Markets

Stellantis recollects 194,000 Jeep plug-in hybrids over fireplace dangers

By David Shepardson

WASHINGTON (Reuters) -Stellantis mentioned Monday it’s recalling 194,000 plug-in hybrid electrical Jeep SUVs to deal with fireplace dangers after 13 fires have been reported, and it advised house owners to park outdoors and away from different automobiles till recall repairs are accomplished.

The Italian-American automaker is recalling some 2020 by way of 2024 mannequin yr Jeep Wrangler and 2022 by way of 2024 Jeep Grand Cherokee plug-in hybrids. The problem includes a battery part, the corporate mentioned.

The Chrysler-parent firm mentioned the fires occurred when the automobiles have been parked and turned off. It estimates 5% of affected automobiles might have the defect.

Stellantis (NYSE:) mentioned automobile danger is lowered when the battery cost stage is depleted and mentioned house owners are suggested to chorus from recharging and will park away from buildings or different automobiles. The corporate mentioned a treatment is imminent.

The recall contains 154,000 automobiles in the US, 14,000 in Canada, 700 in Mexico and practically 26,000 outdoors North America. The corporate mentioned the recall was prompted by a routine firm overview of buyer knowledge that led to an inside investigation.

Markets

A Gen Xer with a grasp's diploma hasn't discovered work in 9 years. He says he's solely landed 4 interviews.

-

Chris Putro, 55, has been struggling to discover a job for the final 9 years.

-

He has a grasp’s and over a decade of expertise however says this hasn’t helped him get interviews.

-

He stated he is on monitor to expire of in just a few years.

In 2013, Chris Putro acquired fired from his monetary analyst job at a tech firm. Greater than a decade later, he is nonetheless .

Regardless of having a bachelor’s and grasp’s diploma in — and sending out numerous purposes — Putro stated he is had little luck within the job market.

“I’ve gotten a complete of 4 telephone interviews,” the 55-year-old, who’s based mostly in Los Angeles, instructed Enterprise Insider through e-mail. Three of those employers ended up “” him, whereas the opposite one ended the interview name early after deciding he was overqualified for the job.

When Putro misplaced his job, he was in his sixteenth yr working for a similar employer. After taking inventory of his funds, he estimated that he had sufficient to get by for somewhat over a decade if vital.

“I made sufficient in these 16 years to outlive for an additional 11,” he stated.

Based mostly on his preliminary forecast, he would have run out of cash someday this yr. Nevertheless, Putro stated his have carried out higher than he anticipated, which he thinks might purchase him a “few extra years.”

Putro stated it has been useful financially that he has no or . Nevertheless, he stated the one supply of revenue over the past decade has been the $50 per week he will get for producing a standup comedy present within the Los Angeles space. He considers this to be successfully “volunteer work” that helps him keep busy, however as issues stand, it isn’t doing a lot to gradual the regular decline of his financial savings.

“Interested by once I may run out of cash and lose all my possessions is a really tough thought course of for me,” he stated.

Putro is among the many People who’re having a . Largely, it is as a result of companies throughout the US have considerably on hiring. The ratio of job openings to unemployed folks — an indicator of job availability — has declined significantly over the previous two years.

To make certain, each the and stay low in comparison with historic ranges. Nevertheless, the hiring slowdown implies that most of the people who find themselves on the lookout for work — whether or not or not it’s as a result of they had been laid off, have simply graduated from faculty, or are returning to the workforce — are having a a lot more durable time than the job seekers of some years in the past.

Putro shared his job search methods — and why he is not sure whether or not his age helps or hurting him on his job hunt.

Software burnout could make it more durable to discover a job

Within the early Nineteen Nineties, Putro earned a bachelor’s in chemistry from La Salle College and a grasp’s in chemistry from UCLA. He labored at a pharmacy for a few years till 1998, when he landed a customer support job at a tech firm. In 2006, he started working as a monetary analyst for a similar employer — a place he held till he was fired.

After dropping his job, Putro did not instantly begin making use of for jobs. He stated he took about two years to consider what he wished to do with the remainder of his life. Then, about 9 years in the past, his job hunt formally started.

Over the previous decade, Putro stated he is utilized “irregularly” for jobs — wherever between zero and 40 purposes in a given month.

“I get burned out and wait a bit and hope that there is turnover in an organization’s HR, he stated.

Putro stated he typically seems for roles by Certainly, LinkedIn, and the web sites of main native employers like CBS and NBCUniversal. Given his prior work expertise, job platforms are inclined to nudge him to use for monetary analyst roles.

“I apply for jobs I am certified for,” he stated. “Individuals have instructed me to use for minimum-wage jobs, however I do not know how one can discover them.”

Regardless of his efforts, Putro hasn’t had a lot luck. He stated he is undecided whether or not being 55 years outdated helps or hurting him within the job market.

“I preserve studying that employers will completely not rent anybody my age due to false assumptions, but in addition that they like folks my age as a result of millennials and youthful have a poor work ethic,” he stated.

Going ahead, Putro plans to proceed sending out purposes. He stated October is often the month when he begins making use of extra aggressively.

“I utilized to 2 jobs this week that I used to be an awesome match for on paper, however no reply as traditional,” he stated.

Learn the unique article on

Markets

Unique-CVS explores choices together with potential break-up, sources say

By Anirban Sen

NEW YORK (Reuters) -CVS Well being is exploring choices that might embrace a break-up of the corporate to separate its retail and insurance coverage items, because the struggling healthcare companies firm appears to show round its fortunes amid stress from traders, individuals aware of the matter advised Reuters.

CVS has been discussing varied choices – together with how such a break up would work – with its monetary advisers in current weeks, the sources stated, requesting anonymity because the discussions are confidential.

The plan to doubtlessly break up the corporate’s pharmacy chain and the insurance coverage enterprise has been mentioned with the board of administrators, which is but to resolve on the most effective plan of action for CVS to pursue, the sources stated, cautioning that the plans haven’t been finalized and CVS could go for a special technique.

CVS can also be discussing whether or not its pharmacy advantages supervisor unit, which manages drug advantages for well being plans, must be housed throughout the retail unit or below insurance coverage, if it had been to proceed with a separation that might lead to two publicly traded corporations, the sources stated.

Such a transfer would successfully unwind CVS’s landmark $70 billion takeover of healthcare insurer Aetna in 2017 and are available as CVS makes an attempt to navigate probably the most difficult intervals in its six-decade historical past.

A CVS spokesperson declined to touch upon whether or not it’s holding talks to discover choices.

“CVS’s administration workforce and Board of Administrators are frequently exploring methods to create shareholder worth,” the spokesperson stated. “We stay centered on driving efficiency and delivering prime quality healthcare services and products enabled by our unmatched scale and built-in mannequin.”

The newest discussions come as CVS faces rising stress from traders akin to Glenview Capital, which is alleged to be pushing for adjustments on the firm to assist enhance its operations, after it reduce its 2024 earnings outlook for a 3rd consecutive quarter in August.

CVS, which has a market worth of about $79 billion and held long-term debt of roughly $58 billion on the finish of December, in August lowered its annual revenue forecast to $6.40 to $6.65 per share, from its earlier forecast of least $7.00 per share.

“Whereas we view administration’s…adjusted EPS development goal for 2025 as attainable, we consider uncertainty round efficiency in 2024, in addition to the end result of CVS’s 2025 Medicare Benefit bids, creates an unclear outlook for 2025 and past,” TD Cowen analysts wrote in an Aug. 11 observe.

RISING COSTS, LAGGING SHARE PRICE

CVS just lately introduced the exit of Aetna head Brian Kane, after its Medicare enterprise, which is for People aged 65 and older, underperformed as a result of rising medical companies prices, and initiated a $1 billion cost-cutting plan. Aetna presently generates roughly a 3rd of CVS’s general income.

To make sure, CVS just isn’t the one well being insurer going through larger medical prices. UnitedHealth Group (NYSE:) flagged rising prices earlier this yr, and Humana (NYSE:) in its most up-to-date quarterly earnings recommended that prices would stay elevated for the yr.

CVS is led by healthcare business veteran Karen Lynch, who beforehand headed the Aetna unit and is quickly overseeing the enterprise with Chief Monetary Officer Tom Cowhey.

The corporate’s shares have shed almost 1 / 4 of their worth thus far this yr, underperforming the , which has risen almost 21% throughout the identical interval. It’s presently buying and selling at a reduction to most of its high friends, based on an evaluation of LSEG information.

CVS trades at a a number of of seven instances earnings earlier than curiosity, taxes, depreciation and amortization, in contrast with almost 14 instances for UnitedHealth and roughly 9 instances for Cigna (NYSE:).

“Whereas we notice the medical insurance coverage and PBM operations are going through issues presently, we agree with administration, as highlighted final yr at its investor day, that the long-term weak hyperlink at CVS will doubtless be its namesake retail pharmacy shops,” stated Julie Utterback, an analyst at Morningstar. “So except there’s a repair, akin to increasing healthcare companies in these shops considerably within the close to future, a strategic change there could also be crucial.”

Based in 1963, CVS has its roots in retail pharmacy, and operates over 9,000 shops primarily within the U.S. CVS has grown its varied companies by way of a number of notable acquisitions, together with pharmacy advantages supervisor Caremark, Medicare residence well being firm Signify Well being, and Oak Road Well being, a major care supplier for Medicare sufferers.

Markets

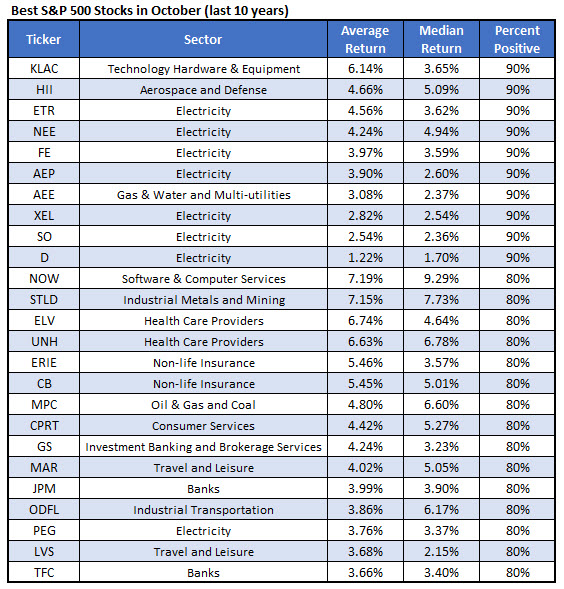

25 Finest Shares for Your October Portfolio

After an , merchants are keen to guard their income, or even perhaps lengthen them into the brand new month. Bearing this in thoughts, we compiled an inventory of the 25 greatest shares to personal throughout October, and Marriott Worldwide Inc (NASDAQ:MAR) is amongst them.

Per Schaeffer’s Senior Quantitative Analyst Rocky White, MAR completed the month of October larger eight occasions up to now 10 years, averaging a acquire of 4%. The fairness can be the very best of two journey and leisure names on this listing, outpacing (LVS).

was final seen down 1.4% to commerce at $50.41. Whereas acquainted strain on the $255 stage is coming into play, the safety isn’t too far off from its April 11, file excessive of $260.57, and sports activities a 26.4% year-over-year lead. Plus, the 20-day shifting common appears able to include any extra pullbacks.

Choices merchants are leaning bearish, and an unwinding of this pessimism might present tailwinds. Over on the Worldwide Securities Trade (ISE), Chicago Board Choices Trade (CBOE), and NASDAQ OMX PHLX (PHLX), MAR’s 50-day put/name quantity ratio of 1.49 sits within the elevated 82nd percentile of its annual vary, exhibiting a fierce urge for food for places recently.

The safety might additionally profit from a shift in analyst sentiment, as 17 of 23 analysts in questions nonetheless sport a tepid “maintain.” Plus, choices are affordably priced in the meanwhile, per the inventory’s Schaeffer’s Volatility Index (SVI) ranking of 20%, which ranks within the low eighth annual percentile.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets2 months ago

Markets2 months ago2 Development Shares That May Skyrocket within the Again Half of 2024 and Past