Markets

NYC legislation on sharing meals supply clients' information is unconstitutional, choose guidelines

By Jonathan Stempel

NEW YORK (Reuters) -A federal choose on Tuesday declared unconstitutional a New York Metropolis legislation requiring meals supply corporations to share buyer information with eating places, saying the requirement violated the First Modification.

U.S. District Decide Analisa Torres in Manhattan dominated in favor of DoorDash (NASDAQ:), Grubhub and Uber (NYSE:) Eats, which stated the legislation violated the privateness rights of consumers and threatened their information safety.

A spokesperson for town’s legislation division didn’t instantly reply to a request for remark.

The legislation required the supply corporations to supply eating places with diners’ names, supply addresses, electronic mail addresses and cellphone numbers, in addition to order contents.

New York Metropolis adopted the legislation in the summertime of 2021, one in every of a number of measures to assist its 1000’s of eating places get well from the COVID-19 pandemic.

The town agreed that 12 months to not implement the legislation whereas the supply corporations sued, even because it argued that the legislation helped defend eating places from the businesses’ “exploitive practices.”

However in a 31-page resolution, Torres stated the legislation improperly regulated industrial speech.

She stated town didn’t present it had a considerable curiosity in making certain that eating places gather buyer information from the supply corporations, and that it had much less intrusive means to realize that aim.

These means included letting clients determine whether or not to share information, providing monetary incentives for the supply corporations to share information, and subsidizing on-line ordering platforms for particular person eating places, the choose stated.

Markets

How shares can roar by 10% into year-end, Citi US equity-trading head says

-

The inventory market may soar as a lot as 10% by the year-end, Citi’s stock-trading technique head mentioned.

-

Stuart Kaiser instructed Lusso’s Information TV that the uber-bull case is now “a believable state of affairs.”

-

He mentioned the economic system solely must keep away from a recession, which is able to in the end depend upon the labor market.

Wall Road is forecasting S&P 500 highs that . This bullishness could also be properly earned, Citi’s Stuart Kaiser mentioned.

“The uber-bull case, I feel, for all of this 12 months has been: you keep away from a recession, you get insurance coverage cuts, proper? And that’s now a believable state of affairs,” the agency’s head of US equity-trading technique instructed on Tuesday.

If that is achieved, shares can surge one other 5% to 10% by the top of this 12 months, Kaiser mentioned.

Up to now, the second half of these circumstances have been met. This month, the Federal Reserve lastly began lowering rates of interest, in a transfer meant to stop a future financial droop.

This precautionary “insurance coverage” lower — amounting to a 50-basis-point discount to the federal funds charge — was embraced by inventory traders, and indexes have since notched new report highs.

To Kaiser’s level, this can proceed so long as a recession doesn’t materialize. However although the Fed emphasised that it was not forecasting a looming downturn throughout its newest coverage assembly, all of it hinges on incoming labor market knowledge, he famous.

Since August, slipping employment circumstances have been the core driver of slowdown fears. Traders might want to see labor figures stay intact in upcoming month-to-month knowledge, or else recession outlooks may develop into more and more legitimate.

“Our view is danger reward is hard as a result of it is actually depending on month-to-month,” Kaiser famous, warning that recessionary prints would simply upend any Fed efforts to help the market.

Different banks are additionally .

Based on Morgan Stanley, traders can rejoice if unemployment falls beneath 4.1% and non-farm payrolls attain over 150,000. This would be the , conserving momentum going.

In any other case, buying and selling ought to put together for the worst if unemployment climbs above 4.3% and payrolls slide underneath 100,000.

“The Fed places not going to guard you for those who get that sort of knowledge, and that is why we expect the chance reward is sort of a bit bit off proper now,” Kaiser mentioned.

Learn the unique article on

Markets

Elliott to name particular Southwest shareholder assembly for management overhaul

By Rajesh Kumar Singh

(Reuters) -Activist investor Elliott Funding Administration on Tuesday escalated its boardroom battle with Southwest Airways (NYSE:), saying it plans to name a particular shareholder assembly as quickly as subsequent week to overtake the airline’s management.

The hedge fund has launched a marketing campaign to oust CEO Bob Jordan and different high executives, blaming them for the corporate’s underperformance. It needs the U.S. provider to vary the way in which it runs its enterprise and has laid out plans to exchange two-thirds of the board’s 15 administrators.

Southwest stated in a press release that if Elliott submits a request for a particular assembly, the board will “fulfill its duties to rigorously overview the request in good religion.”

In a bid to stop a proxy battle, Southwest this month stated six administrators would step down in November and Govt Chairman Gary Kelly would retire subsequent yr. The corporate would appoint 4 new impartial administrators within the close to future and would doubtlessly embody as much as three candidates proposed by Elliott, it added.

However Southwest reiterated its assist for Jordan, saying there was “no higher chief” to efficiently execute its technique to “evolve the airline and improve sustainable shareholder worth.”

In a letter to shareholders on Tuesday, Elliott accused the airline of obstructing a management change.

“We don’t assist the corporate’s present course, which is being charted in a haphazard method by a bunch of executives in full self-preservation mode,” it stated.

“The urgency of administration and board change at Southwest couldn’t be clearer.”

Elliott requested Southwest shareholders to name again all of their shares previous to Oct. 7.

The hedge fund now owns sufficient Southwest inventory to name a particular assembly and take the following steps to shake up the board and administration.

Southwest has struggled to search out its footing after the pandemic, partially resulting from Boeing (NYSE:)’s plane supply delays and industry-wide overcapacity within the home market.

Its working prices have elevated by 23% for the reason that pandemic, however unit revenues have elevated by simply 6%.

The working margin declined to 0.2% within the first half of this yr from greater than 13% in 2019. Compared, Delta posted an working margin of 9.5% within the first six months, with United’s at 7.4%.

Southwest’s shares, which had been up 0.5% at $29.78 in afternoon commerce, have misplaced about 43% prior to now three years, in contrast with a 9% achieve in Delta’s shares.

To show round its fortunes, Southwest plans to supply assigned and extra-legroom seats to draw premium vacationers, and begin in a single day flights. The corporate additionally intends to hold out community adjustments.

Southwest is because of share extra particulars on Thursday at its investor day.

Markets

Costco (COST) vs. Goal (TGT): Which is the Higher Inventory Going Ahead?

Right now I’m taking a look at Costco and Goal; two fellow massive field retailers. Shares of retail powerhouse Costco have risen about 63%% over the previous 12 months, whereas Goal shares are up round 39% over the identical time-frame. Each shares have carried out nicely, however which is the higher alternative for buyers going ahead? Let’s study that query.

I’m impartial on Costco primarily based on its expensive valuation. Concerning Goal, I’m bullish this inventory primarily based on its cheap valuation, engaging dividend yield, and lengthy historical past of dividend progress. Moreover, sell-side analysts view Goal as having significantly extra upside forward over the subsequent 12 months.

The Setup

Costco is way beloved by buyers, and rightfully so. The inventory has generated good-looking returns for its shareholders over time, to the tune of almost 900% over the previous decade. Costco is usually cited as being nicely managed and possessing a pretty enterprise mannequin as a consequence of recurring annual charges paid my its members.

Goal has generated a complete return of 224% over the previous decade. Goal is not any slouch, but it surely has considerably lagged Costco’s efficiency over the previous 10 years. Nevertheless, this will likely create a extra compelling setup for an funding in shares of Goal right now, as we’ll focus on subsequent.

Large Hole in Valuations

Whereas Costco is a superb enterprise with a powerful observe file of efficiency, it trades at fairly a steep a number of at this cut-off date. Costco has an off-cycle fiscal 12 months that ends in August, and can quickly report its This autumn 2024 earnings outcomes. The corporate trades above 50 occasions consensus 2025 earnings estimates. This sky-high a number of leaves little room for error going ahead if the corporate disappoints buyers in This autumn or throughout the subsequent fiscal 12 months.

In the meantime, Goal trades at a way more cheap valuation of 14.8x ahead earnings estimates, nicely beneath Costco’s a number of and in addition considerably beneath the S&P 500’s (SPX) ahead valuation of 24x. One can actually make a case that Costco is a higher-quality enterprise than Goal primarily based on its recurring membership charges, however a valuation 3 times as costly looks like an excessive amount of of a niche.

Moreover, regardless of Costco’s status for high quality, Goal is a higher-margin enterprise, with gross margins of 26.1% roughly twice as excessive as Costco’s gross margins of 12.5%. Goal’s revenue margin of 4.2% can be noticeably larger than Costco’s 2.8%. From my perspective, Goal’s considerably decrease valuation affords the inventory extra draw back safety and extra room to shock to the upside.

Two Robust Dividend Progress Shares

Costco is a dividend inventory, however its yield of 0.5% is pretty inconsequential. That mentioned, Costco deserves credit score for its robust dividend progress, having raised its dividend price 19 years in a row.

In the meantime, Goal’s dividend yield is 2.9%. That is almost six occasions larger than Costco’s present yield, and greater than double the yield for the S&P 500. Goal has an much more spectacular observe file of constantly paying and rising its dividend than Costco. Goal is a Dividend King that has elevated its payout for an unimaginable 55 years in a row.

Each firms additionally keep comparatively conservative payout ratios, that means that each dividends look protected for the foreseeable future. Whereas Costco has executed a very good job of rising its dividend, Goal’s yield is considerably larger, and its constant historical past of dividend progress is even higher, which helps my bullish view of the inventory.

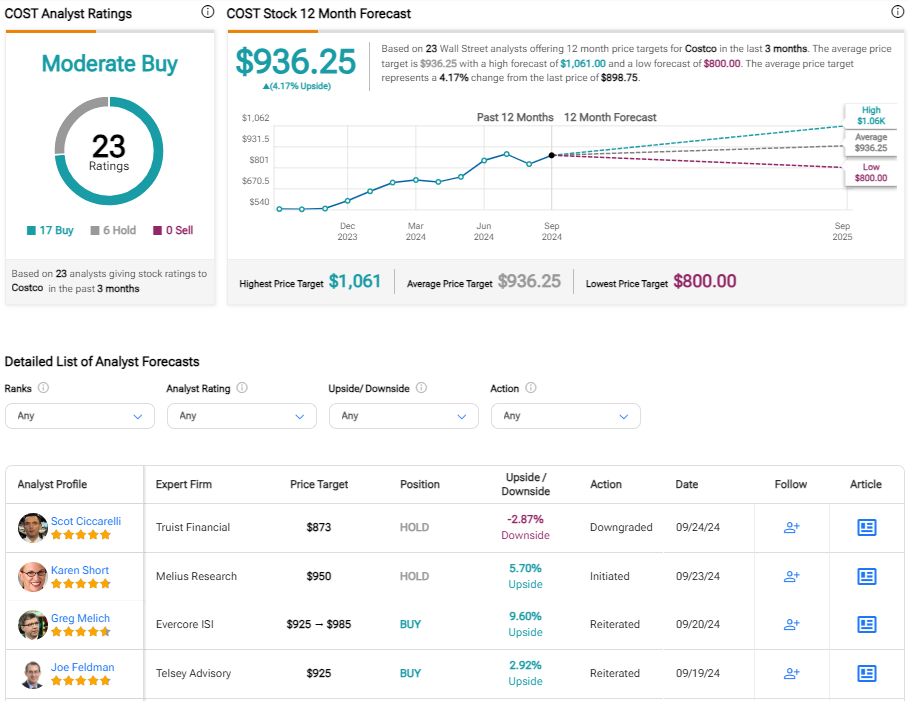

Is COST Inventory a Purchase, In accordance with Analysts?

Turning to Wall Road, COST earns a Robust Purchase consensus score primarily based on 17 Purchase, 5 Maintain, and no Promote scores assigned prior to now three months. The of $936.25 implies about 4.0% potential upside from present ranges.

Is TGT Inventory a Purchase, In accordance with Analysts?

On the similar time, TGT earns a Reasonable Purchase consensus score primarily based on 17 Buys, 10 Holds, and 0 Promote score assigned prior to now three months. The of $180.87 implies about 16% potential upside from present ranges.

Good Selections

As you possibly can see utilizing TipRanks’ beneath, each Costco and Goal obtain Outperform scores from TipRanks’ system.

Good Rating is a quantitative inventory scoring system created by TipRanks. It offers shares a rating from one to 10, primarily based on eight key market components. Scores of eight, 9, or 10 are thought of equal to an Outperform score.

Cocsto’s Outperform-equivalent Good Rating of 9 is spectacular, however Goal comes out on prime with a perfect-10 Good Rating.

Goal Inventory Appears to be like Just like the Most popular Funding Alternative

Costco is a superb firm and has been an awesome performer for its shareholders over a few years. Nevertheless, I’m impartial on shares at this level as this robust run of efficiency has despatched its valuation above 50x ahead earnings, giving the inventory little margin for error going ahead.

Goal trades at a way more engaging valuation of beneath 15x ahead earnings, affords the next dividend yield, and longer historical past of dividend progress. I’m bullish on Goal given its cheap valuation, engaging dividend yield, and 55 straight years of dividend progress. Costco is an effective inventory with a reliable historical past of efficiency, however proper now I view Goal as the higher funding choice primarily based on my evaluation of the 2 decisions.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June