Markets

Palantir Inventory Is Skyrocketing. 1 Analyst Thinks It Has One other 38% Achieve Forward.

The unreal intelligence revolution has been a blended bag for software program firms. Whereas software program shares that harness the ability of enormous language fashions (LLMs) have the potential to speed up revenues, AI additionally offers software program prospects the potential to “do-it-yourself.”

As an illustration, personal buy-now-pay-later firm Klarna just lately introduced it could try and do away with its Salesforce and Workday software program in lieu of constructing its personal CRM and worker administration software program internally, by way of using AI.

But AI software program platform Palantir (NYSE: PLTR) is exhibiting an acceleration in its business enterprise as a result of introduction of AI. And one Wall Road analyst thinks it has a lot farther to run.

Palantir isn’t any meme inventory

Some buyers have equated Palantir with the revolution, resulting in doubts about its latest run. This could possibly be due to some issues. First, the inventory has a excessive share of retail buyers relative to institutional buyers. Second, Palantir went public in a direct itemizing in late 2020, when rates of interest had been low and lots of doubtful software program and know-how firms bought shares to the general public. Lastly, CEO Alex Karp is considered some as a unusual and outspoken chief, for higher or worse.

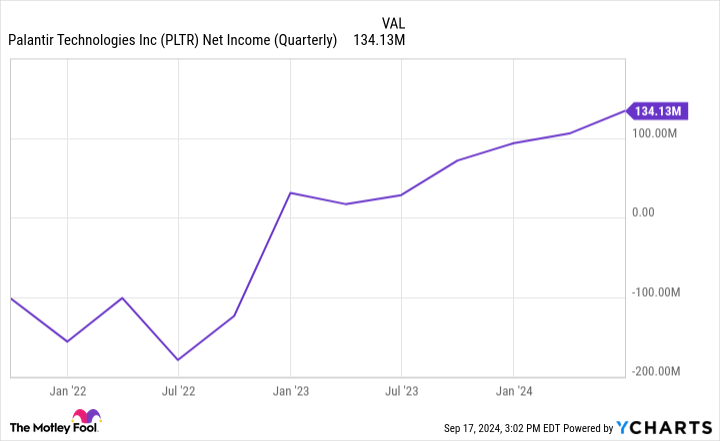

However Palantir isn’t any meme inventory. As a proof level, the corporate was just lately admitted to the celebrated S&P 500 index, which has stringent standards for admission. Previously couple years, Palantir has certified for the index by posting constant GAAP profitability — considerably uncommon for a software program inventory.

information by

AI is resulting in a reacceleration in progress

As well as, Palantir has seen its income progress speed up. That acceleration coincided with the introduction of the Palantir Synthetic Intelligence Platform, or “AIP,” a few 12 months in the past. AIP permits firms to include third-party LLMs or different specialised fashions immediately into Palantir’s current Gotham or Foundry software program platforms.

AIP has invigorated curiosity in Palantir’s software program, particularly from business prospects, leading to a reacceleration of income progress since AIP was launched.

Usually, it is more durable for firms to extend their progress charge as they get greater due to the legislation of enormous numbers. Nevertheless, one can see that Palantir has defied this development. The introduction of AIP and Palantir fine-tuning its advertising technique to incorporate periodic, “boot camps,” are possible causes for the inflection. These boot camps permit potential prospects to carry their precise information and expertise the AIP in a trial with Palantir’s engineers.

One analyst sees $50 in Palantir’s future

At present, most of Wall Road is definitely bearish on Palantir’s inventory. As of August, solely six out of 18 analysts charge shares a Purchase or Robust Purchase, with one other six ranking shares Impartial and the remaining six ranking shares a Promote. The common value goal on shares is $27, under the $36 present value as of this writing. That is in all probability attributable to Palantir’s inventory having greater than doubled this 12 months, whereas at present buying and selling at an costly valuation of roughly 35 instances gross sales.

However one analyst, Mariana Perez Mora of Financial institution of America charges shares a Purchase, with a street-high $50 value goal on the inventory. The analyst believes Wall Road misunderstands Palantir, and sees large issues within the firm’s future, justifying the next inventory value.

Mora thinks others miss how differentiated Palantir is relative to different enterprise software program shares, each product-wise and the way Palantir goes to market. Of observe, Palantir usually has members of its R&D staff embed themselves with a buyer first, with a view to perceive a buyer’s enterprise issues and ache factors. Then, Palantir tailors its modular software program to that enterprise’ particular infrastructure, making its information analytics capabilities extra related to every particular person buyer. In its annual report, Palantir notes seeks out “dangerous and resource-intensive” engagements the place different opponents could draw back.

Mora believes this technique, which is harder upfront and the place Palantir would not see instant revenues, finally pays off. It’s because the upfront work permits Palantir extra pricing energy in a while. She then sees Palantir’s merchandise spreading to extra industries as Palantir rolls out industry-specific platforms, such because the upcoming Warp Velocity for manufacturing companies.

An industry-standard OS like Home windows?

Whereas Palantir was previously referred to as a specialised software program platform for the Protection {industry} within the Struggle on Terror, Mora sees Palantir changing into an industry-standard platform sooner or later, calling it, “the widespread information operational system for the U.S. authorities and enormous U.S. companies.”

If Palantir’s latest continues, she could very nicely find yourself being appropriate. With nearly all of revenues nonetheless coming from the Protection {industry}, Palantir’s latest penetration of the a lot bigger enterprise market offers it the prospect to maintain progress charges excessive for some time, doubtlessly justifying immediately’s lofty inventory value.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $708,348!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. and/or his purchasers have positions in Financial institution of America. The Motley Idiot has positions in and recommends Financial institution of America, Palantir Applied sciences, Salesforce, and Workday. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

FedEx quarterly revenue disappoints as demand for quick supply wanes

(Reuters) -FedEx lowered its full-year income forecast and missed Wall Avenue estimates for first-quarter revenue on Thursday as prospects continued to commerce down from speedy, expensive supply to cheaper, slower choices.

Shares within the Memphis-based supply big have been down practically 10% to $271 in after-hours buying and selling.

Income at FedEx and rival United Parcel Service have been eroding as less-profitable packages fill their networks.

On the similar time, FedEx is restructuring with executives slashing billions of {dollars} in overhead prices as in addition they merge its separate Floor and Specific supply models.

Value cuts did not offset the drag from weak demand for the profitable precedence companies and one fewer working day within the newest quarter, FedEx stated.

The corporate now expects income for fiscal 2025 to develop by a low single-digit share, in comparison with its prior expectations of low- to mid-single digit share development.

FedEx additionally lowered the highest finish of its full-year adjusted working revenue to between $20 and $21 per share, in contrast with its prior forecast of $20 to $22 per share.

On an adjusted foundation, the corporate earned $3.60 per share. Analysts had anticipated a revenue of $4.76 per share, in response to LSEG knowledge.

FedEx is winding down contract work for america Postal Service, its largest buyer, and expects a $500 million headwind from the lack of the contract within the present fiscal yr.

FedEx’s unprofitable USPS air contract, which accounted for about $1.75 billion in income to FedEx through the postal service’s newest fiscal yr, will finish on Sept. 29. Rival UPS picked up that enterprise.

Executives are additionally assessing whether or not to spin off or promote its FedEx Freight enterprise.

(Reporting by Lisa Baertlein in Los Angeles and Ananta Agarwal in Bengaluru; Enhancing by Shounak Dasgupta and Lisa Shumaker)

Markets

Opaleye Administration Inc. buys $193k value of Codexis inventory

Opaleye Administration Inc., a big shareholder in Codexis , Inc. (NASDAQ:), has just lately elevated its stake within the firm by the acquisition of further shares. On September 18, 2024, Opaleye Administration executed two separate transactions, buying a complete of 61,000 shares of Codexis frequent inventory at a median worth of $3.1638 per share, amounting to a complete funding of roughly $193,000.

The majority of the acquisition consisted of 55,000 shares, which, after the transaction, introduced Opaleye Administration’s whole holdings in Codexis to 7,380,000 shares. The remaining 6,000 shares have been acquired for a individually managed account, growing its holdings to 205,000 shares. The shares have been purchased in a number of transactions at costs starting from $3.0883 to $3.22.

These transactions display Opaleye Administration’s continued confidence in Codexis, an organization specializing in industrial natural chemical substances. As a ten p.c proprietor of Codexis, Opaleye Administration’s funding selections are intently watched by market individuals for indications of the agency’s outlook on the corporate’s prospects.

Opaleye Administration’s purchases are noteworthy, contemplating the agency’s important place in Codexis and the potential affect such transactions could have in the marketplace’s notion of the corporate’s worth. Nonetheless, Opaleye Administration has acknowledged that they disclaim useful possession of the shares reported herein, besides to the extent of its pecuniary curiosity.

Traders and observers of Codexis will probably be paying shut consideration to future filings to gauge the funding agency’s technique and its implications for the corporate’s inventory efficiency.

In different latest information, Codexis, Inc. reported its second quarter 2024 outcomes, which aligned with expectations, and reaffirmed its steering for the complete 12 months 2024. The corporate’s efficiency was bolstered by the profitable commercialization of its dsRNA ligase program, a key element in Codexis’ progress technique. Piper Sandler, which maintains an Chubby score on Codexis, famous the corporate’s strategic deal with producing RNAi therapeutics by its proprietary ECO Synthesis platform.

As well as, Codexis reported revenues of $8 million for the second quarter, and anticipates double-digit product income progress in 2024. The corporate can also be aiming for optimistic money stream by the tip of 2026, leveraging its pharmaceutical manufacturing pipeline and ligase orders. Codexis is participating with main gamers to offer cost-effective options in siRNA synthesis, and is working in direction of changing into a Contract Growth and Manufacturing Group (CDMO).

These latest developments counsel a powerful finish to the 12 months for Codexis, with the chance of reaching money stream positivity inside the subsequent two years. The corporate’s deal with including new screening and evolution packages is predicted to drive near-term R&D income and future product income progress. Traders are inspired to contemplate Piper Sandler’s evaluation of Codexis’ market place and its potential for future progress.

Lusso’s Information Insights

Amid the latest transactions by Opaleye Administration, Codexis, Inc. (NASDAQ:CDXS) reveals monetary metrics that warrant investor consideration. The corporate’s market capitalization stands at a modest $226.97 million, reflecting its place within the industrial natural chemical substances sector. Notably, Codexis has a unfavourable price-to-earnings (P/E) ratio of -2.94, which additional adjusted for the final twelve months as of Q2 2024, deepens to -3.75. This implies that buyers are at the moment valuing the corporate’s earnings potential conservatively, doubtless because of the absence of profitability over the previous 12 months.

Furthermore, the corporate’s income has seen a considerable decline, with a -38.59% change during the last twelve months as of Q2 2024. That is compounded by a big quarterly income progress lower of -62.58% as of Q2 2024. The gross revenue margin stands at a unfavourable -0.15% for a similar interval, underscoring challenges in profitability and operational effectivity. Regardless of these figures, Codexis has skilled a excessive return during the last 12 months, with a 77.71% one-year worth whole return, which can replicate market optimism concerning the firm’s long-term potential or particular occasions which have caught the curiosity of buyers.

From an operational standpoint, Lusso’s Information Ideas spotlight two key elements: Codexis holds additional cash than debt on its stability sheet, which is a optimistic signal of economic stability. Moreover, the corporate’s liquid belongings exceed its short-term obligations, suggesting a stable short-term monetary place. Nonetheless, analysts have revised their earnings downwards for the upcoming interval, indicating potential issues concerning the firm’s future efficiency. For these involved in a deeper evaluation, there are further Lusso’s Information Ideas out there at Lusso’s Information, which might additional inform funding selections.

Because the market assesses Opaleye Administration’s elevated stake in Codexis, these monetary metrics and insights from Lusso’s Information provide a broader context for understanding the corporate’s present place and future prospects. Traders will doubtless proceed to watch these developments intently.

This text was generated with the help of AI and reviewed by an editor. For extra info see our T&C.

Markets

Nike names former government Elliott Hill as CEO

Nike () named a brand new CEO Thursday, sending its top off almost 10% in after hours buying and selling as the corporate makes an attempt to reinvigorate slowing gross sales development amid elevated competitors.

Elliott Hill, a former Nike government who retired in 2020, will return to the corporate because the CEO and president on Oct. 14. John Donahoe, Nike’s present CEO, will retire efficient Oct. 13 and can stay an advisor to the corporate till January 2025.

Earlier than retiring, Hill was president of Nike’s shopper and market enterprise, main industrial and advertising and marketing operations for Nike and the Jordan model.

“Given our wants for the long run, the previous efficiency of the enterprise, and after conducting a considerate succession course of, the Board concluded it was clear Elliott’s international experience, management model, and deep understanding of our business and companions, paired along with his ardour for sport, our manufacturers, merchandise, shoppers, athletes, and staff, make him the appropriate particular person to steer Nike’s subsequent stage of development,” Nike Government Chairman Mark Parker

The information comes as Nike inventory has stumbled this yr, falling greater than 25% amid slowing income development and considerations in regards to the success of the corporate’s pivot to direct-to-consumer gross sales.

“This is excellent information for the inventory, each the manager named, in addition to the timing,” Bernstein senior analyst Aneesha Sherman advised Lusso’s Information. “Elliott Hill has labored at Nike for 32 years. He is a product man. He is ran retail in [Europe, Middle East, Africa] and US in North America. He is aware of the corporate and the product very nicely.”

The inventory fell 20% in June when the corporate reported fiscal fourth-quarter earnings and mentioned it expects income to say no greater than it beforehand thought within the coming yr. The corporate mentioned quarterly income within the fourth quarter fell 2% from the yr previous to $12.61 billion, beneath Wall Road’s estimates for $12.86 billion. In the meantime, Nike’s $0.99 earnings per share exceeded analysts’ expectations of $0.66. Nike’s direct-to-consumer gross sales declined 8% from the identical quarter a yr in the past to $5.1 billion.

Wall Road has been carefully watching Nike’s product pipeline because the Oregon-based firm works to fend off competitors in its core athletic footwear market from rivals like Adidas () and relative upstarts like On () and Deckers’ () Hoka model.

Josh Schafer is a reporter for Lusso’s Information. Observe him on X .

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now