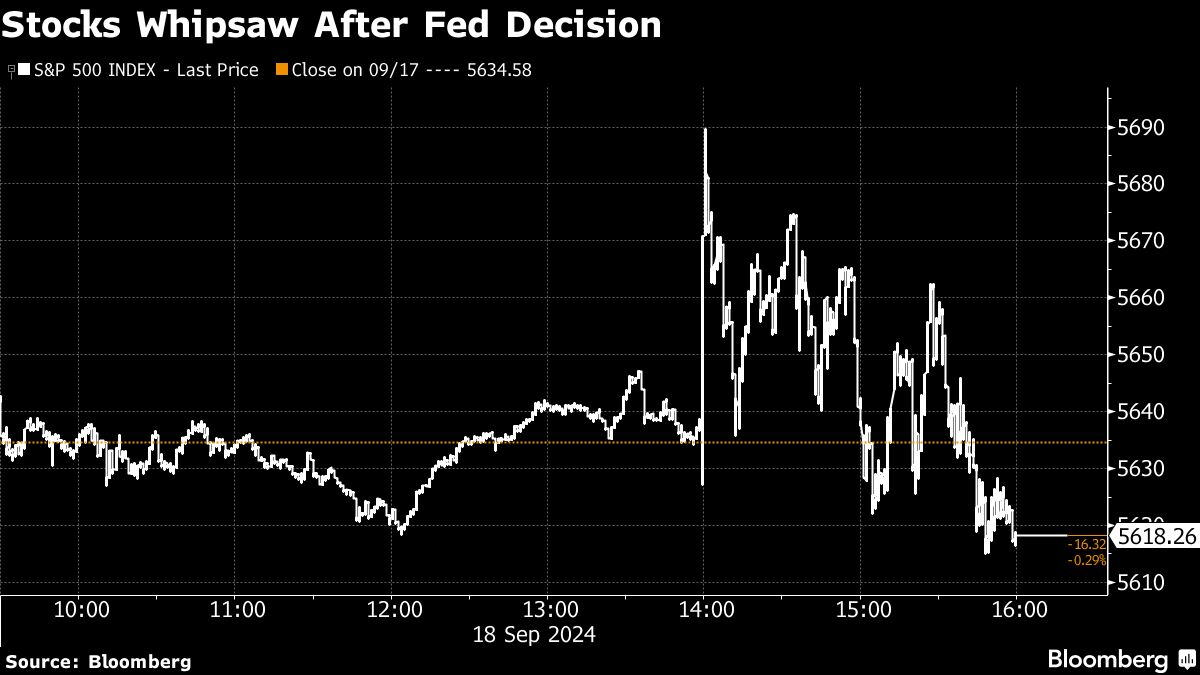

Japanese fairness futures rose, whereas contracts for US benchmarks additionally climbed, to largely erase Wednesday’s losses. The S&P 500 initially touched a file excessive earlier than closing 0.3% decrease, whereas the Nasdaq fell 0.5%. Australian fairness futures had been barely decrease whereas Hong Kong markets resume buying and selling after a vacation.

The Fed’s first minimize in additional than 4 years was accompanied by projections indicating a slim majority favored a further 50 foundation factors of cuts throughout the remaining two coverage conferences this 12 months. Markets had been pricing in a extra aggressive 70 foundation factors of reductions. Fed Chair Jerome Powell cautioned in opposition to assuming large fee cuts would proceed.

An index of greenback energy pared its beneficial properties from the earlier session early on Thursday, whereas the yen weakened to commerce at round 142 per buck. Treasury 10-year yields superior six foundation factors to three.7% on Wednesday with Australian and New Zealand bonds monitoring the strikes in early buying and selling.

“The speed-cut was a primary step of the powerful job for the Fed to handle soft-landing of economic system,” stated Ayako Sera, a market strategist at Sumitomo Mitsui Belief Financial institution Ltd. in Tokyo. “Merchants will proceed to weigh how deep the Fed would minimize fee, giving the dollar-yen downward strain going ahead resulting from a decline in US rates of interest. That stated, Japanese shares is about to rise immediately after the yen weakened in a single day in any case.”

Within the US, equities, particularly these of economically delicate corporations, briefly surged Wednesday, driving the S&P 500 up as a lot as 1%. From shares to Treasuries, company bonds to commodities, each main asset was down Wednesday. Whereas the size of the declines had been minor, a concerted pullback like that hadn’t adopted a Fed coverage determination since June 2021.

Gold pulled again from a file excessive whereas oil edged decrease as indicators of weak demand outweighed rising tensions within the Center East.

“Although the Fed sometimes avoids acknowledging coverage missteps, it seems that the bigger than-expected preliminary fee minimize displays an effort to appropriate a slight lag in earlier selections,” Manish Bhargava, chief government officer at Straits Funding Administration, stated. “By performing now, the Fed is taking a preemptive step to extend the chance of reaching a smooth touchdown, balancing each its mandates in an more and more unsure financial atmosphere.”

In Asia, the Hong Kong Financial Authority minimize its base rate of interest for the primary time since 2020 following the Fed’s minimize, whereas New Zealand’s economic system shrank within the second quarter. Information set for launch within the area contains unemployment for Australia and Hong Kong, commerce figures for Malaysia and an rate of interest determination in Taiwan.

Elsewhere, the Financial institution of England is prone to chorus for chopping charges for a second consecutive assembly.

In considering the market response to a half-point minimize coming into the assembly, some anticipated the response to be constructive due to the profit to the economic system, some anticipated a drop resulting from ‘what do they know that we don’t know’ logic, in response to Mark Hackett at Nationwide.

“The shortage of directional transfer was the least seemingly consequence, however it’s the one which we received,” Hackett stated. “The S&P 500 is having a tough time breaking via July’s file excessive, and the extra failed breakouts that we observe, the harder one shall be to realize.”

Treasuries, that are set for a fifth-straight month of beneficial properties in September, slipped after the Fed’s determination and Powell’s remarks. Officers’ up to date quarterly forecasts confirmed the median projections had been for the funds fee to fall by 12 months’s finish to 4.375% — representing an extra half-point of complete reductions this 12 months. By the top of 2025 and 2026, the median forecasts are for 3.375% and a pair of.875%, respectively.

“It now shall be a battle between market expectations and the Fed, with employment knowledge — not inflation knowledge — figuring out which aspect is true,” stated Jack McIntyre at Brandywine World. “Now, everyone seems to be again to knowledge dependency.”

Key occasions this week:

-

UK fee determination, Thursday

-

US Conf. Board main index, preliminary jobless claims, present residence gross sales, Thursday

-

FedEx earnings, Thursday

-

Japan fee determination, Friday

-

Eurozone client confidence, Friday

A number of the foremost strikes in markets:

Shares

-

S&P 500 futures rose 0.3% as of 8:34 a.m. Tokyo time

-

Grasp Seng futures had been unchanged

-

S&P/ASX 200 futures fell 0.5%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1111

-

The Japanese yen fell 0.3% to 142.71 per greenback

-

The offshore yuan was little modified at 7.0956 per greenback

-

The Australian greenback fell 0.1% to $0.6757

Cryptocurrencies

-

Bitcoin rose 1.7% to $61,246.78

-

Ether rose 1.3% to $2,354.98

Bonds

Commodities

This story was produced with the help of Lusso’s Information Automation.

–With help from Winnie Hsu and Yasutaka Tamura.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Why Intuitive Machines Inventory Rocketed 24% Skyward on Thursday

The inventory of house exploration firm Intuitive Machines (NASDAQ: LUNR) strongly defied gravity on Thursday. It closed the day greater than 24% greater, thanks in no small half to information of a significant price-target enhance from an analyst. That transfer got here mere days after the corporate delivered a number of the greatest information it is ever reported.

Over the moon about NASA’s moon contract

The elevate was enacted by B. Riley‘s Mike Crawford, who now feels a good worth estimation for Intuitive Machines must be significantly greater. He raised his by 50%, to $12 per share from the earlier $8, and maintained the present purchase suggestion. The brand new anticipates upside of 29% on the inventory’s most up-to-date shut.

It is not arduous to be glowingly bullish on Intuitive Machines as of late. On Tuesday, the corporate was chosen by the Nationwide Aeronautics and Area Administration (NASA) as the only enterprise to ascertain a between our planet and the moon.

Within the grand custom of main federal contracts, this one is doubtlessly value fairly a little bit of coin. All instructed the association, which will likely be in pressure for 5 years with an possibility to increase to 10, may pay out as a lot as $4.8 billion for the stipulated providers.

A shock solo choice

Crawford didn’t anticipate Intuitive Machines could be the one winner of the contract; he anticipated one or two different suppliers would even be chosen for the NASA venture. This added to his impression that the formidable firm “is shortly establishing itself as a full-service house exploration firm on the cusp of layering in a whole bunch of thousands and thousands of {dollars} of high-margin providers income, enabling an extended tail of sturdy free money move technology.”

Do you have to make investments $1,000 in Intuitive Machines proper now?

Before you purchase inventory in Intuitive Machines, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Intuitive Machines wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $694,743!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

SpaceX 'forcefully rejects' FAA conclusion it violated launch necessities

By David Shepardson

WASHINGTON (Reuters) -SpaceX stated Thursday it “forcefully rejects” the Federal Aviation Administration’s conclusion that Elon Musk’s firm did not observe U.S. rules throughout two rocket launches, alleged violations carrying $633,000 in fines.

The FAA on Tuesday faulted SpaceX’s actions forward of launches in June and July of 2023 in Cape Canaveral, Florida, prompting Musk to name the fines politically motivated and threaten to sue to contest them.

Musk has chafed for years at what he sees as authorities inefficiency and has battled with federal regulators. SpaceX should acquire FAA signoffs for rocket launches and new expertise.

Late Thursday Musk asserted FAA leaders attacked SpaceX “for petty issues that don’t have anything to do with security, whereas neglecting actual issues of safety at Boeing (NYSE:). That is deeply fallacious and places human lives in danger.”

Musk cited the NASA resolution to not have astronauts return to earth in Boeing’s Starliner spacecraft after a three-month take a look at mission hobbled by technical points. “As a substitute of fining Boeing for placing astronauts in danger, the FAA is fining SpaceX for trivia!” Musk wrote on X.

Neither the FAA nor Boeing responded to requests for remark about Musk’s X submit.

David Harris, SpaceX vice chairman for authorized, despatched a letter on Wednesday to the leaders of two congressional committees that oversee the FAA, increasing on the corporate’s objections and asserting its dedication to security.

“SpaceX forcefully rejects the FAA’s assertion that it violated any rules,” Harris wrote.

The FAA, Harris wrote, was failing to “maintain tempo with the industrial spaceflight trade” and recommended the tremendous will be the company’s response to elevated congressional scrutiny of the FAA’s oversight of the industrial house trade.

SpaceX stated it has been clear for a while the FAA’s industrial house workplace “lacks the assets to well timed evaluate licensing supplies” and “mistakenly focuses its restricted assets on areas unrelated to its public security regulatory scope.”

Requested in regards to the letter, the FAA stated it “doesn’t touch upon energetic enforcement points.”

In proposing the fines, the FAA stated SpaceX did not acquire approval to revise the communications plan associated to its license for the June 2023 launch of a rocket carrying an Indonesian telecommunication satellite tv for pc. The company stated SpaceX added a brand new launch management room with out approval and eliminated a compulsory telephone name between the corporate, FAA and different launch workers regarding pre-launch readiness procedures.

SpaceX stated the FAA did not evaluate modifications in a well timed method earlier than the launch despite the fact that the company had advance discover of six weeks, and added that the modifications it made have been ones that didn’t require regulatory approval.

The FAA additionally stated SpaceX used an unapproved community of propellant tanks that ship gas to the rocket earlier than the July 2023 launch of a communications satellite tv for pc for the corporate Echostar (NASDAQ:). SpaceX stated the FAA subsequently accredited using this community of tanks for a subsequent launch and determined it could not influence security.

SpaceX has 30 days to formally reply to the FAA.

In February 2023, the FAA proposed a $175,000 civil penalty in opposition to SpaceX for failing to submit some security information to the company previous to an August 2022 launch of Starlink satellites. The corporate paid that tremendous, in keeping with the FAA.

In September 2023, the FAA accomplished an investigation into SpaceX’s April 2023 take a look at launch of its large Starship rocket, requiring the corporate to implement dozens of corrective measures.

Republican presidential candidate Donald Trump has stated he would set up a authorities effectivity fee headed by Musk if he wins the Nov. 5 election. Musk has endorsed Trump.

Markets

Skechers Inventory Tumbles as CFO Offers Warning on China Outlook

(Lusso’s Information) — Skechers U.S.A. Inc. shares delivered their worst every day efficiency since February after the footwear firm’s chief monetary officer informed an trade convention that China gross sales will likely be underneath stress the remainder of the yr.

Most Learn from Lusso’s Information

Shares slipped 9.6% Thursday to shut at $61.56, the bottom stage since early August. Footwear friends together with Nike Inc. and Beneath Armour Inc. noticed their shares briefly dip on the feedback, then rebound. The inventory of competitor On Holding AG shed 2.4%.

“We’ve undoubtedly seen worse circumstances unfold in China than we anticipated for the again half of the yr, so I’d count on the again of the yr’s going to be extra disappointing than what we had initially thought,” stated Skechers CFO John Vandemore on the Wells Fargo Client Convention. “I believe that’s a market that’s nonetheless re-forming itself submit Covid.”

China is a serious marketplace for international retailers, and considerations concerning the energy of Chinese language shopper shopping for have lengthy been a spotlight. The Asia Pacific area accounted for greater than 1 / 4 of Skechers’ gross sales in 2023, in line with a submitting.

Thursday’s droop put Skechers shares in detrimental territory for the yr. Nonetheless, Wall Avenue is bullish on the corporate.

Wall Avenue analysts give Skechers 17 purchase scores and one maintain, in line with knowledge compiled by Lusso’s Information. The typical worth goal of about $81 is greater than 30% greater than the place shares presently commerce.

–With help from Janet Freund.

(Updates inventory transfer at market shut)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now