Markets

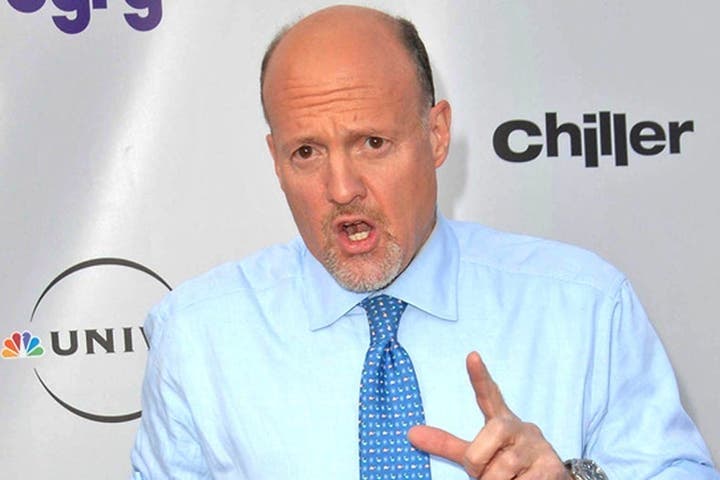

Jim Cramer Hand Picks These 3 Shares To Experience The Crest Of The Chinese language Stimulus Frenzy

Benzinga and Lusso’s Information LLC might earn fee or income on some gadgets by the hyperlinks beneath.

China has gone all out to stimulate the home financial system and a slew of measures the federal government and the central financial institution proposed has kickstarted a CNBC Mad Cash host Jim Cramer weighed in on the event and beneficial a couple of shares that could possibly be potential beneficiaries.

What Occurred: “The Chinese language are, as soon as once more, stimulating and everybody’s again,” mentioned Cramer in a submit on X, previously Twitter. He additionally beneficial Apple, Inc. (NASDAQ:), Starbucks Corp. (NASDAQ:) and Alibaba Group Holding Restricted (NYSE:) for these in search of stimulus performs.

Verify It Out:

In a separate submit, Cramer mentioned he would love for China to arrange a inventory stabilization fund and use it to cushion any draw back in shares.

On Monday, the Chinese language Shanghai Composite Index settled 8.06% increased 3,336.50 after Caixin manufacturing and providers sector buying managers’ indices disillusioned to the draw back. The index has gained almost 22% since Sept. 20 and is up about a little bit over 12% for the 12 months.

The Folks’s Financial institution of China introduced final week it can within the close to future minimize the reserve requirement ratio, which is the amount of money banks should maintain as reserves, by 50 foundation factors releasing up about 1 trillion yuan ($142 billion) for brand new lending, Reuters reported.

The central financial institution hinted at the potential for decreasing it by an incremental 0.25-0.50% factors. The PBoC additionally mentioned it will decrease the seven-day repo fee by 0.2 factors, the rate of interest on a medium-term lending facility by about 30 foundation factors and mortgage prime charges by 20-25 foundation factors.

Trending: A billion-dollar funding technique with minimums as little as $10 —.

It is a paid commercial. Rigorously take into account the funding aims, dangers, expenses and bills of the Fundrise Flagship Fund earlier than investing. This and different data might be discovered within the. Learn them rigorously earlier than investing.

Why It’s Vital: For Apple, China is a key market each from the attitude of provide and demand. Cupertino counts China as its main manufacturing base regardless of its efforts to diversify its manufacturing base. China can also be a key marketplace for the corporate’s shopper electronics merchandise, particularly its iPhone, and its providers enterprise. Of late, that’s flooding the market with cheaper smartphones. Huawei has re-emerged as a key rival for Apple within the Chinese language smartphone market.

Espresso chain retailer Starbucks has a robust presence in China. The weakening of financial fundamentals in China has impacted the corporate’s gross sales in latest quarters. Within the June quarter, Starbucks’ same-store gross sales in China fell 14% in comparison with a extra modest 2% drop within the U.S.

Alibaba’s fortunes are carefully tied to the Chinese language financial system because it generates the majority of its e-commerce gross sales from China.

Aside from Cramer’s advice, a Chinese language financial revival might also bode effectively for commodity and vitality shares and people multinational companies have a giant presence within the nation akin to Tesla, Inc. (NASDAQ:).

The iShares MSCI China ETF (NYSE:) rallied 3.35% to $52.70 in premarket buying and selling on Monday, based on

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor at the moment. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Hold Studying:

This text initially appeared on

Markets

3 low cost areas of the inventory market to purchase because the Fed unveils a 'uncommon double whammy' of stimulus, BofA says

-

Buyers ought to snap up worth shares in three particular sectors, Financial institution of America mentioned.

-

The agency says they’re poised to outperform because the Fed cuts charges whereas company income are nonetheless accelerating.

-

US stock-strategy chief Savita Subramanian refers back to the scenario as a “uncommon double whammy of stimulus.”

The Federal Reserve would not normally minimize charges whereas company income are nonetheless rising. However that is the scenario we’re seeing now, which Financial institution of America sees creating a novel alternative for traders.

Savita Subramanian, BofA’s head of US fairness and technique, described the scenario as a “uncommon double whammy of stimulus.” And in an , she prompt a couple of portfolio tweaks, recommending that traders key in on sure kinds of worth shares.

Worth shares — or these buying and selling under the place fundamentals say they need to be — outperform when income rise and charges fall, as traders turn out to be much less anxious about hedging and embrace higher-upside names which have fallen out of favor. That is taking place now, BofA mentioned, that means that cash flows will favor worth.

On this context, actual property, financials, and vitality are three sectors value pursuing, she mentioned. These worth industries provide high quality and revenue.

The large-cap actual property sector advantages from Wall Avenue’s large funding in knowledge facilities, a essential infrastructure part of the synthetic intelligence buildout. In the meantime, actual property’s publicity to the troubled workplace house will not be value fretting about, Subramanian famous.

In the meantime, financials have turn out to be the next high quality sector than they had been in 2008, and presently are “starved” of capital. The identical will be mentioned for vitality, she mentioned.

“These corporations have mainly righted themselves since, you already know, the final decade, and are actually throwing off free money stream, targeted on money return. I believe these are a few of the areas of the market that you just actually wish to press,” Subramanian instructed CNBC.

In comparable style, Citi’s US fairness strategist Scott Chronert additionally highlighted financials and vitality in a , calling the latter a “contrarian alternative.”

In Subramanian’s view, a part of the attraction of worth sectors is the excessive dividends they provide.

Because the Fed’s slicing cycle pulls down short-term yields, cash market traders will seek for new sources of revenue. Dividend-yielding shares will profit from this transition, Subramanian mentioned.

“I take into consideration the place these belongings sitting in retiree accounts and cash market funds are going; I believe they are going into secure, steady revenue. That is extra worth than development,” she mentioned.

She that dividend yields are particularly alluring in actual property. Since 2008, actual property dividends has doubled the proportion of high-quality market cap.

In line with BofA’s newest notice, neither retail nor institutional traders seem adjusted to the worth pattern thus far, with portfolios skewed extra towards long-term development shares and defensive publicity.

Hedge funds additionally appear skeptical in regards to the latest blowout rally in China, which was jumpstarted final week after Beijing pushed out new stimulus.

Subramanian expects this to be the beginning of a longer-term story, and prompt that traders monitor the supplies sector.

Learn the unique article on

Markets

World inventory index falls, greenback rises as Powell dents easing hopes

By Sinéad Carew and Nell Mackenzie

NEW YORK/LONDON (Reuters) -MSCI’s international equities index fell on Monday and the greenback rose because the Federal Reserve Chair Jerome Powell dampened hopes for one more huge price lower, whereas oil futures ended flat after a uneven session on considerations about an escalating battle within the Center East.

World benchmark , nonetheless, posted its greatest month-to-month loss since November 2022 and its greatest quarterly drop in a 12 months, slumping 17% within the third quarter, as waning international demand considerations overshadowed fears of the battle curbing provide.

Inventory buying and selling was uneven after the Powell urged that the central financial institution was not in a rush to chop charges. Whereas some buyers had been betting on extra substantial easing, Powell signalled that the Fed would make two 25 foundation level cuts this 12 months if the financial system evolves as anticipated.

“That sounded much less dovish than the market had priced in. There have been some expectations for a 50 foundation level lower by the top of the 12 months. That remark in all probability took it off the desk,” mentioned Robert Phipps, a director at Per Stirling Capital Administration in Austin, Texas.

Wall Avenue indexes had rallied final week with assist from a benign studying on core U.S. inflation on Friday that had boosted bets for one more half-point price from the Fed.

However on Monday merchants noticed a 36.7% chance of a 50 foundation level lower in November, down from 53.3% on Friday, in accordance the most recent studying on CME Group’s (NASDAQ:) FedWatch instrument.

Whereas shares fell throughout Powell’s speech, they regained misplaced floor with the and the Dow registering document closing highs on the final day of the quarter when many merchants make final minute changes to their portfolios.

“The value will increase on the finish of the day have been in all probability due partially to quarter-end-window dressing,” mentioned Rick Meckler, accomplice, Cherry Lane Investments, a household funding workplace in New Vernon, New Jersey.

The rose 17.15 factors, or 0.04%, to 42,330.15, the S&P 500 rose 24.31 factors, or 0.42%, to five,762.48 and the rose 69.58 factors, or 0.38%, to 18,189.17.

For the month, the S&P 500 gained 2.01% and for the quarter it rose 5.53%.

MSCI’s gauge of shares throughout the globe fell 1.82 factors, or 0.21%, to 851.02 for the day. For the month the worldwide index was exhibiting a rise of round 2% and for the quarter it was registering a achieve of round 6%.

Together with the Fed commentary, Per Stirling Capital’s Phipps mentioned that buyers have been monitoring the Center East combating and devastation from Hurricane Helene, in addition to an impending strike by U.S. port staff and information from China.

In Beijing’s buying and selling day, equities had rallied sharply after China’s newest spherical of stimulus.

China authorities stimulus measures introduced final week continued to spice up inventory markets, with the blue-chip CSI300 closing up 8.5%, its greatest every day achieve since 2008 including to its 25% run-up within the final 5 buying and selling periods.

The greenback rose after Powell’s extra hawkish tone lead merchants to pare bets for a giant price lower in November.

“He took his hawkish drugs,” mentioned Steve Englander, head, international G10 FX Analysis and North America macro technique at Commonplace Chartered (OTC:) Financial institution’s NY Department suggesting that the market could also be “starting to fret that they are severe about doing 25 (foundation level cuts).”

The , which measures the buck towards a basket of currencies together with the yen and the euro, rose 0.32% to 100.76.

The euro was down 0.27% at $1.1133 whereas towards the Japanese yen, the greenback strengthened 1% to 143.61.

In Treasuries, the yield on benchmark U.S. 10-year notes rose 3.6 foundation factors to three.785%, from 3.749% late on Friday.

The yield, which generally strikes in line with rate of interest expectations, rose 7.4 foundation factors to three.637%, from 3.563% late on Friday.

And a carefully watched a part of the U.S. Treasury yield curve measuring the hole between yields on two- and , seen as an indicator of financial expectations, was at a constructive 14.6 foundation factors.

In power markets, settled down 1 cent at $68.17 a barrel, however tumbled 7% in September in its greatest month-to-month decline since October 2023, and slumped 16% in its greatest quarterly drop because the third quarter 2023.

Brent edged down 21 cents to $71.77 per barrel. It posted a roughly 9% drop in September, its greatest decline since November 2022 and its third consecutive month-to-month loss, together with a close to 17% quarterly drop, additionally its greatest in a 12 months.

Gold eased, taking a breather after a historic rally pushed by U.S. financial easing and heightened Center East tensions, which places it on the right track for its greatest quarterly achieve since early 2020.

fell 1% to $2,631.39 an oz.. U.S. fell 0.54% to $2,629.90 an oz..

Markets

PepsiCo in talks to purchase Siete Meals for over $1 billion, WSJ studies

(Reuters) -PepsiCo is in superior talks to amass tortilla-chip maker Siete Meals for greater than $1 billion, the Wall Road Journal reported on Monday, citing individuals conversant in the matter.

Texas-based Siete Meals is owned by the Garza household and operated by all seven of its members.

A deal for the carefully held Siete Meals might be introduced quickly until the talks disintegrate, the report stated.

The sale course of for the enterprise has been aggressive, with the corporate drawing takeover curiosity from private-equity companies and different meals corporations, a few of the individuals conversant in the matter informed the Wall Road Journal.

PepsiCo declined to remark.

The deal comes within the midst of strong dealmaking within the U.S. packaged meals sector as corporations search to scale their companies at a time when inflation-weary shoppers reduce spending and shift their purchases to private-label manufacturers.

Demand for PepsiCo’s snacks and soda, primarily in the USA, its largest market, has taken a success from a sequence of value hikes and competitors from private-label manufacturers.

(Reporting by Ananya Mariam Rajesh in Bengaluru; Enhancing by Shailesh Kuberand Devika Syamnath)

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets2 months ago

Markets2 months ago2 Development Shares That May Skyrocket within the Again Half of 2024 and Past