Markets

Trump Household's Crypto Enterprise Revealed: New Shopping for Guidelines, Who Can Make investments and What It Means for Early Adopters

The workforce behind ‘s newest crypto enterprise, World Liberty Monetary, took over two hours to launch the important thing element many have been ready for at Monday night time’s occasion on X.

The suspense lastly ended once they revealed who may purchase the forthcoming tokens and the way shares can be distributed. Billed as the subsequent large step for the previous president and his household, this launch had constructed up anticipation for weeks.

Do not Miss:

Zak Folkman, one of many challenge’s founders, defined that the platform’s WLFI token will likely be divided amongst a number of teams. “Twenty p.c of the tokens are put aside for the founding workforce,” he stated, referring to a gaggle that features the Trumps.

One other 17% will go towards consumer rewards, whereas the remaining 63% of tokens will likely be publicly obtainable. He emphasised, “There will likely be no presales or early buy-ins.”

Trending: In line with Cathie Wooden, holding 6 Ethereum (ETH) may make you a millionaire,.

This was a vital clarification, as an earlier draft of the challenge’s define, which had been leaked, raised eyebrows. The draft indicated that the founders would management 70% of the tokens, main many to fret that it would simply be one other quick-cash scheme.

The construction of the providing, a Regulation D token providing, permits World Liberty Monetary to boost funds with out registering with the Securities and Change Fee (SEC), so long as they meet sure standards. This led to a dialog about how the SEC, beneath its chair Gary Gensler, has been regulating the crypto trade, typically utilizing enforcement actions as an alternative of clear tips.

Trending: If there was a brand new fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends?

Trump himself was a part of the motion, talking overtly about his preliminary lack of curiosity in crypto. “I wasn’t overly ,” Trump stated, including that his perspective modified when his kids launched him to crypto via the success of his non-fungible token collections. “I feel my kids opened my eyes greater than the rest,” he remarked.

The occasion befell in opposition to an uncommon backdrop for Trump. Simply the day earlier than, there was an alleged assassination try whereas Trump was {golfing} with Steve Witkoff, his longtime pal and a key determine in World Liberty Monetary.

Trending: One trailblazing feminine with an experience in renewable vitality constructed an organization that is bringing the EV revolution to deprived communities —

The incident befell at Trump’s West Palm Seaside golf membership and the FBI has been investigating. Regardless of the dramatic incident, Witkoff joined Trump for Monday’s occasion, the place he spoke about how the enterprise started.

Witkoff recounted how his son had launched him to 2 younger crypto entrepreneurs, Chase Herro and Zak Folkman, who satisfied him that decentralized finance (DeFi) may very well be the way forward for cash.

“These guys are as sharp as any forex merchants I’ve ever met,” Witkoff stated. He then described how he introduced the Trump household into the fold. “We had a gathering with Eric, Don Jr., the president and his counsel. We have been on it for near 9 months,” he revealed.

Trending: Throughout market downturns, traders are studying that not like equities, these

The similarities between World Liberty Monetary and Trump’s earlier challenge, Trump Media & Expertise Group, did not go unnoticed. Just like the media firm that launched the conservative social platform Reality Social, this crypto enterprise is anticipated to show heads.

Nonetheless, regardless of the Trump household’s involvement, they don’t personal or handle the platform. Eric Trump and Steve Witkoff are the 2 figures on the helm and each are new to the crypto house. Although Trump has been warming to in latest months, even delivering a keynote on the largest bitcoin occasion in July, the general public stays curious – and cautious – about this new challenge.

The founders have been tight-lipped about plans, providing little readability on timelines. The one clue offered was that updates would come via official channels and so they warned followers to be cautious of scammers desperate to make the most of the excitement surrounding the challenge.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

1 Magnificent Excessive-Yield Dividend Progress Inventory Down 40% to Purchase and Maintain Eternally

Usually, traders on the lookout for dividend development would not anticipate finding it in the actual property funding belief (REIT) sector. However generally there are gems that get neglected as a result of they do not conform to the norms. Rexford Industrial Realty (NYSE: REXR) is simply such a genre-defying inventory. Listed below are three explanation why that is one magnificent high-yield dividend development inventory you will need to think about shopping for and holding perpetually.

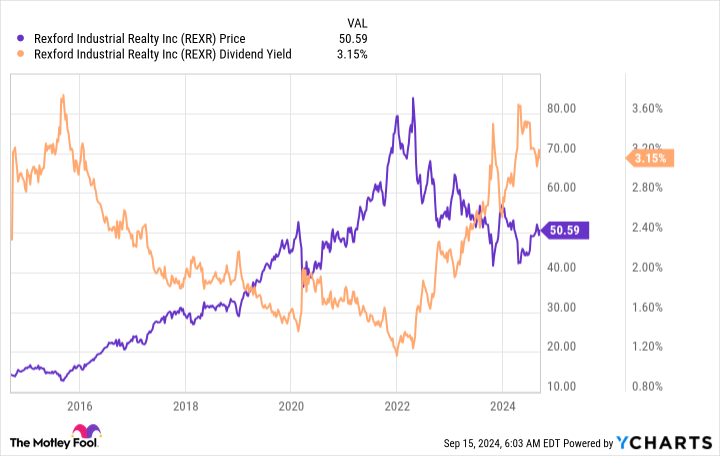

1. Rexford’s yield is engaging

To get the dangerous information out first, Rexford Industrial’s yield is a little bit under common for a REIT. Rexford’s is 3.3% whereas the common REIT has a yield of roughly 3.7%. Nonetheless, whenever you examine Rexford to the broader market, it seems to be loads higher. That 3.3% yield is sort of 3 times bigger than the S&P 500 index’s paltry 1.2% yield.

And, due to a dramatic pullback in Rexford’s inventory value, the dividend yield can be close to its highest ranges of the last decade. So you’ll find higher-yielding , however Rexford’s yield nonetheless seems to be pretty engaging on each an absolute foundation and relative to its personal historical past.

2. Rexford’s dividend development is massively engaging

You may’t simply take a look at Rexford Industrial’s yield and name it a day. The REIT’s most spectacular dividend statistic is the speed of dividend development it has achieved over the previous decade. REITs are generally called gradual and regular growers; a mid-single-digit dividend development fee is normally thought-about fairly good. Rexford’s dividend expanded at an annualized fee of 13% over the previous decade. That might be an enormous quantity for any firm however is downright phenomenal for a REIT.

Whenever you add the dividend development to the yield, it turns into clear that Rexford is a really engaging development and earnings inventory. In truth, over roughly the previous 10 years the dividend has grown from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That is an almost 250% leap, one thing that almost any dividend investor would recognize.

3. Rexford’s enterprise mannequin is differentiated

Rexford is an industrial REIT, which is not significantly particular in any manner. Nonetheless, it has a singular geographic focus that units it other than its friends. Not like most industrial REITs, which concentrate on diversification, Rexford has gone all in on the Southern California market. That is proper — it solely invests in a single area of the US. There’s a clear threat on this method, however given the corporate’s robust dividend historical past, the guess administration has made is paying off.

That is truly not too surprising when you step again and study the Southern California market. It’s the largest industrial market in the US and ranks because the No. 4 market globally. Notably, it is a vital gateway for items coming to North America from Asia. Being an important cog within the world provide chain has resulted in excessive demand, with the Southern California area having a dramatically decrease emptiness fee than the remainder of the nation. Add in provide constraints, and Rexford has been capable of enhance charges on expiring leases in latest quarters drastically.

Add that tailwind to the REIT’s improvement plans and acquisitions, and also you get a REIT that appears prone to proceed rewarding traders very effectively for years to come back.

Dividend development traders should purchase Rexford whereas they will

So why is Rexford’s inventory down 40% or so from its all time highs? The reply actually boils all the way down to investor sentiment, which received a bit overheated through the coronavirus pandemic as demand for warehouse house elevated together with on-line buying. Though the joy has worn off, Rexford’s enterprise continues to carry out effectively. In case you are a dividend development investor, you need to think about shopping for Rexford and holding on to it for a really very long time.

Do you have to make investments $1,000 in Rexford Industrial Realty proper now?

Before you purchase inventory in Rexford Industrial Realty, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Rexford Industrial Realty wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Rexford Industrial Realty and Vanguard Actual Property ETF. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Southwest Airways warns employees of 'powerful selections' forward, Bloomberg reviews

(Reuters) – Southwest Airways (NYSE:) has warned workers that it’s going to quickly make powerful selections as a part of a method to revive earnings and counter calls for from activist investor Elliott Funding Administration, Bloomberg Information reported on Saturday.

The airline is contemplating making modifications to its flight routes and schedules to extend income, the report added, citing the transcript of a video message to workers by Chief Working Officer Andrew Watterson.

“I apologize upfront if you happen to as a person are affected by it,” Watterson mentioned, in accordance with the report, including that he did not supply any particulars on the pending strikes.

Southwest didn’t instantly reply to a Reuters request for remark.

The airline has been struggling to search out its footing after the COVID-19 pandemic, partially as a result of Boeing (NYSE:)’s plane supply delays and industry-wide overcapacity within the home market.

It plans to supply assigned and extra-legroom seats to draw premium vacationers and begin in a single day flights. It’s going to current the main points to traders on Sept. 26.

Earlier this week, Reuters reported that Elliott, which owns 10% of Southwest’s widespread shares, advised one of many firm’s prime unions it nonetheless needs to interchange CEO Robert Jordan, even after the provider pledged to shake up its board.

Markets

3 Dividend Kings to Add to Your Portfolio for a Lifetime of Passive Revenue

Should you’re seeking to increase your dividend earnings, you virtually cannot go incorrect by investing in . These are shares which have elevated their dividend for no less than 50 consecutive years. Clearly, an organization with such a stellar dividend file should have stable financials and progress prospects, or it would not be capable of maintain dividend will increase over a number of a long time.

Coca-Cola (NYSE: KO), Philip Morris (NYSE: PM), and Realty Revenue (NYSE: O) are three Dividend Kings to purchase proper now, in accordance with these idiot.com contributors. Here is why.

A resilient client model

(Coca-Cola): Coca-Cola is a dominant international beverage model that has paid 62 consecutive years of rising dividends. The inventory is up 21% 12 months thus far following robust monetary leads to the primary half of 2024.

Shoppers have tightened their spending, however the beverage business has remained resilient. Coca-Cola reported a 2% year-over-year enhance in unit case quantity final quarter, and it additionally achieved double-digit natural income progress and better margins.

Coca-Cola has a diversified portfolio of manufacturers throughout teas, juices, and carbonated drinks. Throughout all these manufacturers, it generates a strong working revenue margin of 21%, which administration is working to extend by refranchising its bottling operations. The worthwhile lineup offers the corporate numerous gross sales alternatives for various events, whereas producing a wholesome revenue to pay rising dividends.

The corporate is paying out about 75% of its annual earnings in dividends. The quarterly dividend is at present $0.485 per share, up 21% over the past 5 years. This places the forward-dividend yield at a beautiful 2.71% in comparison with simply 1.32% for the S&P 500.

The inventory’s efficiency displays the power of the model and the alternatives to continue to grow over the long run. Coca-Cola’s fastest-growing markets within the second quarter had been Latin America and Asia Pacific. The inventory’s above-average yield provides buyers nice worth with extra progress to return.

This longtime dividend payer continues to be heating up

Jeremy Bowman (Philip Morris): Philip Morris would possibly appear to be an odd selection for a long-term dividend inventory.

In any case, everybody is aware of that smoking is on the decline, however nowadays, Philip Morris’ enterprise is way more than simply cigarettes. The corporate has efficiently diversified into next-gen merchandise, together with the IQOS heat-not-burn sticks that operate like vapes however use tobacco as a substitute of e-liquid, and Zyn nicotine pouches, which it gained in its acquisition of Swedish Match in 2022.

Thanks largely to the success of these two merchandise, the tobacco inventory now generates roughly 40% of income from next-gen, smoke-free merchandise, and since these merchandise generate even wider margins than cigarettes, they now produce greater than 40% of Philip Morris’ gross revenue. Demand has been so robust for Zyn that the corporate lately introduced new investments to broaden capability in Colorado and Kentucky.

Since Philip Morris additionally solely sells cigarettes in worldwide markets, the corporate continues to be rising its cigarette class as natural income from combustibles, that are primarily cigarettes, was up 4.8% in its most up-to-date quarter. Even shipments of cigarettes had been up 0.4% within the quarter.

Altogether, natural income rose 9.6% to $9.5 billion within the quarter and organic-operating earnings was up 12.5%, that are wonderful numbers for a seemingly mature dividend inventory.

Philip Morris additionally simply raised its quarterly payout by 3.8% to $1.35. Whereas the corporate is just not technically a Dividend King, in case you embrace its historical past as a part of Altria, then it is raised its dividend for the final 55 years.

At present, the corporate provides a 4.4% dividend yield, and it seems poised to hike its payout for years forward.

Month-to-month, high-yielding dividends

Jennifer Saibil (Realty Revenue): Few dividend shares in the marketplace can match Realty Revenue. It has every thing a passive-income investor might need in a inventory: The dividend has a excessive yield, it is dependable, it is rising, and the corporate pays month-to-month, an additional perk.

Realty Revenue is a retail actual property funding belief (REIT), which suggests it leases properties to retailers. Nevertheless, it has massively expanded over the previous few years and is nicely diversified by business. Retail properties nonetheless make up 79.4%, and inside retail, it caters to necessities classes like grocery shops, comfort shops, and greenback shops, which give it resilience throughout pressured instances like pandemics and inflation. Collectively, these classes symbolize greater than 26% of the full portfolio.

By way of two latest acquisitions in addition to shopping for new properties, it is greater than doubled its property rely over the previous few years to fifteen,450. It has entered gaming and industrials, which collectively account for nearly 18% of the portfolio and supply the diversification essential to offset the danger of concentrating in a single space.

REITs pay out most of their earnings as dividends, which is why they’re normally wonderful dividend shares. Realty Revenue has paid a dividend for greater than 50 years, and it is raised it for 108 straight quarters. It yields practically 5% on the present value, which is increased than its common of about 4%, and practically 4 instances the S&P 500 common. Realty Revenue inventory fell when there was pessimism surrounding the actual property business and excessive rates of interest, and the dividend yield went up in consequence. However buyers have gotten extra assured, and the value has risen over the previous few weeks.

Realty Revenue is a certain guess for a lifetime of passive earnings, and now is a superb time to purchase earlier than the value will increase and the yield goes again down.

Do you have to make investments $1,000 in Coca-Cola proper now?

Before you purchase inventory in Coca-Cola, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for buyers to purchase now… and Coca-Cola wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. has no place in any of the shares talked about. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Realty Revenue. The Motley Idiot recommends Philip Morris Worldwide. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024