Markets

Japan watchdog to suggest penalties on Nomura's brokerage unit for alleged market manipulation, Yomiuri stories

TOKYO (Reuters) -Japan’s securities watchdog is predicted to suggest imposing tens of hundreds of thousands of yen in penalties on Nomura Holding’s brokerage unit for alleged manipulation within the authorities bond futures market, the Yomiuri reported.

The Securities and Trade Surveillance Fee will make the advice to the banking regulator, the Monetary Providers Company (FSA), which palms out such punishments in Japan, the newspaper stated in its report on Wednesday.

Nomura stated it was not able to remark at the moment however would take such allegations critically together with establishing the info.

The FSA stated in an e-mail that it could maintain a briefing on Wednesday afternoon concerning a advice to impose penalties, but it surely didn’t title Nomura or another firm and didn’t give another particulars.

A seller at Nomura, Japan largest brokerage agency, is suspected of manipulating the value of long-term authorities bond futures contracts in 2021 by means of a observe generally known as “spoofing”, the Yomiuri stated, citing at the least one supply.

The commerce includes illegally inserting numerous orders with out meaning to commerce after which cancelling them, the Yomiuri stated.

The Securities and Trade Surveillance Fee is concentrating on the corporate fairly than the person seller because the seller was a supervisor in Nomura’s world markets division, which trades the corporate’s personal funds, the Yomiuri stated.

Markets

Warren Buffett Has Bought $78 Billion of His Favourite Inventory — however One other Time-Examined Firm Has Been His Prime Purchase Over the Previous Yr

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is one in all Wall Road’s most-followed buyers, and it has all the things to do along with his of the benchmark S&P 500.

Since turning into CEO almost six a long time in the past, the Oracle of Omaha has overseen a cumulative acquire of greater than 5,500,000% in his firm’s Class A shares (BRK.A). Comparatively, the S&P 500 has delivered a really respectable, however Buffett-trailing, whole return, together with dividends, of lower than 38,000% over the identical stretch.

Regardless that Buffett is fallible — he took fairly the tub on his firm’s stake in legacy media inventory Paramount World — buyers typically wait on the sting of their seat for Berkshire Hathaway’s filings. These are required filings for institutional buyers with at the very least $100 million in belongings below administration that present a snapshot of which shares have been bought and bought within the newest quarter.

The humorous factor about 13Fs is they do not all the time inform the total story — particularly with regards to Warren Buffett and Berkshire Hathaway.

Warren Buffett has spent roughly $78 billion shopping for his favourite inventory since mid-2018

Though 13Fs have proven Buffett to be a decisive net-seller of shares in every of the final seven quarters to the mixture tune of just about $132 billion, there have been selective shares which have piqued the curiosity of Berkshire’s chief.

For example, Buffett has overseen the acquisition of greater than 255 million shares of built-in oil and gasoline large Occidental Petroleum for the reason that begin of 2022.

However with regards to the cumulative quantity of Berkshire’s money Buffett has put to work, nothing tops his favourite inventory over the past six years… Berkshire Hathaway. Share repurchases are present in Berkshire’s quarterly working outcomes however aren’t listed within the firm’s 13Fs.

Share buybacks have not all the time been a given for Buffett or his late right-hand man Charlie Munger, who handed away at age 99 in November. Previous to July 2018, share repurchases have been solely allowed if Berkshire’s share value fell to or beneath 120% of e-book worth, as of the newest quarter. This can be a line-in-the-sand threshold that Berkshire Hathaway’s inventory by no means dipped beneath, which meant Buffett and Munger weren’t allowed to spend a cent on buybacks.

On July 17, 2018, Berkshire’s board amended the foundations governing buybacks to permit its most essential gamers to get off the bench. The brand new guidelines set no ceiling or finish date to share repurchases so long as:

-

Berkshire Hathaway has at the very least $30 billion in money, money equivalents, and U.S. Treasuries on its steadiness sheet; and

-

Warren Buffett believes his firm’s share are intrinsically low-cost.

With the second criterion up for interpretation, this coverage change gave Buffett free reign to (lastly) undertake a share repurchase program. He is bought shares of Berkshire Hathaway for twenty-four consecutive quarters, together with $345 million within the June-ended quarter, and put near $78 billion to work within the firm nearest and dearest to his coronary heart over the past six years.

Buybacks are a straightforward means for Buffett to incent a long-term mindset from his firm’s shareholders, in addition to enhance Berkshire’s earnings per share (EPS) over the long term as its excellent share rely decreases.

Whereas Berkshire Hathaway is, with out query, Warren Buffett’s favourite inventory, there’s truly one other firm he is spent extra of Berkshire’s money buying shares of over the past yr.

Transfer over Berkshire Hathaway — that is Buffett’s high purchase over the past yr

Over the earlier 4 quarters, Buffett has green-lit the repurchase of just a little over $6.1 billion value of his firm’s inventory. However for the reason that midpoint of 2023, common price foundation estimates from 13F aggregator WhaleWisdom.com indicate the Oracle of Omaha has spent round $6.5 billion shopping for shares of property and casualty insurer Chubb (NYSE: CB).

For these of you who carefully monitor Berkshire’s 13F filings, Chubb wasn’t all the time listed as a holding. Between July 2023 and Might 2024, Buffett requested for and was granted “confidential remedy” for one in all his positions by regulators. This confidential inventory was revealed to be Chubb in mid-Might 2024.

The “confidential remedy” device is one thing Buffett sometimes depends on when he desires to construct up a stake in an organization with out revealing his playing cards to on a regular basis buyers. Since buyers tend to pile into the shares he and his funding lieutenants (Todd Combs and Ted Weschler) are shopping for, protecting Berkshire’s buy exercise in a bigger holding “confidential” permits him to, in idea, construct a stake with out a lot of a share value premium.

So, what’s compelled the Oracle of Omaha to spend extra of his firm’s capital on Chubb than his favourite inventory over the past yr?

To start out with, the insurance coverage business tends to be boring, extremely predictable, and really worthwhile. Regardless that disaster losses are an eventual given for all insurers, they possess distinctive premium pricing energy in just about all climates. Loss occasions provide a cause to lift premiums, whereas the inevitability of future loss occasions enable insurers to extend premiums even during times of below-average payouts.

Insurers like Chubb are additionally benefiting from a interval of above-average rates of interest. Insurers make investments their float (the premium they gather that is not paid out in claims) in extraordinarily protected, short-term, interest-bearing belongings. Regardless of the Federal Reserve kicking off a rate-easing cycle final week, insurers are producing extra on their float than they’ve in a very long time.

Moreover, Chubb’s house owner insurance coverage phase predominantly caters to high-value houses. Simply as longtime Berkshire holding American Specific thrives by catering to excessive earners, Chubb has discovered a really worthwhile area of interest by focusing on high-end house and content material insurance coverage. Excessive earners are often much less vulnerable to minor downturns and inflationary pressures, when in comparison with common earners.

Whether or not Chubb continues to be a superb worth stays to be seen. As of the closing bell on Sept. 20, shares of the corporate have been buying and selling at a 92% premium to e-book worth, which is a stage not constantly noticed in additional than 20 years. Regardless that Chubb is a gentle grower and caters to higher-end shoppers, a 92% premium to e-book worth is a tricky capsule to swallow.

In different phrases, do not be stunned if Buffett’s stake in Chubb has reached its peak.

Do you have to make investments $1,000 in Berkshire Hathaway proper now?

Before you purchase inventory in Berkshire Hathaway, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Berkshire Hathaway wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $712,454!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

American Specific is an promoting accomplice of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot recommends Occidental Petroleum. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Australia court docket fines Vanguard unit $9 million over moral funding claims

(Reuters) – Australia’s federal court docket has imposed a report A$12.9 million ($8.89 million) effective on high U.S. asset supervisor Vanguard’s native unit for making deceptive claims about its moral and inexperienced funding choices, the nation’s securities watchdog stated on Wednesday.

The Australian Securities & Investments Fee (ASIC) stated the court docket discovered Vanguard Investments Australia misled buyers about its “ethically acutely aware” bond index fund. The fund stated it screened issuers to exclude these with operations in some sectors corresponding to fossil fuels, when that was not at all times the case, ASIC added.

“Roughly 74% of the securities within the Fund by market worth weren’t researched or screened in opposition to relevant ESG (environmental, social, and governance) standards,” the court docket discovered.

“Additional, Vanguard benefited from its deceptive conduct.”

Vanguard made the claims in a spread of public communications which included 12 product disclosure statements, a media launch, and statements on its web site, the ASIC stated.

Vanguard Australia in an e-mail response to Reuters stated it has cooperated with ASIC since informing it of the difficulty in 2021, including that “there have been no findings of monetary loss to buyers.”

($1 = 1.4510 Australian {dollars})

Markets

Inventory market immediately: New document highs as Nvidia surge offsets weak shopper sentiment

-

US shares reached new data on Tuesday, led by positive factors in Nvidia.

-

A weak shopper confidence studying induced indexes to briefly drop early morning.

-

Rising market shares notched their highest stage in two years on China’s stimulus plan.

US shares saved up their successful streak on Tuesday, with indexes pushing increased to new data.

The positive factors weren’t locked in from the beginning, nonetheless, as early-morning financial information briefly drove the and index into the crimson.

Buyers reacted with dismay after the newest shopper sentiment studying, with confidence amongst US customers logging its largest one-month drop in additional than three years.

The Convention Board’s shopper confidence index got here in at 98.7 for September, nicely under consensus estimates of a 104 studying.

“It is by no means good to see shopper confidence fall this a lot. Shoppers are clearly involved concerning the implications of the upcoming election, the growing battle around the globe, and the stubbornly excessive value of meals and credit score,” stated Jamie Cox, managing companion for Harris Monetary Group.

“The Federal Reserve seldom reads the tea leaves appropriately on when and the way a lot to chop charges, however 50 appears extra appropriate in gentle of those information.”

Markets seem like in settlement, and the percentages of a half-point lower in November climbed to 60.7%, in accordance with the .

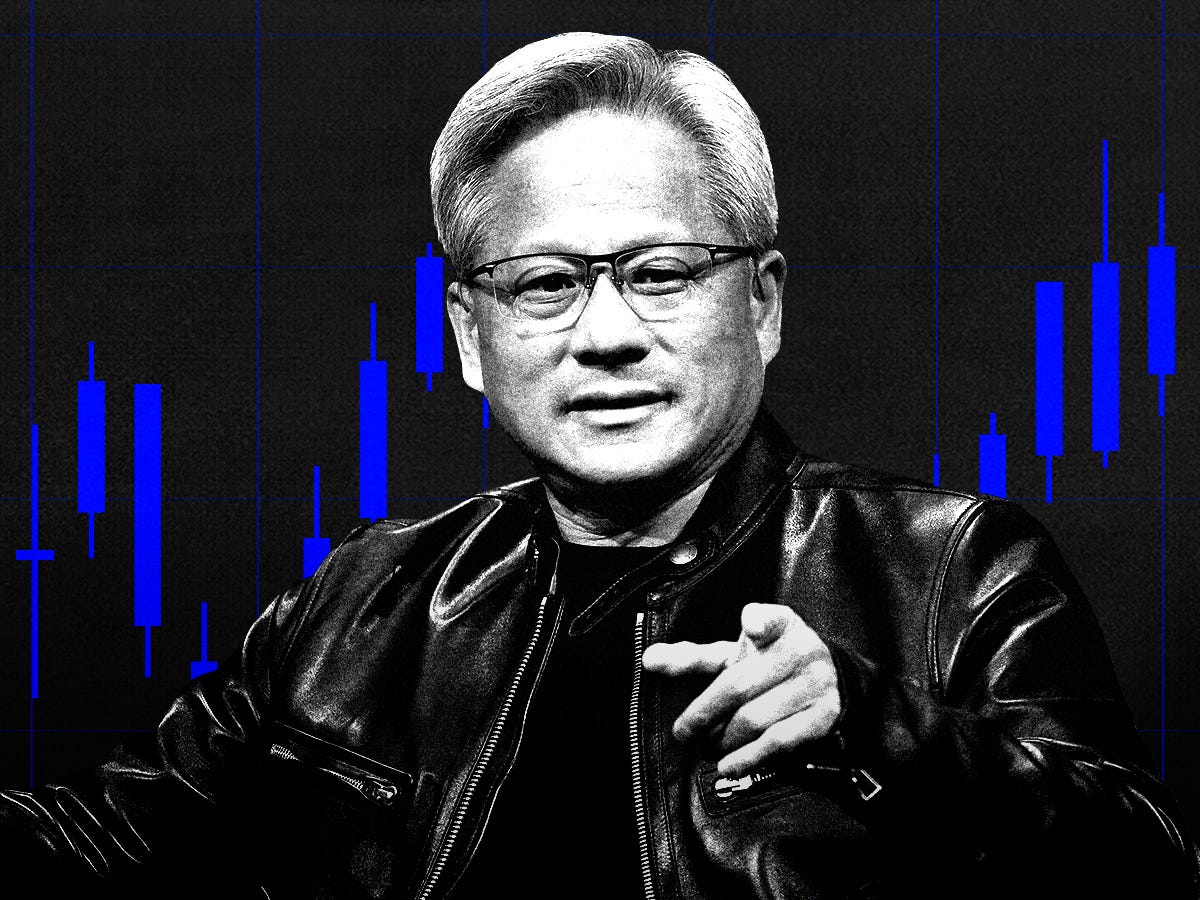

Nevertheless, after the dip, the market bounced again later within the day with a virtually 5% rally in serving to buyers push previous the discouraging shopper replace.

The chipmaker ended the day up by about 4%, leaping on information that its CEO Jensen Huang was completed promoting inventory for now. Underneath a predetermined buying and selling plan, the manager was licensed to promote 6 million Nvidia shares by early subsequent 12 months — however he simply met that threshold, Barron’s first reported.

Exterior of the US, rising fairness markets logged large positive factors. The as China introduced its largest stimulus bundle to revive its ailing financial system.

Here is the place US indexes stood on the 4:00 p.m. closing bell on Tuesday:

Here is what else is occurring:

In commodities, bonds, and crypto:

-

Oil futures had been up. crude oil jumped 1.71% to $71.56 a barrel. , the worldwide benchmark, elevated 1.72% to $75.17 a barrel.

-

rose 1.29% to $2,687.8 an oz.

-

The ten-year Treasury yield was flat at 3.734%.

-

gained 1.55% to $64,305.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.