Markets

Luxor Capital Group LP sells shares in 5 Level holdings

Luxor Capital Group LP, the funding supervisor for a number of funds, has executed a collection of gross sales of Class A Frequent Shares in 5 Level Holdings, LLC (NYSE:). The transactions, which happened between September 20 and September 24, resulted in a complete sale worth of $28,127,841. The shares have been bought at costs starting from $3.1251 to $3.4.

The gross sales have been carried out by numerous entities managed by Luxor Capital Group, together with Luxor Capital Companions, LP, Luxor Wavefront, LP, and Luxor Capital Companions Offshore Grasp Fund, LP, amongst others. Every entity is reported to be a ten % proprietor of 5 Level Holdings, indicating a big stake in the actual property firm.

The most important of those transactions was executed on September 24, the place a complete of 4,589,471 shares have been bought at a worth of $3.1251 per share. This single transaction considerably lowered the possession stake of Luxor Capital Companions, LP in 5 Level Holdings.

Different notable gross sales on the identical day embody 2,513,812 shares bought by Luxor Capital Companions Offshore Grasp Fund, LP on the identical worth of $3.1251 per share, and 682,183 shares bought by Thebes Offshore Grasp Fund, LP on the identical worth.

The transactions have been a part of a collection of gross sales which have collectively lowered the possession of the reporting entities. Following these gross sales, the concerned funds nonetheless retain a considerable variety of shares in 5 Level Holdings, with the precise post-transaction quantities disclosed within the SEC submitting.

Buyers typically monitor such gross sales by important shareholders as they’ll present insights into the shareholders’ views on the corporate’s present valuation and future prospects. The filings, signed by Norris Nissim, Normal Counsel, on behalf of the assorted entities, mirror the adjustments in possession as required by the SEC rules for reporting transactions by main shareholders and firm insiders.

“In different current information, 5 Level Holdings showcased a strong efficiency within the second quarter of 2024, reporting a web earnings of $38.2 million, largely pushed by important land gross sales. The earnings have been notably boosted by strategic execution within the Nice Park and Valencia communities. These current developments denote a wholesome monetary place for the corporate, marked by $217 million in money and no debt on its revolver. Moreover, 5 Level Holdings introduced an extension of its Growth Administration Settlement with Heritage Fields El Toro, LLC, by December 31, 2026, making certain its continued oversight of the Nice Park Neighborhoods group. The renewed settlement consists of an annual base price of $13.5 million, up from the present $12 million. The corporate can also be actively looking for growth companions to maximise shareholder worth and is engaged on entitlements in Los Angeles. Regardless of anticipating a small reported loss within the third quarter as a result of no residential land gross sales, 5 Level Holdings expects sturdy residential land gross sales in This fall, projecting an annual web earnings over $100 million and a money steadiness above $300 million.”

Lusso’s Information Insights

Amid the market exercise surrounding 5 Level Holdings, LLC (NYSE:FPH), buyers are evaluating the corporate’s monetary well being and potential for progress. In keeping with Lusso’s Information information, 5 Level Holdings boasts a notably low Worth-to-Earnings (P/E) ratio at 4.3, which means that the corporate’s shares could be undervalued in comparison with earnings. This aligns with the Lusso’s Information Ideas, which spotlight that 5 Level Holdings is buying and selling at a low earnings a number of.

Furthermore, the corporate’s spectacular income progress during the last twelve months, at 313.37%, signifies a strong enlargement that would catch the attention of growth-focused buyers. That is additional corroborated by the expectation of web earnings progress this 12 months, as famous within the Lusso’s Information Ideas, which might sign a optimistic outlook for profitability within the close to time period.

Buyers searching for an organization with a secure monetary footing could discover assurance in the truth that 5 Level Holdings’ liquid property exceed its short-term obligations, suggesting a powerful liquidity place. This monetary stability is a crucial issue for any firm, particularly in a fluctuating actual property market.

For these desirous about additional evaluation and extra insights, there are extra Lusso’s Information Ideas obtainable for 5 Level Holdings. The platform lists a complete of 11 ideas, offering a complete overview of the corporate’s monetary metrics and potential funding worth.

With a market capitalization of $484.64 million USD and a forward-looking stance from analysts anticipating gross sales progress within the present 12 months, 5 Level Holdings presents a mixture of stability and progress potential that may very well be engaging to a variety of buyers.

To discover a deeper evaluation and to entry the total listing of Lusso’s Information Ideas for 5 Level Holdings, go to https://www.investing.com/professional/FPH.

This text was generated with the help of AI and reviewed by an editor. For extra info see our T&C.

Markets

Asian Shares, Currencies Rise on China Optimism: Markets Wrap

(Lusso’s Information) — Asian shares rose as a rally fueled by China’s wide-ranging stimulus package deal lifted equities for a second day and strengthened the yuan.

Most Learn from Lusso’s Information

Chinese language shares prolonged features after the Folks’s Financial institution of China on Tuesday unveiled the measures to help the financial system and monetary markets. The onshore benchmark CSI 300 rose as a lot as 3.2% and is on monitor to erase its year-to-date losses. The offshore yuan strengthened previous 7 for the primary time since Might 2023.

From equities to currencies, markets already inspired by the Fed’s outsized charge reduce final week acquired a lift from the slew of measures introduced by China to stimulate its financial system, sending the regional gauge round its highest ranges since February 2022. Rising Asian currencies additionally jumped, led by the Malaysian ringgit and Thai baht.

“The liquidity enhance anticipated from China might have some constructive spill-over through commodities and the provision chain, so EM equities and currencies are more likely to be boosted,” stated Vishnu Varathan, head of economics and technique at Mizuho Financial institution in Singapore. “The optimism could also be elevating the bar on follow-through particulars and measures, so if not substantial sufficient, issues can fizzle.”

Hong Kong’s quick gross sales ratio as a proportion of market turnover dipped to 13.6% on Tuesday, one normal deviation beneath common since 2016, indicating many shorts have already been coated, in accordance with JPMorgan Chase & Co.

In one other potential enhance for equities, the Folks’s Financial institution of China reduce the one-year medium-term lending facility charge to 2% from 2.3%.

“Inside Chinese language equities, we anticipate near-term help on the stimulus information, contingent on proof of efficient execution,” stated Solita Marcelli, chief funding officer Americas at UBS International Wealth Administration. “We count on charge cuts and capital market help to profit state-owned enterprises concentrated in high-dividend sectors, together with utilities, telecoms, power companies, and financials.”

Assist measures unveiled by Chinese language authorities Tuesday included rate of interest cuts, additional cash for banks, greater incentives to purchase houses and plans to think about a inventory stabilization fund. Nonetheless, the efforts might solely purchase China a while given the size of challenges going through the financial system.

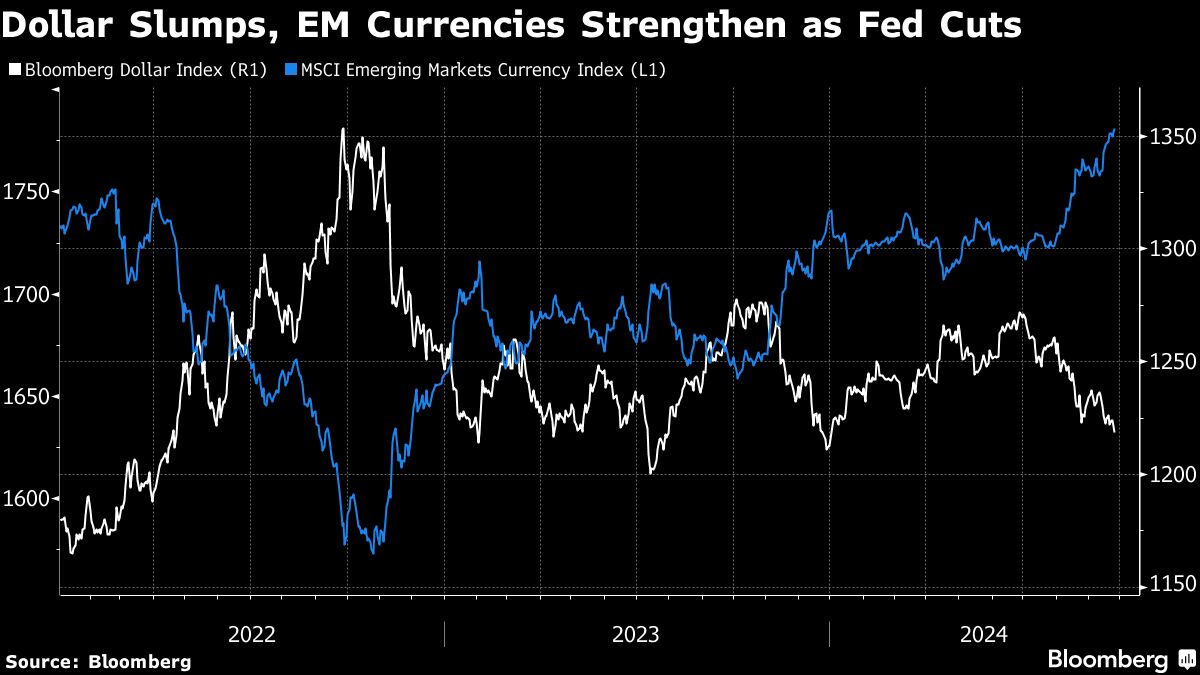

An index of dollar power fell to commerce close to the bottom stage this 12 months. A gauge of rising market currencies set a recent document excessive.

In a single day within the US, the studying on the Convention Board’s gauge of shopper sentiment posted the most important drop since August 2021. The report additionally flagged issues a few slowdown within the labor market whereas manufacturing information additionally got here in weaker than anticipated.

“The decay within the perceptions of jobs out there was hanging,” stated Carl Weinberg, chief economist at Excessive Frequency Economics. “It additionally will ship a warning message in regards to the state of the financial system to monetary markets.”

Swaps merchants elevated their wagers to greater than three-quarters of some extent of coverage easing by year-end from the Federal Reserve, suggesting at the least yet another main US reduce is in retailer, after the information. Buyers are awaiting information on the Fed’s most well-liked value metric and US private spending later this week for additional clues on the depth of future reductions.

Fed Governor Michelle Bowman, the one policymaker to dissent on final week’s half-point reduce, stated the central financial institution ought to decrease rates of interest at a “measured” tempo, in Tuesday feedback. She stated that inflationary dangers stay and that the labor market has not proven important weakening.

Oil steadied after its largest advance in additional than per week, as merchants tracked developments within the Center East and the influence on demand of China’s stimulus measures. Gold hit a document buying and selling above $2,662 an oz..

Within the company world, Japanese reminiscence chipmaker Kioxia Holdings Corp. is pushing again plans for an preliminary public providing till later this 12 months after a downturn in semiconductor shares.

Key occasions this week:

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, sturdy items, revised GDP, Thursday

-

Fed Chair Jerome Powell provides pre-recorded remarks to the tenth annual US Treasury Market Convention, Thursday

-

China industrial earnings, Friday

-

Eurozone shopper confidence, Friday

-

US PCE, College of Michigan shopper sentiment, Friday

A few of the principal strikes in markets:

Shares

-

S&P 500 futures fell 0.2% as of 10:58 a.m. Tokyo time

-

Japan’s Topix was little modified

-

Australia’s S&P/ASX 200 was little modified

-

Hong Kong’s Dangle Seng rose 2.3%

-

The Shanghai Composite rose 2.5%

-

Euro Stoxx 50 futures fell 0.2%

-

Nasdaq 100 futures fell 0.2%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1188

-

The Japanese yen fell 0.2% to 143.45 per greenback

-

The offshore yuan was little modified at 7.0108 per greenback

-

The Australian greenback was little modified at $0.6889

Cryptocurrencies

-

Bitcoin rose 0.3% to $64,442.42

-

Ether was little modified at $2,653.61

Bonds

-

The yield on 10-year Treasuries superior one foundation level to three.74%

-

Japan’s 10-year yield declined one foundation level to 0.805%

-

Australia’s 10-year yield superior two foundation factors to three.91%

Commodities

-

West Texas Intermediate crude fell 0.3% to $71.38 a barrel

-

Spot gold rose 0.1% to $2,660.62 an oz.

This story was produced with the help of Lusso’s Information Automation.

–With help from Richard Henderson.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Asian shares rise, China rallies additional on stimulus cheer

Lusso’s Information– Most Asian shares rose on Wednesday, with Chinese language markets seeing outsized good points after Beijing unveiled a string of latest stimulus measures geared toward shoring up financial progress.

Regional markets took a optimistic lead-in from Wall Avenue, the place power in expertise shares pushed the and the to document highs. U.S. inventory index futures steadied in Asian commerce.

Sentiment in the direction of inventory markets remained upbeat after a bumper rate of interest reduce by the Federal Reserve final week, with buyers now awaiting extra cues from the central financial institution within the coming days.

Chinese language shares surge on stimulus cheer

Chinese language markets have been by far the very best performers on Wednesday, with the and indexes surging round 3% every. Hong Kong’s index added 2.5%.

Markets rallied after the Folks’s Financial institution of China introduced a slew of stimulus measures on Tuesday, together with decrease financial institution reserve necessities and decrease mortgage charges.

Beijing was additionally seen contemplating bumper liquidity help for native shares.

The measures ramped up hopes that Chinese language financial progress will enhance, after practically three years of rampant disinflation and sluggish enterprise exercise.

Chinese language shares additionally benefited from discount shopping for, provided that the CSI 300 and Shanghai Composite indexes had slumped to greater than seven-month lows earlier in September.

However analysts stated that the measures could be inadequate in sparking a Chinese language financial turnaround, with ANZ stating that extra fiscal measures have been wanted to help progress.

Nonetheless, optimism over China spilled over into most regional markets with publicity to the nation. South Korea’s rose 0.2%

Japan’s index rose 0.5%, whereas the broader was flat after knowledge confirmed producer inflation grew barely in August. The studying got here simply days earlier than a shopper inflation from Tokyo, due on Friday.

Futures for India’s index pointed to a muted open, because the index confronted resistance in making new highs at 26,000 factors.

Australian shares battle amid combined inflation, hawkish RBA

Australia’s index traded sideways on Wednesday, taking little help from optimism over China, which is a significant buying and selling associate for Australia.

Native markets have been grappling with hawkish indicators from the Reserve Financial institution of Australia, which on Tuesday. Governor Michele Bullock struck a barely much less hawkish stance than some have been anticipating, though the financial institution flagged no speedy modifications to charges and is more likely to hold them excessive for longer.

The RBA’s stance was pushed mainly by sticky inflation, though knowledge on Wednesday confirmed inflation eased considerably in August. However core CPI inflation nonetheless remained sticky and above the RBA’s goal.

Markets

How shares can roar by 10% into year-end, Citi US equity-trading head says

-

The inventory market may soar as a lot as 10% by the year-end, Citi’s stock-trading technique head mentioned.

-

Stuart Kaiser instructed Lusso’s Information TV that the uber-bull case is now “a believable state of affairs.”

-

He mentioned the economic system solely must keep away from a recession, which is able to in the end depend upon the labor market.

Wall Road is forecasting S&P 500 highs that . This bullishness could also be properly earned, Citi’s Stuart Kaiser mentioned.

“The uber-bull case, I feel, for all of this 12 months has been: you keep away from a recession, you get insurance coverage cuts, proper? And that’s now a believable state of affairs,” the agency’s head of US equity-trading technique instructed on Tuesday.

If that is achieved, shares can surge one other 5% to 10% by the top of this 12 months, Kaiser mentioned.

Up to now, the second half of these circumstances have been met. This month, the Federal Reserve lastly began lowering rates of interest, in a transfer meant to stop a future financial droop.

This precautionary “insurance coverage” lower — amounting to a 50-basis-point discount to the federal funds charge — was embraced by inventory traders, and indexes have since notched new report highs.

To Kaiser’s level, this can proceed so long as a recession doesn’t materialize. However although the Fed emphasised that it was not forecasting a looming downturn throughout its newest coverage assembly, all of it hinges on incoming labor market knowledge, he famous.

Since August, slipping employment circumstances have been the core driver of slowdown fears. Traders might want to see labor figures stay intact in upcoming month-to-month knowledge, or else recession outlooks may develop into more and more legitimate.

“Our view is danger reward is hard as a result of it is actually depending on month-to-month,” Kaiser famous, warning that recessionary prints would simply upend any Fed efforts to help the market.

Different banks are additionally .

Based on Morgan Stanley, traders can rejoice if unemployment falls beneath 4.1% and non-farm payrolls attain over 150,000. This would be the , conserving momentum going.

In any other case, buying and selling ought to put together for the worst if unemployment climbs above 4.3% and payrolls slide underneath 100,000.

“The Fed places not going to guard you for those who get that sort of knowledge, and that is why we expect the chance reward is sort of a bit bit off proper now,” Kaiser mentioned.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June