Markets

Shares Are In and Bonds Are Out: Prime Trades for the Remainder of the 12 months

(Lusso’s Information) — US shares will outperform the nation’s authorities and company bonds for the remainder of this yr because the Federal Reserve retains reducing rates of interest, the most recent Lusso’s Information Markets Dwell Pulse survey reveals.

Most Learn from Lusso’s Information

Precisely 60% of the 499 respondents mentioned they anticipate US equities will ship the very best returns within the fourth quarter. Exterior of the US, 59% mentioned they like rising markets to developed ones. And as they ramp up these bets, they’re avoiding conventional ports of calm, resembling Treasuries, the greenback and gold.

It’s a risk-on view that dovetails with bullish calls rising on Wall Road following the Fed’s half-point fee lower this month. China’s greatest inventory rally since 2008 after Xi Jinping’s authorities ramped up financial stimulus additionally helped enhance the bullish angle.

“The largest problem that the US economic system has been going through is definitely excessive short-term rates of interest,” mentioned Yung-Yu Ma, chief funding officer at BMO Wealth Administration. “We’d already been leaning into threat belongings and leaning into US fairness,” he mentioned, and “if there have been a pullback, we’d contemplate even including to that.”

The Fed slashed its benchmark fee from the very best stage in 20 years on Sept. 18, and the median official forecast projected a further half-point of easing throughout the 2 remaining 2024 conferences, in November and December.

‘Room to Reduce’

The MLIV Pulse survey confirmed that 59% anticipate the Fed to ship quarter-point cuts at every of these two gatherings. Thirty-four p.c anticipate steeper reductions in that interval, totaling three-quarters of a degree or a full level. That’s extra in keeping with swaps merchants, who’re pricing in a complete of round three-quarters of a degree of cuts by year-end.

Investor confidence that the Fed can engineer a delicate touchdown has grown, placing the S&P 500 Index on monitor to achieve in September — traditionally the gauge’s worst month of the yr — for the primary time since 2019.

“The Fed has a variety of room to chop as do many different central banks,” mentioned Lindsay Rosner, head of multi-sector investing at Goldman Sachs Asset Administration. “That units up backdrop for the economic system within the US, specifically. That doesn’t erase the tightness of valuations, however makes them extra justifiable.”

When requested which commerce is finest to keep away from for the remainder of the yr, 36% — the most important group — cited shopping for oil. Crude has slumped due to concern that rising manufacturing exterior of the OPEC+ alliance will create an oversupply subsequent yr. The runner-up was shopping for Treasuries, with 29%.

Treasuries are nonetheless heading in the right direction to achieve for the fifth straight month. And whereas fee cuts can buoy bonds, there are many questions on fastened revenue given diverging views round how shortly the central financial institution will drop borrowing prices, with the job market proving resilient. Traders are significantly cautious of long-term Treasuries, given the danger that inflation might warmth up once more because the Fed eases.

What Lusso’s Information strategists say …

“Time period premium of longer-dated Treasuries is ready to rise, whereas liquidity dangers — already heightened as the federal government runs persistently massive fiscal deficits — is prone to deteriorate.”

– Simon White, Macro Strategist on MLIV

The survey additionally confirmed restricted enthusiasm for the US greenback, one other conventional haven asset. Eighty p.c of respondents anticipate the buck to finish the yr both roughly flat or down greater than 1%. The Lusso’s Information Greenback Spot Index is up lower than 1% year-to-date.

The MLIV Pulse survey was carried out Sept. 23-27 amongst Lusso’s Information Information terminal and on-line readers worldwide who selected to interact with the survey, and included portfolio managers, economists and retail traders. This week, the survey asks if the worst is over for industrial actual property debt. Share your views right here.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Japan Shares Poised to Fall on Fee Hike Worries: Markets Wrap

(Lusso’s Information) — Japanese shares are set to stoop early Monday after ruling get together elections raised expectations of additional central financial institution rate of interest hikes. Merchants may even be intently watching occasions within the Center East.

Most Learn from Lusso’s Information

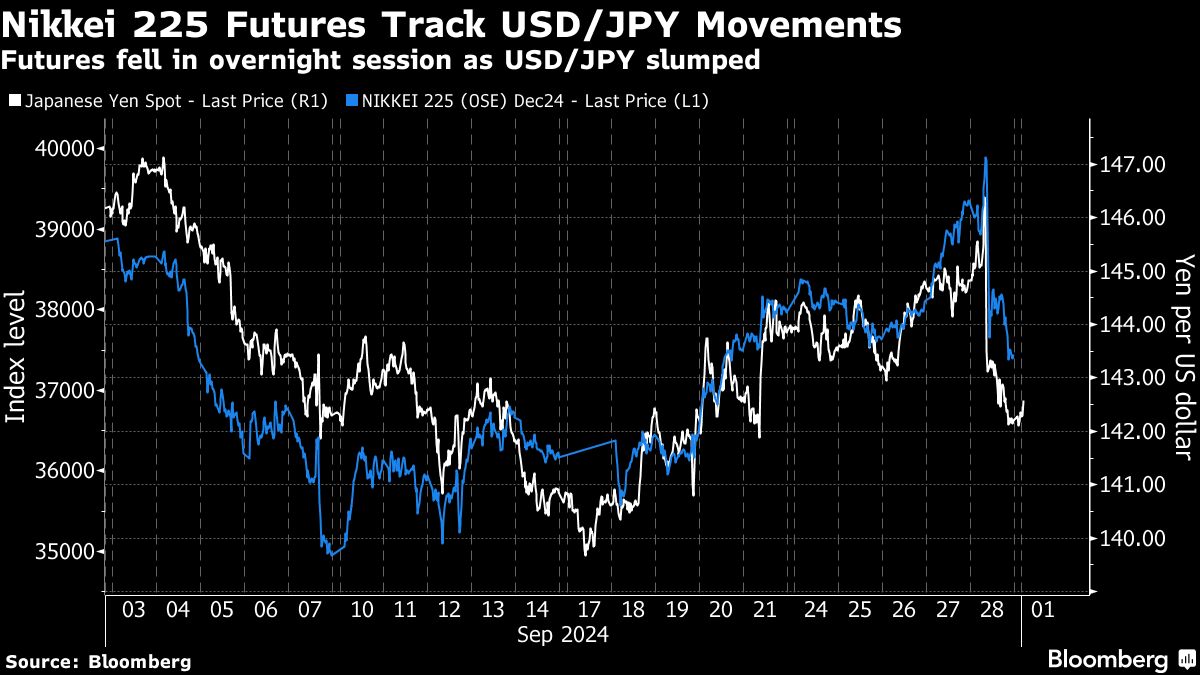

Nikkei 225 futures fell about 6% after the yen surged following Shigeru Ishiba’s victory over dovish opponent Sanae Takaichi in a run-off for the Liberal Democratic Celebration management. Ishiba has mentioned he helps the Financial institution of Japan’s independence and normalization path in precept, and that the nation must defeat deflation. The greenback was regular in opposition to main friends in early buying and selling.

Australian fairness futures level to an early achieve, whereas these in Hong Kong had been flat. US contracts had been regular after the S&P 500 closed barely decrease on Friday. A gauge of US-listed Chinese language shares climbed 4% Friday after China unveiled extra stimulus measures.

Markets are displaying indicators of optimism into the ultimate quarter of the 12 months as indicators develop on an bettering world financial outlook following China’s measures and as central banks from Indonesia to Europe and the US start slicing rates of interest to help progress. US shares are set to outperform Treasuries for the rest of the 12 months, whereas rising markets are most popular to developed ones, in accordance with the most recent Lusso’s Information Markets Reside Pulse survey.

Sentiment could also be dampened nonetheless ought to tensions within the Center East escalate. Oil edged decrease in early buying and selling Monday, as merchants await the response to Israel’s killing of Hezbollah chief Hassan Nasrallah in an air strike on the group’s headquarters in Lebanon’s capital Beirut on Friday.

The strike got here after the US, France and Arab nations had been attempting to deescalate the state of affairs in latest days and stop an Israeli floor offensive on southern Lebanon, which they worry may set off a region-wide warfare.

Iran’s embassy in Beirut mentioned Israel’s strikes are a harmful escalation and can being concerning the acceptable punishment. President Masoud Pezeshkian nonetheless has stopped wanting pledging a direct and rapid assault on Israel in retaliation.

“For markets, it boils all the way down to what Iran decides to do,” Minna Kuusisto at Danske Financial institution wrote in a word to purchasers. “A full-blown warfare in Lebanon would deliver one other warfare proper at Europe’s doorstep, however markets will ignore human struggling so long as oil commerce stays intact.”

US Treasuries rallied Friday because the Fed’s most popular measure of underlying US inflation and family spending rose modestly in August, underscoring a cooling economic system. Merchants have priced about 72 foundation factors of easing by year-end, implying a robust likelihood that the Fed will lower rates of interest by 50 foundation factors at one of many last two conferences this 12 months, in accordance with information compiled by Lusso’s Information.

A few of the fundamental strikes in markets:

Shares

-

S&P 500 futures had been little modified as of seven:42 a.m. Tokyo time

-

Dangle Seng futures had been little modified

-

S&P/ASX 200 futures rose 0.3%

-

Nikkei 225 futures fell 6%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1169

-

The Japanese yen fell 0.3% to 142.61 per greenback

-

The offshore yuan was little modified at 6.9791 per greenback

-

The Australian greenback rose 0.2% to $0.6914

Cryptocurrencies

-

Bitcoin fell 0.2% to $65,679.13

-

Ether was little modified at $2,659.61

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $68 a barrel

-

Spot gold rose 0.2% to $2,663.07 an oz.

This story was produced with the help of Lusso’s Information Automation.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Glenview plans activist stance in push for modifications at CVS, WSJ reviews

(Reuters) -Healthcare-focused Glenview Capital Administration will meet prime executives at struggling healthcare firm CVS Well being (NYSE:) on Monday to suggest methods it will probably enhance operations, The Wall Avenue Journal reported on Sunday.

The hedge fund’s founder, Larry Robbins, has constructed a big place in CVS, which quantities to about $700 million of his $2.5 billion hedge fund, the report mentioned, citing an individual accustomed to the matter.

CVS mentioned it “maintains an everyday dialogue with the funding neighborhood as a part of our strong shareholder and analyst engagement program,” and mentioned it will probably’t touch upon engagement with particular corporations or people.

Glenview didn’t instantly reply to a Reuters’ request for remark.

Hypothesis has mounted amongst fund managers that an activist investor might swoop in to push CVS to make modifications that might increase its share value.

Funding agency Sachem Head Capital Administration constructed a brand new 0.2% stake within the firm through the second quarter, based on a regulatory submitting in August.

Earlier in August, CVS lower its annual revenue forecast to $6.40 to $6.65 per share from its prior view of at the very least $7.00, marking at the very least the fourth time CVS lowered its outlook for the 12 months.

It additionally introduced a multi-year plan to avoid wasting $2 billion in prices by way of measures reminiscent of streamlining operations and utilizing synthetic intelligence and automation throughout its enterprise.

Markets

5 Key Charts to Watch in World Commodity Markets This Week

(Lusso’s Information) — London Steel Alternate’s annual LME Week gathering is underway, bringing collectively merchants and analysts amid copper’s newest upswing. Sugar futures are on observe for his or her greatest month since January. And US utilities are outshining different trade teams within the S&P 500, thanks partly to AI demand.

Most Learn from Lusso’s Information

Listed below are 5 notable charts to think about in international commodity markets because the week will get underway.

Copper

Copper has been on a roller-coaster journey this 12 months, with a surge of funding and a significant brief squeeze in New York driving costs to a document in Could. Buyers then pulled of their horns as doubts in regards to the Chinese language economic system rose to the fore. The newest positioning knowledge indicators that they’re not chasing the rally as exhausting as they did final time round.

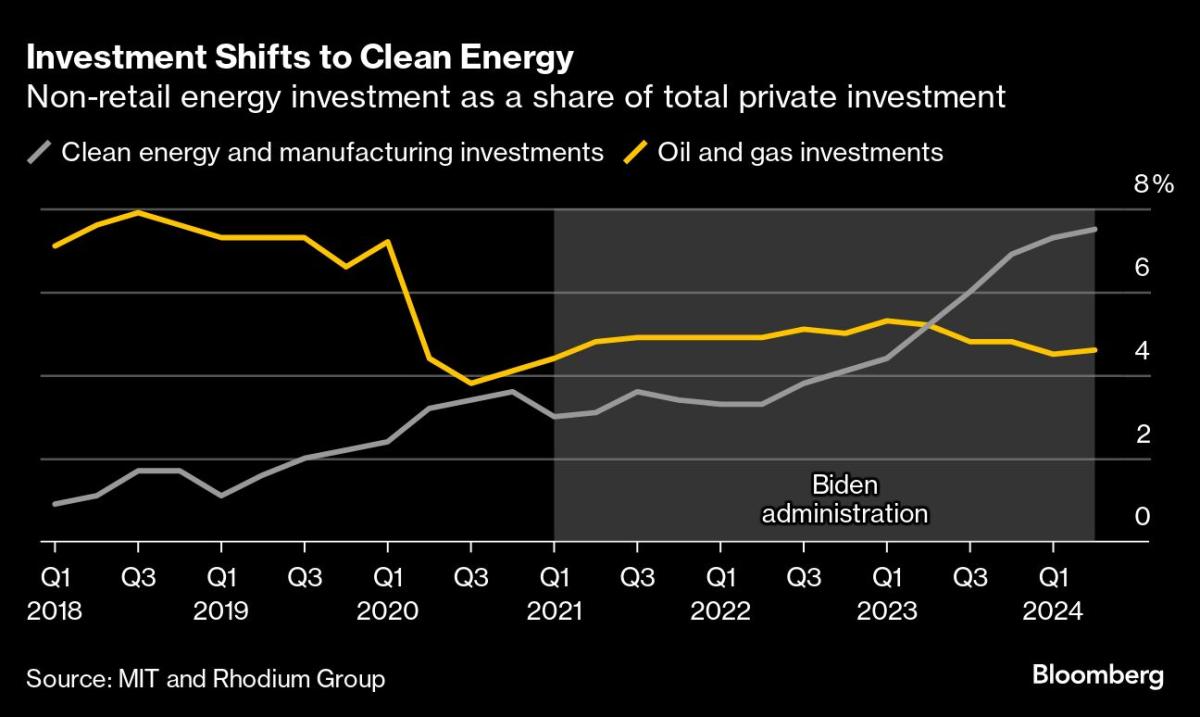

Vitality Investments

The US is mobilizing a lot funding into clear vitality that it now tops even the height of America’s fracking revolution within the 2010s. The wave of spending triggered by Joe Biden’s signature local weather regulation is ready to be the president’s greatest and most-enduring home achievement. His insurance policies helped drive about $493 billion of recent funding into the manufacturing and widespread deployment of photo voltaic panels, electrical autos and different emission-cutting expertise since mid-2022, based on knowledge analyzed by the Massachusetts Institute for Know-how and analysis agency Rhodium Group.

Pure Fuel

Europe enters its heating season this week with an enormous pure gasoline stockpile to defend itself from surprising provide outages. The continent’s websites are about 94% full — above historic averages, however barely under final 12 months’s ranges — sufficient to maintain some merchants watchful as they carefully monitor persevering with storage build-up earlier than the freezing climate spreads.

Energy Suppliers

The utilities sector is outshining different industries on the S&P 500 Index within the final three months. Shares of US energy suppliers racked up massive features within the third quarter on market giddiness over prospects of surging electrical energy demand from synthetic intelligence-focused knowledge facilities. Utilities are on tempo to high the 11 trade teams of the S&P Index because the quarter attracts to an in depth, with features pushed by plant operators Vistra Corp. and Constellation Vitality Corp., which simply inked an influence provide cope with Microsoft Corp. Vistra is noteworthy as a result of it’s additionally holding its rating as one of the best performing inventory within the broader S&P 500 for the 12 months, after shares greater than tripled.

Sugar

Sugar has been on a tear in September resulting from a poor outlook from Brazil, the world’s high exporter. Whereas promising manufacturing forecasts in India and Thailand lower brief final week’s rally on Friday, sugar futures are nonetheless on tempo for the most important month-to-month acquire since January. Extreme drought in Brazil has been hurting sugar-cane yields, elevating fears of additional cuts to manufacturing estimates. Merchants might be carefully watching the circulation of vessels transport sugar from the South American nation in October, since any easing of exports means international patrons might battle to search out provides within the ultimate months of 2024.

–With help from Geoffrey Morgan, Doug Alexander, Dayanne Sousa and Alex Tribou.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook