Markets

Insiders Snap Up These 2 ‘Robust Purchase’ Shares

Let’s speak about insider buying and selling. Not the unlawful type, however the completely regular – and totally authorized – buying and selling by top-level company officers. These are the C-suite residents and the members of the Boards, firm officers who know what’s happening behind the scenes and are accountable to shareholders for bringing in earnings. They usually maintain shares in their very own corporations and make trades primarily based on the information they’ve from behind the scenes.

To maintain the enjoying subject stage, federal regulators require that firm insiders publish these transactions – and traders can profit from seeing simply which shares the company officers are shopping for. There’s one factor to recollect: firm brass will promote their shares for a mess of causes, however they’ll solely purchase huge once they imagine the inventory is on the best way up.

So, let’s check out some current insider trades. Utilizing the device from TipRanks, we’ve pulled up the current information on two shares which have lately seen multi-million greenback buys from Board members. In every case, that is the primary such buy from the insider. With the numerous outlay of the purchase, that factors to elevated confidence within the firm’s prospects for the near- to mid-term.

Along with the current high-value insider purchases, the TipRanks information exhibits us that each shares function Robust Purchase rankings from the Avenue and strong upside potential for the approaching 12 months. Right here’s a better have a look at them.

Terns Prescription drugs (TERN)

First up is Terns Prescription drugs, a biopharmaceutical analysis agency working at each the early growth and the medical trials phases. The corporate has set its sights on the fields of oncology and metabolic illness, and has a medical program underway in every of those areas, concentrating on power myeloid leukemia (CML) within the first and weight problems, a significant well being situation, within the second. The corporate’s pipeline consists of novel small molecule compounds, with clinically validated modes of motion.

That’s a mouthful, however it comes right down to a pipeline that options two Section 1 medical trials. The primary of those options TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor, or TKI, designed to deal with CML. This most cancers begins within the bone marrow, the place blood cells are fashioned, and is taken into account a power, life-long and life-threatening illness that ceaselessly requires adjustments in therapies. Terns’ drug candidate, TERN-701, is present process the Section 1 CARDINAL trial, a two-part examine to judge the protection, pharmacokinetics, and efficacy of the drug. Interim information from the primary cohorts of the dose escalation a part of the examine is predicted for launch this coming December.

Additionally of observe on the medical trial facet is TERN-601, which has simply accomplished a Section 1 trial. This drug is an orally dosed, glucagon-like peptide-1 (GLP-1) receptor agonist, underneath investigation as an weight problems remedy. The corporate launched optimistic trial outcomes from that examine earlier this month, exhibiting that TERN-601 produced a statistically vital weight reduction in trial individuals over a 28-day interval. The drug was thought-about well-tolerated, and the corporate plans to provoke a Section 2 trial subsequent 12 months.

Additionally on the weight problems monitor, Terns has lately reported optimistic pre-clinical information from one other drug candidate, TERN-501. This pre-clinical information helps utilizing TERN-501 together with a GLP-1 receptor agonist as a remedy for weight problems. The information confirmed that TERN-501, within the combo remedy, resulted in larger weight reduction and a greater retention of lean mass.

These medical applications don’t come low-cost, and Terns lately performed a public inventory providing to boost capital. The corporate providing, which noticed greater than 14 million shares made accessible, closed on September 12. Terns raised roughly $172.7 million in gross proceeds from the sale.

With that in thoughts, we are able to flip to the insider trades – and we see that Board of Administrators member Lu Hongbo bought 476,190 shares on the day the general public providing closed. Hongbo paid nealy $5 million for this inventory buy.

This inventory has additionally caught the eye of BMO analyst Etzer Darout, who likes the a number of catalysts lined up for it.

“With the weight problems information from TERN-601 (oral GLP-1 agonist), TERN has delivered on a once-daily and clinically aggressive drug profile for 2 of its three medical applications (TERN-501, TERN-601) which provides us extra confidence forward of Section 1 CML dose escalation information with TERN-701 (BCR-ABL allosteric) in December. With two partially de-risked medical applications and one other de-risking occasion upcoming, we proceed to love the risk-reward for TERN and its setup for worth creation in oncology and metabolic ailments,” Darout opined.

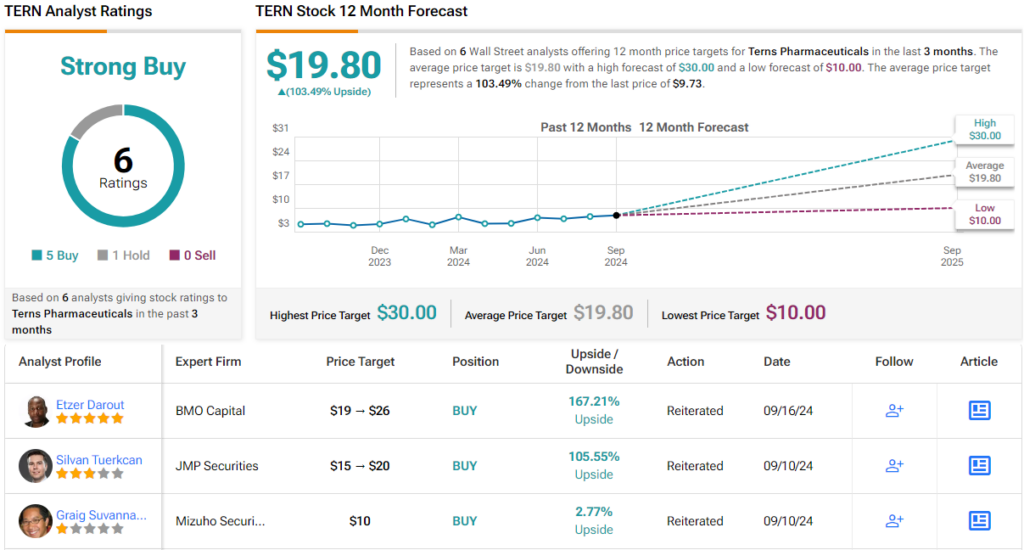

These feedback again up Darout’s Outperform (i.e. Purchase) ranking on TERN shares, and his $26 value goal factors towards a possible one-year achieve of 159%. (To look at Darout’s monitor document, )

General, this inventory’s Robust Purchase consensus ranking relies on 6 current analyst evaluations that break up 5 to 1 in favor of Purchase over Maintain. The shares are presently buying and selling at $9.73, and the typical goal value, $19.80, implies a 103% upside within the subsequent 12 months. (See )

Permian Assets (PR)

For the second inventory on our listing, we’ll shift gears and have a look at the vitality sector. Permian Assets is an unbiased oil and gasoline exploration and manufacturing agency working within the wealthy oil fields of Texas. The corporate’s identify provides away its recreation – Permian’s property are situated within the richest components of the Permian Basin of Texas-New Mexico. The corporate’s land holdings complete greater than 400,000 internet leasehold acres, which incorporates greater than 68,000 internet royalty acres. These holdings are centered within the Midland and Delaware Basins of the bigger Permian formation, and a few 45% of the manufacturing on these landholdings is crude oil.

This makes Permian one of many area’s largest pure-play hydrocarbon E&P corporations, and on September 17 the corporate introduced the closing of a bolt-on acquisition to its Delaware Basin property. The acquisition, a cope with Occidental, added ~29,500 internet acres and ~9,900 internet royalty acres, together with a major quantity of midstream infrastructure, to Permian’s present Reeves County, Texas positions.

In one other replace that ought to curiosity traders, Permian introduced on September 3 a big enhance to its common base dividend. The dividend cost, previously at 6 cents per widespread share, has been elevated by 150% and is now set at 15 cents per share to be paid out beginning in 3Q24. The brand new annualized price of 60 cents per share will give a ahead yield of 4.3% primarily based on the present share worth.

Permian attracted a current giant purchase from an insider, firm director William Quinn. Quinn made two purchases, on September 10 and 11, that totaled 312,429 shares – and value greater than $3.99 million.

Turning to the analysts’ view of the inventory, we’ll test in with Truist’s vitality sector professional Neal Dingmann, who sees Permian as top-of-the-line shares that he covers, with loads of capital return and efficient merger actions. In a observe earlier this month, Dingmann wrote, “We imagine PR operations proceed to be among the many greatest in our protection with bettering effectively outcomes and decreasing of unit prices whereas now including an equally steady monetary plan that can embody notable share buybacks. Additional, the excessive share overhang has been eradicated with present personal fairness doubtless promoting fewer shares going ahead. The corporate additionally continues to have one of many simpler M&A methods that won’t change going ahead with a concentrate on accretive additions in core areas. As such, we imagine there stays notable share value upside potential with the present valuation not reflective of continued operational and monetary success.”

For Dingmann, PR shares get a Purchase ranking with a $22 value goal that suggests an upside of 55% on the one-year horizon. (To look at Dingmann’s monitor document, )

All in all, PR’s Robust Purchase consensus ranking relies on 16 evaluations that embody 14 Buys in opposition to simply 2 Holds. With a buying and selling value of $14.18 and a mean goal value of $19.43, Permian’s inventory has a 37% upside this coming 12 months. (See )

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ , a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your individual evaluation earlier than making any funding.

Markets

Underground crypto mining farms uncovered in Russia’s Dagestan

Given Russia’s current pivot towards cryptocurrency adoption on the authorities stage, one may assume that the period of underground digital asset operations is over within the nation.

Latest developments have, nevertheless, confirmed that precisely the alternative could also be taking place and that some cryptocurrency mining operations have gone from being metaphorically underground to being actually beneath the floor.

To be exact, the authorities in Russia’s Republic of Dagestan have lately showcased a complicated cryptocurrency facility dug into the bottom, based on a September 24 Reuters report.

Russia approves worldwide cryptocurrency transactions

In the meantime, whereas the Prime Minister of the Republic of Dagestan has referred to as for tighter management of cryptocurrency miners, the Russian Federation has, after some turbulence earlier in 2024, turned decidedly extra digital asset-friendly.

Certainly, the State Duma, decrease home of the Russian Parliament, authorized using cryptocurrencies for worldwide commerce and different settlements in late July.

The choice was extensively interpreted as a step within the nation’s sanctions evasion program.

Markets

Futures rise on gentle touchdown optimism, China stimulus

(Reuters) – U.S. inventory index futures trended increased on Tuesday, as buyers had been optimistic concerning the economic system attaining a goldilocks “gentle touchdown” situation, whereas additionally cheering a bumper stimulus bundle out of China.

The S&P 500 and the blue-chip Dow closed at document highs within the earlier session after a survey signaling regular enterprise exercise soothed considerations of an imminent recession, and as a lot of policymakers supported additional coverage easing by the Federal Reserve.

Yields on longer-dated Treasury bonds rose as merchants priced in a better chance of the economic system attaining progress with low inflation and unemployment.

Nevertheless, with equities on the benchmark index already buying and selling above long-term averages and readability nonetheless missing concerning the measurement of the Fed’s subsequent transfer, some buyers stayed away from massive bids.

At 5:28 a.m. ET, Dow E-minis had been up 58 factors, or 0.14%, S&P 500 E-minis had been up 9.75 factors, or 0.17% and Nasdaq 100 E-minis had been up 61 factors, or 0.30%.

A market rally within the aftermath of the Fed’s choice to chop charges final week has now arrange the three fundamental indexes for month-to-month good points, defying a historic pattern of losses on common in September.

Markets now await remarks from Governor Michelle Bowman later within the day. She had voted for a 25 foundation level price discount on indicators of persistent value pressures, versus the bigger 50 bps price lower the central financial institution delivered within the earlier week.

Merchants are pricing within the Fed’s November choice to be a coin toss, with bets neither strongly favoring a 50 bps nor a 25 bps discount, as per the CME Group’s FedWatch Device.

On the info entrance, a survey, due at 10:00 a.m. ET., is anticipated to point out client confidence improved in September from the earlier month. Nonetheless, the principle focus shall be on Friday’s Private Consumption Expenditure determine for August.

Amongst high premarket movers, U.S.-listed shares of Chinese language companies similar to Alibaba and PDD Holdings added 5% every and Li Auto superior 7.3% after the world’s second-largest economic system, China, unveiled its greatest stimulus for the reason that pandemic to drag the economic system out of its deflationary funk.

The upbeat temper additionally lifted copper miners together with Freeport-McMoRan, Southern Copper and U.S.-listed shares of Rio Tinto that jumped over 4.6% every as copper costs surged.

Visa misplaced 1.6% after a report confirmed the U.S. Division of Justice plans to file a lawsuit in opposition to the funds community operator, alleging that it illegally monopolized the nation’s debit card market.

Starbucks dropped 2% after Jefferies downgraded the espresso chain to “underperform” from “maintain”, whereas Salesforce rose 2.1% after Piper Sandler upgraded the software program firm to “chubby” from “impartial”.

(Reporting by Johann M Cherian in Bengaluru; Enhancing by Maju Samuel)

Markets

Factbox-Qualcomm's potential bid for Intel turns the highlight on their merchandise

(Reuters) – Qualcomm (NASDAQ:) has approached the once-dominant chipmaker Intel (NASDAQ:) for a possible buyout, turning the highlight on the portfolio of merchandise these chip corporations have to supply.

A deal would unite Qualcomm’s mobile-focused Snapdragon line with Intel’s dominant PC and server chip divisions, making a semiconductor powerhouse.

Listed below are a number of the areas the place Qualcomm and Intel’s product strains would come collectively:

PROCESSORS

Intel dominates the PC processor market with its Core sequence, which is broadly utilized in desktops and laptops, whereas its Xeon sequence chips, designed to deal with demanding workloads, are extensively utilized in servers and workstations.

Qualcomm is a pacesetter in cell chips, producing Snapdragon processors which are broadly utilized in smartphones and tablets.

Intel additionally produces Atom processors for low-power units, whereas Qualcomm has been increasing into laptop computer processors with its personal compute platforms.

MANUFACTURING

Intel fabricates its chips in-house at company-owned services referred to as “fabs,” situated in varied elements of the world.

Qualcomm doesn’t make its personal processors however has partnered with contract producers like Taiwan Semiconductor Manufacturing Co and Samsung (KS:) Foundry for chip manufacturing.

CHIP ARCHITECTURE

Intel primarily makes use of the x86 computing structure, which is normal in desktops, laptops, and servers.

Qualcomm depends on Arm Holdings (NASDAQ:)’ processor structure, which powers smartphones and targets low energy consumption. Pc code constructed for x86 chips is not going to routinely run on Arm-based designs.

Intel has beforehand explored creating Arm-based chips, and software program options can be found to facilitate some compatibility between x86 and Arm architectures.

AUTOMOTIVE BUSINESS

Qualcomm additionally has a rising automotive enterprise, specializing in applied sciences like related vehicles, infotainment programs, and superior driver-assistance programs.

Intel’s chips are utilized in automobiles, powering infotainment programs, digital instrument clusters, and extra. The corporate’s superior chips for vehicles help AI options like generative AI and digicam programs that monitor drivers and passengers.

Intel additionally owns a majority stake in Mobileye International (NASDAQ:) and just lately confirmed that it could not divest its majority stake within the self-driving tech agency.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June