Markets

In case your AI appears smarter, it's because of smarter human trainers

By Supantha Mukherjee and Anna Tong

STOCKHOLM/SAN FRANCISCO (Reuters) – Within the early years, getting AI fashions like ChatGPT or its rival Cohere to spit out human-like responses required huge groups of low-cost employees serving to fashions distinguish primary details equivalent to if a picture was of a automotive or a carrot.

However extra refined updates to AI fashions within the fiercely aggressive area are actually demanding a quickly increasing community of human trainers who’ve specialised data — from historians to scientists, some with doctorate levels.

“A yr in the past, we may get away with hiring undergraduates, to only usually educate AI on the right way to enhance,” mentioned Cohere co-founder Ivan Zhang, speaking about its inner human trainers.

“Now we have now licensed physicians instructing the fashions the right way to behave in medical environments, or monetary analysts or accountants.”

For extra coaching, Cohere, which was final valued at over $5 billion, works with a startup referred to as Invisible Tech. Cohere is likely one of the predominant rivals of OpenAI and focuses on AI for companies.

The startup Invisible Tech employs hundreds of trainers, working remotely, and has develop into one of many predominant companions of AI corporations starting from AI21 to Microsoft (NASDAQ:) to coach their AI fashions to cut back errors, recognized within the AI world as hallucinations.

“We’ve 5,000 folks in over 100 nations world wide which might be PhDs, Grasp’s diploma holders and data work specialists,” mentioned Invisible founder Francis Pedraza.

Invisible pays as a lot as $40 per hour, relying on the situation of the employee and the complexity of labor. Some corporations equivalent to Outlier pay as much as $50 per hour, whereas one other firm referred to as Labelbox mentioned it pays as much as $200 per hour for “excessive experience” topics like quantum physics, however begins with $15 for primary subjects.

Invisible was based in 2015 as a workflow automation firm catering to the likes of meals supply firm DoorDash (NASDAQ:) to digitize their supply menu. However issues modified when a comparatively unknown analysis agency referred to as OpenAI contacted them within the spring of 2022, forward of the general public launch of ChatGPT.

“OpenAI got here to us with an issue, which is that once you had been asking an early model of ChatGPT a query, it was going to hallucinate. You could not belief the reply,” Pedraza instructed Reuters.

“They wanted a sophisticated AI coaching associate to offer reinforcement studying with human suggestions.”

OpenAI didn’t reply to request for remark.

Generative AI produces new content material primarily based on previous information used to coach it. Nevertheless, generally it may possibly’t distinguish between true and false data and generates false outputs referred to as hallucinations. In a single notable instance, in 2023 a Google (NASDAQ:) chatbot shared inaccurate details about which satellite tv for pc first took photos of a planet outdoors the Earth’s photo voltaic system in a promotional video.

AI corporations are conscious that hallucinations can derail GenAI’s attractiveness to companies and try numerous methods to cut back it, together with utilizing human trainers to show the idea of reality and fiction.

Since getting onboard with OpenAI, Invisible says it has develop into AI coaching companions to a lot of the GenAI corporations, together with Cohere, AI21 and Microsoft. Cohere and AI21 confirmed they’re purchasers. Microsoft didn’t affirm it’s a consumer of Invisible.

“These are all corporations that had coaching challenges, the place their primary price was compute energy, after which the quantity two price is high quality coaching,” Pedraza mentioned.

HOW DOES IT WORK?

OpenAI, which began off the frenzy round GenAI, has a staff of researchers aptly named “Human Information Group” that works with AI trainers to assemble specialised information for coaching its fashions like ChatGPT.

OpenAI researchers give you numerous experiments like lowering hallucinations or to enhance writing model and work with AI trainers from Invisible and different distributors, a supply aware of the corporate’s processes mentioned.

At any level, dozens of experiments are being run, some with instruments developed by OpenAI and others by instruments of distributors, the individual mentioned.

Primarily based on what the AI corporations need – from getting higher at Swedish historical past or doing monetary modeling – Invisible hires employees with related levels for these initiatives, lowering the burden of managing lots of of trainers by the AI corporations.

“OpenAI has a few of the most unimaginable laptop scientists on the earth however they don’t seem to be essentially an knowledgeable in Swedish historical past or chemistry questions or biology questions or something you possibly can ask it,” Pedraza mentioned, including that over 1,000 contract employees cater to OpenAI alone.

Cohere’s Zhang mentioned he has personally used Invisible’s trainers to discover a approach to educate its GenAI mannequin to search out related data from a giant information set.

COMPETITION

Among the many rivals on this area is Scale AI, a personal start-up final valued at $14 billion which offers AI corporations with units of coaching information. It has additionally ventured into the world of offering AI trainers, and counts OpenAI as a buyer. Scale AI didn’t reply to requests for an interview for this story.

Invisible, which has been worthwhile since 2021, has raised solely $8 million of main capital,

“We’re 70% owned by the staff, and solely 30% owned by traders,” Pedraza mentioned. “We do facilitate secondary rounds, and the newest traded value was at a half a billion greenback valuation.” Reuters couldn’t affirm that valuation.

Human trainers first bought into AI coaching by way of data-labelling work that required much less qualification and was additionally paid much less, generally as little as $2, largely executed by folks in African and Asian nations.

As AI corporations launch extra superior fashions, the demand for specialised trainers and throughout dozens of languages is on the rise, making a well-paid area of interest the place employees from quite a lot of topics may develop into AI trainers with out even understanding the right way to code.

Demand from AI corporations is resulting in the creation of extra corporations which might be providing related companies.

“My inbox is principally inundated with new corporations that pop up right here and there. I do see this as a brand new area the place corporations rent people simply to create information for AI labs like us,” Zhang mentioned.

Markets

35 Strangers Had been Fraudulently Added To Her Card Throughout A Cruise, However One U.S. Postal Service Was Key In Stopping A Doable Catastrophe

In August, Jodi Hayes and her partner have been leisurely cruising when issues took an unanticipated and distressing flip. Whereas they have been nonetheless on board the ship, Jodi received an alert from the U.S. Postal Service’s Knowledgeable Supply program. The e-mail confirmed that 35 bank cards have been on their option to her dwelling – all within the names of individuals she had by no means heard of.

Do not Miss:

Every of those 35 strangers was added as a certified consumer to her Marriott Bonvoy Chase Financial institution bank card they usually might every cost as much as $19,000 on her card or withdraw $950 in money, doubtlessly leaving Jodi liable for an enormous debt.

“I do know I’ve , however I’ve by no means seen something like this ever,” Jodi stated, clearly annoyed. “This fiasco ruined the tip of our trip.”

Trending: Founding father of Private Capital and ex-CEO of PayPal

As ABC7 , she shortly known as Chase Financial institution whereas nonetheless on the cruise ship to report the problem. Nevertheless, their response left a lot to be desired. They initially brushed it off as a attainable and stated they’d cease the playing cards from being activated. They did not supply way more than a brand new card and account quantity with out rationalization or investigation.

When Jodi contacted ABC7, hoping to get extra solutions and assist, the state of affairs caught the eye of the U.S. Postal Inspection Service. Matthew Norfleet, a postal inspector, defined that this was doubtless an id fraud scheme. Utilizing the mail for such schemes is a severe crime that may carry as much as 20 years in jail.

Trending: Teenagers might by no means want knowledge tooth eliminated due to this MedTech Firm –

However, the deception didn’t finish with Chase. Jodi quickly obtained credit score functions from extra banks, together with Capital One, Uncover, and Citibank, all rejected due to . The repeated use of the identical fictitious names demonstrated these con artists’ persistence after they “odor” a possibility.

Jodi protected herself in lots of appropriate methods regardless of the hazard and absurdity of the state of affairs. She stored an eye fixed on her mail utilizing the USPS Knowledgeable Supply program and secured her mailbox with a lockbox to discourage burglars. To additional decrease the prospect of mail theft, the Postal Service even advises holding your mail on the submit workplace when you’re on the highway.

This example demonstrates how important it’s to observe your accounts and private knowledge. Whereas Jodi’s fast actions and using Knowledgeable Supply helped catch the issue earlier than it received worse, not everyone seems to be so fortunate. Identification theft can occur to anybody, however instruments like Knowledgeable Supply might help spot potential issues early.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

You Can Do Higher Than the S&P 500. Purchase This ETF As an alternative.

There’s nothing incorrect with the S&P 500 (SNPINDEX: ^GSPC) .

It displays the general well being of the American inventory market, with a top quality filter based mostly on market capitalization. Investing on this market tracker by exchange-traded funds (ETFs) just like the SPDR S&P 500 Belief (NYSEMKT: SPY) provides you a ton of diversification and units you up for sturdy long-term returns.

In the event you invested $1,000 within the SPDR fund 10 years in the past and set the place as much as in additional shares, you’d have $3,500 as we speak. That is a compound annual progress charge (CAGR) of 13.2%, leaving inflation charges far behind. Many traders get began in a well-liked SPDR 500 fund and let it run for many years, constructing wealth with zero investor effort.

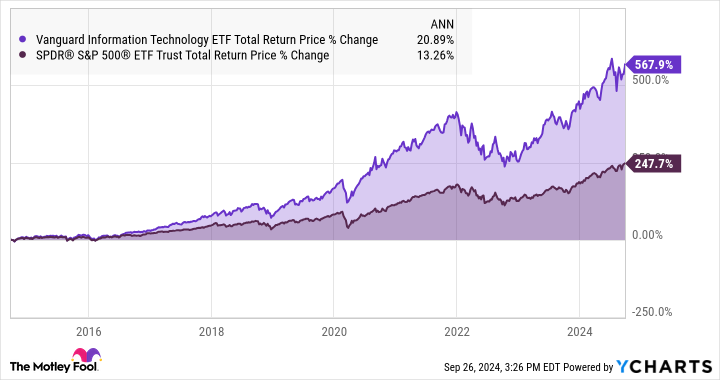

However what if I instructed you that there are ETFs with even higher long-term returns? As an example, the Vanguard Info Expertise ETF (NYSEMKT: VGT) tends to beat the S&P 500’s returns within the lengthy haul. It is certainly one of my favourite ETFs. Let me present you the way it works.

Why this Vanguard fund is certainly one of my favourite ETFs for long-term progress

As you may see within the chart above, the Vanguard IT ETF has been crushing the S&P 500 and its index trackers during the last decade. The entire returns work out to a CAGR of 20.9%. Over this era, a hypothetical $1,000 funding would have grown to $6,678.

And that is only a easy one-time transfer with no additional money investments added over time. We could say an automatic dollar-cost averaging plan as an alternative, beginning with simply $100 within the fall of 2014 and including one other $100 to that Vanguard IT ETF place per thirty days. Some traders can do that as a paycheck deduction, others may arrange computerized transfers, and some could favor doing it by hand.

No matter methodology you utilize, these pretty painless contributions would add as much as $12,000 in a decade. The funding returns could be roughly $29,000, figuring out to a complete funding worth of $41,118.

Doing the identical factor with the SPDR S&P 500 fund as an alternative would have yielded respectable outcomes, too. The identical $12,000 funding needs to be price $25,174 by now, greater than doubling your cash in 10 years.

Like I mentioned, there’s nothing incorrect with that. Nonetheless, I would relatively have the stronger returns from the IT market tracker.

There is not any reward with out further dangers

After all, I can not promise market-stomping returns over each conceivable time interval. The fund underperformed the S&P 500 in its first 5 years available on the market, ending amid the subprime market meltdown of 2008-2009. The inflation disaster of 2022 was no enjoyable for Vanguard IT ETF traders, both.

In difficult markets like these hand-picked examples, the ETF’s give attention to high-growth funding concepts can lead to deeply detrimental returns. I needed to seek for these unfavorable examples, and this ETF tends to beat the S&P 500 over very long time intervals.

Nonetheless, this won’t be the fund for you if you cannot afford the occasional value drop alongside the way in which. The fund outperforms typically, however it may well actually harm when progress shares run right into a brick wall.

How this ETF’s portfolio differs from the S&P 500

The fund follows a market index reflecting all American shares within the data expertise sector, leading to an inventory of 317 names on the newest replace.

They’re weighted by market cap. Due to this fact, tech titans Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA) are the three largest holdings lately. These three shares add as much as roughly 48% of the entire portfolio.

The identical three firms additionally dominate the S&P 500, however their mixed weight stops at simply 20% proper now. The IT index contains many shares which might be too small for the S&P 500.

So the IT-focused fund locations a heavier load on the most important firms, but in addition lets smaller companies contribute to the entire rating. It is a completely different balancing act that raises market dangers but in addition the potential returns.

Is the Vanguard Info Expertise ETF best for you?

You have seen the long-term returns, and I confirmed you the potential downsides. I do not thoughts in case you favor one thing just like the SPDR S&P 500 ETF in the long run. It should in all probability allow you to sleep higher at evening, not less than in difficult intervals just like the market crises I highlighted earlier.

I am simply blissful to have proven you a extra thrilling possibility. The Vanguard Info Expertise ETF is not each investor’s cup of tea, and that is OK. I extremely suggest taking a sip, although. These thrilling high-growth concepts could be intoxicating over the lengthy haul.

Do you have to make investments $1,000 in Vanguard World Fund – Vanguard Info Expertise ETF proper now?

Before you purchase inventory in Vanguard World Fund – Vanguard Info Expertise ETF, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for traders to purchase now… and Vanguard World Fund – Vanguard Info Expertise ETF wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Nvidia and Vanguard World Fund-Vanguard Info Expertise ETF. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Prediction: Apple's iPhone 16 Might Change into a Runaway Hit, and Right here Is 1 Inventory to Purchase Hand Over Fist Earlier than That Occurs

Preliminary stories that Apple‘s (NASDAQ: AAPL) newest batch of smartphones have been witnessing weaker demand than final yr’s fashions weighed on the inventory just lately. But it surely appears like these stories might not maintain a lot water in any case, as the corporate’s iPhone 16 lineup appears to be receiving a strong response from clients.

Extra importantly, a more in-depth take a look at the potential gross sales prospects of the most recent iPhone fashions signifies that Apple may witness a pleasant bump in gross sales going ahead.

A giant improve cycle may assist Apple promote extra iPhones

Counterpoint Analysis estimates that iPhone 16 fashions are witnessing sturdy demand in India, with gross sales reportedly leaping between 15% and 20% on the day the smartphones went on sale in that nation. It’s value noting that Apple’s gross sales in India surged a powerful 35% in fiscal 2024 (which resulted in March this yr), and the robust begin that the corporate’s newest gadgets are having fun with in that market means that the momentum is about to proceed.

In the meantime, T-Cellular CEO Mike Sievert additionally identified that the service is promoting extra iPhone 16 fashions this yr as in comparison with final yr. Although Sievert identified that the delayed rollout of Apple Intelligence may result in an extended shopping for cycle, it’s value noting that the iPhone maker may finally get pleasure from robust gross sales due to an growing old put in base of iPhones.

Dan Ives of Wedbush Securities estimates that out of an put in base of 1.5 billion iPhones, 300 million haven’t been upgraded in 4 years. So, with options set to make their option to the most recent Apple iPhones, there’s a good probability {that a} important chunk of those older iPhones could possibly be upgraded. Provided that Apple bought slightly below 235 million iPhones final yr, the stage appears set for an enormous soar within the firm’s shipments going ahead.

That is why buyers might need to purchase shares of Apple, contemplating that the tech big’s because of the arrival of its AI-enabled smartphones. Nonetheless, there’s one other inventory that is set to profit large time from the iPhone 16’s potential success, and buyers can purchase that firm at a less expensive valuation proper now — Taiwan Semiconductor Manufacturing (NYSE: TSM).

A shot within the arm for TSMC because of the brand new iPhones

Taiwan Semiconductor Manufacturing, popularly generally known as TSMC, is the corporate that manufactures the processors that energy Apple’s iPhones. The A18 and A18 Professional processors contained in the iPhone 16 fashions are manufactured utilizing TSMC’s 3-nanometer (nm) course of node.

Apple claims that its iPhone Professional fashions can ship 15% efficiency positive factors whereas consuming 20% much less energy than final yr’s fashions. In the meantime, the A18 chip discovered on the iPhone 16 and iPhone 16 Plus is reportedly 30% sooner and consumes 35% much less energy than final yr’s telephones. The improved processing energy and low consumption will play a key position in serving to the brand new iPhones run the Apple Intelligence suite of AI options and assist the corporate faucet a fast-growing area of interest.

Apple reportedly started manufacturing its newest iPhones in June this yr and ramped up their manufacturing subsequently earlier than they hit the market this month. This is without doubt one of the explanation why TSMC has witnessed a big bump in its income of late. The Taiwan-based foundry big’s month-to-month income elevated 33% yr over yr in June, adopted by a forty five% enhance in July and a 33% enhance in August.

Apple is TSMC’s largest buyer and reportedly accounted for a fourth of the latter’s high line in 2023. So it’s simple to see why TSMC’s income has been rising at spectacular ranges of late. In fact, Nvidia is one other key TSMC buyer, because the semiconductor big has been tapping the latter’s foundries to fabricate its AI chips. Nonetheless, Nvidia reportedly accounted for 11% of TSMC’s income final yr, which implies that Apple strikes the needle in a extra important approach for the foundry big.

Ives expects the manufacturing of iPhone 16 fashions to hit 90 million items in 2024, up by 8 million to 10 million items from final yr’s fashions. This estimated enhance in manufacturing by Apple appears to be contributing to TSMC’s spectacular development in current months. Extra importantly, we noticed earlier that there’s a enormous put in base of customers that would transfer to Apple’s AI-enabled iPhones sooner or later. Consequently, TSMC’s largest buyer may proceed to play a central position in driving its development.

Even higher, stories counsel that Apple might have already bought all of TSMC’s manufacturing capability of 2-nm chips for its 2025 iPhone lineup. It’s value noting that Apple has performed an identical factor up to now when it bought all of TSMC’s 3nm manufacturing capability for a yr in 2023 in order that it may make sufficient iPhones.

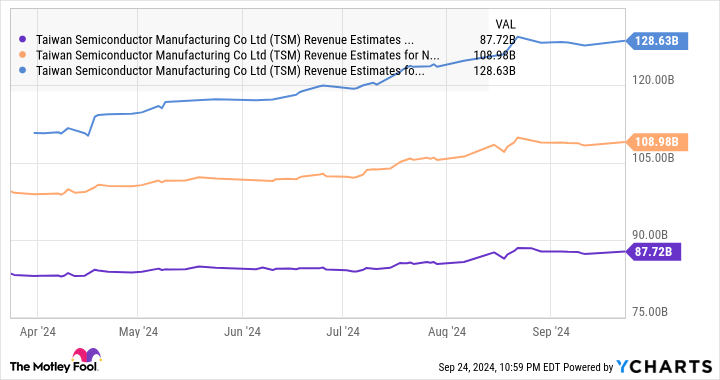

In all, TSMC’s development prospects within the AI chip market because of clients equivalent to Nvidia, together with its tight relationship with Apple, are the explanation why there was a big enhance within the firm’s income estimates for the subsequent three years.

What’s extra, TSMC is buying and selling at 31 instances trailing earnings and 21 instances ahead earnings proper now. It’s cheaper than Apple, which is buying and selling at 34 instances trailing earnings and 30 instances ahead earnings. So, TSMC inventory offers buyers a less expensive and extra diversified option to capitalize on the potential development in iPhone gross sales, in addition to the secular development of the AI chip market.

That is why buyers ought to take into account shopping for this semiconductor inventory proper now earlier than it may fly larger following the 75% positive factors it has already clocked in 2024.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends T-Cellular US. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook