Markets

US probing SAP, Carahasoft over potential price-fixing- Bloomberg

Lusso’s Information– The U.S. authorities is probing German software program agency SAP SE (NYSE:) and product reseller Carahsoft over doubtlessly overcharging authorities businesses for a minimum of a decade, Bloomberg reported on Wednesday.

The Division of Justice has been trying into whether or not enterprise software program maker SAP illegally conspired with Carahsoft to repair larger costs on gross sales to the U.S. navy and different authorities businesses, Bloomberg reported, citing federal court docket data filed in Baltimore. The investigation has been ongoing since a minimum of 2022.

Bloomberg mentioned different know-how corporations have been additionally underneath scrutiny over potential violations of the False Claims Act, together with a unit of Accenture plc (NYSE:).

Carahsoft- a serious vendor of software- noticed its workplaces in Virginia raided on Tuesday by FBI brokers and navy investigators.

The civil probe is investigating potential worth rigging for greater than $2 billion value of SAP merchandise utilized by the U.S. authorities since 2014, Bloomberg reported.

SAP is Germany’s largest agency, with the potential investigation offering a blow to the agency amid an ongoing rally in its shares. Carahsoft is likely one of the largest non-public corporations on the planet, and is a serious participant in offering know-how to authorities businesses.

SAP had earlier this yr agreed to pay over $200 million over bribery costs involving authorities officers from all over the world.

Markets

Inventory market immediately: New document highs as Nvidia surge offsets weak shopper sentiment

-

US shares reached new data on Tuesday, led by positive factors in Nvidia.

-

A weak shopper confidence studying induced indexes to briefly drop early morning.

-

Rising market shares notched their highest stage in two years on China’s stimulus plan.

US shares saved up their successful streak on Tuesday, with indexes pushing increased to new data.

The positive factors weren’t locked in from the beginning, nonetheless, as early-morning financial information briefly drove the and index into the crimson.

Buyers reacted with dismay after the newest shopper sentiment studying, with confidence amongst US customers logging its largest one-month drop in additional than three years.

The Convention Board’s shopper confidence index got here in at 98.7 for September, nicely under consensus estimates of a 104 studying.

“It is by no means good to see shopper confidence fall this a lot. Shoppers are clearly involved concerning the implications of the upcoming election, the growing battle around the globe, and the stubbornly excessive value of meals and credit score,” stated Jamie Cox, managing companion for Harris Monetary Group.

“The Federal Reserve seldom reads the tea leaves appropriately on when and the way a lot to chop charges, however 50 appears extra appropriate in gentle of those information.”

Markets seem like in settlement, and the percentages of a half-point lower in November climbed to 60.7%, in accordance with the .

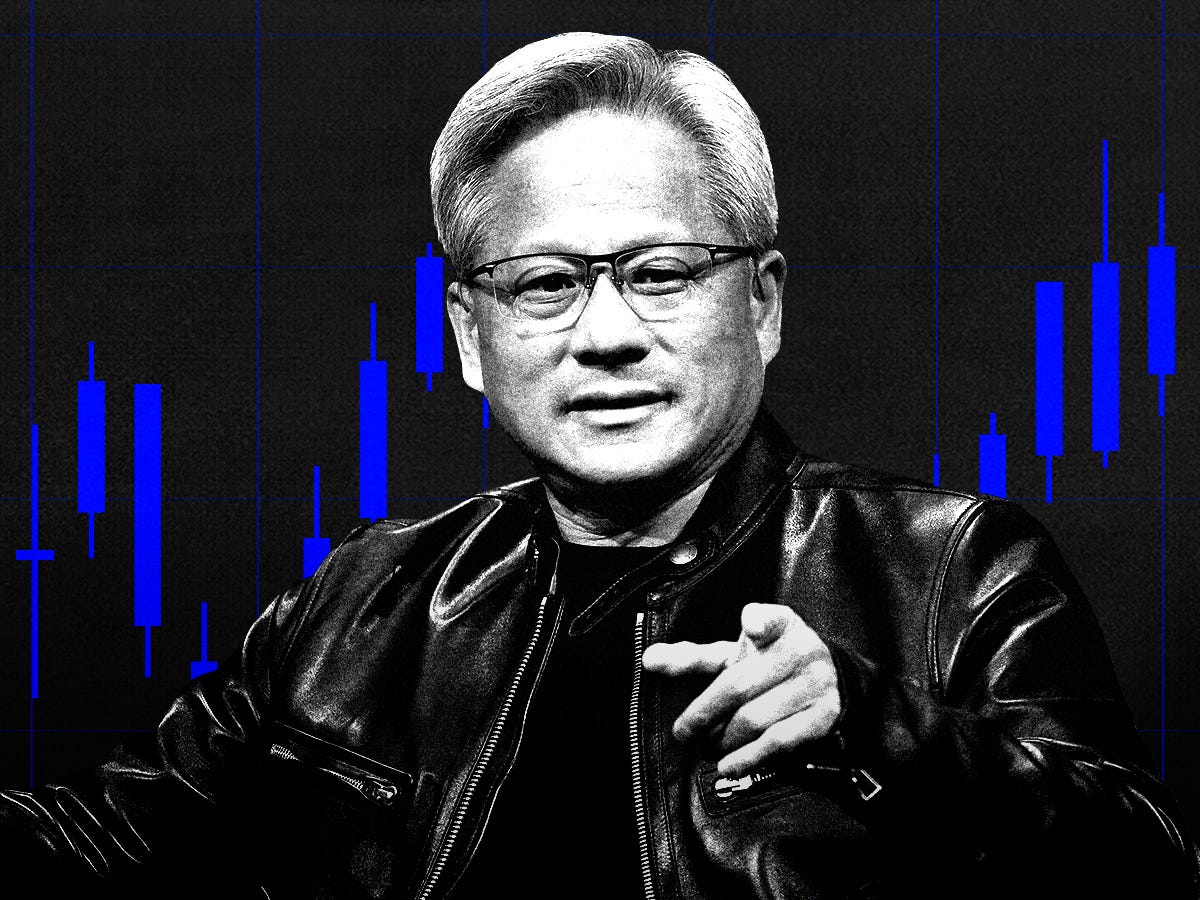

Nevertheless, after the dip, the market bounced again later within the day with a virtually 5% rally in serving to buyers push previous the discouraging shopper replace.

The chipmaker ended the day up by about 4%, leaping on information that its CEO Jensen Huang was completed promoting inventory for now. Underneath a predetermined buying and selling plan, the manager was licensed to promote 6 million Nvidia shares by early subsequent 12 months — however he simply met that threshold, Barron’s first reported.

Exterior of the US, rising fairness markets logged large positive factors. The as China introduced its largest stimulus bundle to revive its ailing financial system.

Here is the place US indexes stood on the 4:00 p.m. closing bell on Tuesday:

Here is what else is occurring:

In commodities, bonds, and crypto:

-

Oil futures had been up. crude oil jumped 1.71% to $71.56 a barrel. , the worldwide benchmark, elevated 1.72% to $75.17 a barrel.

-

rose 1.29% to $2,687.8 an oz.

-

The ten-year Treasury yield was flat at 3.734%.

-

gained 1.55% to $64,305.

Learn the unique article on

Markets

Hedge fund promoting is accelerating: Citi

Lusso’s Information — Lengthy-only managers elevated their publicity this previous week, with the most important additions in tech, industrials, and financials, Citi mentioned in a Tuesday report. Alternatively, they decreased their holdings in power, well being care, and actual property.

“Power is the one sector to have seen outflows from long-only managers over the past 2 months, whereas financials, tech, and client discretionary have seen essentially the most inflows,” Citi strategists mentioned.

In the meantime, hedge fund flows remained skewed in direction of promoting through the week, with only some sectors seeing internet inflows. Particularly, hedge funds elevated their publicity to financials, well being care, and power, whereas the most important internet outflows occurred in client staples, tech, and industrials.

Citi additionally highlighted adjustments in its flow-based relative worth mannequin, the place tech changed actual property among the many prime three sectors. Utilities and supplies now rank within the backside three, changing tech and communications.

In keeping with Citi’s strategists, present market internals recommend that pricing, as of final Friday, has shifted away from “Tender Touchdown” sector positioning. Notably, the current worth motion resembles a mix of “early recession,” with power and tech underperforming, and “recession late,” the place cyclicals have outperformed defensive shares.

Extra lately, strategists be aware that the “Tender Touchdown” correlation has declined, whereas the “Overheat” correlation has risen. They warning that over the previous few years, when the ‘Overheat’ correlation has turned constructive, it has “spelled hassle for the S&P and is one thing buyers ought to control.”

The and closed at document highs on Tuesday, overcoming weak client confidence information, as mining shares surged in response to China’s announcement of a significant stimulus package deal.

The Dow rose 0.20%, the S&P 500 gained 0.25%, and the climbed 0.56%.

Markets

Evaluation-China's financial volleys miss key menace to financial development

By Liangping Gao, Ellen Zhang and Marius Zaharia

BEIJING/HONG KONG (Reuters) – China’s central financial institution has shifted to a extra aggressive easing stance, however its coverage weapons do not have the important thing enemy to financial development of their line of sight: the persistently weak client demand.

The liquidity injections and the decrease borrowing prices flagged by the Individuals’s Financial institution of China on Tuesday have lifted market sentiment, however primarily as a result of they raised expectations authorities will comply with quickly with a fiscal package deal to enhance the financial and monetary measures.

The world’s second-largest economic system faces sturdy deflationary pressures and dangers lacking this yr’s roughly 5% development goal as a consequence of a pointy property downturn and frail client confidence, which analysts say solely fiscal insurance policies that put cash into client pockets via larger pensions and different social advantages can deal with.

“The central financial institution insurance policies exceeded expectations, however the principle drawback within the economic system at this time shouldn’t be the shortage of liquidity,” stated Shuang Ding, chief economist for Better China and North Asia at Commonplace Chartered.

“When it comes to serving to the actual economic system, I feel there can be one other coverage package deal, particularly fiscal insurance policies.”

HSBC chief Asia economist Fred Neumann concurred, saying authorities should enhance demand which may very well be “executed via different coverage measures like fiscal coverage.”

Whereas the PBOC is unleashing its boldest set of measures for the reason that pandemic, the full measurement of the stimulus stays small and analysts doubt its total effectiveness.

Given weak credit score demand from households and companies, the 1 trillion yuan ($142 billion) that may be launched into the monetary system via a minimize in financial institution reserve necessities might spur extra sovereign bond shopping for than actual economic system lending.

Corporations “have been unwilling for years to borrow it doesn’t matter what credit score situations are as a result of company sentiment is so poor,” China Beige E-book stated in a notice.

“And households usually are not going to reply to worse returns on financial savings by turning into out of the blue extra optimistic.”

Cuts within the current mortgage charges will launch an additional 150 billion yuan yearly to households. However that is equal to solely 0.12% of annual financial output, and a few of it could be saved for early mortgage repayments.

Chinese language shoppers spend simply 35 yuan of any further 100 yuan they obtain, estimates Raymond Yeung, chief Better China economist at ANZ.

The important thing rate of interest minimize by 20 foundation factors is bigger than regular, however smaller than what most central banks usually do. The U.S. Federal Reserve minimize charges by 50 bps final week.

“Every of the principle monetary-policy measures introduced by the PBOC has already been used up to now, and had minimal financial impression earlier than,” Gavekal Dragonomics analysts stated in a notice, describing the size of the package deal as “modest.”

“The importance of this package deal is thus largely in whether or not it opens the door to different strikes.”

MORE STIMULUS?

By injecting liquidity, the PBOC supplies extra room for the federal government to challenge debt for any further stimulus, Neumann stated.

“What the market is hoping for is that the liquidity injections sign a possible announcement within the coming weeks for a giant bond issuance programme,” he added.

Lynn Music, chief economist for higher China at ING, says essentially the most direct approach to stimulate the economic system within the short-term is thru extra authorities funding, though “economists are more and more in favour of demand-side assist, which might come within the type of consumption vouchers or comparable insurance policies.”

The well-trodden path is funding. In October final yr, to make sure assembly the 2023 development goal, Beijing introduced an additional 1 trillion yuan in particular treasury bonds to fund numerous infrastructure initiatives.

It is unclear how totally different any extra stimulus this yr could be.

Officers in July flagged a marginal shift in spending in the direction of shoppers by subsidising purchases of recent home equipment and different items. This was seen a small step within the path many economists have for years known as on Beijing to take to deal with its large investment-consumption imbalance.

The share of family consumption in annual financial output is roughly 20 proportion factors beneath the worldwide common, whereas the share of funding – government-driven, debt-fuelled and yielding dwindling returns – is 20 factors above.

This may very well be addressed via transfers from the state sector to shoppers.

Nomura analysts stated in a notice on the PBOC package deal that Beijing might increase pensions and medical advantages for low-income teams and subsidise youngster delivery to make some progress in rebalancing its economic system.

However they warn such steps might not be imminent.

“We don’t imagine these financial and monetary insurance policies alone are sufficient to arrest the worsening financial slowdown,” they stated.

“We imagine fiscal stimulus ought to take the entrance seat, though we encourage traders to handle their expectations.”

($1 = 7.0331 Chinese language yuan renminbi)

(Writing by Marius Zaharia; Modifying by Shri Navaratnam)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June