Markets

Is Tremendous Micro Pc Inventory a Purchase Now?

Following a terrific begin to the 12 months, Tremendous Micro Pc‘s (NASDAQ: SMCI) inventory chart has undergone a stark reversal over the previous six months. It has misplaced near 60% of its worth from its peak, and up to date developments appear to have additional dented investor confidence within the firm.

First, the fiscal 2024 fourth-quarter outcomes it launched on Aug. 6 , and administration’s steerage was disappointing. Second, short-seller Hindenburg Analysis launched a report alleging accounting irregularities at Supermicro. Then, Supermicro administration introduced that it was delaying the submitting of its annual report, which solely added to the adverse press.

These components clarify why Wall Avenue analysts have been downgrading the inventory recently. However provided that shares of this server and storage techniques producer at the moment are buying and selling at a sexy 22 instances trailing earnings and 13 instances ahead earnings, opportunistic buyers could also be tempted to purchase Supermicro. Ought to they be doing that in gentle of the current developments?

Addressing the elephant within the room

Traders ought to word that Hindenburg is a , and it has a monetary curiosity in seeing Supermicro’s inventory value fall. In that context, we can’t make certain that the allegations that Hindenburg is making are legitimate, particularly contemplating that the short-seller has been mistaken prior to now. That stated, Supermicro was charged by the Securities and Change Fee (SEC) for accounting violations in August 2020, when it was discovered to have prematurely acknowledged income and understated its bills over a three-year interval.

Nevertheless, the corporate has recovered remarkably since then, clocking excellent positive aspects over the previous couple of years because of the emergence of a brand new catalyst within the type of synthetic intelligence (AI). Its income in its fiscal 2024 greater than doubled to $14.9 billion from $7.1 billion within the earlier 12 months. Non-GAAP earnings shot as much as $22.09 per share, from $11.81 per share in fiscal 2023.

Addressing the delay in Supermicro’s annual submitting, administration clarified that “we do not anticipate any materials modifications in our fourth quarter or fiscal 12 months 2024 monetary outcomes.” It added that the corporate is wanting ahead to a “historic” 2025 with “a document variety of orders, a robust and rising backlog of design wins and main market positions throughout quite a lot of areas.”

Supermicro says that the current developments will not have an effect on its manufacturing capabilities, and it is on monitor to satisfy the demand for its AI server options. It is value noting that Supermicro is anticipating its fiscal 2025 income to land between $26 billion and $30 billion. That will be one other 12 months of exceptional development from its $14.9 billion in fiscal 2024.

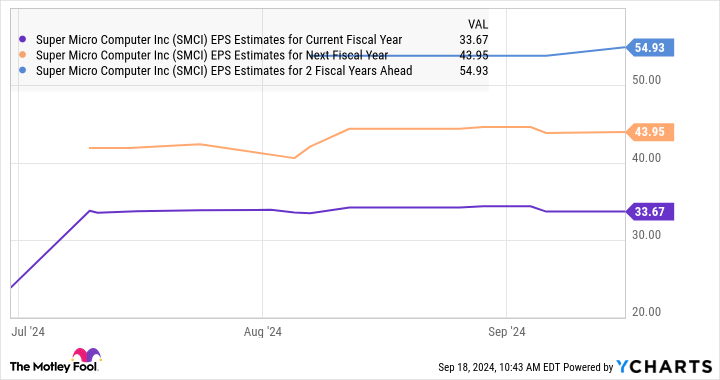

Although it’s going through margin challenges as a result of elevated investments it is making because it boosts capability to satisfy the sturdy demand for its liquid-cooled server options, administration is assured that it’s going to return to its regular margin vary earlier than the fiscal 12 months ends. Analysts’ consensus estimates additionally point out that Supermicro’s earnings are on monitor to extend at an unimaginable tempo within the present fiscal 12 months, adopted by wholesome jumps within the subsequent couple of years as effectively.

What ought to buyers do?

The delay in Supermicro’s annual submitting led JPMorgan to downgrade the inventory from obese to impartial and to slash its value goal to $500 from $950. Even Barclays downgraded the inventory to equal weight from obese, citing the margin strain that Supermicro faces in addition to the submitting delay. Nevertheless, JPMorgan’s downgrade wasn’t a results of the Hindenburg report nor a mirrored image of its skill to grow to be compliant, however due to the near-term uncertainty that surrounds the corporate and the dearth of a compelling argument to purchase the inventory.

So, risk-averse buyers would do effectively to attend for extra readability earlier than shopping for this AI inventory. Nevertheless, these with greater threat appetites who want to add a fast-growing firm to their portfolios can take into account shopping for Supermicro now. It appears able to sustaining its spectacular development in the long term because of the large alternatives obtainable to it within the AI server market.

Analysts count on Supermicro’s earnings to develop at an annualized price of 62% over the subsequent 5 years. If the corporate can get previous its present troubles, it may develop into a stable funding contemplating the valuation at which it’s buying and selling proper now.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for buyers to purchase now… and Tremendous Micro Pc wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot recommends Barclays Plc. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

This Monster Progress Inventory Is Up Practically 300% in 5 Years. Right here's Why It's the Largest Inventory Place in My Portfolio Proper Now.

The final 5 years had been chaotic, with a world pandemic, a presidential election, inflation, swift rate of interest modifications, financial institution failures, and extra. Regardless of this stage of financial disruption, the S&P 500 is up practically 90%. That is a great run, all issues thought of.

Pretty much as good as these broad market returns have been, MercadoLibre (NASDAQ: MELI) inventory has left the S&P 500 utterly within the mud. Shares of this Latin American enterprise are up over 280% within the final 5 years.

MercadoLibre is the biggest place in my private , and I am going to clarify why in a second. However first, I need to present some context to forestall potential misunderstandings.

My Roth IRA is lower than 5 years outdated. I beforehand had a retirement account with my employer. I did not have management over how that account was invested. However upon altering jobs, I rolled the account over and out of the blue had investable money and decision-making potential.

I shortly diversified the account to over 20 inventory positions as a result of diversification is essential — it is a . In early 2022, I bought shares of MercadoLibre for the primary time, dollar-cost averaging into my new place till it was price about 5% of the Roth IRA’s worth.

It wasn’t the biggest place on the time, however MercadoLibre inventory actually holds that title now. It is price excess of 5% of the full portfolio worth. Nevertheless, there are three explanation why I am not trying to promote any MercadoLibre shares anytime quickly.

1. MercadoLibre is poised for progress

Traders can earn cash in low-growth industries. Nevertheless it’s means simpler to seek out profitable investments by concentrating on leaders in rising markets.

In MercadoLibre’s case, its two essential enterprise segments are its e-commerce market and its monetary expertise (fintech) providers. Competitors can be way more fierce in North America or Europe. However in its native Latin America, MercadoLibre enjoys a number one place due to its early entry into the house.

When it comes to market maturity, Latin American markets for e-commerce and digital monetary merchandise are youthful than these markets in North America, typically talking. This partly explains why MercadoLibre’s progress has been stellar and why it may stay robust for the foreseeable future.

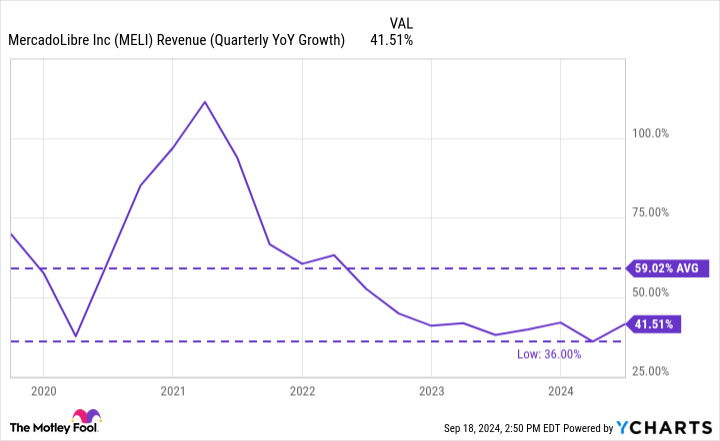

Relating to its progress charge, the chart beneath reveals that MercadoLibre’s slowest progress charge of the final 5 years was 36% — most corporations not often have a single 12 months of progress that good. And MercadoLibre has averaged top-line progress of practically 60% throughout that interval. At this charge, the enterprise will quadruple in measurement each three years, which is simply mind-blowing.

I am not essentially saying that MercadoLibre will preserve this present tempo. However its progress nonetheless appears to have loads of runway, which is the highest purpose I am pleased that MercadoLibre inventory is the biggest place in my Roth IRA.

2. MercadoLibre is poised for income

A few years in the past, MercadoLibre determined to sacrifice its good revenue margins to put money into transport and logistics. In its geographies, logistics was the problem that few corporations had been fixing for. It wasn’t fast, low cost, or simple. However as we speak, MercadoLibre has spectacular talents.

For perspective, over half of orders on MercadoLibre’s e-commerce platform are being delivered identical day or subsequent day, which is a uncommon stage of service within the firm’s key markets.

Its power in logistics helps the long-term progress of MercadoLibre’s e-commerce market. Not solely are extra third-party sellers getting on board (feeding a high-margin income stream), however progress of the platform additionally permits for progress in promoting income. The corporate had round $250 million in advert income within the second quarter of 2024, which was up greater than 50% 12 months over 12 months.

Furthermore, MercadoLibre’s power in logistics provides it a aggressive benefit, and firms with highly effective benefits typically discover methods to enhance their margins over time.

In recent times, MercadoLibre’s income progress has been excellent. However because the chart beneath reveals, progress for revenue metrics corresponding to working earnings and free money circulate has been even higher.

I’d anticipate extra positive aspects for MercadoLibre inventory if its income proceed to develop as they’re now.

3. Letting winners run is a profitable technique

One precept for investing the Motley Idiot means is to have a various portfolio. One other precept is to let a profitable funding proceed working, slightly than promoting it prematurely.

Let’s face it, a various portfolio goes to be crammed with loads of dangerous investments — mine certain is. This could drag down general long-term returns. Nevertheless, a single profitable inventory can do the heavy lifting. However this could solely occur if it is allowed sufficient time to develop.

There are authentic causes to promote a inventory. However MercadoLibre’s enterprise is flourishing, and it seems to have an extended runway. For these causes, I am going to hold holding my high inventory and permit it to raise my portfolio as a complete.

The place to speculate $1,000 proper now

When our analyst workforce has a inventory tip, it may possibly pay to hear. In any case, Inventory Advisor’s complete common return is 757% — a market-crushing outperformance in comparison with 167% for the S&P 500.*

They only revealed what they imagine are the for buyers to purchase proper now… and MercadoLibre made the record — however there are 9 different shares you might be overlooking.

*Inventory Advisor returns as of September 16, 2024

has positions in MercadoLibre. The Motley Idiot has positions in and recommends MercadoLibre. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

JPMorgan CEO Jamie Dimon Calls For Federal Workers To Return To Workplace, Says Empty Buildings 'Trouble' Him: 'I Can't Imagine…'

Benzinga and Lusso’s Information LLC could earn fee or income on some objects via the hyperlinks under.

JPMorgan Chase (NYSE:) CEO Jamie Dimon has known as for federal workers in Washington, DC, to return to their places of work, highlighting the continued debate over

What Occurred: Talking at The Atlantic Competition, Dimon expressed his frustration with the variety of empty buildings within the capital, to Enterprise Insider on Friday.

“By the best way, I’d additionally make Washington, DC, return to work. I can’t consider, once I come down right here, the empty buildings. The individuals who give you the results you want not going to the workplace,” he said,

“That bothers me,” he added. Dimon emphasised that he doesn’t enable such flexibility at JPMorgan.

Don’t Miss:

Why It Issues: Dimon just isn’t alone in his stance. Earlier this week, Amazon (NASDAQ:) CEO Andy Jassy introduced that Amazon workers wouldk, reverting to pre-pandemic norms.

JPMorgan’s coverage mandates managing administrators to be within the workplace full-time, whereas different workers should work in particular person no less than three days every week. Final 12 months, the Biden Administration additionally pushed federal workers to return to in-person work.

Regardless of these efforts, many federal staff nonetheless have versatile work preparations. As an example, some Environmental Safety Company workers are required to be within the workplace solely 4 days a month. Different companies, just like the Division of the Treasury and the Division of the Inside, require no less than 50% in-office presence.

Workplace emptiness charges in DC stay excessive, with about 22% of within the second quarter of 2024, in response to CBRE. The federal authorities and private-sector places of work contribute to this pattern.

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor immediately. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Maintain Studying:

-

This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Rigorously contemplate the funding targets, dangers, prices and bills of the Fundrise Flagship Fund earlier than investing. This and different info might be discovered within the. Learn them rigorously earlier than investing. -

New fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends

This text initially appeared on

Markets

US to suggest barring Chinese language software program, {hardware} in related automobiles, sources say

WASHINGTON (Reuters) – The U.S. Commerce Division is predicted on Monday to suggest prohibiting Chinese language software program and {hardware} in related and autonomous automobiles on U.S. roads attributable to nationwide safety issues, sources informed Reuters.

The Biden administration has raised severe issues concerning the assortment of knowledge by Chinese language firms on U.S. drivers and infrastructure in addition to the potential overseas manipulation of related automobiles. The proposed regulation would ban the import and sale of automobiles from China with key communications or automated driving system software program or {hardware}.

The division plans to offer the general public 30 days to remark earlier than any finalization of the principles, the sources mentioned, including that the division plans to suggest making the prohibitions on software program efficient within the 2027 mannequin yr and the prohibitions on {hardware} would take impact in January 2029. The Commerce Division declined to touch upon Saturday.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024