Markets

Costco (COST) vs. Goal (TGT): Which is the Higher Inventory Going Ahead?

Right now I’m taking a look at Costco and Goal; two fellow massive field retailers. Shares of retail powerhouse Costco have risen about 63%% over the previous 12 months, whereas Goal shares are up round 39% over the identical time-frame. Each shares have carried out nicely, however which is the higher alternative for buyers going ahead? Let’s study that query.

I’m impartial on Costco primarily based on its expensive valuation. Concerning Goal, I’m bullish this inventory primarily based on its cheap valuation, engaging dividend yield, and lengthy historical past of dividend progress. Moreover, sell-side analysts view Goal as having significantly extra upside forward over the subsequent 12 months.

The Setup

Costco is way beloved by buyers, and rightfully so. The inventory has generated good-looking returns for its shareholders over time, to the tune of almost 900% over the previous decade. Costco is usually cited as being nicely managed and possessing a pretty enterprise mannequin as a consequence of recurring annual charges paid my its members.

Goal has generated a complete return of 224% over the previous decade. Goal is not any slouch, but it surely has considerably lagged Costco’s efficiency over the previous 10 years. Nevertheless, this will likely create a extra compelling setup for an funding in shares of Goal right now, as we’ll focus on subsequent.

Large Hole in Valuations

Whereas Costco is a superb enterprise with a powerful observe file of efficiency, it trades at fairly a steep a number of at this cut-off date. Costco has an off-cycle fiscal 12 months that ends in August, and can quickly report its This autumn 2024 earnings outcomes. The corporate trades above 50 occasions consensus 2025 earnings estimates. This sky-high a number of leaves little room for error going ahead if the corporate disappoints buyers in This autumn or throughout the subsequent fiscal 12 months.

In the meantime, Goal trades at a way more cheap valuation of 14.8x ahead earnings estimates, nicely beneath Costco’s a number of and in addition considerably beneath the S&P 500’s (SPX) ahead valuation of 24x. One can actually make a case that Costco is a higher-quality enterprise than Goal primarily based on its recurring membership charges, however a valuation 3 times as costly looks like an excessive amount of of a niche.

Moreover, regardless of Costco’s status for high quality, Goal is a higher-margin enterprise, with gross margins of 26.1% roughly twice as excessive as Costco’s gross margins of 12.5%. Goal’s revenue margin of 4.2% can be noticeably larger than Costco’s 2.8%. From my perspective, Goal’s considerably decrease valuation affords the inventory extra draw back safety and extra room to shock to the upside.

Two Robust Dividend Progress Shares

Costco is a dividend inventory, however its yield of 0.5% is pretty inconsequential. That mentioned, Costco deserves credit score for its robust dividend progress, having raised its dividend price 19 years in a row.

In the meantime, Goal’s dividend yield is 2.9%. That is almost six occasions larger than Costco’s present yield, and greater than double the yield for the S&P 500. Goal has an much more spectacular observe file of constantly paying and rising its dividend than Costco. Goal is a Dividend King that has elevated its payout for an unimaginable 55 years in a row.

Each firms additionally keep comparatively conservative payout ratios, that means that each dividends look protected for the foreseeable future. Whereas Costco has executed a very good job of rising its dividend, Goal’s yield is considerably larger, and its constant historical past of dividend progress is even higher, which helps my bullish view of the inventory.

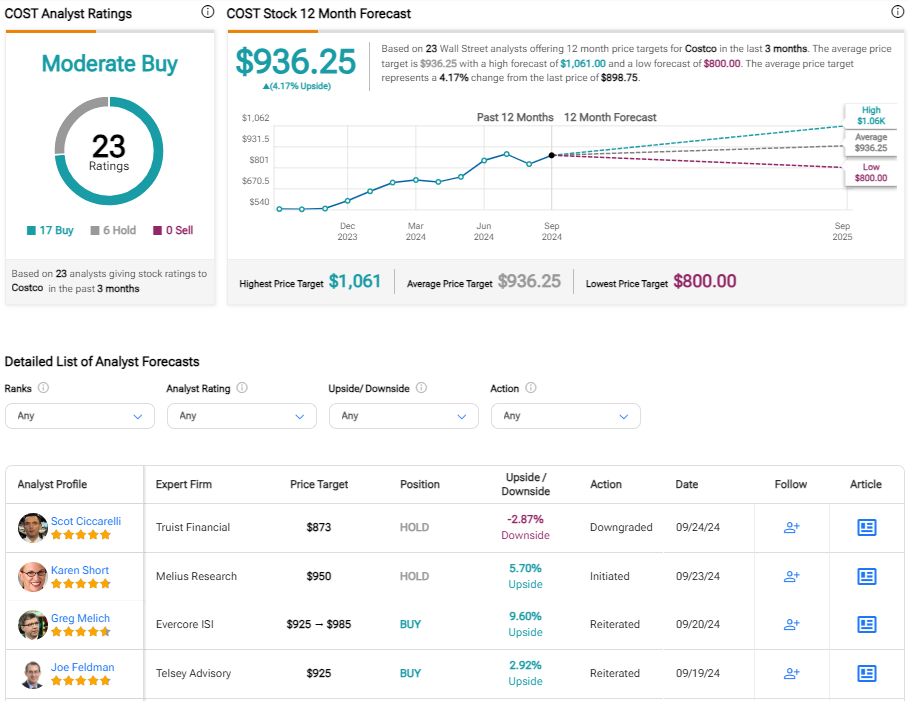

Is COST Inventory a Purchase, In accordance with Analysts?

Turning to Wall Road, COST earns a Robust Purchase consensus score primarily based on 17 Purchase, 5 Maintain, and no Promote scores assigned prior to now three months. The of $936.25 implies about 4.0% potential upside from present ranges.

Is TGT Inventory a Purchase, In accordance with Analysts?

On the similar time, TGT earns a Reasonable Purchase consensus score primarily based on 17 Buys, 10 Holds, and 0 Promote score assigned prior to now three months. The of $180.87 implies about 16% potential upside from present ranges.

Good Selections

As you possibly can see utilizing TipRanks’ beneath, each Costco and Goal obtain Outperform scores from TipRanks’ system.

Good Rating is a quantitative inventory scoring system created by TipRanks. It offers shares a rating from one to 10, primarily based on eight key market components. Scores of eight, 9, or 10 are thought of equal to an Outperform score.

Cocsto’s Outperform-equivalent Good Rating of 9 is spectacular, however Goal comes out on prime with a perfect-10 Good Rating.

Goal Inventory Appears to be like Just like the Most popular Funding Alternative

Costco is a superb firm and has been an awesome performer for its shareholders over a few years. Nevertheless, I’m impartial on shares at this level as this robust run of efficiency has despatched its valuation above 50x ahead earnings, giving the inventory little margin for error going ahead.

Goal trades at a way more engaging valuation of beneath 15x ahead earnings, affords the next dividend yield, and longer historical past of dividend progress. I’m bullish on Goal given its cheap valuation, engaging dividend yield, and 55 straight years of dividend progress. Costco is an effective inventory with a reliable historical past of efficiency, however proper now I view Goal as the higher funding choice primarily based on my evaluation of the 2 decisions.

Markets

Nvidia inventory jumps on report CEO Jensen Huang is completed promoting shares after $713 million windfall

-

Nvidia inventory closed 4% larger on a report that CEO Jensen Huang is completed promoting shares.

-

Huang raked in $713 million in complete proceeds from the gross sales.

-

He stays Nvidia’s greatest shareholder.

shares climbed as a lot as 5% on Tuesday as CEO Jensen Huang is completed with deliberate gross sales of inventory.

Huang has reached the 6-million-share most threshold he is permitted to promote below a prearranged plan adopted in March. The buying and selling plan, often known as a 10b5-1, permits firm insiders to commerce a agency’s inventory in a predetermined method.

Huang stays the corporate’s largest Nvidia shareholder. Based on an from September 18th, the manager holds over 75 million value of Nvidia frequent inventory; that is apart from one other 785 million held by varied trusts and partnerships.

The inventory has rallied 150% year-to-date. Nvidia has develop into a Wall Road favourite in recent times, as that its semiconductor {hardware} has develop into a core part of the substitute intelligence growth.

Its high clients embody different massive tech names, reminiscent of Microsoft, Meta, Alphabet, and Amazon.

Learn the unique article on

Markets

'Darkest day': Volkswagen's trailblazing labour chief gears up for jobs battle

By Christoph Steitz

FRANKFURT (Reuters) – When labour unions step into the ring with Volkswagen (ETR:) executives on Wednesday to battle over job safety and plant closures, it can mark the hardest check but for probably the most highly effective determine on the automaker behind its CEO: Daniela Cavallo.

However the 49-year-old Italian-German will even seem a formidable opponent for managers, having risen via the ranks to turn into the primary feminine head of the corporate’s works council, styling herself as a defender of the “Volkswagen household”.

The negotiations begin lower than a month after Volkswagen stated it would shut crops in Germany for the primary time. That ended a two-year truce between unions and managers, highlighting that whereas battle briefly subsided beneath Cavallo and Volkswagen CEO Oliver Blume, the trade’s issues didn’t.

“Sadly, I’ve received to confess that that is the darkest day to this point,” Cavallo stated earlier this month, hours after Volkswagen informed employees of plans to probably shut crops and finish long-standing job ensures.

Excessive power and labour prices, together with weakening demand in Europe, left administration no selection however to take drastic measures, the corporate argued, breaking two taboos that Cavallo stated marked a significant cultural change at Europe’s greatest automaker.

Her feedback, in response to two individuals acquainted with the matter, replicate Cavallo’s deep dedication to Wolfsburg-based Volkswagen, the place she has spent her whole profession, ultimately turning into works council chief in 2021.

In addition they present the dispute is extra than simply enterprise for a employee born and raised in Wolfsburg – it has been a household affair ever since her father swapped southern Italy for Germany in 1969 to affix the agency.

Right this moment, Cavallo, her husband and two sisters are all a part of Volkswagen’s roughly 680,000 world workforce, together with the 130,000 VW model staff in Germany affected by the dispute.

‘REASON TO FIGHT’

“Each single one of many 130,000 staff is motive sufficient to battle,” Cavallo, one of many 20 members of Volkswagen’s supervisory board, informed Reuters.

“But it surely’s not simply concerning the 130,000 colleagues. It is also about their households, the suppliers and repair suppliers round them and, final however not least, your complete areas the place the crops are situated.”

Cavallo, who joined Volkswagen in 1994 to coach as an workplace clerk, shortly caught the eye of rising union star Bernd Osterloh for serving to to barter fewer shifts at Auto 5000, a former unit that didn’t get pleasure from the identical advantages as VW employees.

Osterloh later grew to become head of Volkswagen’s works council, a place he held for 15 years, incomes the nickname “King of Wolfsburg” as he used the numerous historic powers granted to employees on the group to their full extent.

As Osterloh rose, so did Cavallo, who grew to become the primary works council member in Wolfsburg to take maternity go away, beforehand thought of a no-go in a historically male-dominated sector.

“She’s not impulsive, however structured,” one of many individuals stated. “That does not imply she’s much less efficient. In relation to enterprise she’s simply as powerful.”

In reality, Cavallo is thought for patiently however persistently sticking to a degree, the individuals stated.

When Volkswagen negotiated a pact round electrical mobility in 2016, Cavallo insisted that jobs may solely be minimize if there was tangible proof that they had been now not wanted, elevating the bar for layoffs.

Whether or not she succeeds in avoiding plant closures, a crimson line she has drawn forward of negotiations, can also depend upon how she wields her strongest weapon – strikes – which may, in idea, happen from Dec. 1.

Markets

China shares soar in stimulus afterglow; greenback sags on price bets

By Kevin Buckland

TOKYO (Reuters) – Chinese language shares surged on Wednesday, lifting regional markets and serving to prolong a stimulus-fueled international rally that additionally underpinned risk-sensitive currencies, whereas Brent crude hovered close to a three-week excessive.

The greenback drooped after weak U.S. macroeconomic information in a single day boosted the case for a second super-sized rate of interest minimize on the Federal Reserve’s subsequent assembly. Gold rose to a contemporary all-time peak.

Mainland Chinese language blue chips superior 3.1% as of 0230 GMT, following a 4.3% bounce within the prior session. Hong Kong’s Dangle Seng climbed 2.2%, including to Tuesday’s 4.1% surge.

The robust begin for Chinese language shares invigorated different regional indexes, with Taiwan’s benchmark up 1.3% and South Korea’s Kospi gaining 0.1%

MSCI’s broadest index of Asia-Pacific shares exterior Japan rallied 1%.

Japan’s Nikkei shook off early weak point to rise 0.3%, helped by a retreat within the yen, a conventional protected haven.

The Folks’s Financial institution of China adopted its announcement of wide-ranging coverage easing on Tuesday with a minimize to medium-term lending charges to banks on Wednesday. Beijing’s broad-based stimulus – the most important because the pandemic – additionally consists of steps to spice up China’s inventory market and help for the ailing property sector.

“The main focus in Asia stays very a lot on China,” UBS analysts wrote in a word to shoppers.

“The controversy stays intense on whether or not there are legs to this rally, although the desk is seeing buyers opting to purchase/quick cowl first and ask questions later.”

The yen retreated about 0.17% to 143.47 per greenback, reversing earlier beneficial properties amid broad greenback weak point.

The euro ticked as much as $1.11915 after earlier pushing so far as $1.1194 for the primary time in a month.

Sterling edged as much as $1.3417, and earlier reached a contemporary excessive since March 2022 at $1.3430.

In a single day, information confirmed U.S. shopper confidence unexpectedly fell to 98.7 this month from an upwardly revised 105.6 in August. The decline was the most important since August 2021.

The percentages on one other 50-basis level Federal Reserve price minimize on the November assembly jumped to 60.4% from 53% a day earlier, in keeping with CME Group’s FedWatch Device.

In the meantime, Australia’s greenback initially scaled its highest since February of final yr at $0.6908 however then slipped again to $0.68915 after month-to-month inflation figures confirmed some cooling, doubtlessly establishing an earlier price minimize by the Reserve Financial institution.

“The autumn within the underlying measures of inflation is an surprising and welcomed shock,” mentioned Tony Sycamore, an analyst at IG.

Offered the cooling is replicated in quarterly value information subsequent month, “it units up a dovish pivot from the RBA,” resulting in a quarter-point price minimize in December, Sycamore added.

Gold rose 0.2% to $2,662.50 per ounce, and earlier marked a brand new document peak at $2,665.10.

Brent crude futures slipped 19 cents to $74.98 a barrel, however remained near Tuesday’s excessive of $75.87, a stage beforehand not seen since Sept. 3.

U.S. West Texas Intermediate crude misplaced 22 cents to $71.34 per barrel.

(Reporting by Kevin Buckland; Modifying by Shri Navaratnam)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June