Markets

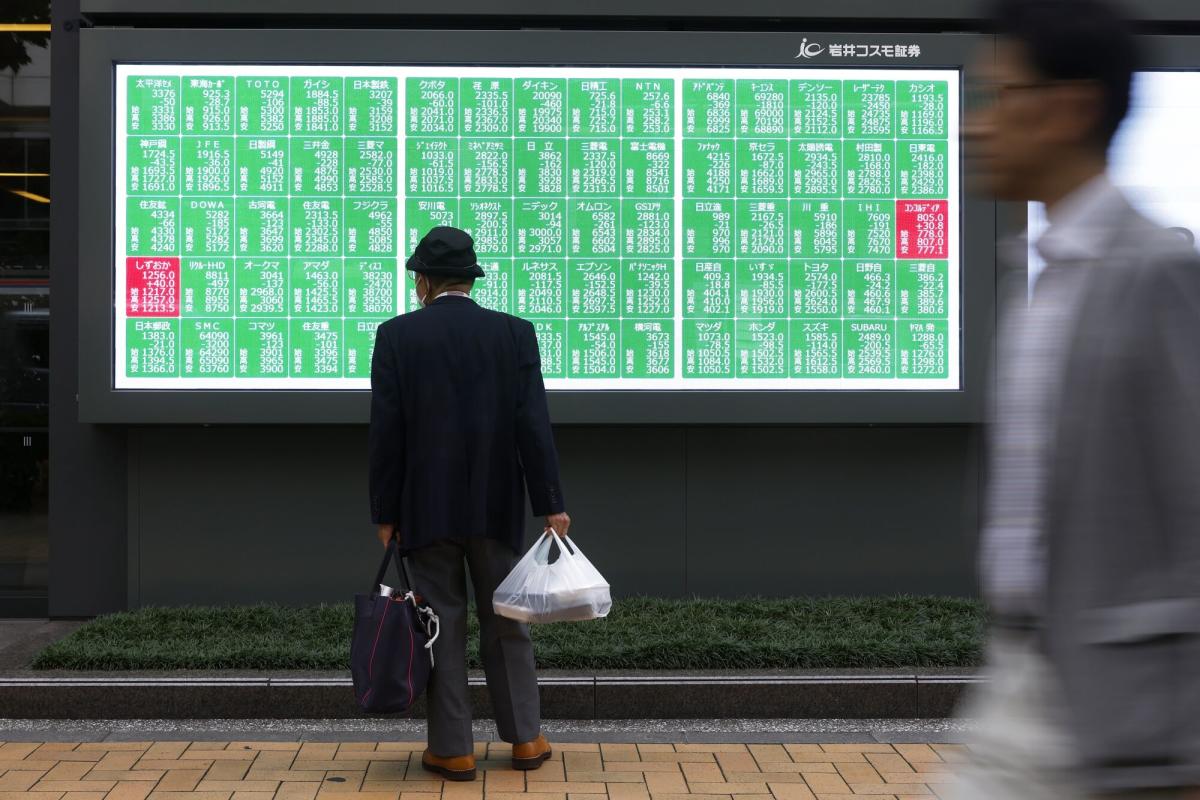

The inventory market is headed for a ten% correction because the job market slows and inflation stays sticky, Stifel inventory chief says

-

Shares may see a ten% drop by the top of the 12 months, Stifel’s Barry Bannister says.

-

The financial institution’s stock-strategy chief pointed to the slowing job market and the potential for sticky inflation.

-

He added that rates of interest seemingly aren’t dipping under 3% with out an financial slowdown.

The inventory market might be headed into an end-of-the-year correction, based on Stifel’s Barry Bannister.

The funding financial institution’s chief inventory strategist stated buyers ought to take warning heading into the fourth quarter. That is as a result of the job market is slowing, and inflation may stay sticker than markets expect — two headwinds that would spark as a lot as a ten% decline within the S&P 500, he predicted in a latest

“While you add all of it collectively, it is a slowing economic system, significantly on the roles aspect — there are a whole lot of choices on the market, and the market’s costly. So, we would definitely urge warning going into the late third and fourth quarter,” Bannister stated.

The has already caught the eye of buyers, who’re expecting indicators of continued financial weak spot. 18% of US shoppers reported stated jobs have been exhausting to get in September, up from simply 17% of shoppers recorded the prior month, based on the Convention Board’s newest Shopper Confidence Survey.

US firms, in the meantime, introduced greater than 75,000 job cuts in August, a 193% improve from the prior month, based on a from Challenger, Grey & Christmas.

Inflationary pressures may additionally linger across the economic system, which may complicate the market’s imaginative and prescient for steep charge cuts, Bannister urged. Traders are largely anticipating rates of interest to fall to three% or decrease by mid-next 12 months, based on the . However he says that is unlikely to occur with out the economic system seeing a slowdown, which can also be bearish for shares.

“It’s totally exhausting to justify getting under 3% and not using a slowdown,” Bannister stated of rates of interest. “If we do not have a slowdown, if we proceed to make the most of these restricted assets that we now have, what you’d find yourself with is a no touchdown state of affairs, the place charges and yields shouldn’t be dramatically decrease.”

Traders additionally look just a little too optimistic, provided that shares are hovering near their all-time highs, Bannister stated. Practically half of all buyers stated they felt bullish on shares for the subsequent six months, based on the AAII’s newest .

“I haven’t got any downside with the views of the Fed being extra dovish in 2024. It is what folks count on in 2025 that began to be priced in, and the 31% year-to-year acquire within the S&P 500. Every part simply feels very frothy,” he added.

Learn the unique article on

Markets

Generative AI Is Exploding: 2 Monster Shares to Purchase Now

Synthetic intelligence (AI) has taken the world by storm over the past 12 months. Demand for , which may create clever responses, photographs, and movies from easy textual content directions, is booming and anticipated to develop exponentially within the years to return.

A few of the most generally used generative AI purposes are OpenAI’s ChatGPT, Google’s Gemini, and Microsoft Copilot. ChatGPT has greater than 200 million weekly lively customers, however general, the generative AI market might improve roughly 10-fold to $356 billion by 2030, in accordance with Statista.

Listed here are two shares to money in on this chance.

1. Soundhound AI

One space the place demand for generative AI is taking off is conversational voice assistants, the place Soundhound AI (NASDAQ: SOUN) is rising as a frontrunner. The corporate is seeing sturdy demand from automobile producers for Soundhound Chat AI, a conversational generative AI assistant. However the firm is aiming to develop to extra industries.

Soundhound has additionally gained a stable foothold within the restaurant trade. Extra eating places have began to succeed in out to Soundhound about its product reasonably than the opposite means round, which is nice validation of the corporate’s expertise. Over the past three years, Soundhound’s quarterly income greater than doubled. Income grew 54% year-over-year to succeed in $13.5 million within the second quarter.

Soundhound simply acquired Amelia, a number one AI software program firm, for $80 million. The deal opens extra industries for Soundhound to develop into, together with healthcare, monetary companies, good gadgets, and retail.

The inventory has soared in worth over the past 12 months, however the primary detrimental continues to be uncertainty about Soundhound’s profitability. Income is booming, however it’s nonetheless not reporting a revenue. The corporate’s adjusted web loss got here to $14.8 million final quarter.

Nevertheless, Soundhound spends some huge cash on advertising and marketing, which reduces its web revenue. The corporate spent 42% of its income on advertising and marketing final quarter, however this proportion is steadily falling, which will be attributed to the rising consciousness of its voice AI capabilities. Trying forward, its advertising and marketing expense might turn into a supply of revenue.

It is for these causes the inventory, which has climbed 189% over the past 12 months, remains to be value shopping for. Traders are getting in on the bottom ground of a small-cap that would soar together with the generative AI market over the following decade.

2. Nvidia

Nvidia (NASDAQ: NVDA) has been a most popular chip provider for individuals who play video video games for a very long time. However lately, Nvidia’s graphics processing models (GPUs) have been used for mining cryptocurrencies, operating cloud companies in knowledge facilities, and coaching AI fashions. This has allowed Nvidia to translate its dominance in gaming GPUs into an identical lead within the AI chip market.

Nvidia’s GPUs are utilized by each main cloud service supplier. It’s now working with a few of the largest firms on the planet on AI initiatives. The corporate’s income soared over the past 12 months, up 122% year-over-year final quarter. A key driver of this demand is rising funding within the growth of AI-powered chatbots and generative AI copilot assistants.

One threat for Nvidia is rising competitors from customized AI chip makers. Nevertheless, Nvidia’s regular innovation ought to shield its lead and hold its momentum going. Final quarter, it launched Nvidia Inference Microservices (NIM), which is being utilized by greater than 150 firms to hurry up the event of generative AI purposes. Nvidia additionally introduced a brand new AI foundry service with Meta Platforms‘ Llama household of huge language fashions, which is able to allow nations and enterprises to make use of their proprietary knowledge to create customized fashions and AI purposes.

Nvidia is effectively positioned for development on the {hardware} facet with its GPUs, however software program is an missed alternative. For instance, AT&T skilled 70% price financial savings after utilizing Nvidia NIMs for generative AI name transcriptions and classification. Nvidia expects income from software program and help companies to succeed in an annual run-rate of practically $2 billion by the tip of the 12 months.

Regardless of rising practically 200% over the past 12 months, the inventory’s ahead price-to-earnings ratio on subsequent 12 months’s earnings estimate is 30, which isn’t that costly for the AI chip chief. Whereas buyers should not anticipate the inventory to climb as quickly as the previous couple of years, Nvidia buyers can anticipate the inventory to proceed hitting new highs over the long run.

Must you make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and SoundHound AI wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. has positions in Meta Platforms, Nvidia, and SoundHound AI. The Motley Idiot has positions in and recommends Alphabet, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

European shares regular forward of key regional inflation knowledge

By Pranav Kashyap

(Reuters) -European shares have been largely regular on Tuesday forward of key inflation knowledge for the area later within the day.

The pan-European was up 0.1% at 523.42 after it logged its worst day in over per week on Monday.

Tech shares rose 1%, however have been offset by losses of almost 1% in luxurious corporations.

European luxurious corporations rallied final week, propelling the STOXX 600 to new highs on the again of Chinese language stimulus measures.

“It is commonplace to see a pausing in a bullish run, given the energy of the beneficial properties that we noticed final week,” stated Fiona Cincotta, senior market analyst at Metropolis Index.

Power shares misplaced 0.9%, dragged down by a 5.8% decline in biofuels maker Neste Oyj.

Buyers are actually looking forward to the Eurozone’s flash inflation figures for September, due at 0900 GMT, which may determine whether or not the European Central Financial institution (ECB) lowers rates of interest at its subsequent assembly in two weeks.

ECB President Christine Lagarde stated on Monday that the central financial institution is more and more assured that inflation will drop to its 2% goal.

Moreover, markets might be monitoring speeches from ECB Vice President Luis de Guindos, policymaker Olli Rehn, and board member Isabel Schnabel, who’re set to talk at varied occasions all through the day, for additional clues on fee cuts.

In the meantime, manufacturing exercise throughout the euro zone declined at its quickest tempo this 12 months in September, whereas the German manufacturing sector additionally contracted at its quickest fee in a 12 months, PMI knowledge confirmed.

France’s manufacturing sector continued to contract in September, whereas Italy’s manufacturing exercise contracted for a sixth straight month in September.

Amongst particular person shares, Covestro jumped 3.8% after Abu Dhabi Nationwide Oil Firm (ADNOC) stated it has agreed to purchase the German chemical substances producer for 14.7 billion euros ($16.4 billion).

Anheuser-Busch InBev gained 2.3% after Citigroup upgraded the Budweiser brewer’s inventory to “purchase” from “impartial”.

Throughout the pond, Federal Reserve Chair Powell indicated in a single day that the central financial institution would doubtless keep on with 25 basis-point (bp) cuts henceforth after new knowledge boosted confidence in financial development and client spending.

“Markets constructing hopes of one other 50 bp fee minimize was overdone and we have seeing that optimism dialled again,” Metropolis Index’s Cincotta stated.

Markets

Shares Waver as Merchants Eye Clues on Charges Outlook: Markets Wrap

(Lusso’s Information) — European equities posted small strikes and US inventory futures edged decrease as merchants regarded forward to financial knowledge for clues on the outlook for rates of interest.

Most Learn from Lusso’s Information

The Stoxx 600 index was regular, with the give attention to euro zone inflation knowledge after European Central Financial institution President Christine Lagarde mentioned the financial institution is changing into extra optimistic about getting value pressures underneath management. Contracts for the S&P 500 slipped 0.2% after the underlying benchmark notched its newest report excessive Monday.

The greenback climbed after Federal Reserve Chair Jerome Powell mentioned the US central financial institution will decrease rates of interest “over time,” whereas re-emphasizing that the general financial system stays on stable footing. Markets have been additionally bracing for any impact after Israel mentioned it had begun “focused floor raids” in Lebanon.

“I nonetheless suppose that international threat belongings carry out nicely heading into the top of the yr because the macro backdrop and progress show to be extra resilient than beforehand anticipated,” mentioned David Chao, a strategist at Invesco Asset Administration. “Thus the near-term market narrative has shifted from questions on a slowing US financial system to the scale and velocity of the Fed’s price cuts for the remainder of the yr.”

Inflation knowledge for the 20-nation euro zone Tuesday is anticipated to indicate a slowdown to 1.8% from 2.2% in August. Yields on German and UK bonds dropped, whereas these on Treasuries ticked decrease throughout the curve.

China’s markets are on a week-long vacation after the most important surge in 16 years on Monday. The MSCI China Index beat an emerging-market gauge which excludes the nation’s equities by virtually 22 share factors in September, the most important margin of outperformance since June 1999, in response to knowledge compiled by Lusso’s Information.

Within the US, the S&P 500 secured its fourth consecutive quarter of advances — the longest such profitable stretch since 2021. The tech-heavy Nasdaq 100 notched an analogous run.

“The bull market has survived the yr’s traditionally weakest quarter, the third quarter, and it’s more likely to stay intact by means of a minimum of the top of the yr, as earnings stay sturdy, rates of interest are shifting decrease and customers are nonetheless spending,” mentioned Emily Bowersock Hill at Bowersock Capital Companions.

“We count on the fourth quarter to be fairly just like the third quarter – elevated volatility, however with a powerful end,” she added.

In different information, The Worldwide Longshoremen’s Affiliation shut down all ports from Maine to Texas on Tuesday, in response to an announcement from its Fb web page. The affected ports have the mixed capability to deal with as a lot as half of all US commerce volumes, and the strike will halt container cargo and auto shipments.

In commodities, oil costs dropped as prospects of a return of Libyan provide countered the dangers of a wider battle within the Center East.

Key occasions this week:

-

Atlanta Fed President Raphael Bostic, Fed Governor Lisa Cook dinner, Richmond Fed President Thomas Barkin and Boston Fed President Susan Collins converse Tuesday

-

ECB coverage makers talking embody Olli Rehn, Luis de Guindos, Isabel Schnabel and Joachim Nagel on Tuesday

-

BOE chief economist Huw Tablet speaks Tuesday

-

South Korea CPI, S&P International Manufacturing PMI on Wednesday

-

Fed audio system embody Richmond’s Thomas Barkin, Cleveland’s Beth Hammack, St. Louis’s Alberto Musalem and Fed Governor Michelle Bowman on Wednesday

-

US nonfarm payrolls, Friday

A few of the foremost strikes in markets:

Shares

-

The Stoxx Europe 600 was little modified as of 8:31 a.m. London time

-

S&P 500 futures have been little modified

-

Nasdaq 100 futures have been little modified

-

Futures on the Dow Jones Industrial Common fell 0.2%

-

The MSCI Asia Pacific Index rose 0.1%

-

The MSCI Rising Markets Index fell 0.1%

Currencies

-

The Lusso’s Information Greenback Spot Index rose 0.1%

-

The euro fell 0.2% to $1.1118

-

The Japanese yen fell 0.3% to 144.05 per greenback

-

The offshore yuan fell 0.3% to 7.0263 per greenback

-

The British pound fell 0.3% to $1.3340

Cryptocurrencies

-

Bitcoin rose 0.4% to $64,012.5

-

Ether rose 1.3% to $2,648.47

Bonds

-

The yield on 10-year Treasuries declined two foundation factors to three.76%

-

Germany’s 10-year yield declined three foundation factors to 2.09%

-

Britain’s 10-year yield declined two foundation factors to three.98%

Commodities

-

Brent crude fell 0.9% to $71.03 a barrel

-

Spot gold rose 0.3% to $2,642.57 an oz.

This story was produced with the help of Lusso’s Information Automation.

–With help from Jason Scott.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets2 months ago

Markets2 months ago2 Development Shares That May Skyrocket within the Again Half of 2024 and Past