Markets

3 Inventory-Break up Shares to Purchase Earlier than They Soar as A lot as 243%, In accordance with Choose Wall Avenue Analysts

The recognition of inventory splits has seen a resurgence in recent times. Whereas the process was widespread all through the Nineteen Nineties, it had pale into close to obscurity earlier than having fun with a renaissance over the previous decade. Firms will usually embark on a inventory break up after years of sturdy operational and monetary outcomes have pushed a surging inventory value. The prospect of a inventory break up is mostly a cause for buyers to take a contemporary have a look at the corporate in query — and with good cause.

The sturdy enterprise efficiency that in the end led to the inventory break up within the first place tends to proceed, fueling additional positive factors. Analysis exhibits that corporations that initiated a usually return 25%, on common, within the 12 months following the announcement, in contrast with common will increase of 12% for the S&P 500, in accordance with information compiled by Financial institution of America analyst Jared Woodard.

Listed below are three stock-split shares that also have an extended runway forward, in accordance with choose Wall Avenue analysts.

Nvidia: Implied upside 82%

The primary stock-split inventory with a great deal of upside potential is Nvidia (NASDAQ: NVDA). The corporate has turn into the de facto flag bearer for current advances in synthetic intelligence (AI) because of its pioneering work with graphics processing items (GPUs).

It seems that the identical chips that revolutionized the gaming business work equally properly at dashing information via the ether, making them the primary selection amongst cloud-computing and data-center operators. It additionally accelerates the processing of AI fashions, which helped Nvidia turn into the gold commonplace for generative AI.

For its fiscal 2025 second quarter (ended July 28), Nvidia generated record-quarterly income that soared 122% 12 months over 12 months to $30 billion, delivering diluted earnings per share (EPS) that surged 168% to $0.67. The headliner was a blockbuster efficiency from the corporate’s data-center phase — which incorporates AI chips — as gross sales soared to $26.3 billion, rising 154%.

The rise of AI has fueled a blistering improve in Nvidia’s inventory value, which has gained 716% because the begin of 2023 and led to its viral in June. The inventory has skilled a lull in current months as buyers questioned the endurance of one of many market’s greatest performers, however many on Wall Avenue consider the adoption of AI is simply getting began, a pattern that favors Nvidia.

In an interview on CNBC earlier this month, Niles Funding Administration founder Dan Niles stated he “firmly believes” that over the following a number of years, Nvidia’s income and inventory value will double from present ranges, pushed increased by demand for AI. That means potential positive factors for buyers of 82% in comparison with Wednesday’s closing value.

He is not the one one who believes the longer term is shiny. Of the 60 analysts who lined the inventory in August, 55 rated the inventory a purchase or sturdy purchase, and none advisable promoting.

I’ve made no secret about my bullish tackle Nvidia, predicting that the inventory will high $200 by 2026 — and I stand by that prediction.

Nvidia inventory is at the moment promoting for 39 occasions ahead gross sales. Whereas that may appear lofty at first look, contemplate this: Wall Avenue expects the corporate’s income to extend by 53%, on common, over the approaching 5 years, exhibiting that Nvidia inventory is deserving of a premium.

Sirius XM Holdings: Implied upside of 179%

The second inventory break up with important potential upside is Sirius XM Holdings (NASDAQ: SIRI). The corporate is the ultimate relating to satellite tv for pc radio companies in North America. Sirius has 34 million paying subscribers, and its viewers will increase to 150 million together with its ad-supported Pandora music-streaming service, so its listener base is unequalled.

The excessive ranges of inflation that marked the previous couple of years pressured folks to make robust selections with their disposable earnings, and a few selected to not renew their Sirius subscription. This, mixed with buyers’ basic misunderstanding of its current merger and the ensuing reverse-stock break up, has helped push the inventory down 56% up to now this 12 months. Whereas the outcomes had been weak, the stock-price decline is clearly an overreaction.

In Q2, Sirius’ income slipped 3% 12 months over 12 months to $2.18 billion, whereas EPS of $0.08 was flat. Whereas paid subscribers declined by 100,000 (or roughly 1.5%), this was an enchancment, as its churn price continues to sluggish forward of an anticipated turnaround.

Regardless of the weak spot within the inventory value, some on Wall Avenue consider the promoting was overdone. Benchmark analyst Matthew Harrigan is one such analyst. He maintains a purchase ranking on Sirius XM, with a split-adjusted value goal of $65. That represents potential upside of 179% in comparison with Wednesday’s closing value. The analyst cites a “market dislocation” because of its current merger with monitoring inventory Liberty Sirius XM. He additional believes administration’s “strategic initiatives” will bear fruit.

Moreover, the declining inventory value presents savvy buyers with a compelling valuation. Sirius XM is at the moment promoting for roughly 7 occasions earnings, which elements in little-to-no future progress.

I feel the analyst’s opinion is spot on, because the bettering macroeconomic scenario ought to reignite Sirius XM’s progress, which is able to possible ship the inventory increased.

Tremendous Micro Pc: Implied upside 243%

The ultimate firm in our trio of stock-split shares with room to run is Tremendous Micro Pc (NASDAQ: SMCI), generally known as Supermicro. The corporate has been designing customized servers for greater than 30 years, and the accelerating adoption of AI has taken demand to the following stage.

The key of the corporate’s success is the building-block structure of Supermicro’s rack-scale servers. This permits prospects to design a system that meets their particular wants. Moreover, the corporate is the dominant supplier of servers that includes direct-liquid cooling (DLC), which has turn into nearly desk stakes within the period of AI-focused information facilities. CEO Charles Liang suggests Supermicro’s DLC market share is at the moment between 70% and 80%.

Within the firm’s fiscal 2024 This autumn (ended June 30), Supermicro reported file income that surged 143% 12 months over 12 months to $5.3 billion, which additionally elevated 38% sequentially. The ensuing adjusted EPS jumped 78% to $6.25.

Buyers bought off the inventory within the wake of the report, as considerations concerning the firm’s declining-profit margin sparked a knee-jerk response. Liang stated a change in product combine brought on by part bottlenecks was accountable, a scenario which must be rectified shortly.

Supermicro’s monitor file of sturdy outcomes has pushed its inventory value up 432% since sturdy demand for AI-centric methods kicked off in early 2023. This brought about the corporate to provoke a 10-for-1 inventory break up early final month.

Loop Capital analyst Ananda Baruah maintains a purchase ranking on the inventory and a Avenue-high value goal of $1,500. That represents potential upside of 243% in comparison with Wednesday’s closing value.

The analyst is bullish on Supermicro’s place throughout the AI server market, citing its management relating to scale and complexity. He calculates the corporate’s gross sales will speed up to a run price of $40 billion by the tip of fiscal 2026, increasing on administration’s steering for income of $28 billion in fiscal 2025.

I feel the analyst hit the nail on the top, as Supermicro continues to realize market share on the expense of its rivals.

Many on Wall Avenue concur. Of the 18 analysts who provided an opinion in August, 9 rated the inventory a purchase or sturdy purchase, and none advisable promoting.

Moreover, at 22 occasions earnings and fewer than two occasions gross sales, Supermicro is the very definition of an attractively priced inventory.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting accomplice of The Ascent, a Motley Idiot firm. has positions in Nvidia and Tremendous Micro Pc. The Motley Idiot has positions in and recommends Financial institution of America and Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Is Tremendous Micro Pc Inventory a Purchase Now?

Following a terrific begin to the 12 months, Tremendous Micro Pc‘s (NASDAQ: SMCI) inventory chart has undergone a stark reversal over the previous six months. It has misplaced near 60% of its worth from its peak, and up to date developments appear to have additional dented investor confidence within the firm.

First, the fiscal 2024 fourth-quarter outcomes it launched on Aug. 6 , and administration’s steerage was disappointing. Second, short-seller Hindenburg Analysis launched a report alleging accounting irregularities at Supermicro. Then, Supermicro administration introduced that it was delaying the submitting of its annual report, which solely added to the adverse press.

These components clarify why Wall Avenue analysts have been downgrading the inventory recently. However provided that shares of this server and storage techniques producer at the moment are buying and selling at a sexy 22 instances trailing earnings and 13 instances ahead earnings, opportunistic buyers could also be tempted to purchase Supermicro. Ought to they be doing that in gentle of the current developments?

Addressing the elephant within the room

Traders ought to word that Hindenburg is a , and it has a monetary curiosity in seeing Supermicro’s inventory value fall. In that context, we can’t make certain that the allegations that Hindenburg is making are legitimate, particularly contemplating that the short-seller has been mistaken prior to now. That stated, Supermicro was charged by the Securities and Change Fee (SEC) for accounting violations in August 2020, when it was discovered to have prematurely acknowledged income and understated its bills over a three-year interval.

Nevertheless, the corporate has recovered remarkably since then, clocking excellent positive aspects over the previous couple of years because of the emergence of a brand new catalyst within the type of synthetic intelligence (AI). Its income in its fiscal 2024 greater than doubled to $14.9 billion from $7.1 billion within the earlier 12 months. Non-GAAP earnings shot as much as $22.09 per share, from $11.81 per share in fiscal 2023.

Addressing the delay in Supermicro’s annual submitting, administration clarified that “we do not anticipate any materials modifications in our fourth quarter or fiscal 12 months 2024 monetary outcomes.” It added that the corporate is wanting ahead to a “historic” 2025 with “a document variety of orders, a robust and rising backlog of design wins and main market positions throughout quite a lot of areas.”

Supermicro says that the current developments will not have an effect on its manufacturing capabilities, and it is on monitor to satisfy the demand for its AI server options. It is value noting that Supermicro is anticipating its fiscal 2025 income to land between $26 billion and $30 billion. That will be one other 12 months of exceptional development from its $14.9 billion in fiscal 2024.

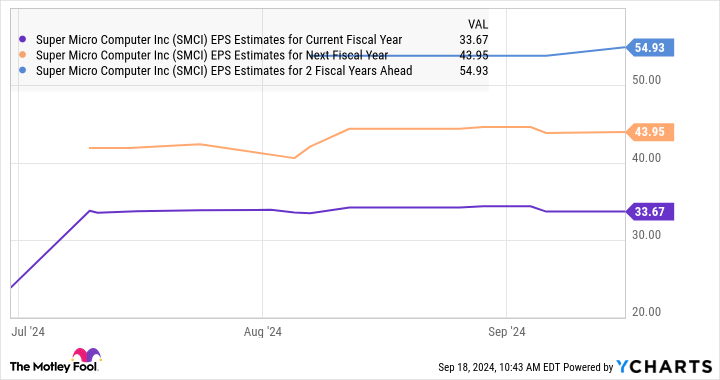

Although it’s going through margin challenges as a result of elevated investments it is making because it boosts capability to satisfy the sturdy demand for its liquid-cooled server options, administration is assured that it’s going to return to its regular margin vary earlier than the fiscal 12 months ends. Analysts’ consensus estimates additionally point out that Supermicro’s earnings are on monitor to extend at an unimaginable tempo within the present fiscal 12 months, adopted by wholesome jumps within the subsequent couple of years as effectively.

What ought to buyers do?

The delay in Supermicro’s annual submitting led JPMorgan to downgrade the inventory from obese to impartial and to slash its value goal to $500 from $950. Even Barclays downgraded the inventory to equal weight from obese, citing the margin strain that Supermicro faces in addition to the submitting delay. Nevertheless, JPMorgan’s downgrade wasn’t a results of the Hindenburg report nor a mirrored image of its skill to grow to be compliant, however due to the near-term uncertainty that surrounds the corporate and the dearth of a compelling argument to purchase the inventory.

So, risk-averse buyers would do effectively to attend for extra readability earlier than shopping for this AI inventory. Nevertheless, these with greater threat appetites who want to add a fast-growing firm to their portfolios can take into account shopping for Supermicro now. It appears able to sustaining its spectacular development in the long term because of the large alternatives obtainable to it within the AI server market.

Analysts count on Supermicro’s earnings to develop at an annualized price of 62% over the subsequent 5 years. If the corporate can get previous its present troubles, it may develop into a stable funding contemplating the valuation at which it’s buying and selling proper now.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for buyers to purchase now… and Tremendous Micro Pc wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot recommends Barclays Plc. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Microsoft deal propels Three Mile Island restart, with key permits nonetheless wanted

(Refiles to repair typo in ‘firms’ in paragraph three)

(Reuters) -Constellation Power and Microsoft (NASDAQ:) have signed an influence deal to assist resurrect a unit of the Three Mile Island nuclear plant in Pennsylvania in what could be the first-ever restart of its form, the businesses mentioned on Friday.

Key regulatory permits for the plant’s new life, nevertheless, have not been filed, regulators say.

Large tech has led to a sudden surge in U.S. electrical energy demand for knowledge facilities wanted to develop applied sciences like synthetic intelligence and cloud computing. Nuclear power, which is sort of carbon-free and broadly thought-about extra dependable than power sources like photo voltaic and wind, has develop into a well-liked possibility for expertise firms with uninterrupted energy wants and local weather pledges.

“Nuclear vegetation are the one power sources that may persistently ship on that promise,” Constellation Chief Govt Officer Joe Dominguez mentioned in an announcement.

Constellation’s shares had been up greater than 20% by early afternoon to $251.42 and have risen greater than 100% to this point this yr.

Energy from the plant could be used to offset Microsoft’s knowledge heart electrical energy use, the businesses mentioned.

A relaunch of Three Mile Island, which had a separate unit undergo a partial-meltdown in 1979 in one of many largest industrial accidents within the nation’s historical past, nonetheless requires federal, state and native approvals.

Constellation has but to file an utility with federal nuclear regulators to restart the plant.

“It’s as much as Constellation to put out its rationale for justifying restart, so we’re ready to interact with the corporate on subsequent steps,” mentioned Nuclear Regulatory Fee (NRC) spokesperson Scott Burnell.

Constellation mentioned it anticipated the NRC evaluate course of to be accomplished in 2027.

BILLION DOLLAR BET

The deal would assist allow a revival of Unit 1 of the five-decades-old facility in Pennsylvania that was retired in 2019 as a result of financial causes. Unit 2, which had the meltdown, won’t be restarted.

Constellation plans to spend about $1.6 billion to revive the plant, which it expects to return on-line by 2028.

Reuters first reported on the potential restart in July.

Sources advised Reuters on the time that Constellation hoped it will obtain federal help for Three Mile Island that was much like what was given to the Palisades Nuclear Producing Station, which acquired a $1.5 billion conditional mortgage for a relaunch from the Biden administration.

Beneath the Constellation-Microsoft deal, Microsoft will buy power from the restarted plant for a interval of 20 years. The Three Mile Island unit will present 835 megawatts of electrical energy, or sufficient to energy about 700,000 houses.

A restart is predicted to be difficult, however as energy demand spikes, the just about carbon-free electrical energy supply is seeing renewed help from tech firms.

“This settlement is a significant milestone in Microsoft’s efforts to assist decarbonize the grid in help of our dedication to develop into carbon unfavourable,” Bobby Hollis, vice chairman of power at Microsoft, mentioned in an announcement.

Microsoft has additionally signed an influence buy settlement with Washington-state fusion firm Helion, which says the plant will probably be on-line by 2028, far sooner than many scientists say fusion will develop into industrial.

Main tech executives, together with ChatGPT developer OpenAI CEO Sam Altman and Microsoft co-founder Invoice Gates, have touted nuclear power as an answer to the rising energy wants of information facilities.

Altman has backed and is the chairman of nuclear energy startup Oklo, which went public by way of a blank-check merger in Might, whereas TerraPower – a startup Gates co-founded – broke floor on a nuclear facility in June.

Nuclear vegetation generated about 18.6% of the entire electrical energy within the U.S. final yr, based on Power Info Administration knowledge.

The facility provide offers with A.I. knowledge facilities are additionally dealing with elevated scrutiny. An identical deal between Talen Power and Amazon (NASDAQ:) signed earlier this yr has been challenged by a bunch of electrical utilities alleging it may spike prices for patrons or hamper grid reliability.

Monetary particulars of the Microsoft-Constellation deal weren’t disclosed. The businesses declined to offer extra particulars on the settlement.

Markets

After Its Reverse Inventory Break up, Is SiriusXM Satellite tv for pc Radio a Purchase?

SiriusXM Holdings (NASDAQ: SIRI) launched almost a era in the past with massive plans to disrupt media.

Quick-forward to 2024 and people plans appear to have principally fallen flat. Web-native options like Spotify dwarf SiriusXM in viewers measurement and market cap, and SiriusXM has struggled to interrupt away from the automotive market the place it is hottest.

Nevertheless, SiriusXM simply made an uncommon transfer, and a few traders appear to suppose it might be a catalyst for a breakout within the inventory.

A spin-off and a reverse inventory cut up

On Sept. 9, Liberty Media accomplished its spin-off of Liberty SiriusXM Holdings, which is now referred to as SiriusXM Holdings.

The transaction decreased the variety of shares excellent by roughly 12%, after which the corporate enacted a 1-for-10 that lifted the share worth out of .

The transaction appeared to breathe new life into SiriusXM, and will give it a contemporary starting. The corporate’s administration could have extra flexibility as Liberty Media takes a again seat.

Sirius reiterated its full-year forecasts for income of $8.75 billion and adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of $2.7 billion. It additionally trimmed its free money circulation steerage from $1.2 billion to $1 billion to account for fees associated to the spin-off.

Moreover, the corporate declared a quarterly dividend of $0.27, giving it a yield of 4.6%, and introduced a $1.166 billion share repurchase program.

Reverse inventory splits are typically a warning signal for traders. Corporations usually use them when their inventory costs have fallen thus far that they’ve gone out of compliance with their alternate’s itemizing guidelines. Merging shares collectively lifts their face worth, which may convey such firms again into compliance and preserve them away from being delisted.

That was not precisely the state of affairs with SiriusXM, nevertheless. True, its inventory has traded beneath $10 a share for a number of years, partly on account of the corporate’s issuing extra inventory to remain afloat in the course of the 2008-2009 monetary disaster. Nevertheless, the corporate appears to be like far more secure now than the everyday reverse inventory cut up inventory.

Sirius after the cut up

Sirius is solidly worthwhile, however the firm has struggled to develop its revenues and viewers in recent times. The satellite tv for pc radio veteran continues to focus on a leverage ratio of mid-to-low 3 occasions adjusted EBITDA, and plans to spend its free money circulation on investments, sustaining its dividend, and paying down its money owed.

The corporate completed the second quarter with $9 billion in long-term debt, that means it is in vary of its goal leverage ratio primarily based on its EBITDA forecast of $2.7 billion.

SiriusXM additionally stated it is evaluating the goodwill and intangible belongings it inherited from Liberty Media, which might result in a write-down within the third quarter. That might be a non-cash accounting cost, although.

Is SiriusXM a purchase?

For dividend traders and worth traders, SiriusXM appears to be like like a great candidate. The inventory trades at a price-to-earnings ratio of seven, and its yield of 4.6% on the present share worth can also be engaging.

Nevertheless, it is affordable to ask how sustainable the corporate’s enterprise is, which doubtless explains its low valuation.

Sirius is prone to lose Howard Stern subsequent 12 months when his contract expires, as he is anticipated to retire. The corporate additionally continues to lose market share to rival platforms like Spotify, and satellite tv for pc radio appears much less related as extra autos are outfitted with internet-ready interfaces like Carplay.

Within the third quarter, Sirius’s income fell 3% to $2.18 billion, and complete subscribers fell by 100,000 sequentially from the second quarter to 33.3 million; its subscriber base was down by 806,000 from a 12 months earlier.

For the proper of investor, Sirius might be a good selection, particularly if the corporate takes benefit of its low share worth and buys again its inventory. Nevertheless, traders ought to regulate income and subscriber traits to make sure that the enterprise is secure. Whereas these dangers are diminished given the corporate’s low valuation, they’re nonetheless the largest threats to SiriusXM inventory.

Must you make investments $1,000 in Sirius Xm proper now?

Before you purchase inventory in Sirius Xm, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Sirius Xm wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Spotify Know-how. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024