Markets

Hedge funds well-positioned to navigate market swings, says UBS

Lusso’s Information — Hedge funds have proven their worth in defending portfolios throughout occasions of great market volatility, as seen in August 2024.

UBS analysts in a be aware flagged that hedge funds, particularly these utilizing non-directional methods, took benefit of market disruptions whereas additionally defending in opposition to losses in shares and bonds.

With ongoing market uncertainty, hedge funds have gotten extra necessary for managing dangers, boosting returns, and dealing with unpredictable financial situations.

Opposite to expectations of a quiet summer season, August 2024 delivered vital market turbulence. A mix of skinny liquidity, weak U.S. financial information, and geopolitical considerations led to heightened volatility.

The volatility index surged, and world equities skilled sharp sell-offs, with the U.S. 60/40 portfolio declining by 3.1% in simply three days, based on UBS analysts.

225 additionally noticed a dramatic 20% decline, underscoring the fragility of world markets.

“Nevertheless, early August introduced market jitters in opposition to a backdrop of skinny liquidity as a consequence of weak US jobs and manufacturing information, sparking considerations of a “arduous touchdown.,” the analysts stated.

The unwinding of leveraged positions, particularly in Japanese markets, exacerbated the state of affairs and led to vital sell-offs throughout asset lessons.

Whereas conventional long-only portfolios suffered as a consequence of heightened correlations between equities and bonds, hedge funds excelled by providing uncorrelated returns and seizing alternatives introduced by volatility.

UBS flags that hedge funds with decrease market publicity, together with these using fairness market-neutral and various credit score methods, considerably outperformed throughout August’s market swings.

Convertible arbitrage methods, which profit from lengthy volatility profiles, gained 1.1% in August by capitalizing on sharp reversals in market sentiment.

Equally, mounted earnings relative worth methods and credit score hedges contributed positively, with UBS noting that many managers have been in a position to monetize good points from widened spreads earlier than markets rebounded.

Hedge funds not solely provide draw back safety but in addition thrive in environments characterised by market dislocations.

UBS analysts stress that in intervals of volatility, costs usually deviate considerably from their intrinsic values, offering hedge fund managers with distinctive alpha alternatives.

By taking contrarian positions—shopping for undervalued belongings or shorting overvalued securities—hedge funds can revenue as costs revert to their pure averages as soon as markets stabilize.

UBS factors to the success of discretionary macro methods, which navigated August’s turbulence by capitalizing on strikes in world forex and bond markets.

One of many key benefits hedge funds provide is their capacity to offer uncorrelated returns during times of market instability.

As correlations between asset lessons rise throughout occasions of stress, portfolios comprising conventional belongings like shares and bonds develop into extra weak to simultaneous declines.

Hedge funds, nevertheless, are designed to take advantage of inefficiencies out there and benefit from worth dislocations, fairly than merely driving broader market actions.

As per UBS, methods equivalent to world macro, fairness market-neutral, and multi-strategy funds have been significantly efficient in delivering uncorrelated returns, serving to to easy out portfolio efficiency and scale back total threat. These methods enable buyers to take care of publicity to high-risk markets whereas mitigating the affect of sharp sell-offs.

UBS analysts foresee continued volatility within the coming months as central banks modify financial insurance policies, and geopolitical dangers stay elevated. Whereas inflation considerations have eased, financial information continues to fluctuate, and the trail of future Federal Reserve charge cuts stays unsure.

In the meantime, the looming U.S. presidential election is predicted to convey additional political uncertainty, which might drive market swings.

Given these elements, UBS recommends that buyers incorporate hedge fund methods into their portfolios to arrange for future volatility.

Low internet fairness methods, various credit score, world macro, and multi-strategy funds are seen as well-positioned to assist buyers handle dangers and seize alternatives as markets evolve.

Whereas hedge funds current vital alternatives, UBS additionally emphasizes the dangers related to these investments. Hedge funds are sometimes illiquid and will require long-term lock-up intervals.

Moreover, their methods will be complicated, and buyers ought to be ready for potential losses, particularly when leverage is employed.

As such, UBS urges buyers to strategy hedge fund investments inside the context of a well-diversified portfolio and guarantee they’re snug with the related dangers.

Markets

Is Tremendous Micro Pc Inventory a Purchase Now?

Following a terrific begin to the 12 months, Tremendous Micro Pc‘s (NASDAQ: SMCI) inventory chart has undergone a stark reversal over the previous six months. It has misplaced near 60% of its worth from its peak, and up to date developments appear to have additional dented investor confidence within the firm.

First, the fiscal 2024 fourth-quarter outcomes it launched on Aug. 6 , and administration’s steerage was disappointing. Second, short-seller Hindenburg Analysis launched a report alleging accounting irregularities at Supermicro. Then, Supermicro administration introduced that it was delaying the submitting of its annual report, which solely added to the adverse press.

These components clarify why Wall Avenue analysts have been downgrading the inventory recently. However provided that shares of this server and storage techniques producer at the moment are buying and selling at a sexy 22 instances trailing earnings and 13 instances ahead earnings, opportunistic buyers could also be tempted to purchase Supermicro. Ought to they be doing that in gentle of the current developments?

Addressing the elephant within the room

Traders ought to word that Hindenburg is a , and it has a monetary curiosity in seeing Supermicro’s inventory value fall. In that context, we can’t make certain that the allegations that Hindenburg is making are legitimate, particularly contemplating that the short-seller has been mistaken prior to now. That stated, Supermicro was charged by the Securities and Change Fee (SEC) for accounting violations in August 2020, when it was discovered to have prematurely acknowledged income and understated its bills over a three-year interval.

Nevertheless, the corporate has recovered remarkably since then, clocking excellent positive aspects over the previous couple of years because of the emergence of a brand new catalyst within the type of synthetic intelligence (AI). Its income in its fiscal 2024 greater than doubled to $14.9 billion from $7.1 billion within the earlier 12 months. Non-GAAP earnings shot as much as $22.09 per share, from $11.81 per share in fiscal 2023.

Addressing the delay in Supermicro’s annual submitting, administration clarified that “we do not anticipate any materials modifications in our fourth quarter or fiscal 12 months 2024 monetary outcomes.” It added that the corporate is wanting ahead to a “historic” 2025 with “a document variety of orders, a robust and rising backlog of design wins and main market positions throughout quite a lot of areas.”

Supermicro says that the current developments will not have an effect on its manufacturing capabilities, and it is on monitor to satisfy the demand for its AI server options. It is value noting that Supermicro is anticipating its fiscal 2025 income to land between $26 billion and $30 billion. That will be one other 12 months of exceptional development from its $14.9 billion in fiscal 2024.

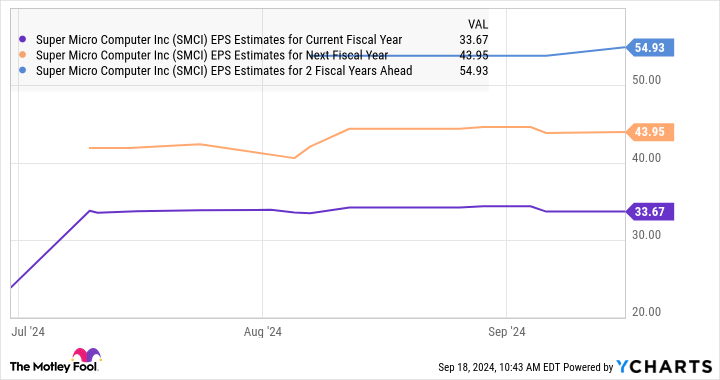

Although it’s going through margin challenges as a result of elevated investments it is making because it boosts capability to satisfy the sturdy demand for its liquid-cooled server options, administration is assured that it’s going to return to its regular margin vary earlier than the fiscal 12 months ends. Analysts’ consensus estimates additionally point out that Supermicro’s earnings are on monitor to extend at an unimaginable tempo within the present fiscal 12 months, adopted by wholesome jumps within the subsequent couple of years as effectively.

What ought to buyers do?

The delay in Supermicro’s annual submitting led JPMorgan to downgrade the inventory from obese to impartial and to slash its value goal to $500 from $950. Even Barclays downgraded the inventory to equal weight from obese, citing the margin strain that Supermicro faces in addition to the submitting delay. Nevertheless, JPMorgan’s downgrade wasn’t a results of the Hindenburg report nor a mirrored image of its skill to grow to be compliant, however due to the near-term uncertainty that surrounds the corporate and the dearth of a compelling argument to purchase the inventory.

So, risk-averse buyers would do effectively to attend for extra readability earlier than shopping for this AI inventory. Nevertheless, these with greater threat appetites who want to add a fast-growing firm to their portfolios can take into account shopping for Supermicro now. It appears able to sustaining its spectacular development in the long term because of the large alternatives obtainable to it within the AI server market.

Analysts count on Supermicro’s earnings to develop at an annualized price of 62% over the subsequent 5 years. If the corporate can get previous its present troubles, it may develop into a stable funding contemplating the valuation at which it’s buying and selling proper now.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for buyers to purchase now… and Tremendous Micro Pc wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot recommends Barclays Plc. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Microsoft deal propels Three Mile Island restart, with key permits nonetheless wanted

(Refiles to repair typo in ‘firms’ in paragraph three)

(Reuters) -Constellation Power and Microsoft (NASDAQ:) have signed an influence deal to assist resurrect a unit of the Three Mile Island nuclear plant in Pennsylvania in what could be the first-ever restart of its form, the businesses mentioned on Friday.

Key regulatory permits for the plant’s new life, nevertheless, have not been filed, regulators say.

Large tech has led to a sudden surge in U.S. electrical energy demand for knowledge facilities wanted to develop applied sciences like synthetic intelligence and cloud computing. Nuclear power, which is sort of carbon-free and broadly thought-about extra dependable than power sources like photo voltaic and wind, has develop into a well-liked possibility for expertise firms with uninterrupted energy wants and local weather pledges.

“Nuclear vegetation are the one power sources that may persistently ship on that promise,” Constellation Chief Govt Officer Joe Dominguez mentioned in an announcement.

Constellation’s shares had been up greater than 20% by early afternoon to $251.42 and have risen greater than 100% to this point this yr.

Energy from the plant could be used to offset Microsoft’s knowledge heart electrical energy use, the businesses mentioned.

A relaunch of Three Mile Island, which had a separate unit undergo a partial-meltdown in 1979 in one of many largest industrial accidents within the nation’s historical past, nonetheless requires federal, state and native approvals.

Constellation has but to file an utility with federal nuclear regulators to restart the plant.

“It’s as much as Constellation to put out its rationale for justifying restart, so we’re ready to interact with the corporate on subsequent steps,” mentioned Nuclear Regulatory Fee (NRC) spokesperson Scott Burnell.

Constellation mentioned it anticipated the NRC evaluate course of to be accomplished in 2027.

BILLION DOLLAR BET

The deal would assist allow a revival of Unit 1 of the five-decades-old facility in Pennsylvania that was retired in 2019 as a result of financial causes. Unit 2, which had the meltdown, won’t be restarted.

Constellation plans to spend about $1.6 billion to revive the plant, which it expects to return on-line by 2028.

Reuters first reported on the potential restart in July.

Sources advised Reuters on the time that Constellation hoped it will obtain federal help for Three Mile Island that was much like what was given to the Palisades Nuclear Producing Station, which acquired a $1.5 billion conditional mortgage for a relaunch from the Biden administration.

Beneath the Constellation-Microsoft deal, Microsoft will buy power from the restarted plant for a interval of 20 years. The Three Mile Island unit will present 835 megawatts of electrical energy, or sufficient to energy about 700,000 houses.

A restart is predicted to be difficult, however as energy demand spikes, the just about carbon-free electrical energy supply is seeing renewed help from tech firms.

“This settlement is a significant milestone in Microsoft’s efforts to assist decarbonize the grid in help of our dedication to develop into carbon unfavourable,” Bobby Hollis, vice chairman of power at Microsoft, mentioned in an announcement.

Microsoft has additionally signed an influence buy settlement with Washington-state fusion firm Helion, which says the plant will probably be on-line by 2028, far sooner than many scientists say fusion will develop into industrial.

Main tech executives, together with ChatGPT developer OpenAI CEO Sam Altman and Microsoft co-founder Invoice Gates, have touted nuclear power as an answer to the rising energy wants of information facilities.

Altman has backed and is the chairman of nuclear energy startup Oklo, which went public by way of a blank-check merger in Might, whereas TerraPower – a startup Gates co-founded – broke floor on a nuclear facility in June.

Nuclear vegetation generated about 18.6% of the entire electrical energy within the U.S. final yr, based on Power Info Administration knowledge.

The facility provide offers with A.I. knowledge facilities are additionally dealing with elevated scrutiny. An identical deal between Talen Power and Amazon (NASDAQ:) signed earlier this yr has been challenged by a bunch of electrical utilities alleging it may spike prices for patrons or hamper grid reliability.

Monetary particulars of the Microsoft-Constellation deal weren’t disclosed. The businesses declined to offer extra particulars on the settlement.

Markets

After Its Reverse Inventory Break up, Is SiriusXM Satellite tv for pc Radio a Purchase?

SiriusXM Holdings (NASDAQ: SIRI) launched almost a era in the past with massive plans to disrupt media.

Quick-forward to 2024 and people plans appear to have principally fallen flat. Web-native options like Spotify dwarf SiriusXM in viewers measurement and market cap, and SiriusXM has struggled to interrupt away from the automotive market the place it is hottest.

Nevertheless, SiriusXM simply made an uncommon transfer, and a few traders appear to suppose it might be a catalyst for a breakout within the inventory.

A spin-off and a reverse inventory cut up

On Sept. 9, Liberty Media accomplished its spin-off of Liberty SiriusXM Holdings, which is now referred to as SiriusXM Holdings.

The transaction decreased the variety of shares excellent by roughly 12%, after which the corporate enacted a 1-for-10 that lifted the share worth out of .

The transaction appeared to breathe new life into SiriusXM, and will give it a contemporary starting. The corporate’s administration could have extra flexibility as Liberty Media takes a again seat.

Sirius reiterated its full-year forecasts for income of $8.75 billion and adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of $2.7 billion. It additionally trimmed its free money circulation steerage from $1.2 billion to $1 billion to account for fees associated to the spin-off.

Moreover, the corporate declared a quarterly dividend of $0.27, giving it a yield of 4.6%, and introduced a $1.166 billion share repurchase program.

Reverse inventory splits are typically a warning signal for traders. Corporations usually use them when their inventory costs have fallen thus far that they’ve gone out of compliance with their alternate’s itemizing guidelines. Merging shares collectively lifts their face worth, which may convey such firms again into compliance and preserve them away from being delisted.

That was not precisely the state of affairs with SiriusXM, nevertheless. True, its inventory has traded beneath $10 a share for a number of years, partly on account of the corporate’s issuing extra inventory to remain afloat in the course of the 2008-2009 monetary disaster. Nevertheless, the corporate appears to be like far more secure now than the everyday reverse inventory cut up inventory.

Sirius after the cut up

Sirius is solidly worthwhile, however the firm has struggled to develop its revenues and viewers in recent times. The satellite tv for pc radio veteran continues to focus on a leverage ratio of mid-to-low 3 occasions adjusted EBITDA, and plans to spend its free money circulation on investments, sustaining its dividend, and paying down its money owed.

The corporate completed the second quarter with $9 billion in long-term debt, that means it is in vary of its goal leverage ratio primarily based on its EBITDA forecast of $2.7 billion.

SiriusXM additionally stated it is evaluating the goodwill and intangible belongings it inherited from Liberty Media, which might result in a write-down within the third quarter. That might be a non-cash accounting cost, although.

Is SiriusXM a purchase?

For dividend traders and worth traders, SiriusXM appears to be like like a great candidate. The inventory trades at a price-to-earnings ratio of seven, and its yield of 4.6% on the present share worth can also be engaging.

Nevertheless, it is affordable to ask how sustainable the corporate’s enterprise is, which doubtless explains its low valuation.

Sirius is prone to lose Howard Stern subsequent 12 months when his contract expires, as he is anticipated to retire. The corporate additionally continues to lose market share to rival platforms like Spotify, and satellite tv for pc radio appears much less related as extra autos are outfitted with internet-ready interfaces like Carplay.

Within the third quarter, Sirius’s income fell 3% to $2.18 billion, and complete subscribers fell by 100,000 sequentially from the second quarter to 33.3 million; its subscriber base was down by 806,000 from a 12 months earlier.

For the proper of investor, Sirius might be a good selection, particularly if the corporate takes benefit of its low share worth and buys again its inventory. Nevertheless, traders ought to regulate income and subscriber traits to make sure that the enterprise is secure. Whereas these dangers are diminished given the corporate’s low valuation, they’re nonetheless the largest threats to SiriusXM inventory.

Must you make investments $1,000 in Sirius Xm proper now?

Before you purchase inventory in Sirius Xm, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Sirius Xm wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Spotify Know-how. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024