Markets

TSLA, RIVN, or LCID: Which U.S. EV Inventory Is the Prime Choose?

Within the extremely aggressive electrical car (EV) market, main gamers equivalent to Tesla , Rivian Automotive , and Lucid Group have encountered vital headwinds, with demand not assembly expectations. On this article, I’ll use the to clarify why I’m bullish on TSLA and RIVN, and bearish on LCID. I’ll additionally define why I take into account Tesla to be your best option among the many three automakers.

Regardless of a stretched valuation, I’m bullish on Tesla. The corporate’s shares at present commerce at a ahead P/E ratio of 97 instances future earnings estimates, which is about 15% under its five-year common. That is largely resulting from a considerable decline of over 40% within the share worth because it peaked in 2021, pushed by weaker-than-expected EV demand and elevated competitors. Nonetheless, Tesla stays the top-selling EV maker globally.

Tesla had aimed for 50% progress in car gross sales and manufacturing this 12 months however as an alternative has seen its income decline. In Q2, complete automotive income was $19.8 billion, down 7% from a 12 months in the past. Tesla’s quarterly manufacturing and supply figures in July confirmed 443,956 car deliveries, which was about 5% decrease than the earlier 12 months.

On the optimistic facet, Q2 noticed sturdy operational efficiency, with money from operations up 18% 12 months over 12 months to $3.61 billion, and free money circulation of $1.34 billion. This marks a rebound from Q1 of this 12 months when money from operations fell 90% to $242 million, and free money circulation declined to unfavourable $2.5 billion.

Is TSLA A Purchase, Maintain or Promote?

My bullish stance on Tesla isn’t primarily based on current outcomes however reasonably on its formidable progress forecasts. Tesla’s future is more and more tied to synthetic intelligence (AI), Robotaxis, and robotics. The corporate is ready to unveil its extremely anticipated Robotaxi on October 10, which might function a serious catalyst for the inventory.

Whereas some traders might not view Tesla as a serious AI participant, its massive put in base and vital involvement in AI are noteworthy. Dan Ives, a tech analyst at Wedbush Securities, argues that Tesla is probably the most undervalued AI firm. He believes Tesla might grow to be a trillion-dollar concern because it stabilizes demand and improves its pricing mannequin.

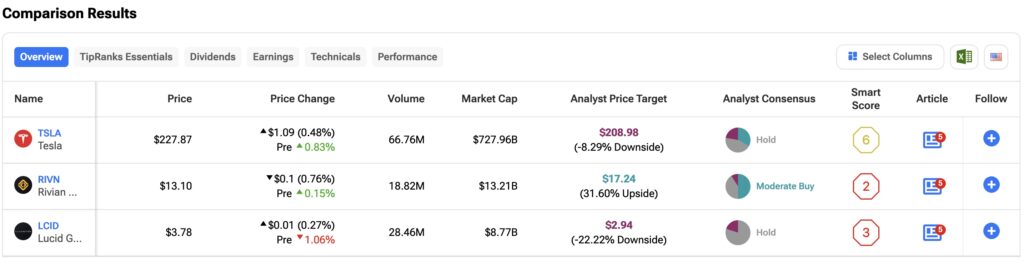

At present, Wall Avenue’s consensus on TSLA inventory is that it’s a Maintain. That is primarily based on 12 Purchase, 16 Maintain and eight Promote suggestions made within the final three months. of $208.98 implies potential draw back danger of 8.10%.

Rivian Automotive

Like Tesla, I’m additionally bullish on Rivian Automotive. That is primarily due to the corporate’s potential undervaluation vis-à-vis its formidable manufacturing targets. After dropping almost 90% of its worth since its 2021 preliminary public providing (IPO), Rivian now trades at a pretty worth primarily based on its money place.

With a market capitalization of $13.04 billion and $7.9 billion in money and short-term investments, greater than half of Rivian’s market worth is tied to its stability sheet. Nonetheless, primarily based on its electrical car gross sales, Rivian trades at a P/S ratio of two.5 instances, which, whereas decrease than Tesla, stays nearly 3 instances above the common for the automotive business.

That mentioned, the primary problem dealing with Rivian is reaching profitability and rising the manufacturing of its electrical car fashions. The corporate goals to provide as much as 215,000 autos yearly by 2026, up from 57,232 autos produced in 2023.

Is RIVN Inventory a Purchase?

Whereas I’m bullish on Rivian, it’s necessary to level out the dangers with this inventory. Rivian’s unprofitability is a priority. In Q2 of this 12 months, the corporate posted a internet lack of $1.45 billion, up from a $300 million loss a 12 months earlier. The corporate’s year-to-date loss now totals $2.9 billion. Nonetheless, as Wedbush analyst Dan Ives notes, Rivian’s main concern is its quarterly money burn of $800 million to $1 billion. This stays a priority as the corporate requires capital to scale manufacturing and meet demand. Extra not too long ago, a has eased dilution fears.

Wall Avenue is usually optimistic on RIVN, with 22 analysts score the inventory a Reasonable Purchase. That is primarily based on 11 Purchase, 9 Maintain and two Promote suggestions made up to now three months. The suggests 31.10% upside potential.

Relating to luxurious electrical car producer Lucid, I maintain a bearish place. That is due to the intense decline seen within the firm’s funds and market worth. The corporate’s market capitalization has declined to $8.34 billion from greater than $90 billion in 2021 when it went held its IPO. Regardless of the corporate’s decline, the valuation multiples nonetheless stay tough to justify.

Lucid trades at a 13 instances P/S ratio, almost double Tesla’s a number of and greater than six instances larger than Rivian’s. Moreover, the corporate reported a Q2 2024 internet lack of $643.3 million, translating to roughly $268,000 in losses per car bought, primarily based on the supply of two,394 autos through the quarter.

The state of affairs at Lucid could be extra dire if it weren’t for funding from Saudi Arabia’s Public Funding Fund (PIF). Due to that funding, Lucid holds $3.21 billion in money and short-term investments. This 12 months, the corporate raised a further $1 billion for the manufacturing of its new SUV referred to as “the Gravity.” Scheduled to launch in December this 12 months, the Gravity is predicted to be priced beneath $80,000, and will function a catalyst for LCID inventory.

Is LCID Inventory A Purchase, Maintain, or Promote?

My bearish view of Lucid is essentially resulting from its give attention to the slender and area of interest luxurious car market. Shoppers are clamoring for extra inexpensive EVs within the U.S. and elsewhere. Morgan Stanley analyst Adam Jonas my bearish outlook, noting Lucid’s issue in maintaining manufacturing prices under the promoting worth of its autos. This concern is additional exacerbated by the excessive value of its luxurious mannequin, the Lucid Air, which has a beginning worth of $69,900.

A complete of 10 Wall Avenue analysts have a consensus Maintain score on LCID inventory. That is primarily based on eight Maintain and two Promote suggestions made within the final three months. There aren’t any Purchase scores on the inventory. The implies draw back danger of 20.97% from the place the shares at present commerce.

Conclusion

I view Tesla as a high choose amongst this trio of main electrical car producers. The corporate has loads of progress potential with its Robotaxis, AI and robotics. Rivian Automotive can be a Purchase resulting from its upside potential and cheap valuation. I’m bearish on Lucid as a result of its valuation is simply too excessive and profitability stays a problem on the firm.

Markets

FedEx, PepsiCo, Trump Media fall premarket; Nike rises

Lusso’s Information — US inventory traded in tight ranges Friday, consolidating after the earlier session’s sharp positive aspects within the wake of the Federal Reserve’s hefty rate of interest reduce.

Listed here are among the greatest premarket US inventory movers at this time

-

FedEx (NYSE:) inventory slumped 13% after the logistics group reduce its full-year steering and reported fiscal first-quarter earnings that fell nicely in need of Wall Road expectations.

-

Nike (NYSE:) inventory rose 5.7% after the athletic attire agency introduced that Chief Govt John Donahoe is about to step down from the place subsequent month.

-

PepsiCo (NASDAQ:) inventory fell 1.1% after Morgan Stanley downgraded its stance on the gentle drinks large to “equal-weight” from “obese”, citing the danger of US income development.

-

Financial institution of America (NYSE:) inventory fell 0.4% after Berkshire Hathaway (NYSE:) resumed gross sales of the financial institution’s inventory in latest days, unloading about $900 million value of shares and dropping its stake to $34 billion, or 10.8% of the shares excellent.

-

Trump Media & Know-how Group (NASDAQ:) inventory fell 4.5%, extending the sharp losses in latest weeks fueled by worries in regards to the finish of so-called lock-up interval associated to its inventory market debut in March.

-

Apple (NASDAQ:) inventory fell 0.4% after iPhone 16 resale costs on September 20, the primary day of cargo, have “collapsed inside the first three hours of buying and selling,” based on analysts at Jefferies.

-

Lennar (NYSE:) inventory fell 2.9% regardless of the homebuilder reporting better-than-expected third quarter outcomes as new residence orders elevated amid sturdy housing demand.

Markets

Funding advisers urge shoppers away from money after Fed price minimize

By Suzanne McGee and Carolina Mandl

(Reuters) – Funding advisers are urging shoppers to dump hefty money allocations now that the Federal Reserve has begun its much-anticipated interest-rate easing, a course of they count on to restrict the attraction of money-market funds within the coming months.

Retail money-market funds have attracted $951 billion in inflows since 2022, when the Fed began its rate-hiking cycle to tame inflation, in accordance with the Funding Firm Institute, which represents funding funds. Their belongings stood at $2.6 trillion on Sept. 18, roughly 80% larger than in the beginning of 2022.

“As coverage charges fall, the attraction of money-market funds will wane,” mentioned Daniel Morris, chief market strategist at BNP Paribas Asset Administration.

On Wednesday, the U.S. central financial institution minimize the federal funds price by a larger-than-usual 50 foundation factors to a spread of 4.75% to five%, which makes holding money in deposit accounts and cash-like devices much less interesting.

“You are going to should shift every little thing … additional up within the quantity of threat you are accepting,” mentioned Jason Britton, Charleston-based founding father of Reflection Asset Administration, who manages or oversees round $5 billion in belongings. “Cash-market belongings must change into fixed-income holdings; fastened revenue will transfer into most well-liked shares or dividend-paying shares.”

Cash-market funds – extremely low-risk mutual funds that put money into short-term Treasury securities and different money proxies – are a option to gauge investor curiosity within the almost risk-free returns they provide. When short-term rates of interest climb, money-market returns rise with them, rising their attraction to buyers.

“Buyers must be conscious that in the event that they’re relying on a sure degree of revenue from that portion of their portfolio, they might want to have a look at one thing completely different, or longer-term, to lock in charges and never be as uncovered to the Fed reducing rates of interest,” mentioned Ross Mayfield, funding strategist at Baird Wealth.

Carol Schleif, chief funding officer of BMO Household Workplace, expects buyers to maintain some money on the sidelines to attend for alternatives to purchase shares.

It might take every week or extra for preliminary reactions to the Fed’s choice on Wednesday to indicate up in money-market fund flows and different knowledge, analysts be aware. Whereas the Funding Firm Institute reported an total decline in money-market holdings in its final weekly report on Thursday, retail positions had been little modified to larger and advisers mentioned it has been robust to influence that group to desert their money holdings.

Christian Salomone, chief funding officer of Ballast Rock Non-public Wealth, mentioned shoppers confronted with decrease returns on money are desperate to put money into one thing else.

Nonetheless, “buyers are caught between a rock and a tough place,” Britton mentioned, confronted with a selection between investing in riskier belongings or incomes a smaller return from cash-like merchandise.

(Reporting by Suzanne McGee and Carolina Mandl; further reporting by Davide Barbuscia; modifying by Megan Davies and Rod Nickel)

Markets

Nio launches Onvo L60, inventory to ‘rise in absolute phrases over the subsequent 15 days,’ analysts say

Nio (NYSE:) on Thursday unveiled its new electrical SUV, the Onvo L60, priced decrease than what the market anticipated.

Shares in Nio jumped greater than 7% Thursday.

“NIO’s share value ought to react positively to the superior price-performance of L60. Nevertheless, with demand seemingly much less of a doubt now, well timed demand achievement would in flip change into the important thing concern – possible a very good drawback to have,” Morgan Stanley analysts commented.

Following a greater than 20% surge in NIO’s inventory month-to-date, in comparison with a 1% acquire for the Nasdaq, expectations for order consumption have elevated considerably.

In keeping with Morgan Stanley analysts, for NIO to see additional substantial re-rating, it can require sturdy execution in scaling up manufacturing and sustaining a optimistic buyer expertise amidst the inflow of orders, which they spotlight as “essential to show NIO is structurally on the rise.”

Nio’s aggressive pricing technique ought to assist the Onvo supply goal of 20,000 items within the fourth quarter, analysts added, with the possible upbeat demand anticipated to place strain on the corporate’s ramp-up tempo.

In a separate notice, Morgan Stanley analysts stated they imagine Nio’s share value “will rise in absolute phrases over the subsequent 15 days.”

NIO launched the ONVO L60 at a lower-than-expected MSRP of RMB 206,900, which features a 60kWh battery and is RMB 13,000 decrease than the pre-sale value. The BaaS mannequin, excluding the battery pack, is RMB 57,000 cheaper, priced at RMB 149,000.

Morgan Stanley analysts imagine that this aggressive pricing, together with extra incentives similar to an early fowl low cost of as much as RMB 4,000 and an area authorities trade-in subsidy of RMB 10,000, is anticipated to drive larger order conversions and enhance gross sales.

The analysts estimate a 70% to 80% likelihood of this optimistic situation taking part in out.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024