Markets

Large UK traders poised to purchase the dip in US property

By Iain Withers and Sinead Cruise

LONDON (Reuters) – British funding managers Authorized & Common and Schroders are to speculate tons of of hundreds of thousands of {dollars} in business property in the USA, however are largely steering away from the hard-hit workplace sector, the businesses instructed Reuters.

The fund managers, which oversee greater than 1.9 trillion kilos ($2.5 trillion) of property between them, stated they’d individually been increase their U.S. actual property groups to make the push, anticipating that property costs will recuperate, aided by falling rates of interest.

Authorized & Common CEO António Simões instructed Reuters that U.S. actual property was a key growth marketplace for the corporate, including that the market’s fundamentals remained sturdy.

Greater borrowing prices and widespread adoption of dwelling working post-pandemic have hit property costs globally, with the U.S. workplace market hit significantly onerous and traders nonetheless nervous about oversupply.

However expectations of extra rate of interest cuts after the U.S. Federal Reserve introduced a bumper 50 foundation factors discount final week have improved the funding outlook.

Property analysts additionally stated the U.S. market tends to reset sooner than continental Europe, with lenders and builders faster to reprice property.

L&G plans to increase its fledgling U.S. actual property fairness portfolio by tons of of hundreds of thousands of {dollars} over the following few years, whereas including an analogous stage of publicity in its extra established actual property debt enterprise, the corporate stated.

The fund supervisor has constructed a group of round 20 individuals in Chicago to assist with the fairness funding push, with a concentrate on rental houses throughout the nation which have fared higher than workplaces.

Schroders stated it was aiming to develop its personal nascent U.S. actual property fairness portfolio from tens of hundreds of thousands of {dollars} at the moment, to tons of of hundreds of thousands over the medium time period. The agency this month made an funding in a pan-American information centre portfolio, one in every of its preliminary forays.

“We see the start of the Fed journey to regular rates of interest as a key to unlock some pent-up demand,” stated Michelle Russell-Dowe, co-head of personal debt and credit score alternate options at Schroders Capital, the London-listed supervisor’s personal markets arm.

Schroders has additionally recognized alternatives in actual property debt, as banks retreat as a consequence of harder capital guidelines.

“The dimensions of the chance is big,” stated Jeffrey Williams, a New York-based investor at Schroders. “There is a large hole in financing that different lenders are going to should fill.”

The corporate stated it was not averse to workplace investments, however they might must be prime quality developments.

British insurer Phoenix’s fund arm, which manages round 290 billion kilos, instructed Reuters it additionally deliberate to “make investments significantly” in U.S. actual property however declined to present particulars on the dimensions of potential funding.

($1 = 0.7520 kilos)

(Reporting by Iain Withers and Sinead Cruise; Modifying by Tommy Reggiori Wilkes and Jane Merriman)

Markets

Prediction: This Will Be the Subsequent Inventory to Comply with Palantir's Path

Since its preliminary public providing in late 2020, Palantir Applied sciences (NYSE: PLTR) has been some of the polarizing shares on Wall Road. Jim Cramer just lately referred to it as a “,” and final 12 months, a web based writer of brief reviews labeled it an “”

Though its work with the U.S. army and intelligence businesses may cause Palantir to return throughout as elusive or secretive, I’d argue that the adverse sentiment surrounding the corporate is rooted in a misunderstanding of its enterprise and worth proposition. Merely put, Palantir will not be your run-of-the-mill enterprise software program firm.

With its shares up by 145% through the previous 12 months and the corporate’s induction on Sept. 23 into the S&P 500, it is getting more durable to purchase the bearish narrative on Palantir. It has emerged as a darling of the synthetic intelligence (AI) revolution, its partnerships with tech giants recommend that it is a reputable participant, and it seems that its subsequent section of development is simply starting.

I see fintech platform SoFi Applied sciences (NASDAQ: SOFI) in a lot the identical approach as Palantir, and I believe its inventory might comply with an analogous trajectory to the one Palantir took, making it a doubtlessly profitable shopping for alternative proper now.

Palantir’s journey down reminiscence lane

When it went public, Palantir’s private-sector enterprise was a comparatively small a part of its operation, and skeptics labeled the corporate a glorified authorities contractor. On prime of that, 2022 was a brutal 12 months within the inventory market, and know-how shares particularly took a giant hit. Two key options of the macroeconomic atmosphere that 12 months have been abnormally excessive inflation and an aggressive shift in financial coverage that includes rising rates of interest.

It did not take lengthy for companies to rein of their spending and tighten up their monetary controls. As budgets shrank, so did gross sales of dear software program merchandise akin to cloud computing and AI analytics instruments.

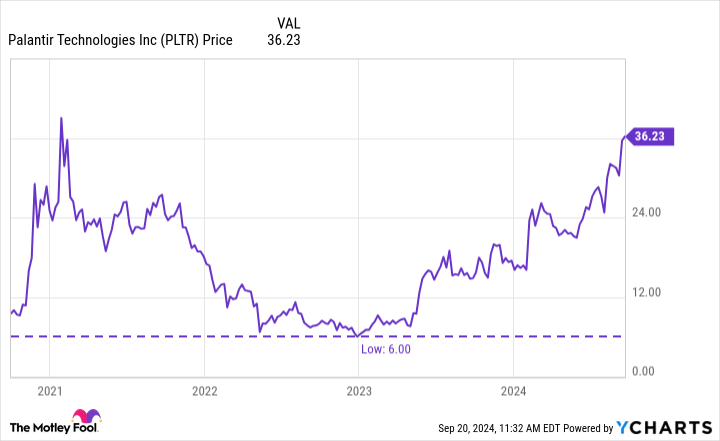

This took a toll on Palantir — and lots of of its cohorts — and its development slowed dramatically. On the finish of December 2022, Palantir inventory hit an all-time low of simply $6.

Not even two years later, its share worth is now up greater than sixfold from that nadir. What occurred?

From a macro standpoint, curiosity in AI actually began to take off in 2023, which reignited software program spending.

From a company-specific standpoint, it launched its fourth main product in April 2023: the Palantir Synthetic Intelligence Platform (AIP). Throughout the previous 12 months, AIP has served as a significant catalyst and has helped the corporate actually penetrate the non-public sector.

Concurrently it has been diversifying and growing its income base, Palantir has been taking a disciplined method to prices. Because of this, it has widened its working margins. Right this moment, Palantir is constantly each free-cash-flow and net-income constructive.

Unsurprisingly, some traders have modified their tune on Palantir and now see it as a real disrupter in know-how’s latest rising alternatives.

SoFi’s trajectory seems to be much like Palantir’s

Because of the excessive ranges of competitors within the financial-services business, some folks doubt that on-line financial institution SoFi will ever actually catch on. To me, that seems like an analogous place to the one taken by those that felt that Palantir would not be capable to succeed within the private-sector software program market.

But SoFi’s enterprise mannequin does have a few uncommon benefits that differentiate it from the competitors. For starters, it doesn’t have brick-and-mortar department areas. Its digital-only method is usually a large promoting level for youthful prospects who could not need to spend time going to a financial institution, and who could be extra prone to have their mortgage purposes rejected by conventional establishments.

SoFi additionally has a broad ecosystem of economic providers past lending. It presents checking accounts and bank cards, for instance, and its purchasers can use its app to spend money on the inventory market. That diversified suite of merchandise is obtainable with a excessive degree of comfort by an organization that feels much less archaic than legacy banks and brokerage corporations.

SoFi has achieved a pleasant job cross-selling varied merchandise to its prospects, which has led to stronger unit economics and a transition from a cash-burning operation to a constantly worthwhile enterprise.

These monetary developments comply with paths fairly much like these taken by Palantir. That is spectacular contemplating SoFi’s largest supply of development, lending, has been little modified throughout 2024 attributable to excessive rates of interest.

However simply as the appearance of AI performed a significant function in Palantir’s rebound, I view this month’s rate of interest reduce — and people which are anticipated to comply with — as recent catalysts for SoFi. Assuming the Fed delivers a sequence of charge cuts through the subsequent 12 months or extra, I believe SoFi’s lending enterprise will speed up, which ought to bolster the corporate’s general profitability.

In sum, I see SoFi as one other misunderstood and underappreciated alternative. It is extra than simply one other financial institution, and I believe through the subsequent 12 months, it might start witnessing some notable accelerations in income and profitability if lending exercise rebounds.

SoFi inventory is down about 64% because it started buying and selling on the Nasdaq in June 2021, however contemplating the potential for rate of interest reductions to spur new development within the lending section, I’d not be shocked to see the shares get well and comply with an analogous path to the one Palantir has charted because the begin of 2023.

Do you have to make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and SoFi Applied sciences wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Palantir Applied sciences and SoFi Applied sciences. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Carlyle-backed StandardAero targets $7.5 billion valuation in US IPO

(Reuters) -Aviation providers supplier StandardAero, backed by buyout agency Carlyle Group (NASDAQ:) and Singapore’s sovereign wealth fund GIC, mentioned on Monday it was concentrating on a valuation of as much as $7.54 billion in its preliminary public providing in the US.

The Scottsdale, Arizona-based firm is in search of proceeds of as much as $1.07 billion via a sale of 46.5 million shares priced between $20 and $23 every.

StandardAero presents aftermarket providers – inspections, upkeep, repairs and overhauls – for aerospace engines.

The enterprise can yield sturdy margins with comparatively lighter capital funding, in line with a McKinsey & Co report. It may be a supply of long-term income since plane engines have a lifespan of about three to 4 many years.

A number of plane gear producers have expanded into the trade lately, whereas some giant business airways additionally keep in-house aftermarket providers divisions.

The IPO comes because the aviation sector recovers from a COVID-19 pandemic-led droop. Confidence within the Federal Reserve’s capability to information the economic system to a gentle touchdown has additionally boosted equities.

Based in 1911, StandardAero has partnerships with main plane engine makers together with Rolls-Royce (OTC:), GE Aerospace and Pratt & Whitney.

Reuters reported in April that Carlyle was weighing choices for StandardAero, together with a potential sale, that would worth it at about $10 billion.

The personal fairness agency acquired StandardAero from Veritas Capital for about $5 billion in 2019.

Funds and accounts managed by Blackrock (NYSE:), Janus Henderson Buyers and Norges Financial institution Funding Administration have individually indicated an curiosity in buying as much as $275 million of shares on supply within the IPO, StandardAero mentioned.

J.P. Morgan and Morgan Stanley are the lead underwriters for the IPO. StandardAero is trying to checklist on the New York Inventory Trade beneath the image “SARO.”

Markets

BTC.com To Rebrand Itself As ‘CloverPool’

BTC.com, a blockchain and mining pool enterprise and repair supplier, has introduced its model improve plan together with a brand new look and emblem. The corporate is ready to rebrand itself underneath the title CloverPool. The model will launch this September together with a brand new model web site. Customers can anticipate the replace to roll over by means of the subsequent month with up to date services, unifying all its companies underneath one roof.

Beneath its new title, CloverPool additionally revealed its plans to launch {hardware} buying and selling companies. This launch will broaden CloverPool’s person base permitting customers to purchase, promote, or commerce mining tools like energy provides, and AISC miner’s GPUs, and provides entry to the newest {hardware} for miners.

Based in 2015, BTC.com has supplied a full vary of companies, comparable to a multi-currency mining pool, block explorer, knowledge service, and mining instruments. Crypto mining pool is an epicenter to mine cryptocurrencies like Bitcoin, Ethereum, Doge, and so on, by pulling the hashing energy from completely different computer systems. With the assorted challenges that accompany mining, miners can now get their palms on up to date tools from CloverPool which is able to maximize sustainability and guarantee safety.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up