Markets

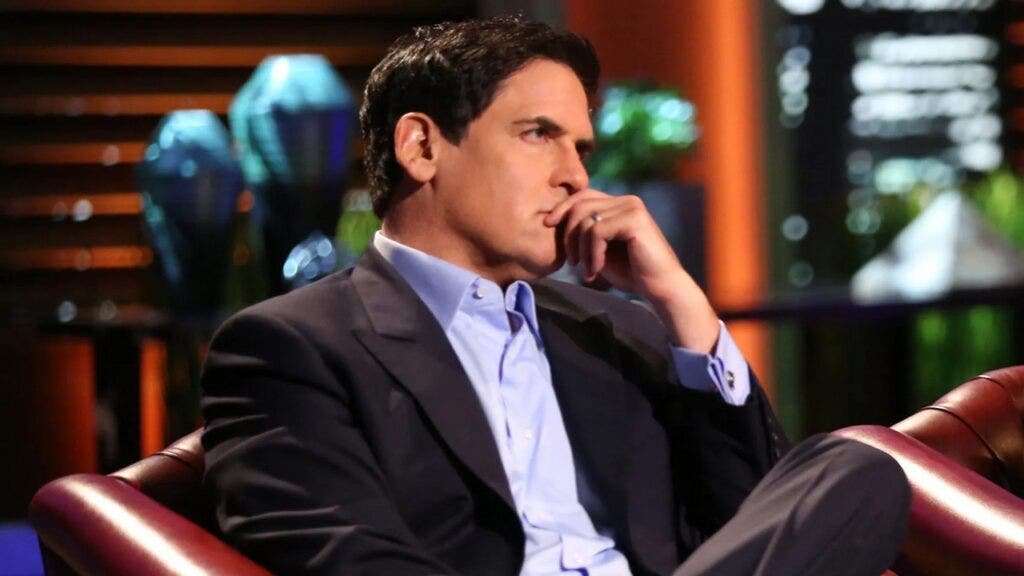

Mark Cuban's Black Amex Card Was Declined Making an attempt To Purchase A $140,000 Bottle Of Champagne After His NBA Group Received Championship

Mark Cuban as soon as famously gave : “Do not use bank cards. In the event you use a bank card, you do not wish to be wealthy.”

He usually shares this mantra on his weblog and through interviews with monetary gurus like Dave Ramsey. It displays his perception in residing inside one’s means, a stable precept for anybody seeking to construct wealth.

Paradoxically, Cuban was in a predicament involving a bank card whereas 2011 NBA championship victory.

Do not Miss:

From promoting rubbish luggage door-to-door as a child to constructing a tech empire, via his onerous work and savvy investments. His huge break got here within the Nineteen Nineties with the sale of Broadcast.com to Yahoo for $5.7 billion, adopted by his buy of the Mavericks for $285 million in 2000. Beneath his possession, the workforce remodeled from perennial underperformers to NBA champions, capturing their first title in 2011.

After the championship win, Cuban and his workforce headed to LIV nightclub in Miami to rejoice in model. He handled himself to an extravagant 15-liter bottle of Armand de Brignac Champagne, usually referred to as “Ace of Spades.” Priced at $140,000 (or $90,000 in keeping with some sources), it was the right solution to commemorate the second. Cuban confidently reached for his American Categorical Centurion Card – an unique bank card for .

Trending: Warren Buffett as soon as mentioned, “In the event you do not discover a solution to become profitable whilst you sleep, you’ll work till you die.”

To his shock, the transaction was declined. Cuban recounted the expertise throughout a 2018 interview on Fox Sports activities 1’s “Honest Sport,” revealing how he needed to name American Categorical into the again workplace. “I am on the cellphone with them, and so they say, ‘Uh, sir, this hasn’t been approved. It is a new card,'” he mentioned, laughing on the absurdity of the scenario. “I requested to talk to a supervisor. I used to be like, ‘Did you see the NBA recreation tonight? Are you a basketball fan?'”

His humorous method shone via as he navigated the layers of customer support, ultimately reaching somebody who understood the context of his extravagant request. “That is Mark Cuban. We simply gained the championship. Can I please spend some cash?” he quipped.

Trending: Founding father of Private Capital and ex-CEO of PayPal

David Grutman, the proprietor of LIV, chimed in, recalling the chaotic scene: “We had been within the again as a result of his bank card was denied.”

Cuban usually emphasizes that was considered one of his hardest monetary classes, however he acknowledges that they are often OK – if used responsibly.

In a 2017 Cash.com interview, he famous, “Over time, what I’ve discovered is utilizing a bank card is OK if you happen to pay it off on the finish of the month.” He added, “Simply acknowledge that the 18% or 20% or 30% you are paying in bank card debt goes to value you much more than you could possibly ever earn wherever else.” Whereas Cuban is probably not a fan of bank cards, he is aware of the suitable solution to deal with them when obligatory.

Trending: Amid the continued EV revolution, beforehand ignored low-income communities

Cuban’s ventures have continued to evolve within the years following the championship. In late 2023, he offered his majority stake within the Mavericks for $3.5 billion however retained a minority share and management over basketball operations.

Even billionaires often whip out the plastic for a celebratory splurge, however Cuban’s message is easy: if you happen to use bank cards, pay them off quick to dodge curiosity costs. Whereas most individuals will not be charging $140,000 bottles of Champagne, his Amex Black Card mishap proves that and indulgence can coexist, even for the ultrawealthy.

Learn Subsequent:

Up Subsequent: Remodel your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in right this moment’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Oil Falls After Iran Says It’s Ready to Ease Israel Tensions

(Lusso’s Information) — Oil fell on a weak outlook for gasoline demand and the potential for the battle between Iran and Israel to de-escalate after its latest flare-up.

Most Learn from Lusso’s Information

West Texas Intermediate slipped virtually 1% to settle under $71 a barrel whereas Brent retreated to settle under $74 a barrel. WTI had gained 4.8% final week in its greatest weekly leap since February.

After days of Israel and Iran-backed Hezbollah buying and selling rocket fireplace, Iranian President Masoud Pezeshkian stated on Monday that his nation is ready to de-escalate tensions so long as it sees the identical degree of dedication on the opposite facet. The overture is easing some considerations that the battle will worsen, threatening oil output in a area that provides a couple of third of the world’s barrels.

Crude can be down this quarter on considerations that demand from China and the US will weaken on the similar time that output from non-OPEC nations rises, creating an oversupplied market. The outlook for gasoline demand is worsening, turning hedge funds essentially the most bearish on diesel on report. Technical elements are also offering headwinds after crude rallied about 10% from its 2024 lows reached earlier this month.

“Sentiment amongst vitality buyers has turned decisively bearish as OPEC+ now plans so as to add barrels right into a surplus oil market,” Financial institution of America Corp. analysts together with Francisco Blanch wrote in a word.

In China, the world’s prime oil importer, authorities introduced plans for monetary regulators to supply a uncommon briefing on the economic system because the nation minimize a short-term coverage fee. That fueled hypothesis officers are getting ready extra efforts to revive progress.

Elevated stimulus from China might enhance demand for crude, stated Robert Yawger, director of the vitality futures division at Mizuho Securities USA.

It’s “robust for crude oil to rally for dimension with out China demand progress,” Yawger stated.

In the meantime, from Mississippi to the Florida Panhandle, the US Gulf Coast is susceptible to a hurricane strike by the tip of the week as a patch of turbulent climate within the Atlantic turns into extra organized. Forward of the storm, Shell Plc has curtailed manufacturing on the Appomattox challenge and the Stones oil area within the Gulf, in response to an organization assertion.

To get Lusso’s Information’s Power Each day publication in your inbox, click on right here.

–With help from Alex Longley.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Griffon Corp president and COO sells over $621k in firm inventory

Griffon Company (NYSE:) President and COO Robert F. Mehmel has offered a complete of $621,045 value of the corporate’s frequent inventory, in response to a latest SEC submitting. The transactions befell on September 19 and September 20, with gross sales costs ranging between $70.00 and $70.385 per share.

On the primary day, Mehmel offered 7,663 shares at a weighted common value of $70.02, whereas the next day, he disposed of 1,205 shares for a mean value of $70.11. The gross sales have been executed in a number of transactions, with share costs various throughout the said ranges. The SEC submitting included footnotes indicating that the costs reported have been weighted averages, and the precise variety of shares offered at every value throughout the vary could be supplied upon request.

Following these transactions, Mehmel nonetheless holds a considerable variety of shares in Griffon Company. The precise variety of shares owned by Mehmel after the gross sales was reported as 754,046 for direct possession. Moreover, there are 3,991 shares held not directly by the ESOP.

Buyers typically hold a detailed eye on insider transactions as they will present insights into the executives’ confidence within the firm’s future efficiency. The sale of a big quantity of inventory by a high-ranking government like Mehmel could also be of explicit curiosity to the market.

Griffon Company, headquartered in New York, operates within the manufacturing sector, specializing in metallic doorways, sash, frames, molding, and trim. The corporate’s inventory is publicly traded on the New York Inventory Change underneath the ticker image GFF.

In different latest information, The Toro Firm (NYSE:) has offered its Pope Merchandise division to The AMES Firm, a subsidiary of Griffon Company. The divestiture is a part of Toro’s strategic plan to focus on sectors with potential for worthwhile development. The sale just isn’t anticipated to considerably affect Toro’s fiscal 2024 outcomes, with the corporate having already accounted for this transaction in its forecast.

On the opposite facet, Griffon Company has been making vital strides in its enterprise operations. The corporate not too long ago acquired Pope, a residential watering merchandise firm, which is predicted to usher in a further $25 million in annualized income and positively affect Griffon’s earnings throughout the first full yr of possession.

As well as, Griffon Company has efficiently repriced its Secured Time period Mortgage B facility, estimated to save lots of the corporate roughly $1.8 million in annual money curiosity bills. The corporate has additionally reported a robust begin to fiscal yr 2024, surpassing market expectations with sturdy income and EBITDA figures. Griffon raised its full-year income steerage to $2.65 billion, with a $30 million enhance in section adjusted EBITDA forecasted at $555 million. These latest developments point out the corporate’s dedication to enhancing shareholder worth and its strategic plan for development.

Lusso’s Information Insights

Amidst the latest insider transactions at Griffon Company (NYSE:GFF), the Lusso’s Information platform gives key metrics and insights that would present a broader context for buyers. As of the final twelve months main as much as Q3 2024, Griffon Company boasts a market capitalization of $3.43 billion, with a Worth/Earnings (P/E) ratio of 17.95, which adjusts to a extra engaging 15.59 when contemplating near-term earnings development.

The corporate’s sturdy monetary well being is additional underscored by a Gross Revenue Margin of 39.79%, reflecting environment friendly operations and a stable grip on price administration. Moreover, Griffon Company’s Working Revenue Margin stands at a powerful 15.97%, indicating robust profitability relative to its revenues.

Lusso’s Information Suggestions spotlight a number of optimistic indicators for Griffon Company. Notably, the administration’s confidence is clear by way of aggressive share buybacks, a observe that always indicators a perception within the firm’s undervaluation. Moreover, the corporate has not solely maintained but additionally raised its dividend for the previous 14 consecutive years, showcasing a dedication to returning worth to shareholders. With 4 consecutive years of dividend will increase and a excessive shareholder yield, these components could also be notably interesting to income-focused buyers.

For these searching for extra complete evaluation and extra insights, Lusso’s Information gives a complete of 14 ideas for Griffon Company, obtainable at https://www.investing.com/professional/GFF. The following tips delve into features equivalent to earnings revisions, buying and selling multiples, and profitability forecasts, offering a well-rounded view of the corporate’s funding potential.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

CEO of Bitcoin Mining Big Marathon Predicts Power Market Disruption

Fred Thiel, chairman and chief govt officer at Bitcoin mining behemoth Marathon Digital, has predicted “fast innovation” and “fast disruption” on power markets.

Thiel has pointed to the truth that AI and knowledge heart corporations have now emerged as one of many greatest monetary backers of recent power technology initiatives.

These knowledge facilities are actually serving to to revive previous nuclear vegetation. Thiel is, after all, alluding to the current information piece about Pennsylvia-based Three Mile Island nuclear plant coming again on-line as a part of its take care of tech behemoth Microsoft. It’s anticipated to restart in 2028 so as to gasoline Microsoft’s AI knowledge facilities.

“Knowledge heart operators search and can attain power self-sovereignty, and in doing so will dramatically change the power markets in a really optimistic manner for all customers,” Thiel stated in his prolonged social media submit.

MicroStrategy-like technique

Because of the declining profitability of Bitcoin mining following the most recent quadrennial halving, some mining trade gamers have pivoted to AI so as to increase their income.

In August, Marathon Digital made headlines by taking a web page out of MicroStrategy’s playbook and promoting convertible notes to purchase extra Bitcoin. The truth that it didn’t decide to purchase mining gear as an alternative underscores the powerful predicament of mining trade gamers. The corporate claimed that merely shopping for Bitcoin can be extra helpful for its shareholders.

The shares of Marathon Digital are down greater than 30% on the year-to-date foundation.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up