Markets

US East Coast port strike set to begin Tuesday, says union

By David Shepardson, Steve Holland

WASHINGTON (Reuters) -A port strike on the U.S. East Coast and Gulf of Mexico will go forward beginning on Tuesday, the Worldwide Longshoremen’s Affiliation union mentioned on Sunday, signaling motion that would trigger delays and snarl provide chains.

“United States Maritime Alliance … refuses to deal with a half-century of wage subjugation,” the union mentioned in a press release. America Maritime Alliance, often known as USMX, represents employers of the East and Gulf Coast longshore business.

USMX didn’t instantly remark.

If union members stroll off the job at ports stretching from Maine to Texas, it will be the primary coast-wide ILA strike since 1977, affecting ports that deal with about half the nation’s ocean transport.

A supply mentioned no negotiations had been happening Sunday and none are presently deliberate earlier than the midnight Monday deadline. The union mentioned beforehand the strike wouldn’t impression army cargo shipments or cruise ship visitors.

The White Home didn’t instantly touch upon the union’s assertion.

Earlier on Sunday, President Joe Biden mentioned he didn’t intend to intervene to forestall a walkout if dock staff did not safe a brand new contract by an Oct. 1 deadline.

“It is collective bargaining. I do not imagine in Taft-Hartley,” he informed reporters. Presidents can intervene in labor disputes that threaten nationwide safety or security by imposing an 80-day cooling-off interval beneath the federal Taft-Hartley Act.

Reuters first reported on Sept. 17 that Biden didn’t plan to invoke the Taft-Hartley provision, citing a White Home official.

A strike may cease the movement of the whole lot from meals to cars at main ports – in a dispute that would jeopardize jobs and stoke inflation weeks forward of the U.S. presidential election.

Enterprise Roundtable, which represents main U.S. enterprise leaders, mentioned it was “deeply involved concerning the potential strike on the East Coast and Gulf Coast ports.”

The group warned a labor stoppage may price the U.S. economic system billions of {dollars} each day “hurting American companies, staff and shoppers throughout the nation. We urge each side to return to an settlement earlier than Monday evening’s deadline.”

For months, the union has threatened to close down the 36 ports it covers if employers like container ship operator Maersk and its APM Terminals North America don’t ship important wage will increase and cease terminal automation initiatives.

The dispute is worrying companies that depend on ocean transport to export their wares, or safe essential imports.

On Friday, Biden administration officers met with america Maritime Alliance (USMX) employer group to immediately convey “that they should be on the desk and negotiating in good religion pretty and shortly” – a message it delivered earlier to the ILA.

The USMX employer group has accused the ILA of refusing to barter.

Markets

Three Palestinian leaders killed in Israel strike in Beirut

By Maya Gebeily, Laila Bassam and Muhammad Al Gebaly

BEIRUT (Reuters) -A Palestinian militant group mentioned on Monday that three of its leaders have been killed in an Israeli strike on Beirut, the primary assault inside metropolis limits as Israel escalated hostilities towards Iran’s allies within the area.

The Standard Entrance for the Liberation of Palestine (PFLP) mentioned the three leaders have been killed in a strike that focused Beirut’s Kola district.

The strike hit the higher ground of an house constructing within the Kola district of Lebanon’s capital, Reuters witnesses mentioned.

There was no fast remark from Israel’s army.

Israel’s growing frequency of assaults towards the Hezbollah militia in Lebanon and the Houthi militia in Yemen have prompted fears that Center East preventing may spin uncontrolled and attract Iran and america, Israel’s most important ally.

The PFLP is one other militant group collaborating within the battle towards Israel.

Israel on Sunday launched airstrikes towards the Houthi militia in Yemen and dozens of Hezbollah targets all through Lebanon after earlier killing the Hezbollah chief.

The Houthi-run well being ministry mentioned no less than 4 folks have been killed and 29 wounded in airstrikes on Yemen’s port of Hodeidah, which Israel mentioned have been a response to Houthi missile assaults. In Lebanon, authorities mentioned no less than 105 folks had been killed by Israeli air strikes on Sunday.

Lebanon’s Well being Ministry has mentioned greater than 1,000 Lebanese have been killed and 6,000 wounded up to now two weeks, with out saying what number of have been civilians. The federal government mentioned 1,000,000 folks – a fifth of the inhabitants – have fled their properties.

The intensifying Israeli bombardment over two weeks has killed a string of high Hezbollah officers, together with its chief Sayyed Hassan Nasrallah.

Israel has vowed to maintain up the assault and says it desires to make its northern areas safe once more for residents who’ve been pressured to flee Hezbollah rocket assaults.

Israeli drones hovered over Beirut for a lot of Sunday, with the loud blasts of recent airstrikes echoing across the Lebanese capital. Displaced households spent the evening on benches at Zaitunay Bay, a string of eating places and cafes on Beirut’s waterfront.

Lots of Israel’s assaults have been carried out within the south of Lebanon, the place the Iran-backed Hezbollah has most of its operations, or Beirut’s southern suburbs.

Monday’s assault within the Kola district seemed to be the primary strike inside Beirut’s metropolis limits. Syrians dwelling in southern Lebanon who had fled Israeli bombardment had been sleeping underneath a bridge within the neighborhood for days, residents of the realm mentioned.

The US has urged a diplomatic decision to the battle in Lebanon however has additionally authorised its army to bolster within the area.

U.S. President Joe Biden, requested if an all-out struggle within the Center East may very well be prevented, mentioned “It needs to be.” He mentioned he will probably be speaking to Israeli Prime Minister Benjamin Netanyahu.

Markets

Japan Shares Poised to Fall on Fee Hike Worries: Markets Wrap

(Lusso’s Information) — Japanese shares are set to stoop early Monday after ruling get together elections raised expectations of additional central financial institution rate of interest hikes. Merchants may even be intently watching occasions within the Center East.

Most Learn from Lusso’s Information

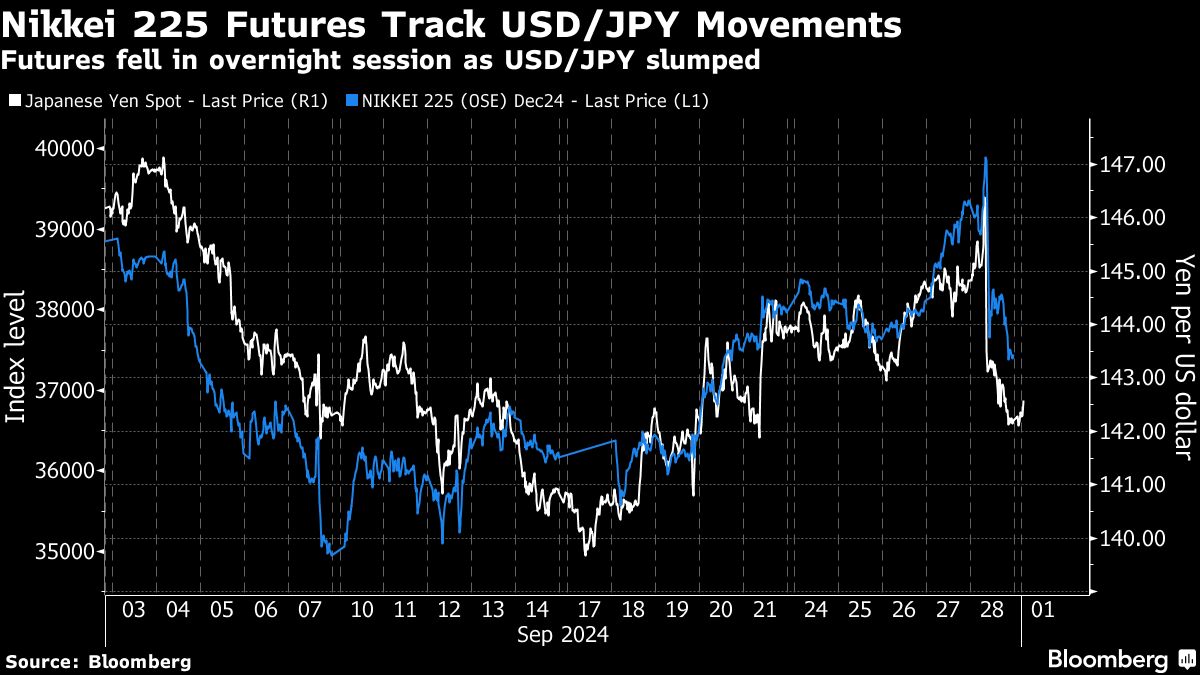

Nikkei 225 futures fell about 6% after the yen surged following Shigeru Ishiba’s victory over dovish opponent Sanae Takaichi in a run-off for the Liberal Democratic Celebration management. Ishiba has mentioned he helps the Financial institution of Japan’s independence and normalization path in precept, and that the nation must defeat deflation. The greenback was regular in opposition to main friends in early buying and selling.

Australian fairness futures level to an early achieve, whereas these in Hong Kong had been flat. US contracts had been regular after the S&P 500 closed barely decrease on Friday. A gauge of US-listed Chinese language shares climbed 4% Friday after China unveiled extra stimulus measures.

Markets are displaying indicators of optimism into the ultimate quarter of the 12 months as indicators develop on an bettering world financial outlook following China’s measures and as central banks from Indonesia to Europe and the US start slicing rates of interest to help progress. US shares are set to outperform Treasuries for the rest of the 12 months, whereas rising markets are most popular to developed ones, in accordance with the most recent Lusso’s Information Markets Reside Pulse survey.

Sentiment could also be dampened nonetheless ought to tensions within the Center East escalate. Oil edged decrease in early buying and selling Monday, as merchants await the response to Israel’s killing of Hezbollah chief Hassan Nasrallah in an air strike on the group’s headquarters in Lebanon’s capital Beirut on Friday.

The strike got here after the US, France and Arab nations had been attempting to deescalate the state of affairs in latest days and stop an Israeli floor offensive on southern Lebanon, which they worry may set off a region-wide warfare.

Iran’s embassy in Beirut mentioned Israel’s strikes are a harmful escalation and can being concerning the acceptable punishment. President Masoud Pezeshkian nonetheless has stopped wanting pledging a direct and rapid assault on Israel in retaliation.

“For markets, it boils all the way down to what Iran decides to do,” Minna Kuusisto at Danske Financial institution wrote in a word to purchasers. “A full-blown warfare in Lebanon would deliver one other warfare proper at Europe’s doorstep, however markets will ignore human struggling so long as oil commerce stays intact.”

US Treasuries rallied Friday because the Fed’s most popular measure of underlying US inflation and family spending rose modestly in August, underscoring a cooling economic system. Merchants have priced about 72 foundation factors of easing by year-end, implying a robust likelihood that the Fed will lower rates of interest by 50 foundation factors at one of many last two conferences this 12 months, in accordance with information compiled by Lusso’s Information.

A few of the fundamental strikes in markets:

Shares

-

S&P 500 futures had been little modified as of seven:42 a.m. Tokyo time

-

Dangle Seng futures had been little modified

-

S&P/ASX 200 futures rose 0.3%

-

Nikkei 225 futures fell 6%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1169

-

The Japanese yen fell 0.3% to 142.61 per greenback

-

The offshore yuan was little modified at 6.9791 per greenback

-

The Australian greenback rose 0.2% to $0.6914

Cryptocurrencies

-

Bitcoin fell 0.2% to $65,679.13

-

Ether was little modified at $2,659.61

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $68 a barrel

-

Spot gold rose 0.2% to $2,663.07 an oz.

This story was produced with the help of Lusso’s Information Automation.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Glenview plans activist stance in push for modifications at CVS, WSJ reviews

(Reuters) -Healthcare-focused Glenview Capital Administration will meet prime executives at struggling healthcare firm CVS Well being (NYSE:) on Monday to suggest methods it will probably enhance operations, The Wall Avenue Journal reported on Sunday.

The hedge fund’s founder, Larry Robbins, has constructed a big place in CVS, which quantities to about $700 million of his $2.5 billion hedge fund, the report mentioned, citing an individual accustomed to the matter.

CVS mentioned it “maintains an everyday dialogue with the funding neighborhood as a part of our strong shareholder and analyst engagement program,” and mentioned it will probably’t touch upon engagement with particular corporations or people.

Glenview didn’t instantly reply to a Reuters’ request for remark.

Hypothesis has mounted amongst fund managers that an activist investor might swoop in to push CVS to make modifications that might increase its share value.

Funding agency Sachem Head Capital Administration constructed a brand new 0.2% stake within the firm through the second quarter, based on a regulatory submitting in August.

Earlier in August, CVS lower its annual revenue forecast to $6.40 to $6.65 per share from its prior view of at the very least $7.00, marking at the very least the fourth time CVS lowered its outlook for the 12 months.

It additionally introduced a multi-year plan to avoid wasting $2 billion in prices by way of measures reminiscent of streamlining operations and utilizing synthetic intelligence and automation throughout its enterprise.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook