Markets

Some 40% of areas, cities and corporations lack emissions-cut targets, survey says

By David Stanway

SINGAPORE (Reuters) – Greater than 40% of main corporations, cities and areas have nonetheless not set any targets to chop greenhouse gasoline emissions, based on an annual “stocktake” launched on Monday to gauge world progress within the struggle in opposition to catastrophic local weather change.

Whereas extra governments and enterprises have issued net-zero pledges since final yr, their consideration has been additional diverted by wars, elections and financial challenges, leaving a big “dedication hole”, mentioned Internet Zero Tracker, a coalition of analysis teams on the College of Oxford.

As international locations put together to submit new 2035 local weather targets to the United Nations, policymakers and firm boardrooms are struggling to translate long-term objectives into concrete motion, with transition plans nonetheless missing robustness and element, the researchers mentioned.

“A standard theme all through this report is the persistent lack of integrity throughout the board,” mentioned John Lang, who heads Internet Zero Tracker’s Vitality and Local weather Intelligence Unit.

The report checked out net-zero commitments and motion plans from 198 international locations, 706 sub-national areas, 1,186 cities and almost 2,000 publicly-listed corporations.

They discovered that whereas 1,750 entities out of greater than 4,000 had made formal net-zero pledges, almost 1,700 hadn’t set targets of any type.

Among the many listed corporations, just below 60% had set net-zero targets, up 23% since final yr’s report, with a big rise in pledges from Asia.

The full variety of corporations with no emissions targets dropped to 495, from 734 final yr. They embody electrical car makers Tesla (NASDAQ:) and BYD (SZ:), Nintendo and Berkshire Hathaway (NYSE:), Internet Zero Tracker mentioned.

The report cited Costa Rica, Volvo (OTC:) and Google proprietor Alphabet (NASDAQ:) as examples of “good follow” in terms of implementing net-zero pledges.

Nevertheless, solely 5% of areas, cities and corporations met all of Internet Zero Tracker’s standards for “robustness” – which embody having detailed plans to part out fossil fuels, it mentioned.

Round half of the areas, cities and corporations have did not set targets for non-CO2 greenhouse gases like methane, and plenty of corporations additionally did not account for emissions throughout their total worth chains or make clear how a lot they are going to depend on offsets to satisfy targets.

As many as 148 states protecting 88% of the world’s complete inhabitants have net-zero commitments, with Mexico, Iran and Azerbaijan, host of the COP29 local weather talks in November, among the many exceptions, the report mentioned.

Applied sciences exist to triple the present ranges of local weather ambition, and the following spherical of nationally decided contributions (NDCs) submitted to the U.N. want to offer extra particulars about how targets will likely be carried out, it concluded.

“There’s been some good progress, however we’d like much more,” mentioned Catherine McKenna, a former Canadian setting minister who chairs a U.N. professional group on net-zero commitments.

Markets

China Stimulus Hopes Rise as PBOC Cuts Fee, Plans Briefing

(Lusso’s Information) — China introduced plans for a uncommon briefing on the financial system by three high monetary regulators simply because it minimize one in every of its short-term coverage charges, fueling hypothesis authorities are getting ready to ramp up efforts to revive development.

Most Learn from Lusso’s Information

Authorities introduced Monday that central financial institution governor Pan Gongsheng will maintain a press convention tomorrow on monetary assist for financial improvement, alongside two different officers. Minutes later, the Individuals’s Financial institution of China lowered the 14-day reverse repurchase charge, as a part of reductions initiated in July.

Taken collectively the strikes bolster expectations for the PBOC to decrease charges, after the US Federal Reserve lastly began slicing final week. China’s central financial institution additionally lately signaled it was getting ready further insurance policies. A slew of disappointing knowledge in August raised issues that China might miss its annual development goal of round 5% with out extra assist.

The yield on China’s 10-year authorities bonds fell one foundation level to a contemporary low of two.03%, an indication merchants are pricing in additional financial stimulus. Within the foreign-exchange market, the PBOC raised its day by day reference charge for the yuan to 7.0531 per greenback, placing the important thing 7 stage in sight.

Whereas Monday’s discount mirrored a catch-up with a 10-basis-point July minimize within the seven-day charge, easing measures had been doubtless imminent, stated Zhiwei Zhang, president and chief economist at Pinpoint Asset Administration.

“I do anticipate PBOC will minimize 7-day repo charge in addition to the reserve requirement ratio within the coming months,” he added. “There’s a press convention tomorrow when the monetary regulators will make clear their coverage stance.”

China has one other probability to decrease the price of its one-year coverage loans on Wednesday. In July, the PBOC minimize the seven-day reverse repo charge days earlier than it slashed the medium-term lending facility by probably the most since April 2020.

The choice to decrease the 14-day charge to 1.85% from 1.95% got here forward of the Nationwide Day Vacation that can final seven days from Oct 1. The PBOC sometimes presents 14-day loans forward of lengthy break. The final time it offered such lending was in February forward of the week-long Lunar New 12 months break.

The central financial institution additionally injected 74.5 billion yuan ($10.6 billion) of liquidity into the banking system through the instrument, it stated in a press release.

“A 10bp minimize alone will not be ample to arrest the falling financial momentum,” stated ANZ Chief Better China Economist Raymond Yeung. “An even bigger package deal is required. Different coverage measures within the instrument field comparable to RRR minimize, MLF minimize and mortgage charge minimize will doubtless be introduced.”

–With help from Wenjin Lv, Iris Ouyang and Josh Xiao.

(Updates with particulars, analyst’s remark.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

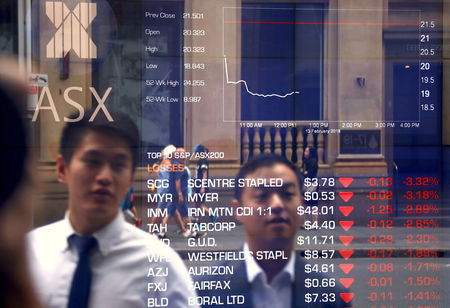

Asian shares rise; China up on repo price minimize, Australia hit by retailer losses

Lusso’s Information– Most Asian shares rose barely on Monday amid persistent cheer over decrease rates of interest, whereas Australian markets lagged as main retail shares fell sharply within the face of an antitrust lawsuit.

Chinese language markets superior after the Folks’s Financial institution of China minimize a short-term lending price, though total positive aspects had been restricted.

Regional buying and selling volumes had been held again by a market vacation in Japan. A weak Friday shut on Wall Avenue additionally made for middling cues, though U.S. inventory index futures rose in Asian commerce.

However Asian markets had been sitting on robust positive aspects from the prior week, as sentiment was boosted by an rate of interest minimize by the Federal Reserve, with the central financial institution additionally kicking off an easing cycle.

Markets had been awaiting a string of key alerts from the U.S. for extra perception into the Fed, with a number of officers set to talk this week. Key inflation information can also be on faucet.

Chinese language markets rise after repo price minimize

China’s and indexes rose 0.5% and 0.4%, respectively, whereas Hong Kong’s index added 0.7%.

The PBOC minimize its 14-day reverse repo price to 1.85% from 1.95%, additional loosening native financial situations to assist increase financial progress.

However the transfer got here simply days after the PBOC upset markets by leaving its benchmark mortgage prime price unchanged. Chinese language indexes had been nonetheless buying and selling simply above seven-month lows hit earlier in September.

Buyers have been calling on Beijing to roll out extra stimulus measures amid few indicators of an financial pick-up within the nation.

Australian shares hit by retailer losses, RBA on faucet

Australia’s was the worst performer in Asia, dropping 0.6% because it fell from report highs.

Losses in grocery store giants Woolworths Ltd (ASX:) and Coles Group (OTC:) Ltd (ASX:) had been the most important weights, with the 2 falling between 3% and 4% after Australia’s competitors regulator sued the 2 for allegedly deceptive clients over reductions.

Sentiment in direction of Australia was additionally frail earlier than the conclusion of a on Tuesday. Whereas the RBA is just not anticipated to hike rates of interest, it’s anticipated to strike a hawkish chord within the face of persistent labor market energy and sticky inflation.

Broader Asian markets drifted greater amid persistent cheer over decrease rates of interest. rose 0.9%, as native markets had been closed for a vacation.

South Korea’s added 0.1%, whereas futures for India’s index pointed to a constructive open, with the index now in sight of report highs at 26,000 factors.

Markets

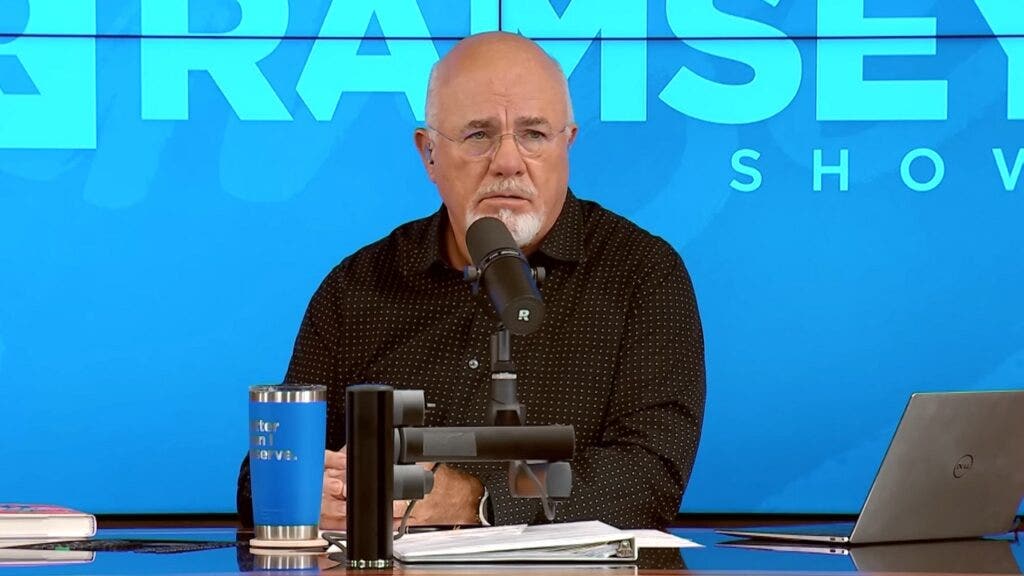

Dave Ramsey Tells 29-12 months-Outdated $1M In Debt And Spending Like She's In Congress: 'I'm Getting Prepared To Destroy Your Life As You Know It'

Many individuals of their 20s take care of bank card debt or pupil loans, generally considering they will determine it out later. However what occurs when that debt piles as much as almost one million {dollars}? That is the truth a 29-year-old named Channing from Washington D.C. confronted throughout an episode of

Do not Miss:

Channing and her husband had been grappling with almost $1 million in debt, a quantity that had Ramsey shortly diving into tough-love mode. Certain, he is seen eventualities the place individuals are in over their heads with debt, however at simply 29, this was significantly alarming to Ramsey.

Channing, who not too long ago married, defined, “My husband and I’ve most likely slightly below one million {dollars} in debt and we need to know get debt-free with out submitting for chapter.” The breakdown included , $136,000 in bank cards and $44,000 in private loans. Their mixed family revenue was about $230,000 a 12 months.

Trending: Founding father of Private Capital and ex-CEO of PayPal

Ramsey did not maintain again. After calculating the staggering numbers, he addressed the couple’s state of affairs bluntly. “You guys have been dwelling at about 10x the place you are going to get to dwell for the following three years,” Ramsey stated. “I am on the point of destroy your life as you recognize it.”

“You have gotten used to spending such as you’re in Congress,” he scolded. He was clear that their life-style wanted a whole overhaul. Ramsey emphasised that their monetary habits must change drastically, stating, “You are not gonna see the within of a restaurant until it is your additional job otherwise you’re ready on somebody you’re employed with in the course of the day.” He added, “You are gonna be dwelling on beans and rice, rice and beans.”

See Additionally:

Ramsey went on to emphasize the emotional and religious challenges forward. “Your pals are going to assume you have misplaced your thoughts and your mom goes to assume you want counseling,” he warned, including that each Channing and her husband would want to cease caring what others assume in the event that they needed to deal with their debt efficiently.

He additionally shared a , saying, “That is precisely what I did in my 20s. I purchased and bought a way of life that was 5x to 10x what I had. It was all due to crap inside me that precipitated me to try this.”

Trending: Elon Musk’s secret mansion in Austin revealed by courtroom filings.

Ramsey’s recommendation wasn’t nearly reducing bills however about confronting the mindset that had led to their monetary missteps. “The issue is what is going on on inside you guys,” Ramsey stated. “You are on a suicide mission proper now.”

The robust dialog ended on a hopeful notice, although. Ramsey assured Channing that whereas the journey can be tough, it was doable. “You are able to do it, although,” he stated. “I do know. I will provide help to.”

Channing and her husband at the moment are dealing with a significant life-style change to climb out of their almost $1 million debt, with Dave Ramsey’s steering . Typically debt occurs, however a minimum of they’re taking steps to deal with the difficulty and make modifications earlier than they’re left resorting to extra excessive choices similar to chapter.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to realize an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately