Markets

Commerce desk CEO Jeffrey Inexperienced sells over $43 million in inventory

Commerce Desk, Inc. (NASDAQ:) President and CEO Jeffrey Terry Inexperienced has just lately engaged in important inventory transactions, based on a brand new SEC submitting. The manager bought shares totaling over $43 million, with costs ranging between $108.58 and $110.04. These gross sales had been carried out by a pre-arranged 10b5-1 buying and selling plan, which permits insiders to promote shares at predetermined instances to keep away from accusations of insider buying and selling.

Along with the gross sales, Inexperienced additionally acquired shares by the train of choices, with transactions totaling roughly $30.5 million at costs between $61.46 and $68.29. Nonetheless, you will need to word that the acquired shares by possibility workouts are usually not included within the complete gross sales worth.

The current transactions point out a rebalancing of Inexperienced’s holdings in Commerce Desk, an organization specializing in laptop programming and information processing providers. The CEO’s actions are a part of routine monetary administration and are sometimes seen within the regular course of govt compensation and inventory possession.

Buyers and market watchers typically pay shut consideration to insider transactions as they will present insights into executives’ views on the corporate’s future efficiency. Nonetheless, such transactions are frequent and might be influenced by a wide range of elements, together with private monetary planning and diversification methods.

The reported transactions befell on September 20 and September 23, with the gross sales being executed underneath the aforementioned buying and selling plan established in March of the identical yr. The submitting additionally notes transfers of shares to a belief managed by Inexperienced, which doesn’t have an effect on the entire helpful possession however adjustments the character of how the shares are held.

Commerce Desk’s inventory actions and insider transactions are carefully monitored by the market, as they will typically sign the boldness degree of the corporate’s management within the enterprise’s development and monetary well being. Nonetheless, it’s also understood that such transactions don’t essentially replicate a direct correlation with the corporate’s operational efficiency and needs to be thought of inside the broader context of every govt’s particular person monetary technique.

In different current information, The Commerce Desk, a notable participant within the digital promoting sector, reported a 26% improve in Q2 gross sales and an improved adjusted EBITDA margin of 41%. The corporate additionally projected a Q3 income of $618 million and an anticipated adjusted EBITDA of round $248 million. Analyst companies MoffettNathanson and Cantor Fitzgerald initiated protection with a Impartial ranking, whereas Baird maintained an Outperform ranking and BofA Securities and Citi initiated protection with a Purchase ranking. The Commerce Desk’s development is attributed to its revolutionary Kokai platform, a partnership with Netflix (NASDAQ:), and the adoption of UID2. Regardless of potential challenges equivalent to financial uncertainty and browser compatibility points with UID2, the agency maintains a constructive outlook, supported by $1.5 billion in money and no debt, together with a excessive buyer retention fee of over 95%. These are among the current developments in The Commerce Desk’s operations and market place.

Lusso’s Information Insights

Commerce Desk Inc . (NASDAQ:TTD), whereas being the topic of debate as a result of its CEO’s current inventory transactions, additionally presents an fascinating monetary profile based on Lusso’s Information information. The corporate holds a market capitalization of $54.33 billion, indicating a big presence in its sector. Its gross revenue margin stands at a powerful 81.23% for the final twelve months as of Q2 2024, showcasing the corporate’s means to retain a big share of income after the price of items bought has been deducted.

Regardless of the CEO’s current sale of shares, Commerce Desk boasts sturdy income development, with a 25.53% improve during the last twelve months as of Q2 2024. This development is additional mirrored within the quarterly figures, with a 25.91% rise in the identical interval. These metrics counsel a powerful monetary efficiency and should point out potential for future development.

Furthermore, two Lusso’s Information Ideas spotlight extra strengths of Commerce Desk. The corporate holds additional cash than debt on its stability sheet, offering monetary stability and adaptability. Moreover, web revenue is anticipated to develop this yr, which could possibly be a constructive signal for buyers wanting on the firm’s profitability potential. For these occupied with deeper evaluation, there are 18 extra Lusso’s Information Ideas accessible on the Commerce Desk profile on Lusso’s Information, which might present additional insights into the corporate’s monetary well being and inventory efficiency.

These monetary metrics and Lusso’s Information Ideas can provide buyers a extra complete understanding of Commerce Desk’s efficiency, particularly when contemplating the context of insider transactions.

This text was generated with the assist of AI and reviewed by an editor. For extra data see our T&C.

Markets

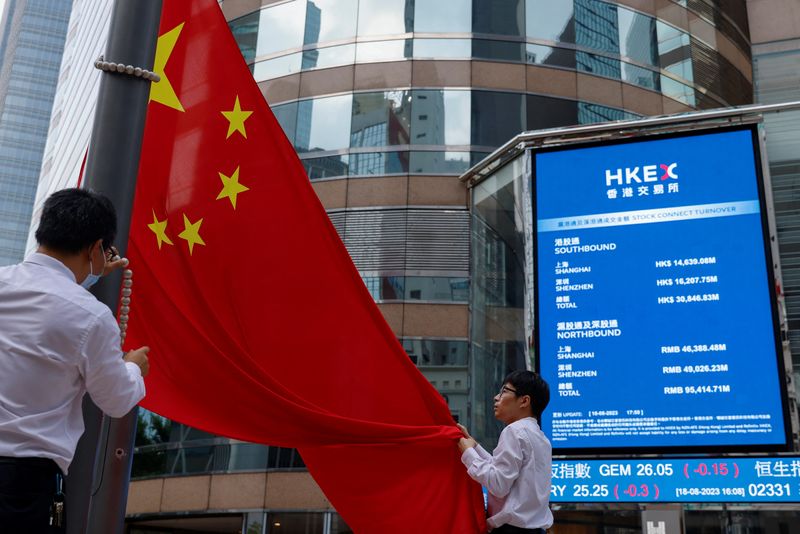

China shares soar in stimulus afterglow; greenback sags on price bets

By Kevin Buckland

TOKYO (Reuters) – Chinese language shares surged on Wednesday, lifting regional markets and serving to prolong a stimulus-fueled international rally that additionally underpinned risk-sensitive currencies, whereas Brent crude hovered close to a three-week excessive.

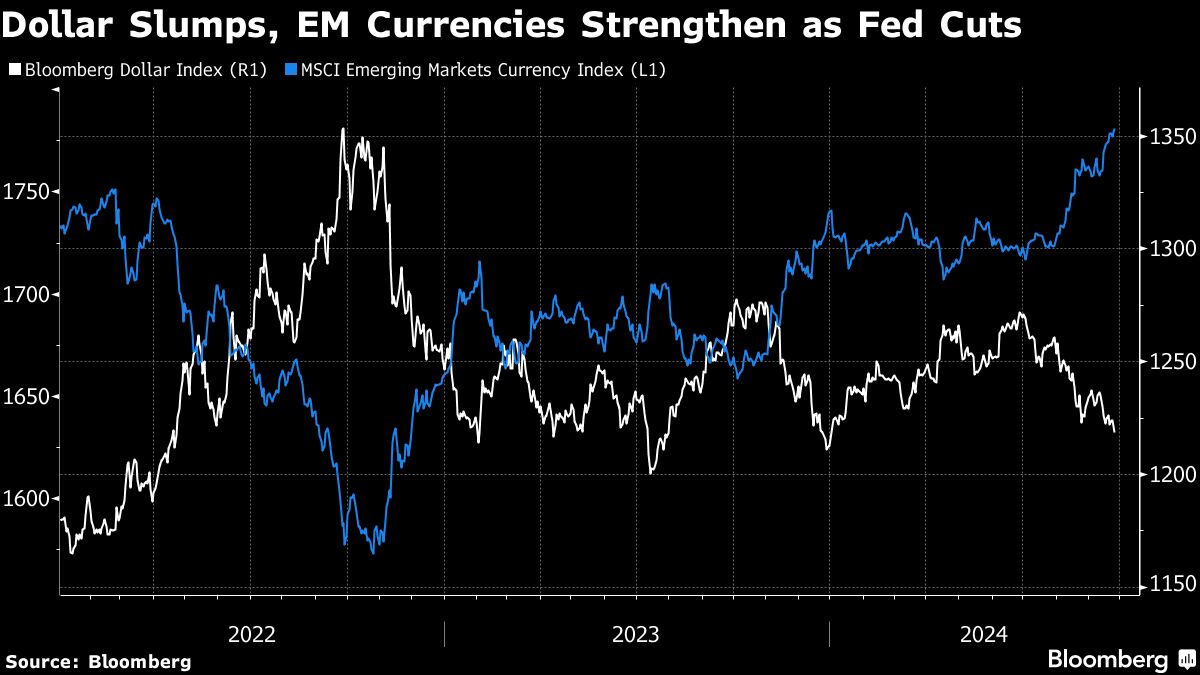

The greenback drooped after weak U.S. macroeconomic information in a single day boosted the case for a second super-sized rate of interest minimize on the Federal Reserve’s subsequent assembly. Gold rose to a contemporary all-time peak.

Mainland Chinese language blue chips superior 3.1% as of 0230 GMT, following a 4.3% bounce within the prior session. Hong Kong’s Dangle Seng climbed 2.2%, including to Tuesday’s 4.1% surge.

The robust begin for Chinese language shares invigorated different regional indexes, with Taiwan’s benchmark up 1.3% and South Korea’s Kospi gaining 0.1%

MSCI’s broadest index of Asia-Pacific shares exterior Japan rallied 1%.

Japan’s Nikkei shook off early weak point to rise 0.3%, helped by a retreat within the yen, a conventional protected haven.

The Folks’s Financial institution of China adopted its announcement of wide-ranging coverage easing on Tuesday with a minimize to medium-term lending charges to banks on Wednesday. Beijing’s broad-based stimulus – the most important because the pandemic – additionally consists of steps to spice up China’s inventory market and help for the ailing property sector.

“The main focus in Asia stays very a lot on China,” UBS analysts wrote in a word to shoppers.

“The controversy stays intense on whether or not there are legs to this rally, although the desk is seeing buyers opting to purchase/quick cowl first and ask questions later.”

The yen retreated about 0.17% to 143.47 per greenback, reversing earlier beneficial properties amid broad greenback weak point.

The euro ticked as much as $1.11915 after earlier pushing so far as $1.1194 for the primary time in a month.

Sterling edged as much as $1.3417, and earlier reached a contemporary excessive since March 2022 at $1.3430.

In a single day, information confirmed U.S. shopper confidence unexpectedly fell to 98.7 this month from an upwardly revised 105.6 in August. The decline was the most important since August 2021.

The percentages on one other 50-basis level Federal Reserve price minimize on the November assembly jumped to 60.4% from 53% a day earlier, in keeping with CME Group’s FedWatch Device.

In the meantime, Australia’s greenback initially scaled its highest since February of final yr at $0.6908 however then slipped again to $0.68915 after month-to-month inflation figures confirmed some cooling, doubtlessly establishing an earlier price minimize by the Reserve Financial institution.

“The autumn within the underlying measures of inflation is an surprising and welcomed shock,” mentioned Tony Sycamore, an analyst at IG.

Offered the cooling is replicated in quarterly value information subsequent month, “it units up a dovish pivot from the RBA,” resulting in a quarter-point price minimize in December, Sycamore added.

Gold rose 0.2% to $2,662.50 per ounce, and earlier marked a brand new document peak at $2,665.10.

Brent crude futures slipped 19 cents to $74.98 a barrel, however remained near Tuesday’s excessive of $75.87, a stage beforehand not seen since Sept. 3.

U.S. West Texas Intermediate crude misplaced 22 cents to $71.34 per barrel.

(Reporting by Kevin Buckland; Modifying by Shri Navaratnam)

Markets

US probing SAP, Carahasoft over potential price-fixing- Bloomberg

Lusso’s Information– The U.S. authorities is probing German software program agency SAP SE (NYSE:) and product reseller Carahsoft over doubtlessly overcharging authorities businesses for a minimum of a decade, Bloomberg reported on Wednesday.

The Division of Justice has been trying into whether or not enterprise software program maker SAP illegally conspired with Carahsoft to repair larger costs on gross sales to the U.S. navy and different authorities businesses, Bloomberg reported, citing federal court docket data filed in Baltimore. The investigation has been ongoing since a minimum of 2022.

Bloomberg mentioned different know-how corporations have been additionally underneath scrutiny over potential violations of the False Claims Act, together with a unit of Accenture plc (NYSE:).

Carahsoft- a serious vendor of software- noticed its workplaces in Virginia raided on Tuesday by FBI brokers and navy investigators.

The civil probe is investigating potential worth rigging for greater than $2 billion value of SAP merchandise utilized by the U.S. authorities since 2014, Bloomberg reported.

SAP is Germany’s largest agency, with the potential investigation offering a blow to the agency amid an ongoing rally in its shares. Carahsoft is likely one of the largest non-public corporations on the planet, and is a serious participant in offering know-how to authorities businesses.

SAP had earlier this yr agreed to pay over $200 million over bribery costs involving authorities officers from all over the world.

Markets

Asian Shares, Currencies Rise on China Optimism: Markets Wrap

(Lusso’s Information) — Asian shares rose as a rally fueled by China’s wide-ranging stimulus package deal lifted equities for a second day and strengthened the yuan.

Most Learn from Lusso’s Information

Chinese language shares prolonged features after the Folks’s Financial institution of China on Tuesday unveiled the measures to help the financial system and monetary markets. The onshore benchmark CSI 300 rose as a lot as 3.2% and is on monitor to erase its year-to-date losses. The offshore yuan strengthened previous 7 for the primary time since Might 2023.

From equities to currencies, markets already inspired by the Fed’s outsized charge reduce final week acquired a lift from the slew of measures introduced by China to stimulate its financial system, sending the regional gauge round its highest ranges since February 2022. Rising Asian currencies additionally jumped, led by the Malaysian ringgit and Thai baht.

“The liquidity enhance anticipated from China might have some constructive spill-over through commodities and the provision chain, so EM equities and currencies are more likely to be boosted,” stated Vishnu Varathan, head of economics and technique at Mizuho Financial institution in Singapore. “The optimism could also be elevating the bar on follow-through particulars and measures, so if not substantial sufficient, issues can fizzle.”

Hong Kong’s quick gross sales ratio as a proportion of market turnover dipped to 13.6% on Tuesday, one normal deviation beneath common since 2016, indicating many shorts have already been coated, in accordance with JPMorgan Chase & Co.

In one other potential enhance for equities, the Folks’s Financial institution of China reduce the one-year medium-term lending facility charge to 2% from 2.3%.

“Inside Chinese language equities, we anticipate near-term help on the stimulus information, contingent on proof of efficient execution,” stated Solita Marcelli, chief funding officer Americas at UBS International Wealth Administration. “We count on charge cuts and capital market help to profit state-owned enterprises concentrated in high-dividend sectors, together with utilities, telecoms, power companies, and financials.”

Assist measures unveiled by Chinese language authorities Tuesday included rate of interest cuts, additional cash for banks, greater incentives to purchase houses and plans to think about a inventory stabilization fund. Nonetheless, the efforts might solely purchase China a while given the size of challenges going through the financial system.

An index of dollar power fell to commerce close to the bottom stage this 12 months. A gauge of rising market currencies set a recent document excessive.

In a single day within the US, the studying on the Convention Board’s gauge of shopper sentiment posted the most important drop since August 2021. The report additionally flagged issues a few slowdown within the labor market whereas manufacturing information additionally got here in weaker than anticipated.

“The decay within the perceptions of jobs out there was hanging,” stated Carl Weinberg, chief economist at Excessive Frequency Economics. “It additionally will ship a warning message in regards to the state of the financial system to monetary markets.”

Swaps merchants elevated their wagers to greater than three-quarters of some extent of coverage easing by year-end from the Federal Reserve, suggesting at the least yet another main US reduce is in retailer, after the information. Buyers are awaiting information on the Fed’s most well-liked value metric and US private spending later this week for additional clues on the depth of future reductions.

Fed Governor Michelle Bowman, the one policymaker to dissent on final week’s half-point reduce, stated the central financial institution ought to decrease rates of interest at a “measured” tempo, in Tuesday feedback. She stated that inflationary dangers stay and that the labor market has not proven important weakening.

Oil steadied after its largest advance in additional than per week, as merchants tracked developments within the Center East and the influence on demand of China’s stimulus measures. Gold hit a document buying and selling above $2,662 an oz..

Within the company world, Japanese reminiscence chipmaker Kioxia Holdings Corp. is pushing again plans for an preliminary public providing till later this 12 months after a downturn in semiconductor shares.

Key occasions this week:

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, sturdy items, revised GDP, Thursday

-

Fed Chair Jerome Powell provides pre-recorded remarks to the tenth annual US Treasury Market Convention, Thursday

-

China industrial earnings, Friday

-

Eurozone shopper confidence, Friday

-

US PCE, College of Michigan shopper sentiment, Friday

A few of the principal strikes in markets:

Shares

-

S&P 500 futures fell 0.2% as of 10:58 a.m. Tokyo time

-

Japan’s Topix was little modified

-

Australia’s S&P/ASX 200 was little modified

-

Hong Kong’s Dangle Seng rose 2.3%

-

The Shanghai Composite rose 2.5%

-

Euro Stoxx 50 futures fell 0.2%

-

Nasdaq 100 futures fell 0.2%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1188

-

The Japanese yen fell 0.2% to 143.45 per greenback

-

The offshore yuan was little modified at 7.0108 per greenback

-

The Australian greenback was little modified at $0.6889

Cryptocurrencies

-

Bitcoin rose 0.3% to $64,442.42

-

Ether was little modified at $2,653.61

Bonds

-

The yield on 10-year Treasuries superior one foundation level to three.74%

-

Japan’s 10-year yield declined one foundation level to 0.805%

-

Australia’s 10-year yield superior two foundation factors to three.91%

Commodities

-

West Texas Intermediate crude fell 0.3% to $71.38 a barrel

-

Spot gold rose 0.1% to $2,660.62 an oz.

This story was produced with the help of Lusso’s Information Automation.

–With help from Richard Henderson.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June