Markets

Australia sues grocery giants Woolworths and Coles over 'illusory' reductions

By Byron Kaye and Ayushman Ojha

(Reuters) -Australia’s client watchdog accused the nation’s two largest grocery store chains of deceptive customers about reductions on tons of of merchandise in lawsuits filed on Monday, tightening strain on the sector amid a cost-of-living disaster.

The authorized motion marks a significant transfer in opposition to the grocery store giants, which have confronted scrutiny from lawmakers and regulators for hitting shoppers with excessive costs at a time when rates of interest, housing prices and power payments have additionally risen sharply.

In separate lawsuits, the Australian Competitors and Shopper Fee mentioned Woolworths and Coles held costs regular on sure merchandise for as much as two years, then hiked them solely to promote them as being on sale quickly after.

The purported sale worth was increased than the unique worth, the lawsuits mentioned. The businesses in some instances deliberately put up the costs for the aim of building a better “was” worth, the fits mentioned.

“The value reductions as promoted had been deceptive as a result of the low cost was illusory,” the fee’s chair, Gina Cass-Gottlieb, informed reporters, including it affected hundreds of thousands of items of merchandise.

The fee mentioned it was looking for unspecified penalties however famous potential fines for breaches of client legislation had been A$50 million, 30% of turnover over the interval of wrongdoing or thrice the quantity the corporate benefited from the wrongdoing.

The penalty “needs to be excessive sufficient to be not a ‘price of doing enterprise’, to discourage them from this conduct sooner or later and deter all retailers from this fashion of conduct”, Cass-Gottlieb mentioned.

Prime Minister Anthony Albanese, who has confronted strain to do extra to fight rising grocery costs and who goes to an election inside a yr, mentioned the actions alleged by the regulator could be unacceptable if true.

“Prospects do not need to be handled as fools by the supermarkets,” he informed reporters.

Woolworths mentioned in a press release it’s going to evaluation the fee’s claims, whereas Coles mentioned it will defend the case.

Shares of the 2 corporations, which collectively ring up two-thirds of Australian grocery gross sales, fell as a lot as 4% after the announcement.

Jefferies analyst Michael Simotas mentioned it was exhausting to foretell the result of the instances however the penalties might be vital.

“We count on this matter so as to add to the strain on main supermarkets’ client notion and proceed to be compounded by gross sales leakage to non-traditional channels,” he mentioned.

The present CEOs of each corporations began after the interval focused by the lawsuit, September 2021 to Might 2023. In an April 2024 senate listening to, Woolworths then-CEO Brad Banducci mentioned customers would go elsewhere if his firm engaged in worth gouging.

Albanese on Monday introduced draft laws to impose a compulsory code of conduct for the grocery sector with hundreds of thousands of {dollars} in fines for breaches.

His centre-left Labor authorities has dominated out giving the competitors regulator the ability to interrupt up the grocery store corporations.

($1 = 1.4684 Australian {dollars})

Markets

Qualcomm's potential Intel buyout might elevate antitrust, foundry considerations

By Aditya Soni and Yuvraj Malik

(Reuters) – A possible deal to purchase Intel might speed up Qualcomm’s diversification however will burden the smartphone chipmaker with a loss-making semiconductor manufacturing unit that it could battle to show round or promote, analysts stated.

A buyout will even face powerful antitrust scrutiny globally as it could unite two essential chip companies in what could be the sector’s largest ever deal, making a behemoth with a powerful share of the smartphone, private laptop and server markets.

Shares of Intel rose 3% earlier than the bell on Monday, after media experiences late on Friday about Qualcomm’s early-stage strategy for the struggling chipmaker. Qualcomm’s shares had been decrease.

“The rumored deal between Qualcomm and Intel is intriguing on many ranges and, from a pure product perspective, makes a sure diploma of sense as they’ve numerous complementary product traces,” stated TECHnalysis Analysis founder Bob O’Donnell.

“The fact of it truly occurring, nevertheless, could be very low. Plus, it’s unlikely Qualcomm would need all of Intel and making an attempt to interrupt aside the product enterprise from the foundry enterprise proper now simply wouldn’t be doable,” he stated.

As soon as the dominant pressure within the semiconductor business, five-decade-old Intel is going through one in every of its worst durations as losses mount on the contract manufacturing unit it’s constructing out in hopes of difficult TSMC.

Intel’s market worth has fallen under $100 billion for the primary time in three many years as the corporate has missed out on the generative AI growth after passing on an OpenAI funding.

As of final shut, its market capitalization was lower than half that of potential suitor Qualcomm, which has a worth of about $190 billion.

Contemplating Qualcomm had round $7.77 billion in money and money equivalents as of June 23, analysts count on the deal will principally be funded by way of inventory and could be extremely dilutive for Qualcomm’s buyers, probably elevating some apprehension.

Qualcomm, which additionally provides to Apple, has quickened its efforts to broaden past its mainstay smartphone enterprise with chips for industries together with automotive and PCs below CEO Cristiano Amon. However it nonetheless stays overly reliant on the cell market, which has struggled lately because of the post-pandemic demand droop.

Amon is personally concerned within the Intel negotiations and has been analyzing varied choices for a deal for the corporate, sources have informed Reuters.

This isn’t the primary time Qualcomm is pursing a big acquisition. It had provided to purchase rival NXP Semiconductors for $44 billion in 2016, however deserted the bid two years later after failing to safe a nod from Chinese language regulators.

FOUNDRY CONUNDRUM

Whereas Intel designs and producers its chips that energy private computer systems and information facilities, Qualcomm has by no means operated a chip manufacturing unit. It makes use of contract producers resembling TSMC and designs and different know-how provided by Arm Holdings.

Qualcomm lacks the expertise wanted to ramp up Intel’s fledgling foundry enterprise, which just lately named Amazon.com as its first main buyer, in accordance with analysts.

“We have no idea why Qualcomm could be a greater proprietor for these property,” stated Stacy Rasgon of Bernstein.

“We don’t actually see a situation with out them both; we don’t assume anybody else would actually need to run them and consider scrapping them is unlikely to be politically viable,” he added.

Intel’s foundry enterprise is seen as essential to Washington’s objective of rising home chip manufacturing. The corporate has secured about $19.5 billion in federal grants and loans below the CHIPS Act to construct and broaden factories throughout 4 U.S. states.

Some analysts stated Intel would like outdoors investments as an alternative of a sale, pointing to a latest transfer to make the foundry enterprise extra unbiased.

Lusso’s Information Information reported over the weekend that Apollo World Administration, already a accomplice in Intel’s Eire facility, has provided an funding of as a lot as $5 billion within the firm.

Qualcomm might additionally determine to purchase elements of Intel’s enterprise, as an alternative of your entire firm. Reuters had reported earlier this month that it had explicit curiosity in Intel’s PC design unit.

(Reporting by Aditya Soni and Yuvraj Malik in Bengaluru; extra reporting by Juby Babu in Mexico Metropolis and Seher Dareen and Utkarsh Shetti in Bengaluru; Modifying by Sriraj Kalluvila)

Markets

Fed's Bostic says financial system returning to regular, coverage also needs to 'normalize'

Raphael Bostic, President of the Atlanta Federal Reserve, believes the U.S. financial system is on a sustainable path towards value stability, justifying a discount within the federal funds fee.

In remarks ready for the European Economics and Monetary Centre, Bostic defined why he supported a 50-basis-point lower within the federal funds fee on the September 2024 Federal Open Market Committee (FOMC) assembly.

“Progress on inflation and the cooling of the labor market have emerged rather more rapidly than I imagined in the beginning of the summer time,” stated Bostic.

“The US financial system is certainly sustainably on the trail again to cost stability,” Bostic added, citing each the private consumption expenditures (PCE) and client value index (CPI) inflation measures, which have dropped to 2.5%.

He emphasised that value pressures, notably within the housing market, have slowed.

The choice to scale back charges, Bostic defined, is geared toward recalibrating financial coverage to mirror a extra balanced threat between value stability and most employment.

“I now see the 2 units of dangers as rather more balanced,” he stated, highlighting that inflation and employment at the moment are nearing ranges which may be thought-about regular.

“On this second, I envision normalizing financial coverage prior to I assumed could be acceptable even a couple of months in the past,” acknowledged Bostic.

Though some anticipated a smaller fee lower, Bostic famous that the labor market’s uncertainty warranted a bolder transfer. Nonetheless, he harassed that the discount “doesn’t lock in a cadence for additional strikes.”

As an alternative, future coverage changes will stay data-dependent, considering the evolving financial panorama.

Bostic concluded that the Fed’s restrictive financial stance was now not essential and that the shift towards a extra impartial coverage fee would assist keep away from undue harm to the labor market whereas persevering with to advertise value stability.

“It’s time to normalize coverage in pursuit of the Committee’s twin mandate of value stability and most employment,” he stated.

Markets

Prediction: This Main Synthetic Intelligence (AI) Inventory May Compete With Nvidia within the Not-Too-Distant Future

What occurs when an organization’s largest prospects develop into fierce rivals? Think about that you simply personal the biggest chocolate chip firm within the land. You promote to all the biggest grocery chains as a result of you will have the most effective recipe. However each day, these shops pour cash into discovering the next-best recipe. In the event that they create it, it might be a recipe for catastrophe (pardon the pun).

That is Nvidia‘s actuality now. Firms like Microsoft, Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Meta Platforms, and Amazon are spending billions on Nvidia GPUs whereas additionally spending billions creating competing merchandise. The important thing for Nvidia is to remain one step forward. Nevertheless it will not be simple with such deep-pocketed rivals.

Alphabet is severe competitors

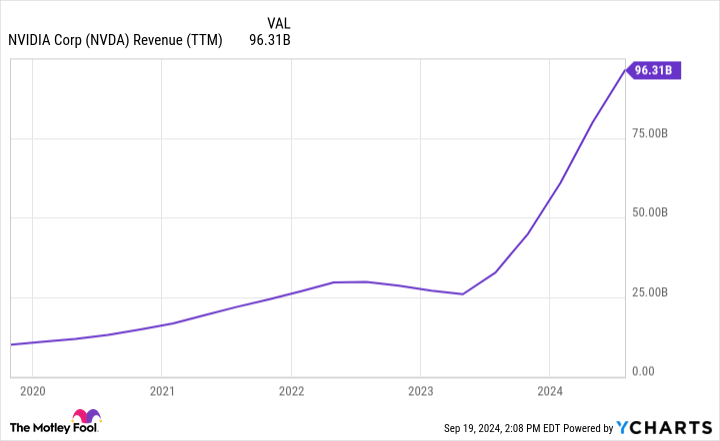

As proven under, the 4 huge tech firms talked about above reportedly account for practically 40% of Nvidia’s income, which exploded to $96 billion over the previous 12 months.

Of this, 85% comes from Nvidia’s information middle division. No matter firm can encroach on Nvidia’s huge market share of reportedly 70% to 95% in synthetic intelligence (AI) chips will profit in two methods: elevated revenue and decreased bills. In spite of everything, a lot of that enormous ramp in Nvidia’s income, depicted above, comes from different large tech firms’ pockets.

Nvidia is main resulting from its groundbreaking H100 GPU, which delivers unparalleled efficiency. These items are crucial for information facilities, giant language fashions, and generative AI, so Nvidia cannot sustain with demand and the margins are gigantic.

Alphabet is creating and bettering its competing AI product, the Tensor Processing Unit (TPU). It launched the sixth-generation TPU, Trillium, earlier this yr. With 5 instances extra velocity and 67% extra vitality effectivity, sixth-gen Trillium is a substantial leap over model 5.

Trillium would not compete straight on the open market with Nvidia. As a substitute, prospects lease house on Google Cloud, permitting Alphabet a broader buyer base. The power to lease house shall be intense competitors for Nvidia as firms can select to lease fairly than make capital investments. And, after all, Alphabet makes use of it internally.

Is Alphabet inventory a purchase now?

Alphabet can pour capital into AI initiatives as a result of it’s massively worthwhile and generates huge money circulation from its core promoting (Google Search and YouTube) and Google Cloud segments. These segments generated $84 billion in gross sales final quarter, a 14% year-over-year enhance that got here with $27 billion in working money circulation.

Additionally spectacular is that the working margin for Google Cloud elevated from 5% to 11% yr over yr. The rise in margin is a transparent indication of elevated effectivity and rising demand. As you possibly can see under, Google Cloud’s progress has been outstanding lately.

Even after rising practically fourfold since 2020, AI will enhance Google Cloud’s gross sales. For Alphabet, investments in AI, Google Cloud, and generative chatbots that rival ChatGPT, like Gemini, are essential to the long-term path.

Microsoft Bing is difficult Google Search by harnessing ChatGPT by its billion-dollar funding in its creator, OpenAI. Plus, generative AI could encroach on the search market. Nonetheless, there isn’t any have to sound an alarm but; Google Search grew 14% final quarter to $49 billion in income and stays far and away the market chief.

Alphabet inventory appears to be like like a cut price in a market the place many tech shares are buying and selling nicely above historic valuations. As proven under, Microsoft trades 14% above its five-year common price-to-earnings (P/E) ratio, whereas Alphabet trades 12% under.

The historic undervaluation, high quality core enterprise, and potential to compete for a part of Nvidia’s market dominance make Alphabet inventory an clever purchase for tech buyers and people searching for firms.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Alphabet wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up