Markets

Omni Retail Enterprises sells shares in Wilhelmina Worldwide value over $114k

In a current transfer that has caught the eye of the market, Omni Retail Enterprises, LLC, a serious stakeholder in Wilhelmina Worldwide, Inc. (NASDAQ:WHLM), has bought a big variety of shares within the firm. The transactions, which befell on September 20 and September 24, concerned the sale of shares at costs starting from $4.5566 to $5.12, leading to a complete sale worth of roughly $114,714.

The collection of transactions started with smaller gross sales of 200, 300, 100, 600, 100, and 42 shares at various costs, main as much as a bigger transaction on September 24, the place 23,710 shares had been bought at a weighted common worth of $4.5566. This bigger sale alone accounted for the majority of the whole worth, with the gross sales occurring at costs between $4.4300 and $4.7500.

It is noteworthy that Omni Retail Enterprises, LLC, via its administration firm Omni Holdings Administration, LLC, and its sole member Mr. Rajesh Gupta, has a big oblique curiosity in these shares. Nevertheless, each Omni Retail Enterprises and Mr. Gupta have disclaimed useful possession of the reported securities, besides to the extent of their pecuniary curiosity.

Traders and market watchers typically preserve a detailed eye on insider transactions corresponding to these for indications of an organization’s monetary well being and the boldness that main stakeholders have within the firm’s future prospects. The current gross sales by Omni Retail Enterprises, LLC present worthwhile perception into the buying and selling actions of serious shareholders inside Wilhelmina Worldwide.

Wilhelmina Worldwide, recognized for its companies within the administration consulting sector, has not commented on these transactions. Shareholders and potential buyers in Wilhelmina Worldwide can entry full particulars of the gross sales, together with the variety of shares bought at every worth level, upon request to the corporate or the SEC.

Lusso’s Information Insights

As stakeholders consider the current insider transactions at Wilhelmina Worldwide, Inc. (NASDAQ:WHLM), a glimpse on the firm’s monetary metrics and market efficiency can present further context. In line with Lusso’s Information information, Wilhelmina Worldwide presently holds a market capitalization of roughly $22.28 million, with a Value/Earnings (P/E) ratio of 36.36, reflecting a excessive valuation relative to earnings over the past twelve months as of Q2 2024. Regardless of current market volatility, the corporate’s P/E ratio has adjusted barely to 35.59, indicating a persistent premium on its earnings.

Lusso’s Information Ideas counsel that Wilhelmina has additional cash than debt on its stability sheet, which is a optimistic signal for monetary stability. Nevertheless, the inventory has skilled vital worth fluctuations, with a one-week whole return of -16.92% and a one-month whole return of -28.0%, which aligns with the bigger transaction by Omni Retail Enterprises, LLC. The corporate’s capacity to cowl curiosity funds with money flows and liquid belongings exceeding short-term obligations could also be a reassuring issue for buyers involved concerning the firm’s short-term monetary well being.

For these contemplating an funding in Wilhelmina Worldwide, or for present shareholders seeking to perceive the current sell-off, these metrics and ideas are essential. It is also value noting that Wilhelmina Worldwide doesn’t pay a dividend, probably affecting the funding technique for income-focused buyers. For extra in-depth evaluation, together with further Lusso’s Information Ideas, buyers can go to Lusso’s Information/professional/WHLM, the place 9 extra ideas can be found, offering additional insights into the corporate’s financials and market efficiency.

This text was generated with the assist of AI and reviewed by an editor. For extra info see our T&C.

Markets

Nvidia inventory jumps on report CEO Jensen Huang is completed promoting shares after $713 million windfall

-

Nvidia inventory closed 4% larger on a report that CEO Jensen Huang is completed promoting shares.

-

Huang raked in $713 million in complete proceeds from the gross sales.

-

He stays Nvidia’s greatest shareholder.

shares climbed as a lot as 5% on Tuesday as CEO Jensen Huang is completed with deliberate gross sales of inventory.

Huang has reached the 6-million-share most threshold he is permitted to promote below a prearranged plan adopted in March. The buying and selling plan, often known as a 10b5-1, permits firm insiders to commerce a agency’s inventory in a predetermined method.

Huang stays the corporate’s largest Nvidia shareholder. Based on an from September 18th, the manager holds over 75 million value of Nvidia frequent inventory; that is apart from one other 785 million held by varied trusts and partnerships.

The inventory has rallied 150% year-to-date. Nvidia has develop into a Wall Road favourite in recent times, as that its semiconductor {hardware} has develop into a core part of the substitute intelligence growth.

Its high clients embody different massive tech names, reminiscent of Microsoft, Meta, Alphabet, and Amazon.

Learn the unique article on

Markets

'Darkest day': Volkswagen's trailblazing labour chief gears up for jobs battle

By Christoph Steitz

FRANKFURT (Reuters) – When labour unions step into the ring with Volkswagen (ETR:) executives on Wednesday to battle over job safety and plant closures, it can mark the hardest check but for probably the most highly effective determine on the automaker behind its CEO: Daniela Cavallo.

However the 49-year-old Italian-German will even seem a formidable opponent for managers, having risen via the ranks to turn into the primary feminine head of the corporate’s works council, styling herself as a defender of the “Volkswagen household”.

The negotiations begin lower than a month after Volkswagen stated it would shut crops in Germany for the primary time. That ended a two-year truce between unions and managers, highlighting that whereas battle briefly subsided beneath Cavallo and Volkswagen CEO Oliver Blume, the trade’s issues didn’t.

“Sadly, I’ve received to confess that that is the darkest day to this point,” Cavallo stated earlier this month, hours after Volkswagen informed employees of plans to probably shut crops and finish long-standing job ensures.

Excessive power and labour prices, together with weakening demand in Europe, left administration no selection however to take drastic measures, the corporate argued, breaking two taboos that Cavallo stated marked a significant cultural change at Europe’s greatest automaker.

Her feedback, in response to two individuals acquainted with the matter, replicate Cavallo’s deep dedication to Wolfsburg-based Volkswagen, the place she has spent her whole profession, ultimately turning into works council chief in 2021.

In addition they present the dispute is extra than simply enterprise for a employee born and raised in Wolfsburg – it has been a household affair ever since her father swapped southern Italy for Germany in 1969 to affix the agency.

Right this moment, Cavallo, her husband and two sisters are all a part of Volkswagen’s roughly 680,000 world workforce, together with the 130,000 VW model staff in Germany affected by the dispute.

‘REASON TO FIGHT’

“Each single one of many 130,000 staff is motive sufficient to battle,” Cavallo, one of many 20 members of Volkswagen’s supervisory board, informed Reuters.

“But it surely’s not simply concerning the 130,000 colleagues. It is also about their households, the suppliers and repair suppliers round them and, final however not least, your complete areas the place the crops are situated.”

Cavallo, who joined Volkswagen in 1994 to coach as an workplace clerk, shortly caught the eye of rising union star Bernd Osterloh for serving to to barter fewer shifts at Auto 5000, a former unit that didn’t get pleasure from the identical advantages as VW employees.

Osterloh later grew to become head of Volkswagen’s works council, a place he held for 15 years, incomes the nickname “King of Wolfsburg” as he used the numerous historic powers granted to employees on the group to their full extent.

As Osterloh rose, so did Cavallo, who grew to become the primary works council member in Wolfsburg to take maternity go away, beforehand thought of a no-go in a historically male-dominated sector.

“She’s not impulsive, however structured,” one of many individuals stated. “That does not imply she’s much less efficient. In relation to enterprise she’s simply as powerful.”

In reality, Cavallo is thought for patiently however persistently sticking to a degree, the individuals stated.

When Volkswagen negotiated a pact round electrical mobility in 2016, Cavallo insisted that jobs may solely be minimize if there was tangible proof that they had been now not wanted, elevating the bar for layoffs.

Whether or not she succeeds in avoiding plant closures, a crimson line she has drawn forward of negotiations, can also depend upon how she wields her strongest weapon – strikes – which may, in idea, happen from Dec. 1.

Markets

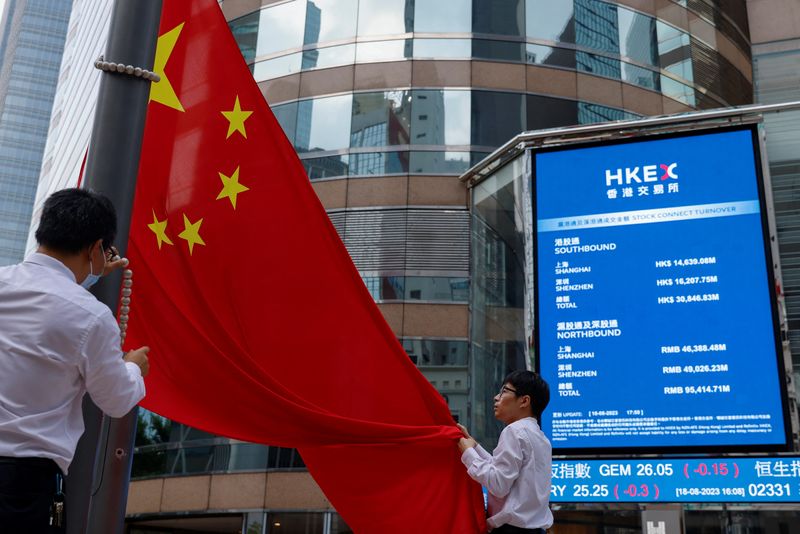

China shares soar in stimulus afterglow; greenback sags on price bets

By Kevin Buckland

TOKYO (Reuters) – Chinese language shares surged on Wednesday, lifting regional markets and serving to prolong a stimulus-fueled international rally that additionally underpinned risk-sensitive currencies, whereas Brent crude hovered close to a three-week excessive.

The greenback drooped after weak U.S. macroeconomic information in a single day boosted the case for a second super-sized rate of interest minimize on the Federal Reserve’s subsequent assembly. Gold rose to a contemporary all-time peak.

Mainland Chinese language blue chips superior 3.1% as of 0230 GMT, following a 4.3% bounce within the prior session. Hong Kong’s Dangle Seng climbed 2.2%, including to Tuesday’s 4.1% surge.

The robust begin for Chinese language shares invigorated different regional indexes, with Taiwan’s benchmark up 1.3% and South Korea’s Kospi gaining 0.1%

MSCI’s broadest index of Asia-Pacific shares exterior Japan rallied 1%.

Japan’s Nikkei shook off early weak point to rise 0.3%, helped by a retreat within the yen, a conventional protected haven.

The Folks’s Financial institution of China adopted its announcement of wide-ranging coverage easing on Tuesday with a minimize to medium-term lending charges to banks on Wednesday. Beijing’s broad-based stimulus – the most important because the pandemic – additionally consists of steps to spice up China’s inventory market and help for the ailing property sector.

“The main focus in Asia stays very a lot on China,” UBS analysts wrote in a word to shoppers.

“The controversy stays intense on whether or not there are legs to this rally, although the desk is seeing buyers opting to purchase/quick cowl first and ask questions later.”

The yen retreated about 0.17% to 143.47 per greenback, reversing earlier beneficial properties amid broad greenback weak point.

The euro ticked as much as $1.11915 after earlier pushing so far as $1.1194 for the primary time in a month.

Sterling edged as much as $1.3417, and earlier reached a contemporary excessive since March 2022 at $1.3430.

In a single day, information confirmed U.S. shopper confidence unexpectedly fell to 98.7 this month from an upwardly revised 105.6 in August. The decline was the most important since August 2021.

The percentages on one other 50-basis level Federal Reserve price minimize on the November assembly jumped to 60.4% from 53% a day earlier, in keeping with CME Group’s FedWatch Device.

In the meantime, Australia’s greenback initially scaled its highest since February of final yr at $0.6908 however then slipped again to $0.68915 after month-to-month inflation figures confirmed some cooling, doubtlessly establishing an earlier price minimize by the Reserve Financial institution.

“The autumn within the underlying measures of inflation is an surprising and welcomed shock,” mentioned Tony Sycamore, an analyst at IG.

Offered the cooling is replicated in quarterly value information subsequent month, “it units up a dovish pivot from the RBA,” resulting in a quarter-point price minimize in December, Sycamore added.

Gold rose 0.2% to $2,662.50 per ounce, and earlier marked a brand new document peak at $2,665.10.

Brent crude futures slipped 19 cents to $74.98 a barrel, however remained near Tuesday’s excessive of $75.87, a stage beforehand not seen since Sept. 3.

U.S. West Texas Intermediate crude misplaced 22 cents to $71.34 per barrel.

(Reporting by Kevin Buckland; Modifying by Shri Navaratnam)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June