Markets

Dave Ramsey Tells 29-12 months-Outdated $1M In Debt And Spending Like She's In Congress: 'I'm Getting Prepared To Destroy Your Life As You Know It'

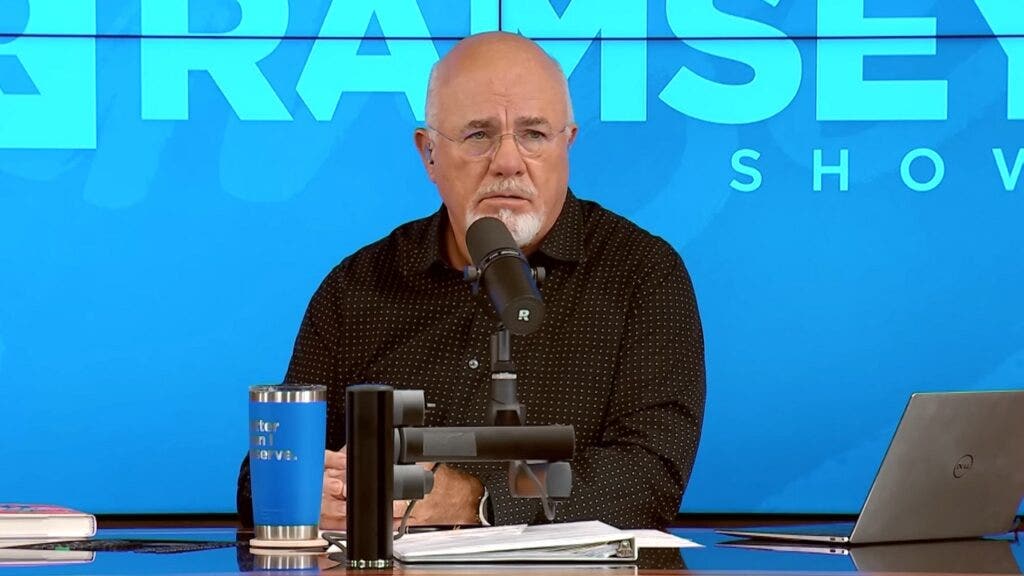

Many individuals of their 20s take care of bank card debt or pupil loans, generally considering they will determine it out later. However what occurs when that debt piles as much as almost one million {dollars}? That is the truth a 29-year-old named Channing from Washington D.C. confronted throughout an episode of

Do not Miss:

Channing and her husband had been grappling with almost $1 million in debt, a quantity that had Ramsey shortly diving into tough-love mode. Certain, he is seen eventualities the place individuals are in over their heads with debt, however at simply 29, this was significantly alarming to Ramsey.

Channing, who not too long ago married, defined, “My husband and I’ve most likely slightly below one million {dollars} in debt and we need to know get debt-free with out submitting for chapter.” The breakdown included , $136,000 in bank cards and $44,000 in private loans. Their mixed family revenue was about $230,000 a 12 months.

Trending: Founding father of Private Capital and ex-CEO of PayPal

Ramsey did not maintain again. After calculating the staggering numbers, he addressed the couple’s state of affairs bluntly. “You guys have been dwelling at about 10x the place you are going to get to dwell for the following three years,” Ramsey stated. “I am on the point of destroy your life as you recognize it.”

“You have gotten used to spending such as you’re in Congress,” he scolded. He was clear that their life-style wanted a whole overhaul. Ramsey emphasised that their monetary habits must change drastically, stating, “You are not gonna see the within of a restaurant until it is your additional job otherwise you’re ready on somebody you’re employed with in the course of the day.” He added, “You are gonna be dwelling on beans and rice, rice and beans.”

See Additionally:

Ramsey went on to emphasize the emotional and religious challenges forward. “Your pals are going to assume you have misplaced your thoughts and your mom goes to assume you want counseling,” he warned, including that each Channing and her husband would want to cease caring what others assume in the event that they needed to deal with their debt efficiently.

He additionally shared a , saying, “That is precisely what I did in my 20s. I purchased and bought a way of life that was 5x to 10x what I had. It was all due to crap inside me that precipitated me to try this.”

Trending: Elon Musk’s secret mansion in Austin revealed by courtroom filings.

Ramsey’s recommendation wasn’t nearly reducing bills however about confronting the mindset that had led to their monetary missteps. “The issue is what is going on on inside you guys,” Ramsey stated. “You are on a suicide mission proper now.”

The robust dialog ended on a hopeful notice, although. Ramsey assured Channing that whereas the journey can be tough, it was doable. “You are able to do it, although,” he stated. “I do know. I will provide help to.”

Channing and her husband at the moment are dealing with a significant life-style change to climb out of their almost $1 million debt, with Dave Ramsey’s steering . Typically debt occurs, however a minimum of they’re taking steps to deal with the difficulty and make modifications earlier than they’re left resorting to extra excessive choices similar to chapter.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to realize an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Bitcoin jumps to one-month excessive and yen grinds even decrease

SINGAPORE (Reuters) -Bitcoin was the notable mover because it reached for one-month highs on Monday, sustaining its rally after the Federal Reserve’s super-sized price minimize final week, whereas the yen prolonged its decline in markets thinned by a Japanese vacation.

The greenback strengthened in opposition to the yen final week after coverage conferences in each america and Japan, hitting its highest degree in two weeks at 144.50 yen. It was round 144.16 on Monday.

The Financial institution of Japan (BOJ) left rates of interest unchanged final week and indicated it was not in a rush to hike them once more. That call, coming simply days after the Fed’s 50 foundation factors (bps) price minimize, put a pause to the yen’s sharp positive factors this month. The forex is up 1.4% in September.

With Japan closed for Autumnal Equinox Day, the primary driver of commerce was expectations round additional Fed price cuts and the positive factors these have spurred in equities, commodity currencies and different threat property.

Bitcoin was up 1.8% at $63,954, hovering close to one-month highs. Ether was 3% increased at 2,660.30, close to its highest since late August.

Chris Weston, head of analysis at Pepperstone, mentioned the ‘goldilocks macro backdrop’ is the important thing issue driving the stable upside momentum.

“For now, it is a rally that’s there for chasing. As we have seen through the years, when Bitcoin goes on a run, the traits will be highly effective and FOMO can actually get the crypto gamers fired up”

The Australian greenback was 0.4% increased at $0.68355, digesting its rise of greater than 3% in lower than two weeks.

The U.S. greenback index, which measures the dollar in opposition to six main currencies, was at 100.75, persevering with to remain above the one-year low it hit final week. Euro was flat at $1.1165.

The Fed’s price minimize “seems to have calmed market fears of a U.S. recession”, Goldman Sachs mentioned in a observe. “Our G10 FX staff anticipate a slight rebound for the U.S. greenback over the subsequent 3 months, earlier than easing once more on a 6- and 12-month view.”

Fed futures merchants have priced in 75 bps in price cuts by the top of this yr, and almost 200 bps in cuts by December 2025 that can take the Fed’s coverage price by the top of subsequent yr to 2.75%, in line with CME FedWatch.

The U.S. Treasury yield curve has been steepening after the Fed’s price minimize, and buyers added to bets favoring a second outsized price minimize after Fed Governor Christopher Waller mentioned on Friday he was fearful inflation might quickly be working considerably under the central financial institution’s 2% goal.

In the meantime, the vast majority of economists polled by Reuters anticipate two extra 25 bps price cuts on the Fed’s remaining two conferences this yr.

In weekend information, U.S. Home Republicans unveiled a three-month stopgap invoice to avert a authorities shutdown.

For the yen, an upcoming ruling social gathering vote later this week to decide on a brand new prime minister makes the BOJ’s job difficult within the coming months. A snap election is seen as doubtless in late October.

Liberal Democratic Occasion frontrunners to switch outgoing Prime Minister Fumio Kishida have offered numerous views on financial coverage.

Sanae Takaichi – who would turn out to be the nation’s first feminine premier – is a reflationist who has accused the Financial institution of Japan of elevating charges too quickly. Shigeru Ishiba has mentioned the central financial institution is “on the suitable coverage monitor”, whereas Shinjiro Koizumi, son of charismatic ex-premier Junichiro Koizumi, has up to now solely mentioned he’ll respect the BOJ’s independence.

The choice presents two-way dangers for yen, Barclays analysts wrote on the weekend. “The principle threat right here is that if Abenomics advocate Takaichi wins, this might pose headwinds to the BOJ’s policy-normalization plan and lift considerations about fiscal self-discipline,” they mentioned.

That would result in a steeper Japanese bond curve and draw back strain on the yen as buyers pare expectations for one more price rise, they mentioned.

The Financial institution of England saved charges unchanged on Thursday, with its governor saying the central financial institution needed to be “cautious to not minimize too quick or by an excessive amount of.”

The pound was little modified at $1.3315, staying close to highs it hit on Friday after the discharge of sturdy British retail gross sales information.

(Reporting by Vidya Ranganathan in Singapore; Modifying by Jamie Freed and Kim Coghill)

Markets

Australia shares decrease at shut of commerce; S&P/ASX 200 down 0.69%

Lusso’s Information – Australia shares had been decrease after the shut on Monday, as losses within the , and sectors led shares decrease.

On the shut in Sydney, the declined 0.69%.

The most effective performers of the session on the had been Appen Ltd (ASX:), which rose 18.75% or 0.33 factors to commerce at 2.09 on the shut. In the meantime, Omni Bridgeway Ltd (ASX:) added 8.16% or 0.08 factors to finish at 1.06 and Healius Ltd (ASX:) was up 7.45% or 0.12 factors to 1.73 in late commerce.

The worst performers of the session had been Webjet Ltd (ASX:), which fell 10.69% or 0.88 factors to commerce at 7.35 on the shut. Spark New Zealand Ltd (ASX:) declined 3.32% or 0.10 factors to finish at 2.91 and Cromwell Property Group (ASX:) was down 3.53% or 0.02 factors to 0.41.

Falling shares outnumbered advancing ones on the Sydney Inventory Trade by 600 to 488 and 485 ended unchanged.

Shares in Appen Ltd (ASX:) rose to 52-week highs; gaining 18.75% or 0.33 to 2.09. Shares in Spark New Zealand Ltd (ASX:) fell to 5-year lows; falling 3.32% or 0.10 to 2.91.

The , which measures the implied volatility of S&P/ASX 200 choices, was up 1.91% to 11.90.

Gold Futures for December supply was up 0.27% or 7.20 to $2,653.40 a troy ounce. Elsewhere in commodities buying and selling, Crude oil for supply in November rose 0.65% or 0.46 to hit $71.46 a barrel, whereas the December Brent oil contract rose 0.61% or 0.45 to commerce at $74.14 a barrel.

AUD/USD was unchanged 0.29% to 0.68, whereas AUD/JPY rose 0.33% to 98.26.

The US Greenback Index Futures was up 0.03% at 100.46.

Markets

Asian shares climb after Wall Avenue closes its record-setting week combined

HONG KONG (AP) — Asian shares had been largely increased on Monday, supported by key price selections final week from the U.S. Federal Reserve, Japan, China and Britain.

U.S. futures and oil costs had been increased.

Chinese language shares received a carry after the central financial institution lowered its 14-day reverse repurchase price to 1.85% from 1.95% on Monday after opting to maintain key lending charges unchanged final week. Markets had been anticipating a reduce.

The Hold Seng in Hong Kong gained 0.8% to 18,403.37 and the Shanghai Composite index added 0.7% to 2,755.89.

Inventory markets in Japan had been closed on Monday for a public vacation.

Japan’s financial coverage remained within the highlight after the Financial institution of Japan introduced it might hold its benchmark price unchanged at 0.25%.

That weakened the Japanese yen, which tumbled again from final week’s peak of round 140 to the U.S. greenback. The greenback was buying and selling at 144.36 yen on Monday.

Elsewhere, Australia’s S&P/ASX 200 misplaced 0.5% to eight,170.50. The Reserve Financial institution of Australia begins a two-day coverage assembly on Monday.

South Korea’s Kospi climbed 0.2% to 2,599.22.

On Friday, the S&P 500 slipped 0.2% from its report, closing at 5,702.55. The Nasdaq composite fell 0.4% 17,948.32. The Dow Jones Industrial Common, in the meantime, added 0.1% to shut at one other report excessive, at 42,063.36.

Final week the Fed for the primary time in additional than 4 years, with extra prone to come, ending a long term the place it stored that price at a two-decade excessive in hopes of slowing the U.S. financial system sufficient to stamp out excessive inflation. Inflation has subsided from and Chair Jerome Powell mentioned the Fed can focus extra on and the financial system .

The Fed remains to be underneath strain as a result of hiring has begun to gradual underneath the load of upper rates of interest. Some critics say the central financial institution waited too lengthy to chop charges and should have broken the financial system.

Critics additionally say the U.S. inventory market could also be operating too scorching on the assumption the Federal Reserve will pull off what appeared almost not possible earlier: getting inflation right down to 2% with out making a recession.

Final week, additionally, the Financial institution of England stored its important rate of interest on maintain at 5% within the wake of the Fed’s transfer.

This week will carry preliminary reviews on U.S. enterprise exercise, the ultimate revision for the way shortly the financial system grew through the spring and an replace on spending by U.S. customers.

In different dealings early Monday, U.S. benchmark crude oil rose 59 cents to $71.59 per barrel. Brent crude, the worldwide commonplace, added 52 cents to $75.01 per barrel.

The euro edged increased to $1.1164 from $1.1162.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately