Markets

Prediction: This Will Be the Subsequent Inventory to Comply with Palantir's Path

Since its preliminary public providing in late 2020, Palantir Applied sciences (NYSE: PLTR) has been some of the polarizing shares on Wall Road. Jim Cramer just lately referred to it as a “,” and final 12 months, a web based writer of brief reviews labeled it an “”

Though its work with the U.S. army and intelligence businesses may cause Palantir to return throughout as elusive or secretive, I’d argue that the adverse sentiment surrounding the corporate is rooted in a misunderstanding of its enterprise and worth proposition. Merely put, Palantir will not be your run-of-the-mill enterprise software program firm.

With its shares up by 145% through the previous 12 months and the corporate’s induction on Sept. 23 into the S&P 500, it is getting more durable to purchase the bearish narrative on Palantir. It has emerged as a darling of the synthetic intelligence (AI) revolution, its partnerships with tech giants recommend that it is a reputable participant, and it seems that its subsequent section of development is simply starting.

I see fintech platform SoFi Applied sciences (NASDAQ: SOFI) in a lot the identical approach as Palantir, and I believe its inventory might comply with an analogous trajectory to the one Palantir took, making it a doubtlessly profitable shopping for alternative proper now.

Palantir’s journey down reminiscence lane

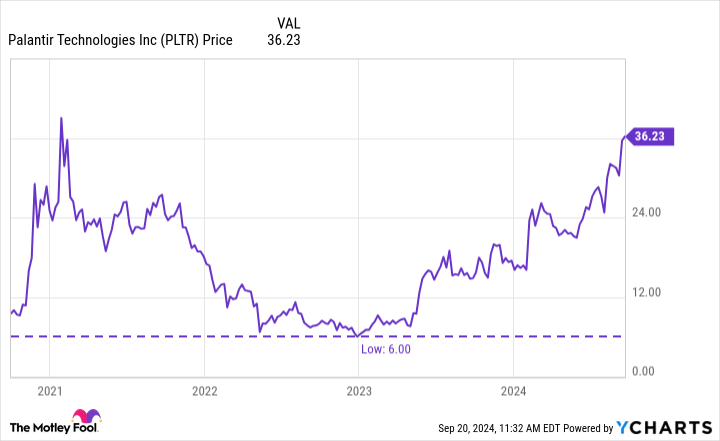

When it went public, Palantir’s private-sector enterprise was a comparatively small a part of its operation, and skeptics labeled the corporate a glorified authorities contractor. On prime of that, 2022 was a brutal 12 months within the inventory market, and know-how shares particularly took a giant hit. Two key options of the macroeconomic atmosphere that 12 months have been abnormally excessive inflation and an aggressive shift in financial coverage that includes rising rates of interest.

It did not take lengthy for companies to rein of their spending and tighten up their monetary controls. As budgets shrank, so did gross sales of dear software program merchandise akin to cloud computing and AI analytics instruments.

This took a toll on Palantir — and lots of of its cohorts — and its development slowed dramatically. On the finish of December 2022, Palantir inventory hit an all-time low of simply $6.

Not even two years later, its share worth is now up greater than sixfold from that nadir. What occurred?

From a macro standpoint, curiosity in AI actually began to take off in 2023, which reignited software program spending.

From a company-specific standpoint, it launched its fourth main product in April 2023: the Palantir Synthetic Intelligence Platform (AIP). Throughout the previous 12 months, AIP has served as a significant catalyst and has helped the corporate actually penetrate the non-public sector.

Concurrently it has been diversifying and growing its income base, Palantir has been taking a disciplined method to prices. Because of this, it has widened its working margins. Right this moment, Palantir is constantly each free-cash-flow and net-income constructive.

Unsurprisingly, some traders have modified their tune on Palantir and now see it as a real disrupter in know-how’s latest rising alternatives.

SoFi’s trajectory seems to be much like Palantir’s

Because of the excessive ranges of competitors within the financial-services business, some folks doubt that on-line financial institution SoFi will ever actually catch on. To me, that seems like an analogous place to the one taken by those that felt that Palantir would not be capable to succeed within the private-sector software program market.

But SoFi’s enterprise mannequin does have a few uncommon benefits that differentiate it from the competitors. For starters, it doesn’t have brick-and-mortar department areas. Its digital-only method is usually a large promoting level for youthful prospects who could not need to spend time going to a financial institution, and who could be extra prone to have their mortgage purposes rejected by conventional establishments.

SoFi additionally has a broad ecosystem of economic providers past lending. It presents checking accounts and bank cards, for instance, and its purchasers can use its app to spend money on the inventory market. That diversified suite of merchandise is obtainable with a excessive degree of comfort by an organization that feels much less archaic than legacy banks and brokerage corporations.

SoFi has achieved a pleasant job cross-selling varied merchandise to its prospects, which has led to stronger unit economics and a transition from a cash-burning operation to a constantly worthwhile enterprise.

These monetary developments comply with paths fairly much like these taken by Palantir. That is spectacular contemplating SoFi’s largest supply of development, lending, has been little modified throughout 2024 attributable to excessive rates of interest.

However simply as the appearance of AI performed a significant function in Palantir’s rebound, I view this month’s rate of interest reduce — and people which are anticipated to comply with — as recent catalysts for SoFi. Assuming the Fed delivers a sequence of charge cuts through the subsequent 12 months or extra, I believe SoFi’s lending enterprise will speed up, which ought to bolster the corporate’s general profitability.

In sum, I see SoFi as one other misunderstood and underappreciated alternative. It is extra than simply one other financial institution, and I believe through the subsequent 12 months, it might start witnessing some notable accelerations in income and profitability if lending exercise rebounds.

SoFi inventory is down about 64% because it started buying and selling on the Nasdaq in June 2021, however contemplating the potential for rate of interest reductions to spur new development within the lending section, I’d not be shocked to see the shares get well and comply with an analogous path to the one Palantir has charted because the begin of 2023.

Do you have to make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and SoFi Applied sciences wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Palantir Applied sciences and SoFi Applied sciences. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

US Treasury market liquidity again to pre-Fed tightening ranges, says NY Fed

By Davide Barbuscia

NEW YORK (Reuters) – Liquidity within the $27 trillion U.S. Treasury market, the most important authorities bond market on the earth, is again to ranges seen earlier than the Federal Reserve began mountaineering rates of interest in 2022, in accordance with a New York Fed report.

Liquidity – or the power to commerce an asset with out considerably shifting its worth – worsened over the previous few years as U.S. authorities bond costs swung sharply because the U.S. central financial institution began mountaineering charges to tame inflation.

However frequent measures to evaluate buying and selling situations “level to an enchancment in Treasury market liquidity in 2024 to ranges final seen earlier than the beginning of the present financial coverage tightening cycle,” Michael Fleming, head of Capital Markets Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group, stated in a submit on the New York Fed’s Liberty Avenue Economics weblog on Monday.

Fleming noticed enhancements within the bid-ask unfold, which is the distinction between the very best bid worth and the bottom ask worth for a safety. Spreads have been slim and secure since mid-2023, after widening within the aftermath of the U.S. regional banking turmoil in March final 12 months, he stated.

Order e book depth, or the typical amount of securities accessible on the market or buy at the most effective bid and supply costs, has additionally elevated since March final 12 months, he stated, though it declined in early August this 12 months when a weaker-than-expected jobs market report and a shock charge hike by the Financial institution of Japan shook monetary markets.

Lastly, Fleming noticed an enchancment within the worth influence of trades, which assesses the worth change that happens when a purchaser or vendor begins a commerce. After rising sharply throughout the March 2023 banking turmoil, worth influence has been declining to ranges final seen in late 2021 and early 2022, he stated, earlier than rising once more in early August 2024.

Regulators and the Treasury itself have lately launched a slate of reforms to enhance buying and selling situations and keep away from disruptions on the earth’s largest bond market. Nonetheless, many market contributors stay involved that vulnerabilities that emerged in earlier incidents, resembling in March 2020 when liquidity quickly deteriorated amid pandemic fears, may nonetheless reappear in case of spikes in volatility and as authorities debt provide continues to develop.

Current enhancements in liquidity have been accompanied by a lower in volatility, or worth fluctuations, stated Fleming.

Nonetheless, a proxy for Treasuries liquidity that measures deviations between sure Treasury yields has saved deteriorating, he added.

“The market’s capability to easily deal with giant buying and selling flows has been of ongoing concern since March 2020 … debt excellent continues to develop, and up to date empirical work reveals how constraints on intermediation capability can worsen illiquidity,” he stated.

“Shut monitoring of Treasury market liquidity, and continued efforts to enhance the market’s resilience, stay applicable.”

(Reporting by Davide Barbuscia, Enhancing by William Maclean)

Markets

Germany's Scholz slams UniCredit 'assault' on Commerzbank, stiffening opposition

By Valentina Za, Tom Sims and Andreas Rinke

MILAN/FRANKFURT (Reuters) -German Chancellor Olaf Scholz slammed as “an unfriendly assault” a transfer by UniCredit to develop into the most important investor in rival Commerzbank (ETR:) with a possible 21% stake, in an indication of rising hostility in the direction of the Italian financial institution.

The German institution’s anger in the direction of UniCredit utilizing derivatives to greater than double its potential stake earlier than receiving regulatory approval piles stress on European Central Financial institution supervisors, led by German educational Claudia Buch.

“Unfriendly assaults, hostile takeovers aren’t a very good factor for banks and that’s the reason the German authorities has clearly positioned itself on this path,” Scholz stated on the sidelines of an occasion in New York.

His phrases despatched Commerzbank shares down 5.7% as buyers reassessed the probabilities of a full takeover. UniCredit fell 3%.

UniCredit CEO Andrea Orcel’s daring try to construct Europe’s greatest financial institution has develop into a check of the bloc’s resolve to beat nationwide borders to retain international relevance.

On Friday Germany’s finance company stated it might not promote any extra Commerzbank shares for now, with the financial institution’s technique “geared in the direction of independence.”

Acknowledging UniCredit’s stakebuilding, Commerzbank stated it might “all the time study strategic choices responsibly within the pursuits of its stakeholders”.

Shares within the German lender have gained multiple fifth since UniCredit revealed it had a 9% stake, which made it the most important personal investor after the German state. Commerzbank is price round a 3rd of UniCredit’s over 60 billion euros in market worth.

“The scenario has taken an surprising flip, because the market was anticipating a gradual timeline and no motion within the quick time period, in addition to … a ‘pleasant improvement’,” Citi analysts stated.

UNIONS OPPOSED

Germany’s Verdi union opposed the event and vowed to “struggle with all means for independence.” Commerzbank Supervisory Board Member Stefan Wittmann deemed it a “fully inappropriate, aggressive act” and stated the financial institution anticipated the federal government to struggle any deal.

Politicians and labour unions have warned {that a} merger may result in huge job losses and stifle lending to small and medium-sized companies.

Commerzbank, with greater than 25,000 enterprise clients, virtually a 3rd of German overseas commerce funds and greater than 42,000 workers, is a linchpin of the German economic system.

The Italian financial institution defended the deserves of a mix of Commerzbank with UniCredit’s German enterprise, which is leaner and extra worthwhile than Commerzbank’s.

“UniCredit believes that there’s substantial worth that may be unlocked inside Commerzbank, both stand-alone or inside UniCredit, for the advantage of Germany and the financial institution’s wider stakeholders,” it stated in an announcement.

Italy’s Overseas Minister Antonio Tajani welcomed UniCredit’s determination.

“Being pro-European solely in phrases leaves one thing to be desired,” Tajani stated.

BLINDSIDED

Orcel had already blindsided the German authorities when it outbid rivals in a young to purchase 4.5% of Commerzbank from the state this month, having already amassed an analogous sized stake available on the market.

The escalation comes at a time of political upheaval in Germany, the place the three political events governing the nation often conflict and proceed to lose floor to the extremely conservative Various for Germany get together.

This disarray may make it tougher for the federal government to forge a robust response the undesirable Italian advance.

“UniCredit now has a greater beginning place with this massive share package deal … It creates a sure momentum, whereas Berlin remains to be contemplating the best way to view it,” stated Michael Grote, company finance professor on the Frankfurt College of Finance & Administration.

Orcel, a star funding banker who engineered a few of Europe’s greatest banking mergers in latest many years, has stated he wouldn’t have moved had he been unwelcome, including he held conferences over the summer time in Germany.

The state retains 12% of Commerzbank.

UniCredit, which in 2005 purchased Bavarian financial institution HVB, has repeatedly focused Commerzbank prior to now 20 years.

It stated it had utilized to extend its Commerzbank holding to 29.9%. In the meantime it entered derivatives contracts on Monday to amass an extra 11.5% of the financial institution.

The European Central Financial institution should approve share possession in a financial institution crossing thresholds set at 10%, 20%, 30% and so forth. Below German company legal guidelines a 30% possession triggers a compulsory buyout supply.

UniCredit would solely take possession of the Commerzbank shares linked to the derivatives if it secured ECB approval. The ECB has as much as 60 days, which might be prolonged to 90, to rule.

Markets

Riot Platforms and Bitfarms attain settlement settlement to finish acquisition bid

Bitcoin mining corporations Riot Platforms and Bitfarms have reached a settlement settlement, ending Riot’s acquisition bid for the crypto mining firm, based on a Sept. 23 assertion.

In consequence, Riot Platforms has withdrawn its request for a particular shareholder assembly of Bitfarms. The settlement, signed on September 23, 2024, maintains Riot’s 19.9% possession stake in Bitfarms, consisting of 90,110,912 widespread shares.

Furthermore, as a part of the deal, Andrés Finkielsztain has resigned from Bitfarms’ Board of Administrators, whereas Amy Freedman has been appointed to the board and several other committees.

Amy has 25 years of expertise in company governance and public capital markets, presently holding a task as an advisor to Ewing Morris and Co. Funding Companions, and with a observe document in corporations comparable to Stifel Monetary Corp. and Morgan Stanley, based on Bitfarms.

The settlement contains Freedman’s appointment to the Governance and Nominating Committee and the Compensation Committee. She may also be a part of any present or future “particular committees” of unbiased administrators, supplied she meets independence necessities.

Riot Platforms acknowledged it should proceed to evaluation its funding in Bitfarms and should modify its place based mostly on varied components, together with market situations and different funding alternatives.

Finish of a hostile takeover

Riot Platforms has been ramping up its participation as Bitfarms’ shareholder in 2024, together with a $950 million supply to purchase the corporate again in April.

This relation led to a back-and-forth between each corporations. Bitfarms tried to cease Riot’s makes an attempt with a plan to promote discounted shares to shareholders aiming to extend their stake within the firm, as much as a 15% threshold.

Consequently, Riot tackled this strategy by suggesting three unbiased candidates for Bitfarms’ board of administrators.

Bitfarms then referred to as a “particular shareholder assembly” to debate Riot’s efforts to amass the corporate.

Thus, the present settlement places an finish to the hostile takeover makes an attempt by Riot.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up