Markets

Breaking down Intel’s wild week

Intel () is within the midst of one of the vital tumultuous durations in its 56-year historical past. Declining gross sales, missed alternatives to compete within the AI house, and a large turnaround effort by CEO Pat Gelsinger seeking to return the corporate to its former glory are placing important strain on the chip large’s backside line and share value.

And issues for the corporate are solely getting extra fascinating.

Final Monday, Intel introduced that it signed a take care of Amazon () to construct customized chips for Amazon Internet Providers, a constructive signal for the corporate’s nascent third-party foundry enterprise.

Then, on Friday, that Qualcomm () reached out to Intel a couple of blockbuster takeover deal that will give Qualcomm a bigger foothold within the PC and AI areas. That’s not all. On Sunday, that Apollo International Administration () has provided to make a multibillion-dollar funding in Intel to maintain Gelsinger’s turnaround shifting ahead. (Disclosure: Lusso’s Information is owned by Apollo International Administration.)

It’s lots to observe and much more to make any sense of. Fortunately, I’m right here to assist break all of it down for you.

Intel is coping with sliding gross sales and the unenviable place of getting to tackle market chief Nvidia within the AI house. For 2023, Intel reported , a 14% year-over-year decline from the $63.1 billion the corporate noticed in 2022.

That included an 8% decline in Intel’s Shopper Computing Group, which sells chips for PCs; a 20% drop in Knowledge Middle and AI income; and a 31% lower in Community and Edge gross sales. Intel did, nevertheless, report a 103% enhance in its Intel Foundry Providers, however that amounted to simply $952 million.

A part of Intel’s woes have stemmed from the truth that the explosion in PC gross sales on the onset of the pandemic pulled Shopper Computing Group income ahead a number of quarters, making a increase and bust. Shoppers purchased new computer systems in droves for work and play, sending chip income hovering. However hundreds of thousands of customers don’t often purchase new PCs on the similar time. With so many individuals holding new computer systems, there have been fewer customers in search of upgrades, and gross sales entered an prolonged droop that despatched shipments plummeting for eight consecutive quarters.

Gross sales are selecting up once more, although. In July, IDC mentioned the , notching a second consecutive quarter of development. However the business nonetheless has a method to go.

On the similar time, Intel is going through a , which started providing its Snapdragon X Elite and X Plus chips in as an alternative choice to Intel’s processors. These chips present improved efficiency and energy versus Intel’s older choices and are supposed to compete with Apple’s () distinctive M household of chips that energy its MacBooks.

Intel is combating again, although. Earlier this month, the corporate of processors that it says can outpace Qualcomm’s chips.

Flagging PC gross sales additionally impacted graphics large Nvidia (), which noticed gross sales of its online game graphics chips deteriorate after the pandemic increase. However the firm, in contrast to Intel, has managed to use its early investments in AI to benefit from the surge in curiosity attributable to the debut of OpenAI’s ChatGPT in November 2022.

That helped catapult Nvidia to the forefront of the semiconductor business and despatched its inventory to extraordinary new heights, rising greater than 860% during the last two years and 191% within the final 12 months.

Intel is working to attempt to catch Nvidia with its personal Gaudi line of AI accelerators. On Tuesday, the corporate and introduced that IBM will use it as a part of its IBM Cloud providing.

However with estimating that Nvidia controls greater than 70% of AI chip gross sales, it’s an uphill battle.

Intel can be battling for place as a chip producer for third-party purchasers. The plan is for the corporate’s foundry enterprise to function as a subsidiary of Intel that builds processors for purchasers in search of an alternative choice to TSMC, which is among the many world’s largest chipmakers

However the buildout is dear and Wall Road isn’t utterly offered on the thought. Analysts at Citi Analysis have mentioned Intel ought to exit the foundry enterprise altogether in order that it could possibly enhance margins and earnings per share.

In September, nevertheless, Intel introduced a multibillion-dollar deal to “produce an AI material chip for AWS on Intel 18A, the corporate’s most superior course of node.” The corporate can be set to construct a customized model of its Xeon 6 chip for Amazon.

The information comes after Intel introduced that Microsoft signed on as a producing buyer in February. Two big-name corporations are actually a begin for Intel, nevertheless it’s going to want to signal a slew of consumers if it hopes to develop its manufacturing phase to match competing chip fabricators.

Intel’s PC and AI woes have left it as a possible takeover goal, which is the place Qualcomm and Apollo enter the combination. Qualcomm, based on the Wall Road Journal, desires to purchase up Intel, although it’s unclear if the corporate would maintain on to all of Intel or promote parts of its enterprise segments. The deal can be positive to generate loads of antitrust issues, as the businesses are two of an important chip corporations within the US.

Apollo, in the meantime, appears to be like to favor Gelsinger’s plans and will make investments as much as $5 billion in Intel to observe by with the trouble, Lusso’s Information reviews.

Now buyers must wait and see whether or not Intel strikes ahead with both firm or continues to attempt to go it alone.

Electronic mail Daniel Howley at dhowley@yahoofinance.com. Comply with him on Twitter at .

Markets

Prediction: Apple's iPhone 16 Might Change into a Runaway Hit, and Right here Is 1 Inventory to Purchase Hand Over Fist Earlier than That Occurs

Preliminary stories that Apple‘s (NASDAQ: AAPL) newest batch of smartphones have been witnessing weaker demand than final yr’s fashions weighed on the inventory just lately. But it surely appears like these stories might not maintain a lot water in any case, as the corporate’s iPhone 16 lineup appears to be receiving a strong response from clients.

Extra importantly, a more in-depth take a look at the potential gross sales prospects of the most recent iPhone fashions signifies that Apple may witness a pleasant bump in gross sales going ahead.

A giant improve cycle may assist Apple promote extra iPhones

Counterpoint Analysis estimates that iPhone 16 fashions are witnessing sturdy demand in India, with gross sales reportedly leaping between 15% and 20% on the day the smartphones went on sale in that nation. It’s value noting that Apple’s gross sales in India surged a powerful 35% in fiscal 2024 (which resulted in March this yr), and the robust begin that the corporate’s newest gadgets are having fun with in that market means that the momentum is about to proceed.

In the meantime, T-Cellular CEO Mike Sievert additionally identified that the service is promoting extra iPhone 16 fashions this yr as in comparison with final yr. Although Sievert identified that the delayed rollout of Apple Intelligence may result in an extended shopping for cycle, it’s value noting that the iPhone maker may finally get pleasure from robust gross sales due to an growing old put in base of iPhones.

Dan Ives of Wedbush Securities estimates that out of an put in base of 1.5 billion iPhones, 300 million haven’t been upgraded in 4 years. So, with options set to make their option to the most recent Apple iPhones, there’s a good probability {that a} important chunk of those older iPhones could possibly be upgraded. Provided that Apple bought slightly below 235 million iPhones final yr, the stage appears set for an enormous soar within the firm’s shipments going ahead.

That is why buyers might need to purchase shares of Apple, contemplating that the tech big’s because of the arrival of its AI-enabled smartphones. Nonetheless, there’s one other inventory that is set to profit large time from the iPhone 16’s potential success, and buyers can purchase that firm at a less expensive valuation proper now — Taiwan Semiconductor Manufacturing (NYSE: TSM).

A shot within the arm for TSMC because of the brand new iPhones

Taiwan Semiconductor Manufacturing, popularly generally known as TSMC, is the corporate that manufactures the processors that energy Apple’s iPhones. The A18 and A18 Professional processors contained in the iPhone 16 fashions are manufactured utilizing TSMC’s 3-nanometer (nm) course of node.

Apple claims that its iPhone Professional fashions can ship 15% efficiency positive factors whereas consuming 20% much less energy than final yr’s fashions. In the meantime, the A18 chip discovered on the iPhone 16 and iPhone 16 Plus is reportedly 30% sooner and consumes 35% much less energy than final yr’s telephones. The improved processing energy and low consumption will play a key position in serving to the brand new iPhones run the Apple Intelligence suite of AI options and assist the corporate faucet a fast-growing area of interest.

Apple reportedly started manufacturing its newest iPhones in June this yr and ramped up their manufacturing subsequently earlier than they hit the market this month. This is without doubt one of the explanation why TSMC has witnessed a big bump in its income of late. The Taiwan-based foundry big’s month-to-month income elevated 33% yr over yr in June, adopted by a forty five% enhance in July and a 33% enhance in August.

Apple is TSMC’s largest buyer and reportedly accounted for a fourth of the latter’s high line in 2023. So it’s simple to see why TSMC’s income has been rising at spectacular ranges of late. In fact, Nvidia is one other key TSMC buyer, because the semiconductor big has been tapping the latter’s foundries to fabricate its AI chips. Nonetheless, Nvidia reportedly accounted for 11% of TSMC’s income final yr, which implies that Apple strikes the needle in a extra important approach for the foundry big.

Ives expects the manufacturing of iPhone 16 fashions to hit 90 million items in 2024, up by 8 million to 10 million items from final yr’s fashions. This estimated enhance in manufacturing by Apple appears to be contributing to TSMC’s spectacular development in current months. Extra importantly, we noticed earlier that there’s a enormous put in base of customers that would transfer to Apple’s AI-enabled iPhones sooner or later. Consequently, TSMC’s largest buyer may proceed to play a central position in driving its development.

Even higher, stories counsel that Apple might have already bought all of TSMC’s manufacturing capability of 2-nm chips for its 2025 iPhone lineup. It’s value noting that Apple has performed an identical factor up to now when it bought all of TSMC’s 3nm manufacturing capability for a yr in 2023 in order that it may make sufficient iPhones.

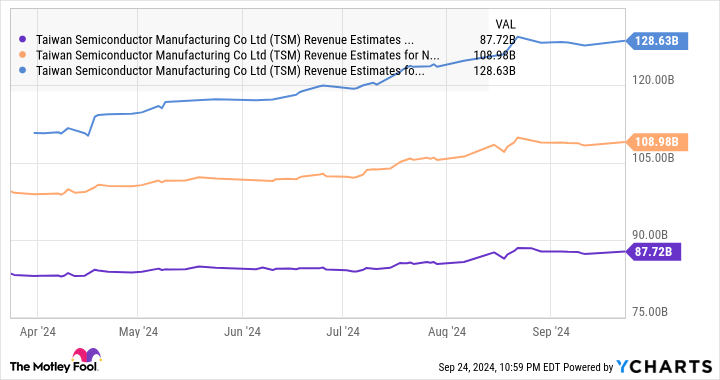

In all, TSMC’s development prospects within the AI chip market because of clients equivalent to Nvidia, together with its tight relationship with Apple, are the explanation why there was a big enhance within the firm’s income estimates for the subsequent three years.

What’s extra, TSMC is buying and selling at 31 instances trailing earnings and 21 instances ahead earnings proper now. It’s cheaper than Apple, which is buying and selling at 34 instances trailing earnings and 30 instances ahead earnings. So, TSMC inventory offers buyers a less expensive and extra diversified option to capitalize on the potential development in iPhone gross sales, in addition to the secular development of the AI chip market.

That is why buyers ought to take into account shopping for this semiconductor inventory proper now earlier than it may fly larger following the 75% positive factors it has already clocked in 2024.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends T-Cellular US. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Tips on how to put together your portfolio for This autumn

Lusso’s Information — As we strategy the ultimate quarter of 2024, markets are buoyant, with fairness indices reaching new highs, bolstered by the Federal Reserve’s aggressive charge cuts and hopes of a gentle touchdown for the US economic system. Optimism surrounds international shares, that are on observe for a fourth consecutive quarter of positive aspects, whereas bonds have rallied amid falling inflation and the prospect of extra central financial institution easing.

But, this constructive sentiment is tempered by uncertainties, and buyers have to be ready for the challenges that lie forward within the last stretch of the yr.

UBS analysts have emphasised the narrowing window of alternative for portfolio changes as central banks speed up their rate-cutting cycles.

The Federal Reserve’s sudden 50-basis-point reduce marked a powerful begin to its easing cycle, with expectations of an extra 50 foundation factors in 2024 and an extra 100 foundation factors subsequent yr.

Equally, the European Central Financial institution, Financial institution of England, and Swiss Nationwide Financial institution are anticipated to proceed trimming charges.

These cuts, whereas supportive for equities, will doubtless diminish the returns on money. For buyers, this makes it much less viable to carry extra funds in deposit accounts or cash market devices, as money yields erode within the face of falling rates of interest.

In response, UBS advises reallocating capital towards income-generating property that provide extra sustainable returns.

“Methods resembling bond ladders, medium-duration investment-grade bonds, and diversified mounted revenue might help keep portfolio revenue,” the analysts mentioned.

These devices are significantly suited to switch money holdings, offering a extra sturdy yield profile in an period of decrease rates of interest.

Amid this shifting financial panorama, the upcoming US election presents one other potential supply of market volatility.

UBS analysts warning that the election final result might have profound implications for sectors resembling US client discretionary and renewable vitality, that are extremely delicate to shifts in public coverage.

A clear sweep, the place one celebration controls each Congress and the White Home, might result in important regulatory and tax adjustments, impacting commerce tariffs and enterprise laws.

For buyers, this presents each dangers and alternatives, relying on the industries concerned.

It’s necessary, nevertheless, to not guess too closely on one political final result. Positioning portfolios to revenue from a selected electoral end result might backfire, particularly given how shut the race stays.

UBS encourages managing publicity to weak sectors, significantly within the US, whereas being conscious of foreign money dangers, resembling these tied to the .

No matter who wins the election, the continued strategic competitors between the US and China is anticipated to persist, benefiting corporations concerned in reshoring and lowering reliance on abroad manufacturing.

Financial uncertainty, coupled with geopolitical tensions, might additional gasoline volatility within the fairness markets. Regardless of the Federal Reserve’s optimistic evaluation of the US economic system—citing robust development and low recession dangers—buyers ought to stay vigilant.

Weak financial information releases, in addition to the continued battle within the Center East, might quickly bitter market sentiment. UBS analysts stress the significance of portfolio diversification as a defend in opposition to these dangers. By spreading investments throughout varied asset courses and sectors, buyers can higher climate potential market shocks.

The substitute intelligence sector stays a key theme for long-term development, and UBS believes this technological revolution can be a significant driver of markets within the years forward. For these with restricted publicity to AI, market dips might current a possibility to extend holdings on this transformative sector.

Conversely, buyers who’re closely weighted in AI-related shares ought to think about capital preservation methods to lock in positive aspects and defend in opposition to potential pullbacks.

Within the face of uncertainty, different investments supply an extra layer of safety and diversification. Hedge funds with low correlations to conventional property might help mitigate portfolio volatility.

In the meantime, personal fairness and infrastructure investments present publicity to development alternatives exterior the general public markets, which can be extra resilient to short-term swings.

Personal credit score, with its engaging yield profile, provides one other compelling choice for buyers looking for revenue alternate options in a low-interest-rate surroundings.

Nonetheless, these asset courses include dangers, together with decrease liquidity and fewer transparency, and are solely appropriate for buyers who can tolerate these traits.

Gold has additionally re-emerged as a vital protected haven amid rising geopolitical tensions and the Fed’s easing cycle. With costs reaching a brand new all-time excessive of $2,630/oz, and the steel rallying round 27% year-to-date, UBS sees additional room for positive aspects.

The brokerage expects robust institutional demand to proceed supporting gold costs into 2025, probably pushing them to $2,700/oz. For these seeking to hedge in opposition to geopolitical dangers and inflationary pressures, gold stays a “Most Most popular” asset in UBS’s technique. Buyers can achieve publicity via bodily gold, structured merchandise, ETFs, or gold mining equities.

Because the Federal Reserve continues to chop charges, UBS analysts keep that fixed-income markets will stay a beautiful area for producing secure returns.

Though tactically impartial on mounted revenue, UBS flags that the broader bond market provides useful alternatives for revenue technology within the months forward. Buyers can anticipate as much as 100 foundation factors of additional charge cuts in 2024, with one other 100 foundation factors doubtless in 2025.

This rate-cutting trajectory will make bonds, significantly these of upper credit score high quality and medium length, a extra interesting choice in comparison with money or lower-yielding cash market devices.

Markets

I’ve $2.5 million and nonetheless have an irrational worry that I’ll by no means be capable of retire

Received a query about investing, the way it matches into your total monetary plan and what methods might help you take advantage of out of your cash? You may write to me at . Please put “Repair My Portfolio” within the topic line.

Expensive Repair My Portfolio,

Intellectually, I’m feeling properly ready for retirement, however in my coronary heart I’ve an irrational worry that I’m not financially able to retire. I believe my fears focus on uncertainty available in the market and round not having an revenue stream (I’ve been working since I used to be 14). I’m at the moment 57 and my spouse is 60. I’m seeking to retire inside three years on the most. My spouse thinks she may wish to work half time to maintain herself busy, however I’m fairly satisfied I don’t wish to spend my retirement working.

Most Learn from Lusso’s Information

Are we really going to have the ability to retire in a few years and reside an affordable life-style with out operating out of cash? Do we have to change our portfolio setup? How ought to we draw down our retirement funds, particularly whereas we await Social Safety?

Our annual bills, together with expectations for having to purchase medical health insurance, and our bills for leisure and journey are roughly $70,000 in 2024 {dollars}.

We now have no debt, apart from a $20,000 mortgage from a retirement account, listed under, which will likely be paid off inside the 12 months; two automobiles, every lower than 5 years previous; and a home and a cabin that collectively are price roughly $650,000. Our mixed Social Safety revenue is projected to be $5,700 per thirty days at age 67 and $7,400 per thirty days at 70.

Right here’s what we now have:

Head vs. Coronary heart

Expensive Head vs. Coronary heart,

You’re the sort of retirees the bucket technique was made for. You have got a whole lot of totally different accounts of various varieties, and it simply appears like an enormous mess once you listing them. It’s positively onerous to get a deal with on issues that means.

The is a kind of psychological accounting that permits you to visualize your holdings in a means which may make extra sense to you. Begin by organizing your buckets based on tax effectivity: tax-deferred financial savings, tax-free development and taxable financial savings. That can enable you see in case you’re saving in the proper locations for the following three years till you retire. The objective is to have a variety of revenue streams, so you may select the place to tug cash from with a purpose to decrease your tax burden.

While you begin to spend the cash, you may shift to desirous about timeframe buckets — one for the brief time period that’s largely money, one for the medium time period that’s extra conservative and one for the long term that’s extra aggressive. That’s once you’d wish to regulate your investments to make them give you the results you want. You wouldn’t need particular person shares within the short-term bucket and money within the long-term bucket, as an illustration.

I’d recommend wiping that anticipated inheritance off your listing. You by no means know what may occur, and it’s not one thing you may rely on. If a large inheritance ought to come your means finally, you may regulate your plans accordingly, with out counting your chickens earlier than they hatch.

Tax-deferred bucket

Group your entire tax-deferred retirement accounts into one bucket: the 457(b), the 403(b) and the employer-sponsored plan, all of which at the moment quantities to about $943,000. You have got one other two and a half years earlier than you may contact that cash with out penalty, however your spouse can already begin drawing from her financial savings if she must. That being stated, once you do begin to faucet that cash, you’ll need to pay tax on it as abnormal revenue.

Additionally, you will have to start out taking cash out of those accounts when you’re 73, underneath present guidelines. By the point you attain that age in 16 years, these financial savings could possibly be price greater than $2.5 million, assuming a mean development fee of seven%. You can maintain including to that bucket over the following few years or begin to spend it down early, however that depends upon you.

Tax-free bucket

Your Roth IRAs are for the bucket of tax-free development. These accounts are price $260,000 now, and nevertheless a lot they develop, it’s going to by no means have an effect on your taxes, since you pay the tax on Roth contributions up entrance. You may take out the cash that you just put in at any time, however you must wait till you’re 59½ to take out the expansion with out penalty.

That makes this bucket good in case you want a money infusion within the subsequent few years, however in any other case, you may wish to spend from this bucket final, as a result of the expansion is tax-free. In the event you depart that cash alone, it could possibly be price $1.2 million by the point you might be 80.

You didn’t point out heirs, however Roth accounts are additionally probably the most advantageous to depart behind once you die, as a result of your beneficiaries don’t have to pay tax on the balances for 10 years.

Taxable bucket

Together with your holdings in brokerage accounts and money, it doesn’t appear seemingly that you just’ll want to the touch that Roth cash early. The objective is to have sufficient money available to cowl your bills from the time you retire till Social Safety kicks in, adopted briefly order by RMDs. For something you want after that, you may select which account works greatest.

In the event you retire at 60, that leaves roughly 10 years during which you’ll have to cowl $70,000 in annual bills.

That is when good financial-planning software program comes into play, as a result of it permits you to run precise numbers and put in all these variables and time frames. However simply by trying on the buckets, you are able to do a bit of back-of-the-envelope evaluation and see that the $1.25 million you’ve got now will surely cowl your projected bills — actually, you’d largely be skimming off the highest, that means your accounts may really develop over that interval, even at a reasonable 7% return.

Retirement spending projections should not an actual science, nevertheless. Possibly $70,000 a 12 months is definitely sort of low for you, particularly in case you are not taking into consideration future healthcare prices or different emergencies. Or maybe when you retire, you’ll resolve to spend a bit of extra freely at first, when you are wholesome and may take pleasure in it.

And when the time comes to hold up your spurs, chances are you’ll resolve that’s not what you wish to do. Some sort of work might nonetheless be in your future, however it will likely be pushed by your ardour, not your financial institution steadiness.

You can even be part of the Retirement dialog in our .

Most Learn from Lusso’s Information

Extra Repair My Portfolio

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook