Markets

Triumph Group minimize to Underperform at BofA as 'manufacturing uncertainty looms'

Lusso’s Information — Financial institution of America double-downgraded Triumph Group (NYSE:) to Underperform from Purchase, citing considerations in regards to the firm’s reliance on unsure manufacturing charges from Boeing (NYSE:) and Airbus.

Whereas TGI has made strides in remodeling its enterprise right into a leaner and extra targeted portfolio, BofA analysts expressed considerations that these optimistic modifications are being overshadowed by unpredictable plane manufacturing schedules.

“Because it pertains to the 737, the Installations phase is producing at price 13/mo (far beneath the speed required for margin enlargement),” stated BofA.

In the meantime, the Composites and Cabin Elements divisions are stated to be producing at a more healthy 30 plane per 30 days, however the analysts see additional draw back dangers as a result of uneven charges.

The financial institution provides {that a} extended strike at Boeing might result in destocking, compounding current challenges.

Along with manufacturing uncertainty, BofA raised considerations about Triumph’s free money circulation (FCF) era.

The corporate is ramping up manufacturing, and whereas Boeing and Airbus are presently accepting stock, Bofa says potential manufacturing cuts might exacerbate money burn by means of destocking.

The financial institution states that different FCF headwinds embody the sunsetting of the V-22 program, OEM deferrals, inflation, and provide chain shortages.

Though Triumph’s aftermarket enterprise is exhibiting energy attributable to prolonged service life for plane and 787 touchdown gear overhauls, it accounts for simply 20% of whole gross sales.

BofA sees this as inadequate to offset near-term headwinds, particularly as the corporate’s margins stay flat regardless of robust top-line progress.

As Triumph continues its portfolio reshaping and steadiness sheet restructuring, BofA expects the board to contemplate strategic alternate options, together with potential mergers and acquisitions.

Nonetheless, the analysts consider that any significant progress will possible happen as soon as the corporate reaches its year-end debt goal. BofA lowered its value goal for Triumph to $12 from $17.

Markets

Cathie Wooden's Ark Make investments Buys $4.5M Of PayPal And $3.5M Of Pinterest Shares, Continues Offloading Palantir

Benzinga and Lusso’s Information LLC might earn fee or income on some objects via the hyperlinks under.

On Monday, Cathie Wooden-led Ark Make investments made some vital trades. Notably, the agency purchased shares of PayPal Holdings Inc (NASDAQ:) and Pinterest Inc (NYSE:), whereas promoting its stake in ARK 21Shares Bitcoin ETF (BATS:).

The PayPal Commerce

Ark Make investments’s Fintech Innovation ETF (NYSE:) added 57,824 shares of PayPal, valued at roughly $4.5 million based mostly on the closing value of $77.67. This transfer comes within the wake of in regards to the firm, with a median 12-month value goal of $78.62.

Don’t Miss:

PayPal has just lately made a to penetrate the U.S. point-of-sale (POS) funds market. The corporate is integrating its debit card with Apple Inc.’s cellular pockets and providing completely different cashback rewards.

The Pinterest Commerce

Ark Make investments’s Subsequent Era Web ETF (NYSE:) bought 115,211 shares of Pinterest, amounting to roughly $3.51 million based mostly on the closing value of $30.46. Pinterest reported stable on the finish of July, with income barely surpassing expectations. Nevertheless, third-quarter steering got here in under analyst projections, elevating issues about sustained development for the remainder of 2024.

Trending: This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Fastidiously think about the funding aims, dangers, fees and bills of the Fundrise Flagship Fund earlier than investing. This and different info may be discovered within the. Learn them fastidiously earlier than investing.

The Bitcoin ETF Commerce

ARKW offered 44,609 shares of ARK 21Shares Bitcoin ETF, valued at roughly $2.82 million based mostly on the closing value of $63.25. This sale occurred on the identical day that Bitcoin hit a brand new excessive of $63,500, in pre-market exercise for a number of Bitcoin ETFs.

On Monday, Bitcoin under $63,000 after a spike to $64,600, following optimistic feedback about cryptocurrency from Democratic presidential candidate Kamala Harris. Complete cryptocurrency liquidations surpassed $124 million up to now 24 hours, with bearish bets at $67 million, whereas Bitcoin’s funding fee remained optimistic, reflecting bullish dealer dominance.

Different Key Trades:

-

ARK Innovation ETF (NYSE:) offered 7,747 shares of Palantir Applied sciences Inc. (NYSE:) in a transaction valued at $293,998, based mostly on Monday’s closing value of $37.95 per share.

-

ARKF offered shares of Adyen NV (ADYEN). ARKG additionally offered shares of Vertex Prescribed drugs Inc (VRTX) and purchased shares of Pacific Biosciences of California Inc (PACB).

-

ARKK offered shares of Roku Inc (ROKU) and ARKQ purchased shares of 3D Techniques Corp (DDD).

Questioning in case your investments can get you to a $5,000,000 nest egg? Converse to a monetary advisor in the present day. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches for gratis to determine which one is best for you.

Preserve Studying:

This text initially appeared on

Markets

NYC legislation on sharing meals supply clients' information is unconstitutional, choose guidelines

By Jonathan Stempel

NEW YORK (Reuters) -A federal choose on Tuesday declared unconstitutional a New York Metropolis legislation requiring meals supply corporations to share buyer information with eating places, saying the requirement violated the First Modification.

U.S. District Decide Analisa Torres in Manhattan dominated in favor of DoorDash (NASDAQ:), Grubhub and Uber (NYSE:) Eats, which stated the legislation violated the privateness rights of consumers and threatened their information safety.

A spokesperson for town’s legislation division didn’t instantly reply to a request for remark.

The legislation required the supply corporations to supply eating places with diners’ names, supply addresses, electronic mail addresses and cellphone numbers, in addition to order contents.

New York Metropolis adopted the legislation in the summertime of 2021, one in every of a number of measures to assist its 1000’s of eating places get well from the COVID-19 pandemic.

The town agreed that 12 months to not implement the legislation whereas the supply corporations sued, even because it argued that the legislation helped defend eating places from the businesses’ “exploitive practices.”

However in a 31-page resolution, Torres stated the legislation improperly regulated industrial speech.

She stated town didn’t present it had a considerable curiosity in making certain that eating places gather buyer information from the supply corporations, and that it had much less intrusive means to realize that aim.

These means included letting clients determine whether or not to share information, providing monetary incentives for the supply corporations to share information, and subsidizing on-line ordering platforms for particular person eating places, the choose stated.

Markets

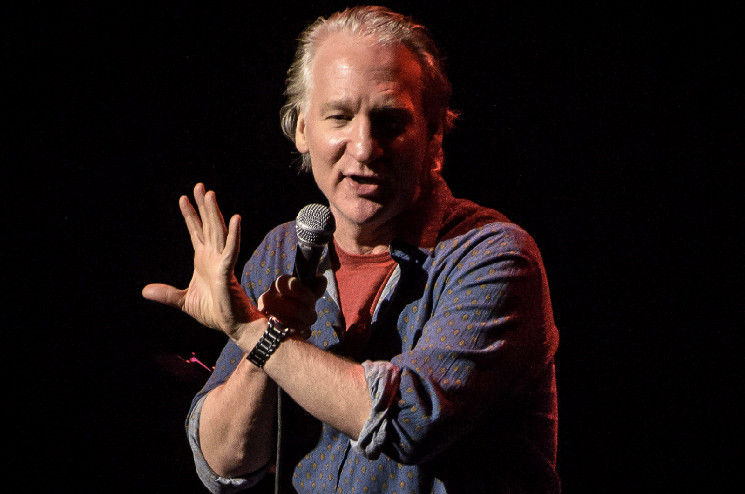

Invoice Maher Exposes Crypto’s “Soiled” Secret

Distinguished American tv host Invoice Maher just lately took goal on the perceived wastefulness of cryptocurrency mining through the newest episode of “Actual Time with Invoice Maher.”

“There’s the opposite massive secret about crypto that no person talks about…All of the progress that we’re making with inexperienced power is being sucked away by crypto,” he stated.

Maher has famous that crypto makes use of 8% of complete electrical energy. “Their knowledge facilities, their mining, this nonsense of discovering a quantity. I am unable to even undergo the entire thing,” he pressured.

The US comic has recalled that the impression of cryptocurrency mining is akin to placing 15.7 million gas-powered automobiles on the highway. “So, as we take them off to go to electrical, crypto eats all of it up, and it goes the opposite manner,” Maher added.

Bitcoin’s power use has at all times confronted sharp criticism from environmental activists since mining gear truly consumes extra electrical energy than lots of nations.

As reported by U.Right this moment, the mining business attracted some recent pushback final month after it transpired that the Electrical Reliability Council of Texas (ERCOT) was paying native miners to curtail their operations. These corporations have been basically early cash by merely lowering stress on the state’s energy grid.

Nonetheless, Bitcoin proponents argue that Bitcoin mining might be truly nice for enhancing renewable power. Mining farms now predominantly depend on inexperienced energy, setting new sustainability milestones.

Nonetheless, these arguments are unlikely to sway most of the people, which sees cryptocurrency mining as dangerous.

As for Maher, this isn’t the primary time that the outstanding tv host has proven his aversion towards crypto. In 2022, he joked that buyers shopping for actual crypto would have been worse off than those that have been unlucky sufficient to purchase pretend tokens.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June