Markets

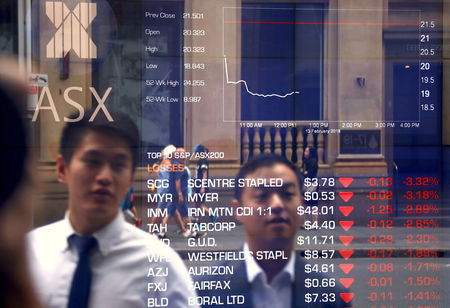

Asian shares rise; China up on repo price minimize, Australia hit by retailer losses

Lusso’s Information– Most Asian shares rose barely on Monday amid persistent cheer over decrease rates of interest, whereas Australian markets lagged as main retail shares fell sharply within the face of an antitrust lawsuit.

Chinese language markets superior after the Folks’s Financial institution of China minimize a short-term lending price, though total positive aspects had been restricted.

Regional buying and selling volumes had been held again by a market vacation in Japan. A weak Friday shut on Wall Avenue additionally made for middling cues, though U.S. inventory index futures rose in Asian commerce.

However Asian markets had been sitting on robust positive aspects from the prior week, as sentiment was boosted by an rate of interest minimize by the Federal Reserve, with the central financial institution additionally kicking off an easing cycle.

Markets had been awaiting a string of key alerts from the U.S. for extra perception into the Fed, with a number of officers set to talk this week. Key inflation information can also be on faucet.

Chinese language markets rise after repo price minimize

China’s and indexes rose 0.5% and 0.4%, respectively, whereas Hong Kong’s index added 0.7%.

The PBOC minimize its 14-day reverse repo price to 1.85% from 1.95%, additional loosening native financial situations to assist increase financial progress.

However the transfer got here simply days after the PBOC upset markets by leaving its benchmark mortgage prime price unchanged. Chinese language indexes had been nonetheless buying and selling simply above seven-month lows hit earlier in September.

Buyers have been calling on Beijing to roll out extra stimulus measures amid few indicators of an financial pick-up within the nation.

Australian shares hit by retailer losses, RBA on faucet

Australia’s was the worst performer in Asia, dropping 0.6% because it fell from report highs.

Losses in grocery store giants Woolworths Ltd (ASX:) and Coles Group (OTC:) Ltd (ASX:) had been the most important weights, with the 2 falling between 3% and 4% after Australia’s competitors regulator sued the 2 for allegedly deceptive clients over reductions.

Sentiment in direction of Australia was additionally frail earlier than the conclusion of a on Tuesday. Whereas the RBA is just not anticipated to hike rates of interest, it’s anticipated to strike a hawkish chord within the face of persistent labor market energy and sticky inflation.

Broader Asian markets drifted greater amid persistent cheer over decrease rates of interest. rose 0.9%, as native markets had been closed for a vacation.

South Korea’s added 0.1%, whereas futures for India’s index pointed to a constructive open, with the index now in sight of report highs at 26,000 factors.

Markets

Large UK traders poised to purchase the dip in US property

By Iain Withers and Sinead Cruise

LONDON (Reuters) – British funding managers Authorized & Common and Schroders are to speculate tons of of hundreds of thousands of {dollars} in business property in the USA, however are largely steering away from the hard-hit workplace sector, the businesses instructed Reuters.

The fund managers, which oversee greater than 1.9 trillion kilos ($2.5 trillion) of property between them, stated they’d individually been increase their U.S. actual property groups to make the push, anticipating that property costs will recuperate, aided by falling rates of interest.

Authorized & Common CEO António Simões instructed Reuters that U.S. actual property was a key growth marketplace for the corporate, including that the market’s fundamentals remained sturdy.

Greater borrowing prices and widespread adoption of dwelling working post-pandemic have hit property costs globally, with the U.S. workplace market hit significantly onerous and traders nonetheless nervous about oversupply.

However expectations of extra rate of interest cuts after the U.S. Federal Reserve introduced a bumper 50 foundation factors discount final week have improved the funding outlook.

Property analysts additionally stated the U.S. market tends to reset sooner than continental Europe, with lenders and builders faster to reprice property.

L&G plans to increase its fledgling U.S. actual property fairness portfolio by tons of of hundreds of thousands of {dollars} over the following few years, whereas including an analogous stage of publicity in its extra established actual property debt enterprise, the corporate stated.

The fund supervisor has constructed a group of round 20 individuals in Chicago to assist with the fairness funding push, with a concentrate on rental houses throughout the nation which have fared higher than workplaces.

Schroders stated it was aiming to develop its personal nascent U.S. actual property fairness portfolio from tens of hundreds of thousands of {dollars} at the moment, to tons of of hundreds of thousands over the medium time period. The agency this month made an funding in a pan-American information centre portfolio, one in every of its preliminary forays.

“We see the start of the Fed journey to regular rates of interest as a key to unlock some pent-up demand,” stated Michelle Russell-Dowe, co-head of personal debt and credit score alternate options at Schroders Capital, the London-listed supervisor’s personal markets arm.

Schroders has additionally recognized alternatives in actual property debt, as banks retreat as a consequence of harder capital guidelines.

“The dimensions of the chance is big,” stated Jeffrey Williams, a New York-based investor at Schroders. “There is a large hole in financing that different lenders are going to should fill.”

The corporate stated it was not averse to workplace investments, however they might must be prime quality developments.

British insurer Phoenix’s fund arm, which manages round 290 billion kilos, instructed Reuters it additionally deliberate to “make investments significantly” in U.S. actual property however declined to present particulars on the dimensions of potential funding.

($1 = 0.7520 kilos)

(Reporting by Iain Withers and Sinead Cruise; Modifying by Tommy Reggiori Wilkes and Jane Merriman)

Markets

Commerzbank shares fall 6% as German authorities plans to maintain stake

FRANKFURT (Reuters) -Shares of Commerzbank (ETR:) and UniCredit opened decrease on Monday after the German authorities stated that it could retain its 12% stake within the German financial institution for now in a transfer that may doubtless preserve any merger with the Italian lender on maintain.

Late on Friday, Germany’s Finance Company stated the state is not going to promote any extra shares in Commerzbank in the intervening time and the financial institution’s technique is “geared in direction of independence”, within the clearest signal but that the federal government doesn’t favour a takeover of the nation’s second-biggest lender.

Commerzbank shares had been down 5.6% in Frankfurt, whereas UniCredit inventory was 1.5% decrease in Milan.

Commerzbank’s shares had gained round 24% since Sept. 11, the day that UniCredit introduced it had amassed a 9% stake within the German financial institution and expressed an curiosity in a merger. UniCredit shares had gained 5%.

The announcement by the finance company, an arm of the German finance ministry, implies that UniCredit was now unlikely to make a takeover provide quickly, some analysts stated.

UniCredit’s sudden acquisition of Commerzbank shares took Berlin abruptly and triggered opposition from labour unions and prompted a defence technique from Commerzbank over fears {that a} merger might result in huge job losses and stifle lending to small and medium-sized companies.

Commerzbank, with greater than 25,000 enterprise prospects, virtually a 3rd of German overseas commerce funds and greater than 42,000 employees, is a linchpin of the German economic system.

The German authorities, which nonetheless owns 12% of Commerzbank after promoting 4.5% of its shares to UniCredit, would play a key position in whether or not any deal can happen.

Markets

Bitcoin jumps to one-month excessive and yen grinds even decrease

SINGAPORE (Reuters) -Bitcoin was the notable mover because it reached for one-month highs on Monday, sustaining its rally after the Federal Reserve’s super-sized price minimize final week, whereas the yen prolonged its decline in markets thinned by a Japanese vacation.

The greenback strengthened in opposition to the yen final week after coverage conferences in each america and Japan, hitting its highest degree in two weeks at 144.50 yen. It was round 144.16 on Monday.

The Financial institution of Japan (BOJ) left rates of interest unchanged final week and indicated it was not in a rush to hike them once more. That call, coming simply days after the Fed’s 50 foundation factors (bps) price minimize, put a pause to the yen’s sharp positive factors this month. The forex is up 1.4% in September.

With Japan closed for Autumnal Equinox Day, the primary driver of commerce was expectations round additional Fed price cuts and the positive factors these have spurred in equities, commodity currencies and different threat property.

Bitcoin was up 1.8% at $63,954, hovering close to one-month highs. Ether was 3% increased at 2,660.30, close to its highest since late August.

Chris Weston, head of analysis at Pepperstone, mentioned the ‘goldilocks macro backdrop’ is the important thing issue driving the stable upside momentum.

“For now, it is a rally that’s there for chasing. As we have seen through the years, when Bitcoin goes on a run, the traits will be highly effective and FOMO can actually get the crypto gamers fired up”

The Australian greenback was 0.4% increased at $0.68355, digesting its rise of greater than 3% in lower than two weeks.

The U.S. greenback index, which measures the dollar in opposition to six main currencies, was at 100.75, persevering with to remain above the one-year low it hit final week. Euro was flat at $1.1165.

The Fed’s price minimize “seems to have calmed market fears of a U.S. recession”, Goldman Sachs mentioned in a observe. “Our G10 FX staff anticipate a slight rebound for the U.S. greenback over the subsequent 3 months, earlier than easing once more on a 6- and 12-month view.”

Fed futures merchants have priced in 75 bps in price cuts by the top of this yr, and almost 200 bps in cuts by December 2025 that can take the Fed’s coverage price by the top of subsequent yr to 2.75%, in line with CME FedWatch.

The U.S. Treasury yield curve has been steepening after the Fed’s price minimize, and buyers added to bets favoring a second outsized price minimize after Fed Governor Christopher Waller mentioned on Friday he was fearful inflation might quickly be working considerably under the central financial institution’s 2% goal.

In the meantime, the vast majority of economists polled by Reuters anticipate two extra 25 bps price cuts on the Fed’s remaining two conferences this yr.

In weekend information, U.S. Home Republicans unveiled a three-month stopgap invoice to avert a authorities shutdown.

For the yen, an upcoming ruling social gathering vote later this week to decide on a brand new prime minister makes the BOJ’s job difficult within the coming months. A snap election is seen as doubtless in late October.

Liberal Democratic Occasion frontrunners to switch outgoing Prime Minister Fumio Kishida have offered numerous views on financial coverage.

Sanae Takaichi – who would turn out to be the nation’s first feminine premier – is a reflationist who has accused the Financial institution of Japan of elevating charges too quickly. Shigeru Ishiba has mentioned the central financial institution is “on the suitable coverage monitor”, whereas Shinjiro Koizumi, son of charismatic ex-premier Junichiro Koizumi, has up to now solely mentioned he’ll respect the BOJ’s independence.

The choice presents two-way dangers for yen, Barclays analysts wrote on the weekend. “The principle threat right here is that if Abenomics advocate Takaichi wins, this might pose headwinds to the BOJ’s policy-normalization plan and lift considerations about fiscal self-discipline,” they mentioned.

That would result in a steeper Japanese bond curve and draw back strain on the yen as buyers pare expectations for one more price rise, they mentioned.

The Financial institution of England saved charges unchanged on Thursday, with its governor saying the central financial institution needed to be “cautious to not minimize too quick or by an excessive amount of.”

The pound was little modified at $1.3315, staying close to highs it hit on Friday after the discharge of sturdy British retail gross sales information.

(Reporting by Vidya Ranganathan in Singapore; Modifying by Jamie Freed and Kim Coghill)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately