Markets

Why This Inventory Might Be the Nvidia of Healthcare

During the last couple of years, synthetic intelligence (AI) has emerged because the world’s subsequent megatrend. To this point, breakthroughs in have largely revolved across the know-how trade.

Particularly, semiconductor specialist Nvidia is considered because the engine powering the AI automobile proper now. Demand for its strongest graphics processing items (GPUs) has been off the charts, and buyers have cheered on the inventory accordingly. That stated, many use instances for AI stay largely neglected by buyers.

One in every of them is how AI is creating thrilling new alternatives within the healthcare area. Among the many firms main the cost for AI within the medical world are big Novo Nordisk and a comparatively tiny however I see Eli Lilly (NYSE: LLY) as the highest alternative. This is why.

AI is an enormous alternative in healthcare

AI can influence a number of areas alongside the healthcare spectrum, together with service-oriented jobs corresponding to nursing, software program platforms, and {hardware} units.

Based on Priority Analysis, the worldwide complete addressable market (TAM) for healthcare AI sits at round $26.7 billion in the present day. This market is anticipated to develop at a compound annual charge of 37% from 2024 to 2034 — reaching $614 billion. The U.S. healthcare AI market alone is forecast to be value $195 billion by 2034.

What firms are bringing AI to healthcare?

One of many largest challenges dealing with the healthcare trade proper now’s staffing. Based on a report printed by multinational conglomerate Philips, staffing shortages in hospital settings are spurring demand for extra digital infrastructure within the type of automation options.

A start-up known as Hippocratic AI is tackling that employee scarcity head-on by creating healthcare brokers powered by massive language fashions (LLM). The corporate is basically searching for to convey synthetic common intelligence to the healthcare world and is leveraging Nvidia’s Avatar Cloud Engine to do it.

One other influential firm that’s serving to bridge the hole between healthcare and AI is Danish pharmaceutical powerhouse Novo Nordisk, the developer of diabetes and weight problems care remedies Ozempic and Wegovy.

Novo Nordisk is teaming up with French IT firm Atos to develop a supercomputer that’s meant to spearhead analysis within the biotechnology and pharmaceutical industries. It will likely be powered by GPUs from each Nvidia and Intel, and might be saved inside one among Digital Realty‘s information facilities in Denmark.

Why do I see Lilly as the highest alternative?

Whereas the tasks from Novo Nordisk and Hippocratic AI are thrilling, I feel there are some dangers surrounding their ambitions. For starters, Hippocratic AI continues to be a start-up. It may take fairly a very long time earlier than the corporate makes vital inroads in treating sufferers (assuming it does in any respect). Moreover, I see Novo Nordisk’s supercomputing undertaking as fairly broad — making the funding prospects just a little unattractive.

Against this, Eli Lilly has recognized a particular alternative to pursue and is leveraging AI to search out options. Particularly, it has teamed up with ChatGPT developer OpenAI to help with analysis for treating drug-resistant pathogens.

Based on a report from MarketsandMarkets, the worldwide market dimension for antimicrobial resistance will attain $7.7 billion by 2028. As well as, the World Financial institution is forecasting that the detrimental financial impacts of antimicrobial resistance may high $1 trillion yearly by 2030.

Eli Lilly is already celebrated as one of many world’s main drug firms. Its portfolio contains many blockbusters, together with Verzenio, Trulicity, Taltz, Jardiance, Mounjaro, and Zepbound. Furthermore, the corporate is about to make a splash within the $31 billion Alzheimer’s illness market.

Not solely is Eli Lilly specializing in a big and underserved space of the healthcare realm, however it’s teaming up with one of many largest names in AI to deal with that problem. I think it’ll take years earlier than Lilly has a breakthrough in creating an efficient new antimicrobial drug that works in opposition to micro organism which have turn into immune to at the moment out there remedies. Or, its efforts may finally fail.

Nonetheless, if I had to decide on one firm that I see as most certainly to search out success on the intersection of AI and healthcare, I’d select Eli Lilly. Given its lengthy monitor document in drug improvement and its dedication to innovation, I see some parallels between Nvidia’s signature on the tech sector and Eli Lilly’s affect in healthcare.

I feel it is laying the groundwork for long-term success and can obtain a brand new degree of innovation past its medical laboratories. If buyers are in search of a high-growth alternative in healthcare AI, I see Eli Lilly as your best option.

Do you have to make investments $1,000 in Eli Lilly proper now?

Before you purchase inventory in Eli Lilly, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Eli Lilly wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $712,454!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Eli Lilly, Novo Nordisk, and Nvidia. The Motley Idiot has positions in and recommends Digital Realty Belief and Nvidia. The Motley Idiot recommends Intel and Novo Nordisk and recommends the next choices: quick November 2024 $24 calls on Intel. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Micron earnings preview: Wall Avenue will get a glimpse into what's forward for US chipmakers

Micron () is the primary chipmaker to report quarterly outcomes this earnings season. Its report, scheduled for launch after the bell on Wednesday, will present perception into how the semiconductor sector is faring amid excessive expectations from Wall Avenue.

Micron’s reminiscence chip enterprise has undergone a resurgence over the previous 12 months as Large Tech companies pour billions into the semiconductor sector for {hardware} to energy synthetic intelligence knowledge facilities.

Micron distinguishes itself by partnering with, fairly than competing in opposition to, business superpower Nvidia (). Micron provides reminiscence chips for Nvidia’s hotly demanded GPUs.

Wall Avenue expects Micron to document quarterly revenues 90% greater than final 12 months — and that’s after analysts barely lowered their expectations by 0.3% from a month in the past. Right here’s a breakdown of analysts’ forecasts, in response to Lusso’s Information consensus estimates:

-

Income: $7.66 billion (Micron’s steering: $7.4 billion to $7.8 billion) vs. $4.01 billion in This autumn 2023

-

Adjusted earnings per share: $1.11 (Micron’s steering: $1 to $1.16) vs. a lack of $1.07 in This autumn 2023

Shares of the chipmaker rose as a lot as 2% in Wednesday buying and selling.

Buyers have staggeringly excessive and ever-increasing requirements for AI chipmakers, leaving them usually disenchanted in latest months. Micron’s third quarter earnings beat did little to sway buyers in late June.

As an alternative, on account of its fourth quarter outlook, which got here proper according to (fairly than beating) Wall Avenue’s expectations. after reporting quarterly earnings on the finish of August. Regardless of greater than doubling earnings and beating gross sales forecasts, buyers needed extra from the semiconductor superpower. Nvidia has since rebounded, however Micron inventory is down over 30% from three months in the past.

Almost 93% of Wall Avenue analysts overlaying Micron suggest shopping for the inventory. On common, they see its shares rising greater than 50% over the subsequent 12 months to $143.94. Nonetheless, their opinions of Micron are blended.

Morgan Stanley’s Joseph Moore thinks Wall Avenue’s softer expectations might assist enhance the inventory post-earnings. “MU inventory might rebound on earnings given a low bar close to time period, significantly if enthusiasm returns to AI beneficiaries,” he wrote in a observe to buyers earlier this week. However Moore maintained his Equal Weight ranking of Micron and sees the inventory as “basically costly.”

JPMorgan, however, maintained its Obese ranking of the inventory and mentioned it “continues to be one among our prime picks in semis subsequent 12 months.”

The PHLX Semiconductor Sector Index () has begun to get well from a dip originally of the month as tech shares rallied following the US and . The index is up almost 6% during the last week. Micron has been a part of that development, rising virtually 10% over that time-frame.

The corporate can be set to learn from that will loosen environmental necessities for microchip initiatives funded by the CHIPS and Science Act. Micron is one among , and the Constructing Chips in America Act handed by the US Home of Representatives Monday would enable the corporate quicker entry to greater than $6 billion in federal subsidies for its .

Laura Bratton is a reporter for Lusso’s Information.

Markets

Meta bulks up AI choices, together with chatbot, at Join occasion

By Katie Paul

MENLO PARK, California (Reuters) -Meta Platforms expanded its guess on synthetic intelligence, asserting a raft of recent product choices for its ChatGPT-like chatbot and plans to start out robotically injecting personalised pictures created by the bot into individuals’s Fb (NASDAQ:) and Instagram feeds, because it kicked off its annual Join convention at its California headquarters on Wednesday.

The Fb proprietor additionally introduced a brand new entry-level model of its Quest line of mixed-reality headsets, the Quest 3S, and is predicted to preview its first augmented-reality glasses and announce updates to its present virtual-reality and artificial-intelligence merchandise.

Among the many AI updates introduced was an audio improve to the digital assistant, referred to as Meta AI, which is able to now reply to voice instructions and supply customers the choice to make the assistant sound like celebrities together with Judi Dench and John Cena.

“I feel that voice goes to be a far more pure approach of interacting with AI than textual content,” CEO Mark Zuckerberg stated.

The corporate stated greater than 400 million individuals are utilizing Meta AI month-to-month, together with 185 million who’re returning to it weekly.

Consistent with its technique of sharing the AI fashions powering its digital agent totally free use by others, Meta launched three new variations of its Llama 3 fashions. Two of the fashions are multimodal, that means they’ll perceive each pictures and textual content, whereas the third is a fundamental text-only mannequin able to operating totally on a consumer’s system, a key privateness benefit.

The augmented-reality reveal is a very long time within the making for Zuckerberg, who positioned AR know-how as a kind of magnum opus when he first pivoted the world’s greatest social media firm towards constructing immersive “metaverse” programs in 2021.

Nevertheless, Meta has struggled to beat technical challenges with its AR mission since then, prompting the top of the corporate’s metaverse-oriented Actuality Labs division to acknowledge final yr {that a} product it may viably carry to market was “nonetheless a couple of years away – a couple of, to place it frivolously.”

The corporate has been plowing tens of billions of {dollars} into its investments in synthetic intelligence, augmented actuality and different metaverse applied sciences, driving up its capital expense forecast for 2024 to a file excessive of between $37 billion and $40 billion.

Its metaverse unit Actuality Labs misplaced $8.3 billion within the first half of this yr, in accordance with the latest disclosures. It misplaced $16 billion final yr.

The social media big is planning for the primary technology of the AR glasses this yr to be distributed solely internally and to a choose group of builders, with every system costing tens of 1000’s of {dollars} to provide, in accordance with a supply aware of the mission.

Meta goals to ship its first industrial AR glasses to shoppers in 2027, by which level technical breakthroughs ought to carry down the price of manufacturing, the supply stated.

The supply spoke on situation of anonymity as a result of they weren’t licensed to debate firm plans.

Zuckerberg appeared to substantiate that method, describing the AR work and telling an viewers at a dwell taping of the Acquired podcast in San Francisco that Meta was “fairly near with the ability to exhibit the primary prototype that we have now of that.”

Meta didn’t instantly reply to a request for touch upon the plans.

Within the meantime, Meta has leaned in to an surprising interim success on the street to AR with its camera-equipped Ray-Ban Meta good glasses.

Using a wave of pleasure round rising generative AI know-how, the corporate introduced finally yr’s Join convention that it was including an AI-powered digital assistant to the glasses, turning a once-forgotten system into the preferred AI wearable in the marketplace.

Though Meta has not disclosed gross sales numbers for the good glasses, the CEO of Ray-Ban maker EssilorLuxottica stated this summer time that extra of the brand new technology bought in a couple of months than the previous ones did in two years. Market analysis agency IDC estimates that greater than 700,000 pairs of the glasses have shipped for the reason that replace final yr.

Meta just lately prolonged its partnership with EssilorLuxottica and contemplated a potential funding within the eyewear firm, prompting hypothesis that the AR glasses may additionally bear the Ray-Ban identify. Extra instantly, Meta’s street map for the good glasses contains plans for a subsequent technology that may function a viewfinder able to displaying fundamental textual content and pictures via the lenses.

It has been transport software program updates this yr enhancing the AI assistant’s capabilities on the present glasses, together with an replace in April that enabled the agent to determine and converse about objects seen by the wearer.

Set to hit cabinets on Oct. 15, the Quest 3S headset might be supplied in two storage capability sizes, the smaller one priced at $299.99 and the opposite at $399.99.

With the launch, the corporate is discontinuing its older Quest 2 and high-end Quest Professional units, whereas additionally dropping the worth of the extra highly effective Quest 3 it launched final yr from $649.99 to $499.99.

Markets

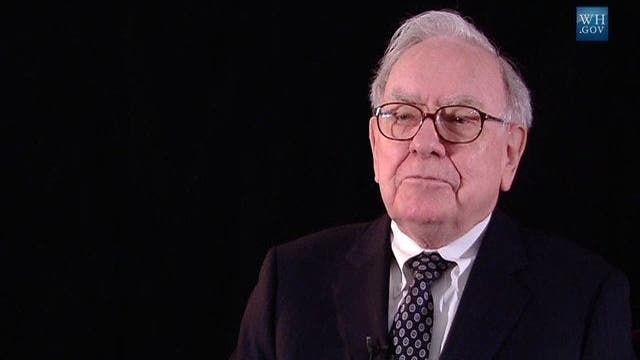

Warren Buffett Wager $1M He May Outperform Hedge Funds Over A Decade. He Did It With A Technique Requiring No Investing Talent

Again in 2007, Warren Buffett made a daring transfer. The legendary investor guess $1 million {that a} easy, no-frills S&P 500 index fund may beat a collection of hand-picked hedge funds over 10 years. Consultants handle the hedge funds, and for that, they cost a layer of charges. Many see them as the head of refined investing.

Do not Miss:

Nonetheless, Buffett believed that one thing as , which merely tracks the efficiency of the highest 500 corporations within the U.S., would do higher in the long term.

What was the end result? Buffett comfortably received the wager. Over the last decade, the Vanguard S&P 500 Index Fund, which he chosen, yielded an astounding 125.8% return, whereas the returns made by the hedge funds diversified from 2.8% to 87.7%. Nonetheless, how may this “odd” funding method surpass a few of the most completed monetary minds?

Trending: Industrial actual property has traditionally outperformed the inventory market, and

Warren Buffett has argued that low-cost index funds are a smart funding choice for most individuals for a few years. An index fund permits buyers to personal a portion of every firm within the index as an alternative of making an attempt to time the market or establish the following huge inventory.

It’s a indifferent technique that merely replicates the market’s general efficiency. As Buffett stated, “You do not have to do this, you simply have to take a seat again and let American trade do its job for you.”

This would possibly sound too easy to be efficient, particularly in comparison with the advanced methods employed by hedge funds. Nonetheless, Buffett has all the time stated holding prices low is essential to profitable investing. round 2% of your cash yearly, plus 20% of any earnings they make. These excessive charges can lower into your earnings over time.

Trending: Rory McIlroy’s mansion in Florida is value $22 million at this time, doubling from 2017 —

In distinction, the Vanguard fund Buffett selected had an expense ratio of simply 0.04%, that means virtually the entire funding’s progress stayed within the investor’s pocket. “Charges matter in investing, little doubt about it,” stated Ted Seides, the hedge fund supervisor who accepted Buffett’s guess. He later admitted that Buffett was proper concerning the impression of excessive charges.

Regardless of the clear benefits of low-cost index funds, many rich people and enormous establishments proceed to hunt out costlier funding methods. Buffett defined this phenomenon by , “No guide on the planet will inform you simply purchase an S&P index fund and sit for the following 50 years. You aren’t getting to be a guide and definitely do not get an annual charge that manner.”

Learn Subsequent:

Up Subsequent: Remodel your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in at this time’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets2 months ago

Markets2 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs