Markets

China’s Sweeping Stimulus Plan Lifts Asian Shares: Markets Wrap

(Lusso’s Information) — Asian shares rose after China’s central financial institution introduced stimulus measures in a bid to succeed in this 12 months’s financial development goal and stem a selloff within the fairness market.

Most Learn from Lusso’s Information

Fairness benchmarks in Hong Kong jumped greater than 2% on the open whereas onshore Chinese language shares additionally gained. The MSCI Asia Pacific Index rose 0.7%, with Japan benchmarks advancing greater than 1% after reopening from a vacation. The yield on China’s 10-year authorities bond declined to 2% for the primary time on report.

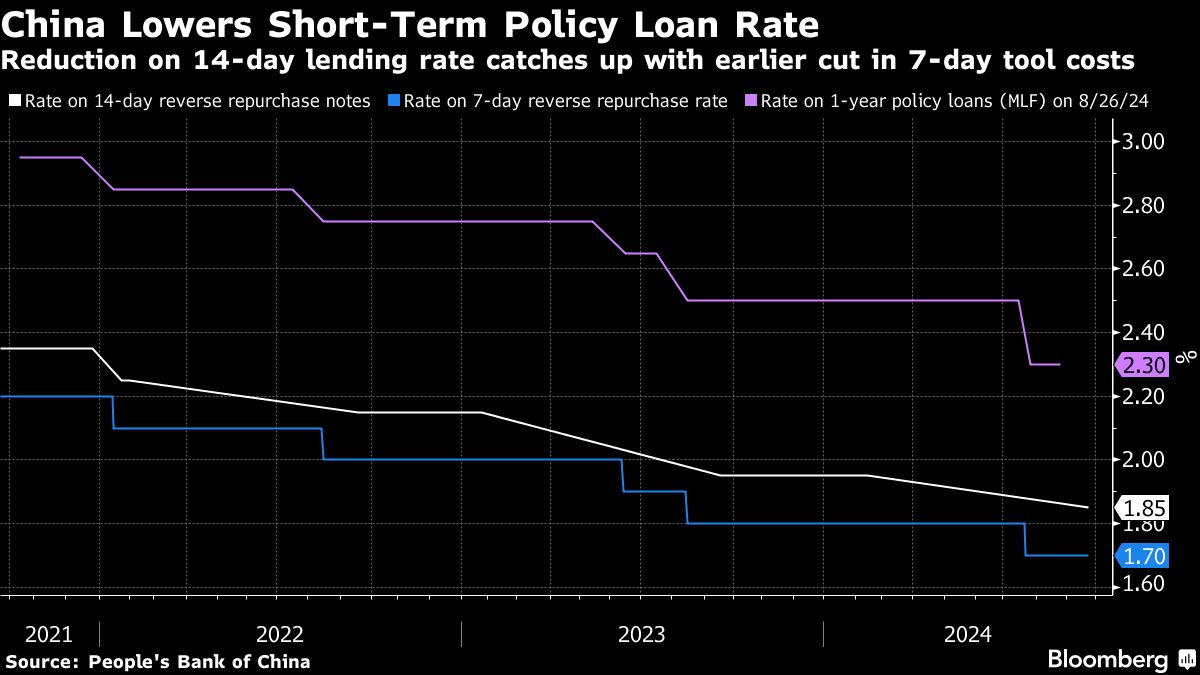

China will enable brokerages and funds to faucet the central financial institution’s funding to purchase shares, including assist after the CSI 300 Index fell to greater than a five-year low earlier this month. Individuals’s Financial institution of China governor Pan Gongsheng introduced a collection of stimulus measures at a uncommon briefing Tuesday, together with strikes to spice up banks’ lending to shoppers and corporates, and a lower to its key short-term rate of interest.

“Market individuals might like what they see at this time,” mentioned Jun Rong Yeap, a market strategist at IG Asia. The efforts “might drive a short-term rebound in Chinese language equities as the most recent transfer dispels earlier issues across the authorities’ inaction.”

US inventory futures edged decrease after the S&P 500 closed 0.3% increased within the earlier session, a whisker away from final week’s all-time excessive.

Knowledge launched Monday confirmed US enterprise exercise expanded at a barely slower tempo in early September, whereas expectations deteriorated and a gauge of costs acquired climbed to a six-month excessive, stoking confidence the world’s largest economic system can nail a smooth touchdown. Traders at the moment are awaiting knowledge on the Fed’s most popular worth metric and US private spending later this week.

Learn Extra on China:

The yield on policy-sensitive two-year Treasuries fell one foundation level to three.58% in Asian buying and selling, whereas longer dated Treasuries had been little modified. Merchants have been wagering on almost three-quarters of some extent of coverage easing by 12 months finish, suggesting a minimum of yet another jumbo price lower is in retailer.

Chicago Fed President Austan Goolsbee mentioned with inflation approaching the central financial institution’s goal the main target ought to flip to the labor market and “that doubtless means many extra price cuts over the following 12 months.”

Neel Kashkari on the Minneapolis Fed additionally pointed to weak spot within the job market, saying he backs decreasing rates of interest by one other half share level by 12 months finish. His counterpart on the Atlanta Fed, Raphael Bostic took a average stance. Beginning the central financial institution’s slicing cycle with a big step would assist convey rates of interest nearer to impartial ranges, however officers mustn’t decide to a cadence of outsize strikes, in line with Bostic.

In different key occasions for Asia, the Reserve Financial institution of Australia is anticipated to carry the money price at a 12-year excessive of 4.35% on Tuesday — and preserve it there till a minimum of February. The nation’s 10-year yield dipped in early buying and selling.

Gold steadied close to a report excessive after a number of Fed officers appeared to go away the door open to further massive price cuts. Oil edged increased after Israel launched airstrikes on Lebanon that killed almost 500 folks and boosted regional tensions.

Key occasions this week:

-

Australia price determination, Tuesday

-

Japan Jibun Financial institution Manufacturing PMI, Providers PMI, Tuesday

-

Mexico CPI, Tuesday

-

Financial institution of Canada Governor Tiff Macklem speaks, Tuesday

-

Australia CPI, Wednesday

-

China medium-term lending facility price, Wednesday

-

Sweden price determination, Wednesday

-

Switzerland price determination, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, sturdy items, revised GDP, Thursday

-

Fed Chair Jerome Powell provides pre-recorded remarks to the tenth annual US Treasury Market Convention, Thursday

-

Mexico price determination, Thursday

-

Japan Tokyo CPI, Friday

-

China industrial income, Friday

-

Eurozone client confidence, Friday

-

US PCE, College of Michigan client sentiment, Friday

A few of the major strikes in markets:

Shares

-

S&P 500 futures had been little modified as of 10:44 a.m. Tokyo time

-

Nasdaq 100 futures had been little modified

-

Japan’s Topix rose 1.1%

-

Australia’s S&P/ASX 200 fell 0.1%

-

Hong Kong’s Hold Seng rose 2.4%

-

The Shanghai Composite rose 0.9%

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was unchanged at $1.1111

-

The Japanese yen was little modified at 143.66 per greenback

-

The offshore yuan was little modified at 7.0595 per greenback

Cryptocurrencies

-

Bitcoin fell 0.5% to $63,003.3

-

Ether fell 1.2% to $2,630.29

Bonds

-

The yield on 10-year Treasuries was little modified at 3.74%

-

Japan’s 10-year yield declined 1.5 foundation factors to 0.815%

-

Australia’s 10-year yield declined two foundation factors to three.94%

Commodities

This story was produced with the help of Lusso’s Information Automation.

–With help from Mark Cudmore.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

European shares rise after Chinese language stimulus; progress considerations stay

Lusso’s Information – European inventory markets rose Tuesday, boosted by extra stimulus measures from main export market China, however considerations over the area’s progress outlook have restricted the features.

At 03:05 ET (07:05 GMT), the in Germany traded 0.9% larger, the in France rose 1.4% and the within the U.Ok. climbed 0.6%.

Chinese language stimulus lifts temper

European equities have acquired a largely optimistic handover from Asia after Chinese language officers unveiled a slew of deliberate measures to spur financial progress, with the Individuals’s Financial institution set to chop reserve necessities for banks by 50 foundation factors to unlock extra liquidity.

Tuesday’s strikes come after the PBOC had on Monday reduce a short-term repo charge to additional enhance liquidity.

The strikes are aimed squarely at shoring up financial progress, because the Chinese language economic system struggles with persistent disinflation and an prolonged property market downturn.

China is a serious export marketplace for various Europe’s senior corporations, who’ve struggled given the downturn in demand as Chinese language customers have curbed spending.

Eurozone progress considerations stay

Nonetheless, worries concerning the progress outlook for the eurozone stay.

Information launched on Monday confirmed that regional contracted sharply and unexpectedly this month, with the bloc’s downturn in manufacturing accelerating.

The droop appeared broad-based with Germany, Europe’s largest economic system, seeing its decline deepen whereas France – the second greatest – returning to contraction.

The is due later within the session, and can also be anticipated to point out a deterioration in sentiment.

The reduce its key rates of interest by 25 foundation factors earlier this month, after the same transfer in June, and this slowdown might elevate bets on additional coverage easing in October.

Commerbank in play

Within the company sector, the main target will stay on Commerzbank (ETR:) after the information that UniCredit SpA (ETR:) has been utilizing derivatives to greater than double its potential stake within the German lender earlier than acquiring regulatory clearance for an precise holding of greater than 9.9%.

German Chancellor Olaf Scholz criticized the transfer as “an unfriendly assault”, and the German state nonetheless owns 12% of Commerzbank.

UniCredit is searching for ECB approval to extend its Commerzbank holding to simply beneath the 30% which triggers a compulsory takeover beneath German company legal guidelines.

Chinese language stimulus boosts crude

Crude costs rose strongly Tuesday, boosted by the contemporary financial stimulus from prime importer China in addition to escalating tensions within the Center East.

By 03:05 ET, the contract climbed 1.1% to $74.03 per barrel, whereas futures (WTI) traded 1.3% larger at $71.25 per barrel.

China’s central financial institution introduced broad financial stimulus earlier Tuesday, boosting hopes of elevated demand for crude from the world’s largest importer as financial exercise will increase.

In the meantime, Israel’s navy stated it launched airstrikes towards Hezbollah websites in Lebanon on Monday, elevating considerations of a disruption to provides from this oil-rich area, tightening world markets.

Markets

Listed below are an important days for the inventory market between now and the November election, in accordance with BofA

-

There are key inventory market catalysts on the horizon earlier than November.

-

The Fed’s latest rate of interest lower has diminished market uncertainty, for now.

-

October 4, October 21, and November 1 are dates for buyers to look at, BofA says.

There are a handful of key market catalysts that might jolt inventory costs between now and November.

With the Federal Reserve’s delivered final week, a lot uncertainty has been faraway from the inventory market — not less than within the brief time period.

In a Monday be aware, highlighted an important days for the inventory market between now and the November Presidential election.

The financial institution used choices costs to map out the implied strikes within the for every single day between now and the day after the election.

November 6

Technically the day after the election, an important day for the inventory market is November 6, when markets can react to the outcomes.

The financial institution estimates a 2.5% transfer within the S&P 500 on November 6 in both path.

This might be a consequential day for buyers as a result of, assuming there’s a decisive winner, markets will start to cost wherein sort of insurance policies may be pursued in the course of the four-year time period of the forty seventh President of america.

The inventory market skilled a similar-sized transfer on the day after the prior Presidential election, with the S&P 500 leaping 2.2% on November 4, 2020.

October 4 and November 1

Buyers can have an in depth eye on the nonfarm payroll reviews for the months of September and October, set to be launched on October 4 and November 1, respectively.

The choices market is pricing in simply over a 1% transfer for the S&P 500 on these days, in both path.

Financial institution of America stated that stable jobs reviews and PMI information might gas a rally in inventory costs.

“We imagine excellent news is sweet information for equities and constructive surprises in these two information must be tailwinds for shares going ahead,” Financial institution of America stated.

October 21

This date represents the estimated day a number of the mega-cap tech corporations will announce third-quarter earnings outcomes.

Choices costs present an implied transfer of 1% in both path for the S&P 500.

“The large 3Q earnings week (Oct. 21-25) must also be an enormous catalyst for the market,” Financial institution of America stated.

Buyers might be paying shut consideration to any updates on the monetization efforts of synthetic intelligence applied sciences.

October 10

With the Fed shifting its consideration to the labor market from inflation, the September CPI print is seen as having much less of an impression on the inventory market than the opposite information launched.

Choices pricing suggests a each day swing of slightly below 1% for the S&P 500 in both path when the September CPI information is launched on October 10.

“Previous to the primary lower, inflation information have been an important information to look at. However now that the Fed has began its chopping cycle, we predict labor market information (e.g. NFP) might be extra essential to look at than inflation,” Financial institution of America stated.

Learn the unique article on

Markets

JPMorgan bullish on India and Japan, prime Asia official says

By Swati Bhat

MUMBAI (Reuters) – JPMorgan, the most important financial institution within the U.S., is bullish on India and Japan inside Asia however can be eager to allocate assets in the direction of Southeast Asia, which is benefiting from the “China Plus One” technique, a prime official on the financial institution stated.

“India continues to be firmly within the prime three, presumably prime two in Asia, along with Japan. Progress in India is definitely very broad-based,” Sjoerd Leenart, JPMorgan’s Asia Pacific CEO, stated in an interview on Monday.

“We’re investing on all fronts in India. We’re including bankers, we’re placing extra capital into the enterprise and we’re constructing capabilities comparable to expertise investments to service new segments of the market,” he added.

JPMorgan expects its business banking enterprise, which is concentrated on mid-sized firms, to develop as a lot as 30% in India over the subsequent few years, Leenart stated.

India would wish to additional construct its manufacturing ecosystem and guarantee scalability to achieve from the “China Plus One” technique which has presently largely benefited the Southeast Asian nations, he added.

China Plus One is a method that companies are following to diversify funding and provide chains from China into different nations.

“In India this subsequent leg will to an extent be about turning into a producing hub, creating blue collar jobs, and that is a chance, but it surely’s nearly a necessity for India,” Leenart stated.

“So if that technique would not work, then India could not do in addition to individuals count on. That is most likely the toughest to execute,” he stated, including he nonetheless anticipated India may succeed.

On Japan, Leenart stated with rates of interest now constructive, shoppers have turn into once more and from a company exercise and charges view, the nation is stuffed with alternative.

JPMorgan’s enterprise in China has been rising considerably and Leenart stated regardless of issues about gradual financial progress there, the nation can’t be ignored.

“We’re truly very enthusiastic about what we have now in China. Now we have all of the capabilities, and we’re trying to maximize the chance that we have now with home shoppers and worldwide shoppers. It has been rising truly properly.”

JPMorgan is trying to put money into Southeast Asia, the place the scale of the mixed economies is round $3 trillion, making it nearly as huge as India, Leenart stated.

“Clearly it’s a little bit harder to navigate as a result of it is fragmented throughout 5 or 6 nations, however that is a spot the place we’re eager to take a position.”

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up