Markets

After Its Reverse Inventory Break up, Is SiriusXM Satellite tv for pc Radio a Purchase?

SiriusXM Holdings (NASDAQ: SIRI) launched almost a era in the past with massive plans to disrupt media.

Quick-forward to 2024 and people plans appear to have principally fallen flat. Web-native options like Spotify dwarf SiriusXM in viewers measurement and market cap, and SiriusXM has struggled to interrupt away from the automotive market the place it is hottest.

Nevertheless, SiriusXM simply made an uncommon transfer, and a few traders appear to suppose it might be a catalyst for a breakout within the inventory.

A spin-off and a reverse inventory cut up

On Sept. 9, Liberty Media accomplished its spin-off of Liberty SiriusXM Holdings, which is now referred to as SiriusXM Holdings.

The transaction decreased the variety of shares excellent by roughly 12%, after which the corporate enacted a 1-for-10 that lifted the share worth out of .

The transaction appeared to breathe new life into SiriusXM, and will give it a contemporary starting. The corporate’s administration could have extra flexibility as Liberty Media takes a again seat.

Sirius reiterated its full-year forecasts for income of $8.75 billion and adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of $2.7 billion. It additionally trimmed its free money circulation steerage from $1.2 billion to $1 billion to account for fees associated to the spin-off.

Moreover, the corporate declared a quarterly dividend of $0.27, giving it a yield of 4.6%, and introduced a $1.166 billion share repurchase program.

Reverse inventory splits are typically a warning signal for traders. Corporations usually use them when their inventory costs have fallen thus far that they’ve gone out of compliance with their alternate’s itemizing guidelines. Merging shares collectively lifts their face worth, which may convey such firms again into compliance and preserve them away from being delisted.

That was not precisely the state of affairs with SiriusXM, nevertheless. True, its inventory has traded beneath $10 a share for a number of years, partly on account of the corporate’s issuing extra inventory to remain afloat in the course of the 2008-2009 monetary disaster. Nevertheless, the corporate appears to be like far more secure now than the everyday reverse inventory cut up inventory.

Sirius after the cut up

Sirius is solidly worthwhile, however the firm has struggled to develop its revenues and viewers in recent times. The satellite tv for pc radio veteran continues to focus on a leverage ratio of mid-to-low 3 occasions adjusted EBITDA, and plans to spend its free money circulation on investments, sustaining its dividend, and paying down its money owed.

The corporate completed the second quarter with $9 billion in long-term debt, that means it is in vary of its goal leverage ratio primarily based on its EBITDA forecast of $2.7 billion.

SiriusXM additionally stated it is evaluating the goodwill and intangible belongings it inherited from Liberty Media, which might result in a write-down within the third quarter. That might be a non-cash accounting cost, although.

Is SiriusXM a purchase?

For dividend traders and worth traders, SiriusXM appears to be like like a great candidate. The inventory trades at a price-to-earnings ratio of seven, and its yield of 4.6% on the present share worth can also be engaging.

Nevertheless, it is affordable to ask how sustainable the corporate’s enterprise is, which doubtless explains its low valuation.

Sirius is prone to lose Howard Stern subsequent 12 months when his contract expires, as he is anticipated to retire. The corporate additionally continues to lose market share to rival platforms like Spotify, and satellite tv for pc radio appears much less related as extra autos are outfitted with internet-ready interfaces like Carplay.

Within the third quarter, Sirius’s income fell 3% to $2.18 billion, and complete subscribers fell by 100,000 sequentially from the second quarter to 33.3 million; its subscriber base was down by 806,000 from a 12 months earlier.

For the proper of investor, Sirius might be a good selection, particularly if the corporate takes benefit of its low share worth and buys again its inventory. Nevertheless, traders ought to regulate income and subscriber traits to make sure that the enterprise is secure. Whereas these dangers are diminished given the corporate’s low valuation, they’re nonetheless the largest threats to SiriusXM inventory.

Must you make investments $1,000 in Sirius Xm proper now?

Before you purchase inventory in Sirius Xm, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Sirius Xm wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Spotify Know-how. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

JPMorgan CEO Jamie Dimon Calls For Federal Workers To Return To Workplace, Says Empty Buildings 'Trouble' Him: 'I Can't Imagine…'

Benzinga and Lusso’s Information LLC could earn fee or income on some objects via the hyperlinks under.

JPMorgan Chase (NYSE:) CEO Jamie Dimon has known as for federal workers in Washington, DC, to return to their places of work, highlighting the continued debate over

What Occurred: Talking at The Atlantic Competition, Dimon expressed his frustration with the variety of empty buildings within the capital, to Enterprise Insider on Friday.

“By the best way, I’d additionally make Washington, DC, return to work. I can’t consider, once I come down right here, the empty buildings. The individuals who give you the results you want not going to the workplace,” he said,

“That bothers me,” he added. Dimon emphasised that he doesn’t enable such flexibility at JPMorgan.

Don’t Miss:

Why It Issues: Dimon just isn’t alone in his stance. Earlier this week, Amazon (NASDAQ:) CEO Andy Jassy introduced that Amazon workers wouldk, reverting to pre-pandemic norms.

JPMorgan’s coverage mandates managing administrators to be within the workplace full-time, whereas different workers should work in particular person no less than three days every week. Final 12 months, the Biden Administration additionally pushed federal workers to return to in-person work.

Regardless of these efforts, many federal staff nonetheless have versatile work preparations. As an example, some Environmental Safety Company workers are required to be within the workplace solely 4 days a month. Different companies, just like the Division of the Treasury and the Division of the Inside, require no less than 50% in-office presence.

Workplace emptiness charges in DC stay excessive, with about 22% of within the second quarter of 2024, in response to CBRE. The federal authorities and private-sector places of work contribute to this pattern.

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor immediately. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Maintain Studying:

-

This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Rigorously contemplate the funding targets, dangers, prices and bills of the Fundrise Flagship Fund earlier than investing. This and different info might be discovered within the. Learn them rigorously earlier than investing. -

New fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends

This text initially appeared on

Markets

US to suggest barring Chinese language software program, {hardware} in related automobiles, sources say

WASHINGTON (Reuters) – The U.S. Commerce Division is predicted on Monday to suggest prohibiting Chinese language software program and {hardware} in related and autonomous automobiles on U.S. roads attributable to nationwide safety issues, sources informed Reuters.

The Biden administration has raised severe issues concerning the assortment of knowledge by Chinese language firms on U.S. drivers and infrastructure in addition to the potential overseas manipulation of related automobiles. The proposed regulation would ban the import and sale of automobiles from China with key communications or automated driving system software program or {hardware}.

The division plans to offer the general public 30 days to remark earlier than any finalization of the principles, the sources mentioned, including that the division plans to suggest making the prohibitions on software program efficient within the 2027 mannequin yr and the prohibitions on {hardware} would take impact in January 2029. The Commerce Division declined to touch upon Saturday.

Markets

Valuation Angst Is Being Stoked by Fed’s Huge Lower: Credit score Weekly

(Lusso’s Information) — Traders are pouring cash into company bonds, threat premiums are grinding tighter, and the Federal Reserve’s rate of interest reduce is reigniting hopes the US will dodge a recession.

Most Learn from Lusso’s Information

Some cash managers say the market is simply too complacent about causes for concern now.

“You will have the US election arising, and expectations round financial progress in Germany are a few of the weakest it’s been since pre-Covid occasions,” stated Simon Matthews, a senior portfolio supervisor at Neuberger Berman. “Shoppers are feeling the pinch and progress in China is slowing. Whenever you pull that each one collectively, it’s not telling you that credit score spreads ought to be near the tights,” he added, noting that falling borrowing prices will assist scale back a few of the headwinds.

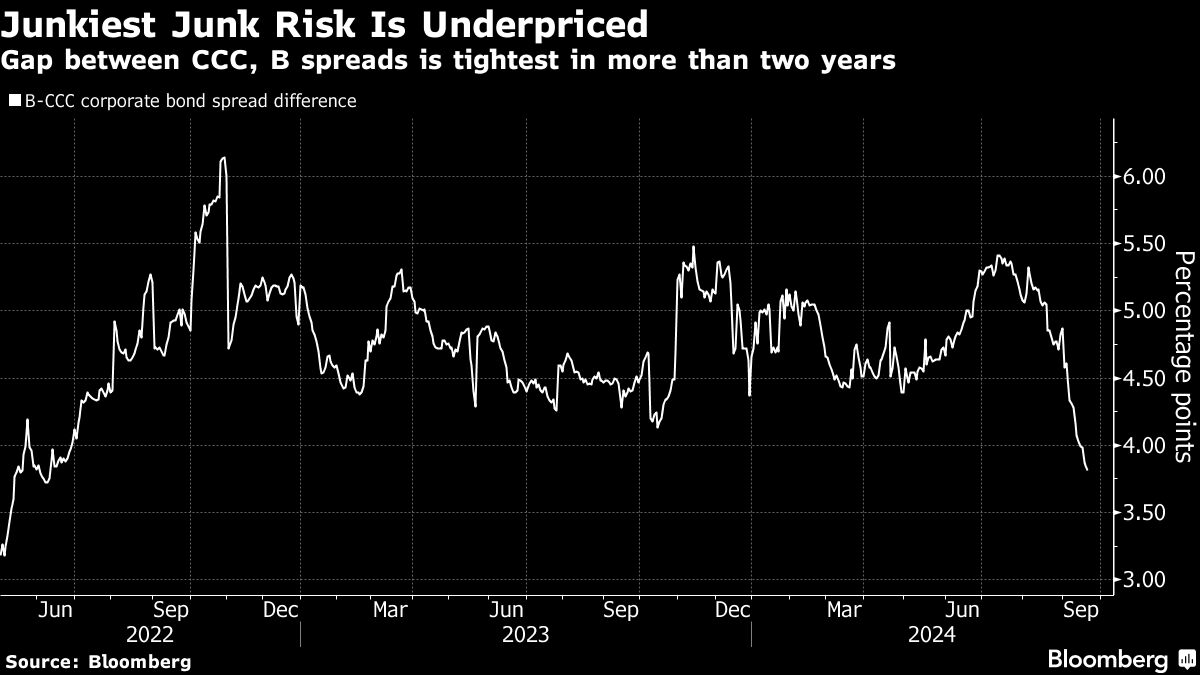

Traders have been setting apart the potential negatives and diving deeper into the riskiest corners of credit score within the hunt for increased yields. The bottom-rated bonds at the moment are outperforming the broader junk bond market whereas demand for Extra Tier 1 bonds, which might drive losses on traders to assist a financial institution survive turmoil, is predicted to extend.

Consumers are betting that decrease borrowing prices will allow debt-laden corporations to refinance and push out their maturities, limiting defaults and supporting valuations. And as short-term charges drop, traders are anticipated to shift their allocations into medium- and longer-term company debt from cash markets which may trigger spreads to tighten even additional.

Nonetheless, inflation may begin ticking up once more if shoppers begin spending extra as rates of interest are reduce, in line with Hunter Hayes, chief funding officer at Intrepid Capital Administration Inc.

“Who is aware of, possibly the Fed funds price has to come back proper again up prefer it has in earlier inflationary cycles after which, swiftly, high-yield bonds are so much much less enticing once more,” he stated.

With US financial coverage more likely to stay restrictive, market members are additionally waiting for indicators of degradation in fundamentals, particularly amongst debtors uncovered to floating-rate debt, BlackRock Inc. researchers Amanda Lynam and Dominique Bly wrote in a observe. As well as, issuers rated CCC stay pressured in combination, regardless of the latest outperformance of their debt, they wrote.

They cited low ranges of earnings the businesses have in combination in contrast with their curiosity expense. Borrowing prices for CCC rated corporations are nonetheless round 10% — crippling for some small corporations after they need to refinance following the top of the straightforward cash period — and leaving them prone to default whilst charges fall.

Any weak point within the labor market would additionally “be a headwind for spreads as it can enhance recession fears and decrease yields,” JPMorgan Chase & Co. analysts together with Eric Beinstein and Nathaniel Rosenbaum wrote in a analysis observe this previous week.

To make sure, valuation issues stay modest and traders are for probably the most half chubby company debt. The start of the rate-cutting cycle also needs to help demand for non-cyclicals over cyclicals within the investment-grade market, analysts at BNP Paribas SA wrote in a observe.

Specifically, restricted issuance by well being care corporations and utilities present room for unfold compression, they added.

“It’s a first-rate alternative for non-cyclicals to outperform,” Meghan Robson, the financial institution’s head of US credit score technique, stated in an interview. “Cyclicals we predict are overvalued.”

Week in Assessment

-

Merchants are piling into bets on additional easing by the US central financial institution after it reduce rates of interest on Wednesday by a half share level — its first discount in 4 years. The historic transfer ended weeks of hypothesis about whether or not the Federal Reserve would kickstart its easing cycle with a quarter- or half-point reduce.

-

The reduce is supportive of credit score spreads general, however it can encourage company bond issuance — notably from high-yield issuers. The reduce will probably favor these borrowing on the front- fairly than back-end of the yield curve, in line with market members surveyed by Lusso’s Information

-

Credit score by-product spreads dipped Wednesday following the transfer, to round their narrowest because the pandemic

-

Nevertheless, Fed Governor Michelle Bowman warns that the 50 foundation level discount “could possibly be interpreted as a untimely declaration of victory” over inflation

-

In different central financial institution information, the Financial institution of England stored charges unchanged and warned traders it received’t rush to ease financial coverage

-

-

Wall Avenue banks burned two years in the past after backing massive company buyouts and ending up with tens of billions of {dollars} of “hung debt” at the moment are again for extra, on the point of underwrite extra European LBOs.

-

Corporations benefiting from decrease financing prices to win higher phrases on present debt or to push out maturities have borrowed probably the most from the US leveraged mortgage market in seven years.

-

Liquidators of China Evergrande Group, the world’s most indebted builder, are returning to a Hong Kong court docket as they try to wind up a subsidiary with key property.

-

UBS Group AG is main a $1.15 billion financing package deal to help Vista Fairness Companions’ acquisition of software program firm Jaggaer, beating out direct lenders who had been additionally competing for the deal.

-

Apollo International Administration Inc. clinched $5 billion in recent firepower from BNP Paribas SA because it appears to develop a key lending enterprise, muscling deeper into turf as soon as dominated by banks.

-

A a lot bigger share of managers within the $1 trillion US collateralized mortgage obligation market are capable of purchase and promote loans extra freely than as soon as feared, after a refinancing and resetting surge pushed again the clock on reinvesting limits.

-

On this planet of personal credit score, KKR & Co.’s capital markets arm led a financing for USIC Holdings to assist repay broadly syndicated debt, whereas Oak Hill Advisors supplied $775 million to help Carlyle Group Inc.’s buy of Worldpac, and Alegeus Applied sciences is seeking to rating about $75 million in curiosity financial savings by means of refinancing the non-public mortgage that Vista Fairness Companions used to take the corporate non-public in 2018.

-

Tupperware filed for chapter after a years-long wrestle with gross sales declines and rising competitors.

-

Bankrupt trucker Yellow Corp. and its hedge fund house owners misplaced a key court docket ruling over $6.5 billion in debt that pension funds declare the defunct firm owes them, probably wiping out most restoration for shareholders.

-

Bausch Well being Cos. is working with Jefferies Monetary Group to discover refinancing a few of its debt to assist a long-planned spinoff of its stake within the eye-care firm Bausch + Lomb.

On the Transfer

-

BlackRock Inc. is overhauling its non-public credit score enterprise. The agency is establishing a brand new division, International Direct Lending, appointing Stephan Caron, head of the European middle-market non-public debt enterprise, to steer it. Jim Keenan, world head of BlackRock’s non-public debt enterprise, will go away the agency subsequent 12 months, as will Raj Vig, co-head of US non-public capital.

-

Silver Level Capital has employed Joseph McElwee from Investcorp as head of collateralized mortgage obligation capital markets and structuring.

-

Jefferies Monetary Group Inc. has employed former Citigroup Inc. banker Simon Francis in a newly created position main its debt financing enterprise in Europe, the Center East and Africa.

-

Constancy Investments has recruited Lendell Thompson, a former director at Vista Credit score Companions, because it continues increasing into the non-public credit score market. He will probably be a managing director within the agency’s direct lending workforce.

–With help from Dan Wilchins and James Crombie.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024