Markets

Riot Platforms and Bitfarms attain settlement settlement to finish acquisition bid

Bitcoin mining corporations Riot Platforms and Bitfarms have reached a settlement settlement, ending Riot’s acquisition bid for the crypto mining firm, based on a Sept. 23 assertion.

In consequence, Riot Platforms has withdrawn its request for a particular shareholder assembly of Bitfarms. The settlement, signed on September 23, 2024, maintains Riot’s 19.9% possession stake in Bitfarms, consisting of 90,110,912 widespread shares.

Furthermore, as a part of the deal, Andrés Finkielsztain has resigned from Bitfarms’ Board of Administrators, whereas Amy Freedman has been appointed to the board and several other committees.

Amy has 25 years of expertise in company governance and public capital markets, presently holding a task as an advisor to Ewing Morris and Co. Funding Companions, and with a observe document in corporations comparable to Stifel Monetary Corp. and Morgan Stanley, based on Bitfarms.

The settlement contains Freedman’s appointment to the Governance and Nominating Committee and the Compensation Committee. She may also be a part of any present or future “particular committees” of unbiased administrators, supplied she meets independence necessities.

Riot Platforms acknowledged it should proceed to evaluation its funding in Bitfarms and should modify its place based mostly on varied components, together with market situations and different funding alternatives.

Finish of a hostile takeover

Riot Platforms has been ramping up its participation as Bitfarms’ shareholder in 2024, together with a $950 million supply to purchase the corporate again in April.

This relation led to a back-and-forth between each corporations. Bitfarms tried to cease Riot’s makes an attempt with a plan to promote discounted shares to shareholders aiming to extend their stake within the firm, as much as a 15% threshold.

Consequently, Riot tackled this strategy by suggesting three unbiased candidates for Bitfarms’ board of administrators.

Bitfarms then referred to as a “particular shareholder assembly” to debate Riot’s efforts to amass the corporate.

Thus, the present settlement places an finish to the hostile takeover makes an attempt by Riot.

Markets

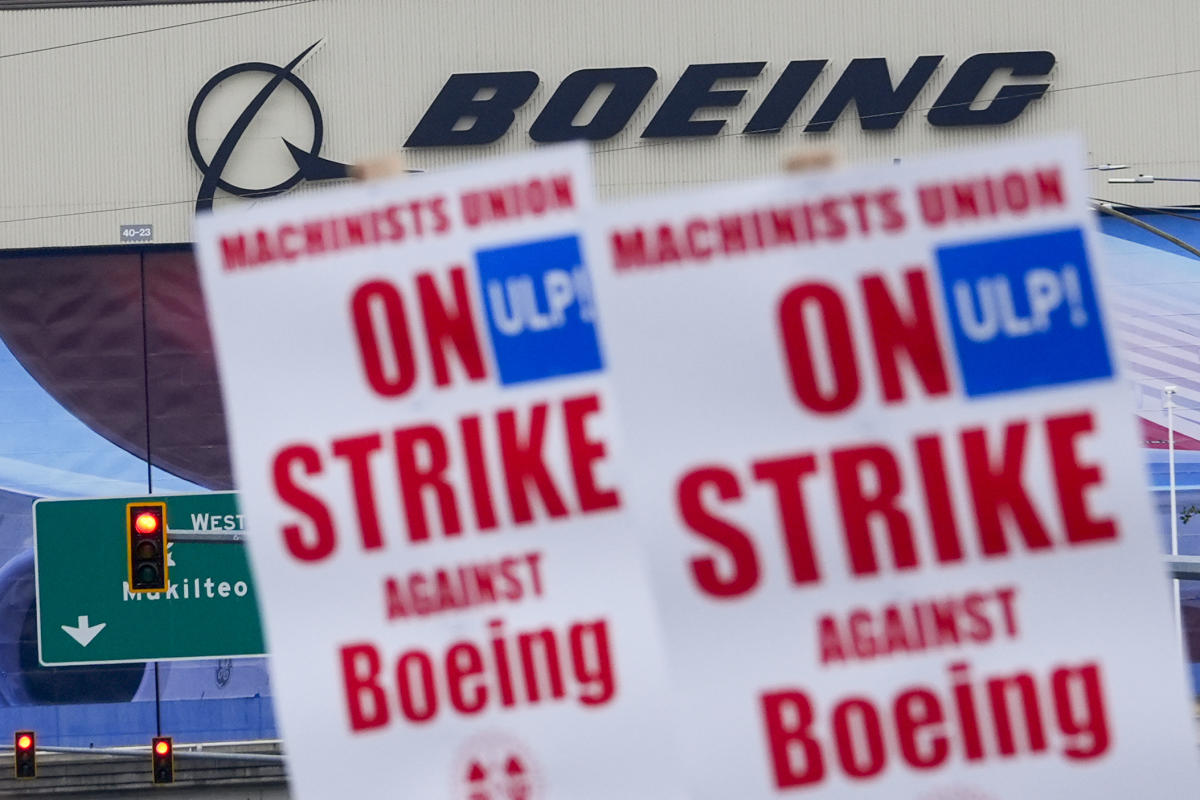

Boeing makes a 'finest and remaining provide' to hanging union staff

Boeing mentioned Monday it made a “finest and remaining provide” to that features greater raises and bigger bonuses than a proposed contract that was .

The corporate mentioned the provide consists of pay raises of 30% over 4 years, up from the rejected 25% raises.

The brand new provide — and labeling it a remaining one — demonstrates Boeing’s eagerness to finish the strike by about 33,000 machinists that started Sept. 13. The corporate launched rolling furloughs of non-unionized staff final week to chop prices through the strike.

The strikers face their very own monetary strain to return to work. They obtained their remaining paychecks final week and can lose company-provided medical health insurance on the finish of the month, in response to Boeing.

The corporate mentioned its new provide is contingent on members of the Worldwide Affiliation of Machinists and Aerospace Staff ratifying the contract by late Friday night time, when the strike can be just a little over two weeks previous.

The union, which represents manufacturing facility staff who assemble a number of the , didn’t instantly reply to requests for remark.

Boeing’s newest provide consists of upfront pay raises of 12% plus three annual raises of 6% every.

It will double the scale of ratification bonuses to $6,000. It additionally would preserve annual bonuses based mostly on productiveness. Within the rejected contract, Boeing sought to with new contributions to retirement accounts.

Boeing mentioned common annual pay for machinists would rise from $75,608 now to $111,155 on the finish of the four-year contract.

The brand new provide wouldn’t restore a standard pension plan that Boeing eradicated a few decade in the past. Placing staff cited pay and pensions as explanation why they voted 94.6% in opposition to the corporate’s earlier provide.

Boeing additionally renewed a promise to construct its subsequent new airline airplane within the Seattle space — if that mission begins within the subsequent 4 years. That was a key provision for union leaders, who advisable adoption of the unique contract provide, however one which appeared much less persuasive to rank-and-file members.

The strike is probably going already beginning to cut back Boeing’s . The corporate will get a lot of its money when it delivers new planes, however the strike has shut down manufacturing of 737s, 777s and 767s. Work on 787s continues with nonunion staff in South Carolina.

On Friday, Boeing started requiring 1000’s of managers and nonunion staff to take one week off with out pay each 4 weeks . It additionally has introduced a hiring freeze, lowered enterprise journey and decreased spending on suppliers.

The cash-saving measures are anticipated to final so long as the strike continues.

Markets

Summit Therapeutics, Intel Stir Monday's Afternoon Market Cap Inventory Movers

Monday’s market has seen notable actions throughout varied shares, with vital exercise in each the mega-cap and large-cap classes. Buyers are witnessing dramatic shifts, reminiscent of Summit Therapeutics PLC (NASDAQ:) taking a steep dive, whereas Intel Corp (NASDAQ:) enjoys a rally amid acquisition buzz. This is a more in-depth have a look at among the most impactful inventory movers at first of the week.

Mega-Cap Movers (Market Cap $200B+)

- No mega-cap firms had been reported for right now’s inventory motion exercise.

Massive-Cap Inventory Movers (Market Cap $10B-$200B)

- Summit Therapeutics PLC (SMMT): -10.91%

- Ke Holdings Inc (BEKE): +7.2%

- Sea Restricted (NYSE:): worth goal raised at BofA; +5.51%

- Tencent Music Leisure Group (NYSE:): +4.72%

- Albemarle (NYSE:): +3.78%

- New Oriental Training & Tech (EDU): -4.02%

- JD.Com Inc Adr (NASDAQ:): +4.15%

- Qualcomm (NASDAQ:) buying Intel? ‘Nearly too foolish to touch upon’ says Citi; Intel Corp (INTC): +4.28%

- Vistra Power Corp (NYSE:): worth goal raised at Morgan Stanley; +3.81%

- Regeneron Phar. (NASDAQ:): -3.43%

Mid-Cap Inventory Movers (Market Cap $2B-$10B)

- Miniso Group Holding Ltd (MNSO): -17.35%; MINISO to grow to be largest Yonghui Superstores shareholder

- Biohaven Pharmaceutical Holding Co (NYSE:): +15.55%

- Troriluzole reveals promise in slowing SCA development; AeroVironment (NASDAQ:): +11.4%

- ZIM Built-in Transport Providers (ZIM): +10.32%

- Geron Corp (NASDAQ:): -8.81%

- TSLL (TSLL): +8.86%

- Edgewise Therapeutics (EWTX): -7.18%

- DigitalOcean Holdings (DOCN): -6.87%

Small-Cap Inventory Movers (Market Cap $300M-$2B)

- Jin Medical Worldwide (ZJYL): -27.45%

- NANO Nuclear Power targets area with new subsidiary; Nano Nuclear Power (NNE): +11.06%

- Arisz Acquisition (FUFU): +15.11%

- Intchains ADR (ICG): +13.23%

- Armada Acquisition I (RZLV): -13.21%

- XCHG Ltd ADR (XCH): -12.27%

- American Superconductor (NASDAQ:): +12.48%

- Emerald Expositions Occasions Inc (NYSE:): +10.34%

- COVA Acquisition (ECX): -11.19%

For real-time, market-moving information, be part of Investing Professional.

This text was generated with the assist of AI and reviewed by an editor. For extra data see our T&C.

Markets

DJT inventory plummets to new lows after lockup interval expires

Shares of Trump Media & Expertise Group () dropped greater than 6% on Monday to commerce at their lowest stage in March. The strikes come after DJT’s lockup interval

Stakeholders, together with former President Donald Trump, have been topic to a six-month lockup interval earlier than with the ability to promote or switch shares. That lockup interval expired final Thursday, though Trump has stated he wouldn’t promote his stake.

“I’ve completely no intention of promoting,” the previous president advised reporters at a press convention previous to the lockup interval expiration. “I find it irresistible. I exploit it as a technique of getting out my phrase.”

As Lusso’s Information’s Ben Werschkul detailed, the is to guard a newly public firm’s pursuits and permit it to protect stability earlier than its founders can money out.

“If I promote, it wouldn’t be the identical, and I can perceive that,” Trump stated on the time, including that he is aware of his stake has been “whittled down” in latest months.

Shares are down about 15% since Thursday and stay far off their file excessive of simply over $79 a share.

Trump maintains a roughly in DJT. At present ranges, Trump Media boasts a market cap of about $2.5 billion, giving the previous president a stake price round $1.5 billion. Proper after the corporate’s public debut, Trump’s stake was price simply over $4.5 billion.

Trump Media went public on the Nasdaq in late March after with particular goal acquisition firm Digital World Acquisition Corp. However the inventory has been on a bumpy journey since, with shares oscillating between highs and lows because the strikes have usually been tied to a unstable information cycle.

In June, the inventory after in his first presidential debate of 2024 with Trump. Biden dropped out of the presidential race one month later.

Since Biden’s announcement, shares have remained below stress as Vice President Kamala Harris, the Democratic presidential nominee, tracks forward of Trump

In Could, Trump on all 34 counts of falsifying enterprise data supposed to affect the 2016 presidential marketing campaign — a verdict that despatched shares down 5% His sentencing was till Nov. 26.

Shares have fallen about 65%

Trump based Fact Social after he was kicked off main social media apps like Fb () and Twitter, the platform now often known as X, following the Jan. 6, 2021, Capitol riots. Trump has since been reinstated on these platforms. He formally after a couple of yr’s hiatus.

However as Fact Social makes an attempt to tackle the social media incumbents, the basics of the corporate have lengthy been in query.

Final month, DJT second quarter outcomes that exposed a internet lack of $16.4 million, about half of which was tied to bills associated to the corporate’s SPAC deal. The corporate additionally reported income of slightly below $837,000 for the quarter ending June 30, a 30% year-over-year drop.

is a Senior Reporter at Lusso’s Information. Comply with her on X , and e mail her at alexandra.canal@yahoofinance.com.

.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up