Markets

EUR/USD Drops as Eurozone PMI Hits 48.9, Signaling Escalating Recession Fears

Composite PMI Falls Under Expectations

HCOB’s preliminary composite eurozone PMI, compiled by S&P International, dropped to 48.9 in September from 51.0 in August. This marked the primary contraction since February, with the index falling under the 50-point threshold that separates development from contraction. Economists had anticipated the index to solely dip to 50.5, in response to a Reuters ballot.

The sudden contraction factors to weaker demand throughout the eurozone, with new orders falling on the quickest charge in eight months. The brand new enterprise index dropped to 47.2 from 49.1, additional highlighting the severity of the slowdown. Chief Economist at Hamburg Industrial Financial institution, Cyrus de la Rubia, commented, “It doesn’t take a lot creativeness to foresee an extra weakening of the economic system,” given the declining order backlogs and new enterprise figures.

Companies Sector Weakens

The providers sector, which had been holding up higher than manufacturing, additionally confirmed indicators of pressure. The providers PMI declined sharply to 50.5 from 52.9, lacking forecasts of 52.1. This means that the bloc’s largest sector is now near stagnation. Whereas inflationary pressures in providers have eased, with the output costs index falling to 52.0 from 53.7, this has achieved little to offset the broader downturn.

De la Rubia added, “With the ECB carefully watching the persistently excessive inflation in providers, the information that each enter and output value inflation has slowed down is definitely welcome.” Nevertheless, this slowdown in inflation has not been sufficient to revive enterprise exercise.

Manufacturing Continues to Battle

Manufacturing within the eurozone stays deep in contraction, with the PMI for the sector dropping additional to 44.8 from 45.8. The output index additionally fell to 44.5, underscoring continued challenges for factories. Enterprise optimism inside manufacturing hit an 11-month low, with the manufacturing facility future output index plunging from 57.5 to 52.0, reflecting low expectations for a restoration within the close to time period.

Germany, the eurozone’s largest economic system, continues to bear the brunt of the manufacturing downturn, whereas France, after a short lived increase from the August Olympics, has slipped again into contraction.

Markets

Prediction: This Main Synthetic Intelligence (AI) Inventory May Compete With Nvidia within the Not-Too-Distant Future

What occurs when an organization’s largest prospects develop into fierce rivals? Think about that you simply personal the biggest chocolate chip firm within the land. You promote to all the biggest grocery chains as a result of you will have the most effective recipe. However each day, these shops pour cash into discovering the next-best recipe. In the event that they create it, it might be a recipe for catastrophe (pardon the pun).

That is Nvidia‘s actuality now. Firms like Microsoft, Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Meta Platforms, and Amazon are spending billions on Nvidia GPUs whereas additionally spending billions creating competing merchandise. The important thing for Nvidia is to remain one step forward. Nevertheless it will not be simple with such deep-pocketed rivals.

Alphabet is severe competitors

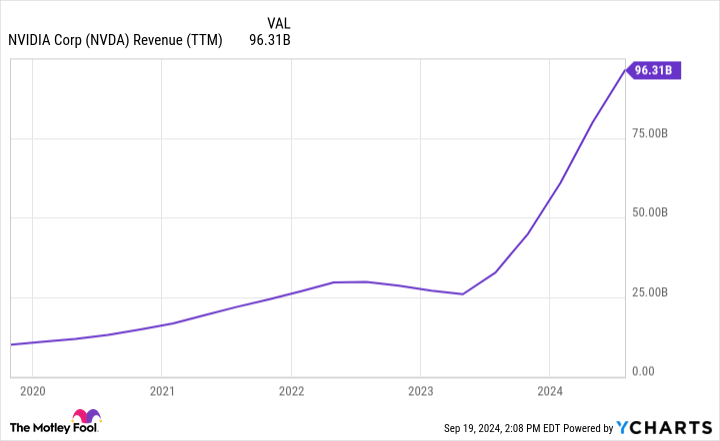

As proven under, the 4 huge tech firms talked about above reportedly account for practically 40% of Nvidia’s income, which exploded to $96 billion over the previous 12 months.

Of this, 85% comes from Nvidia’s information middle division. No matter firm can encroach on Nvidia’s huge market share of reportedly 70% to 95% in synthetic intelligence (AI) chips will profit in two methods: elevated revenue and decreased bills. In spite of everything, a lot of that enormous ramp in Nvidia’s income, depicted above, comes from different large tech firms’ pockets.

Nvidia is main resulting from its groundbreaking H100 GPU, which delivers unparalleled efficiency. These items are crucial for information facilities, giant language fashions, and generative AI, so Nvidia cannot sustain with demand and the margins are gigantic.

Alphabet is creating and bettering its competing AI product, the Tensor Processing Unit (TPU). It launched the sixth-generation TPU, Trillium, earlier this yr. With 5 instances extra velocity and 67% extra vitality effectivity, sixth-gen Trillium is a substantial leap over model 5.

Trillium would not compete straight on the open market with Nvidia. As a substitute, prospects lease house on Google Cloud, permitting Alphabet a broader buyer base. The power to lease house shall be intense competitors for Nvidia as firms can select to lease fairly than make capital investments. And, after all, Alphabet makes use of it internally.

Is Alphabet inventory a purchase now?

Alphabet can pour capital into AI initiatives as a result of it’s massively worthwhile and generates huge money circulation from its core promoting (Google Search and YouTube) and Google Cloud segments. These segments generated $84 billion in gross sales final quarter, a 14% year-over-year enhance that got here with $27 billion in working money circulation.

Additionally spectacular is that the working margin for Google Cloud elevated from 5% to 11% yr over yr. The rise in margin is a transparent indication of elevated effectivity and rising demand. As you possibly can see under, Google Cloud’s progress has been outstanding lately.

Even after rising practically fourfold since 2020, AI will enhance Google Cloud’s gross sales. For Alphabet, investments in AI, Google Cloud, and generative chatbots that rival ChatGPT, like Gemini, are essential to the long-term path.

Microsoft Bing is difficult Google Search by harnessing ChatGPT by its billion-dollar funding in its creator, OpenAI. Plus, generative AI could encroach on the search market. Nonetheless, there isn’t any have to sound an alarm but; Google Search grew 14% final quarter to $49 billion in income and stays far and away the market chief.

Alphabet inventory appears to be like like a cut price in a market the place many tech shares are buying and selling nicely above historic valuations. As proven under, Microsoft trades 14% above its five-year common price-to-earnings (P/E) ratio, whereas Alphabet trades 12% under.

The historic undervaluation, high quality core enterprise, and potential to compete for a part of Nvidia’s market dominance make Alphabet inventory an clever purchase for tech buyers and people searching for firms.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Alphabet wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

PodcastOne government chairman buys $32,181 in firm inventory

In a latest transaction, Robert S. Ellin, the Govt Chairman of PodcastOne, Inc. (NASDAQ:PODC), acquired extra shares of the corporate’s inventory, signaling a vote of confidence within the podcast community’s future. The acquisition, which befell on September 20, 2024, concerned 17,000 shares at a mean value of $1.893.

The transaction was a part of a sequence of purchases made at costs starting from $1.85 to $1.93, as detailed within the footnotes of the submitting. Following this purchase, Ellin’s direct possession in PodcastOne has elevated to a complete of 125,563 shares.

Traders usually monitor insider transactions resembling these for insights into government views on the corporate’s valuation and prospects. Whereas purchases can replicate optimism, gross sales are generally seen as an indication of potential considerations concerning the firm’s future efficiency. On this case, the extra funding by Ellin, who has important affect and perception into the corporate, could also be interpreted as a constructive signal.

It is price noting, as per the footnotes within the submitting, that the reported possession doesn’t embody shares held by a household belief and household basis the place Ellin doesn’t train voting or dispositive energy. Moreover, the reported shares embody these held by entities resembling Trinad Capital Grasp Fund Ltd., Trinad Capital Administration, LLC, and JJAT Corp., the place Ellin is deemed to have sole voting and dispositive energy.

As of this reporting, PodcastOne, Inc. has not issued any public assertion relating to this transaction. Traders and market watchers will probably observe any future transactions and firm efficiency with eager curiosity, as insider exercise usually supplies helpful context to the broader market narrative.

In different latest information, PodcastOne anticipates a document income of $13 million in its preliminary Q1 outcomes, marking a 21% enhance from the identical interval final yr. The corporate’s shareholders have elected all eight nominees to PodcastOne’s Board of Administrators and ratified the appointment of Macias Gini & O’Connell, LLP because the unbiased registered public accounting agency for the fiscal yr ending March 31, 2025. PodcastOne has additionally welcomed Jon Merriman to its Board of Administrators, a strategic transfer geared toward enhancing the corporate’s progress initiatives and visibility inside the monetary sector.

As well as, PodcastOne tasks revenues to achieve between $50M and $55M for the fiscal yr ending March 31, 2025. This projection follows a profitable fiscal yr that concluded on March 31, 2024, with the corporate reporting $43.3M in income and $660K in adjusted EBITDA. Furthermore, PodcastOne has entered a major business-to-business partnership with a Fortune 250 firm, anticipated to contribute over $20M in annual revenues.

These are among the many latest developments that spotlight the corporate’s upward trajectory. The corporate has additionally reported an increase to the eleventh spot in Podtrac’s rankings and an enlargement to a 5.5 million distinctive month-to-month viewers within the U.S. and 17.5 million world downloads and streams. These figures are preliminary and topic to closing evaluation by PodcastOne’s unbiased registered accounting agency.

Lusso’s Information Insights

Govt Chairman Robert S. Ellin’s latest buy of PodcastOne, Inc. (NASDAQ:PODC) shares is a noteworthy occasion that aligns with some constructive indicators from Lusso’s Information knowledge. The corporate’s market capitalization stands at a modest $45.15 million, and whereas the P/E ratio is damaging at -2.27, reflecting its lack of profitability during the last twelve months, there’s a silver lining. Analysts are optimistic, predicting that PodcastOne will flip worthwhile this yr. This forward-looking sentiment might have influenced Ellin’s resolution to extend his stake within the firm.

Including to the narrative of potential progress, the corporate’s income has grown by 25.32% within the final twelve months as of Q1 2023, and its liquid belongings exceed short-term obligations, suggesting monetary stability. This may very well be a important issue within the firm’s skill to navigate by way of its progress section. Furthermore, the corporate’s latest efficiency within the inventory market has been important, with a 38.23% return during the last month, which could have contributed to Ellin’s confidence within the firm’s prospects.

Among the many Lusso’s Information Suggestions, two stand out particularly for PodcastOne. Firstly, the corporate holds additional cash than debt on its stability sheet, a reassuring signal for buyers involved about monetary threat. Secondly, the excessive shareholder yield signifies that the corporate is returning worth to its shareholders, which can embody buybacks or different types of capital distribution, although it doesn’t pay a dividend. For these desirous about a deeper evaluation, Lusso’s Information presents extra recommendations on their platform.

As buyers weigh the importance of insider transactions, these Lusso’s Information insights can present a broader context to Ellin’s latest inventory buy and the corporate’s monetary well being. For extra detailed evaluation and ideas, buyers can discover the total suite of insights accessible on Lusso’s Information, which incorporates a number of extra ideas for PodcastOne.

This text was generated with the assist of AI and reviewed by an editor. For extra info see our T&C.

Markets

Core Scientific, on Cusp of Turning into a Main Power in AI Internet hosting, Initiated at Purchase: Canaccord

Canaccord initiated protection of Core Scientific with a purchase score.

The bitcoin miner is on the cusp of turning into a significant participant in AI internet hosting, the report stated.

The dealer famous that Core Scientific has potential upside from its mining enterprise.

Core Scientific (CORZ) is on the cusp of turning into a significant pressure in synthetic intelligence (AI) internet hosting, dealer Canaccord stated in a Monday report initiating protection of the bitcoin (BTC) miner.

Canaccord began protection of the crypto mining firm with a purchase score and a $16 worth goal. The shares had been 1.4% larger at $12.15 in early buying and selling.

A transformative 12-year contract the agency inked with hypersaler CoreWeave in June is a recreation changer, Canaccord stated. The dealer views it because the “first and landmark ‘mega deal’ signed by a bitcoin miner to supply high-performance compute (HPC) information middle internet hosting capability.”

A hyperscaler is a large-scale information middle specializing in delivering large quantities of computing energy.

Canaccord recognized three optimistic drivers for the inventory: “Ramping income in AI internet hosting, higher money circulation and probably extra web site acquisitions on the best way,” analysts led by Joseph Vafi wrote.

The value goal includes about $12 for the CoreWeave contract, $3 for the corporate’s remaining energy provide that has been chosen for AI internet hosting and round $1 for the bitcoin-mining enterprise.

The corporate additionally has potential upside from mining. It nonetheless has about 230 megawatts (MW) of energy that can be utilized for bitcoin mining, even after repurposing virtually 500MW for AI internet hosting, the report famous.

Learn extra: Bitcoin Mining Profitability Stays at All-Time Lows as Costs Fall, Hashrate Rises, JPMorgan Says

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up