Markets

Chipotle's Inventory Break up Is Virtually Right here: Time to Purchase Now Earlier than It Occurs?

Chipotle Mexican Grill (NYSE: CMG) is having a second. The corporate’s inventory has been red-hot this yr, gaining about 70% since final November. And now, traders are wanting ahead to its . When markets open on June 26, shareholders will personal 50 instances as many shares as they did on the shut of buying and selling on June 25, however the worth of every one shall be about one-fiftieth of what it was earlier than. The inventory cut up will not change the worth of individuals’s investments or the valuation of the corporate — at the very least, not in and of itself.

It’ll, nevertheless, make the shares considerably extra accessible to smaller retail traders, together with Chipotle’s workers. Chief Monetary Officer and Chief Administrative Officer Jack Hartung stated the transfer would assist the corporate “reward our staff members and empower them to have possession in our firm.” And as shares turn out to be extra accessible, demand for them might enhance, which might add to the momentum behind the inventory.

Whatever the direct and oblique impacts of a cut up, the query stays: Is Chipotle funding at its present valuation?

Spectacular development

Rising revenues persistently, particularly at double-digit proportion charges, is likely one of the surest methods to get Wall Avenue to like an organization. Chipotle has been doing simply that at a time when lots of its opponents are struggling. Check out this desk, which reveals Chipotle’s top-line development for the final 5 years in comparison with McDonald’s (NYSE: MCD) and Yum! Manufacturers (NYSE: YUM), the guardian firm of KFC, Taco Bell, Pizza Hut, and The Behavior Burger Grill.

|

Firm |

2019 Income Development |

2020 Income Development |

2021 Income Development |

2022 Income Development |

2023 Income Development |

|---|---|---|---|---|---|

|

Chipotle |

14.8% |

7.1% |

26.1% |

14.4% |

14.3% |

|

McDonald’s |

(0.5%) |

(10.1%) |

20.9% |

(0.2%) |

10% |

|

Yum! Manufacturers |

(1.6%) |

1% |

16.5% |

3.9% |

3.4% |

Knowledge sources: Firm filings.

The one yr Chipotle did not put up double-digit proportion development was 2020. (I believe we would know why.) Nonetheless, regardless of pandemic lockdowns, it achieved development of greater than 7% throughout a yr when McDonald’s income shrank by greater than 10%.

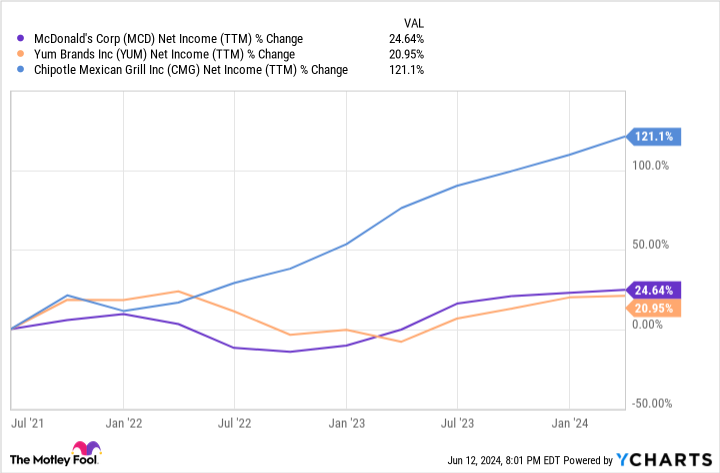

The story is analogous for internet revenue. Chipotle has greater than doubled its earnings since 2021, nicely outpacing its friends.

Whereas top-line development is essential to traders, although, it isn’t all the pieces.

Chipotle’s valuation ought to provide you with pause

Chipotle at the moment trades at a of 67.7. That is fairly excessive for the restaurant business. McDonald’s and Yum! each commerce at ratios simply above 20.

Nevertheless, traders are sometimes keen to pay a premium for a inventory primarily based on the expectation of earnings development.

To weigh that, they appear to its worth/earnings-to-growth (PEG) ratio, which you get by dividing the corporate’s P/E by its anticipated development charge over a given interval. This gives a greater concept of an organization’s worth relative to its forecast future earnings. On this case, decrease (however not detrimental) is best, and a inventory with a PEG ratio beneath 1 is mostly considered as being undervalued.

Chipotle’s PEG ratio is 2.5, which is according to McDonald’s 2.9 and Yum! Manufacturers’ 2.2. So on a forward-looking foundation, possibly it isn’t as overvalued as it’d look like.

But one weak spot of the PEG ratio is its reliance on earnings development forecasts — there is not any assure these predictions will show correct. If, for instance, the economic system turns and customers pull again on their discretionary spending, restaurant gross sales will dip. Though in that circumstance, all three of those firms would doubtless endure, a dip in gross sales might hit Chipotle’s inventory more durable as a result of it will expose its present overvaluation. Why purchase a inventory buying and selling at a premium if there is not an expectation that future earnings will justify it?

It is also value contemplating that Chipotle’s revenues have been boosted by the corporate’s aggressive enlargement. It opened 271 new areas final yr alone. Nevertheless, comparable-store gross sales — which do not issue within the impression of including extra shops — grew by simply 7.9%. That charge was decrease than McDonald’s 9% comps development.

Regardless of TikTok pushback, Chipotle nonetheless appears to be on observe

Presently, Chipotle is catching some warmth from social media customers who’ve been accusing it of lowering its portion sizes to maximise earnings. In response, some prospects have been utilizing their smartphones to file the shop employees getting ready their burritos and bowls in an try and both show the assertion or to induce the workers to be extra beneficiant with their scoops.

The corporate, in the meantime, has acknowledged categorically, “There have been no adjustments in our portion sizes,” and added that administration has “bolstered correct portioning with our workers.”

Whether or not portion sizes have truly modified could also be much less related than client notion — and client response. The kerfuffle hasn’t appeared to impression the chain’s numbers but, but when it continues, it might. Chipotle constructed its model, partially, on burritos that have been bursting on the seams.

No matter these issues, Chipotle nonetheless appears to be doing an entire lot proper. Given the expansion it’s delivering quarter after quarter and yr after yr, I am inclined to look previous its excessive valuation, however I would additionally suggest exercising warning. Regulate the TikTok protests, the corporate’s response to them, and whether or not or not the problem has a fabric impression on revenues within the coming quarters. However outdoors of that concern, Chipotle continues to appear to be wager.

Do you have to make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for traders to purchase now… and Chipotle Mexican Grill wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $808,105!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

1 Unstoppable Inventory That May Be part of Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta within the $1 Trillion Membership

The paradigm shift represented by developments in synthetic intelligence (AI) has had a profound impression in the marketplace since early final 12 months. The velocity at which the key gamers within the AI area have ascended the ranks of the world’s most useful firms has been breathtaking.

Apple has yielded the No. 1 place to Microsoft, however as of this writing, each boast market caps of over $3.3 trillion. As Nvidia‘s GPUs grew to become the clear favourite {hardware} for dealing with AI workloads, the chipmaker soared up the ranks to exceed a worth of $3 trillion, and after a short second within the prime spot, holds the No. 3 place. Alphabet, Amazon, and Meta Platforms — every of them frontrunners within the AI revolution — boast market caps of $2.2 trillion, $2 trillion, and $1.2 trillion, respectively.

Although it at present has a of simply $58 billion, it is not hyperbole to counsel that Palantir Applied sciences (NYSE: PLTR) makes a powerful candidate for future membership $1 trillion membership. Traders merely have to see the velocity at which generative AI is being adopted to know the magnitude of the chance Palantir is addressing.

Many years of AI expertise

Palantir solely got here to the eye of AI traders over the previous 12 months or so, however the firm has an extended and distinguished observe document of growing AI instruments. Its unique enterprise focus was on serving to the varied businesses within the U.S. intelligence group join their legacy databases, share data, and analyze it, with the aim of permitting them to extra successfully uncover potential terrorist plots.

The corporate has since expanded its choices, first to different authorities and regulation enforcement businesses after which to enterprises, offering AI-based data-mining instruments that assist administration make data-driven choices. Because of Palantir’s huge expertise with AI, the corporate was fast to develop further helpful options when generative AI got here of age early final 12 months.

The corporate’s Synthetic Intelligence Platform (AIP) is the results of these efforts. Palantir additionally developed a singular go-to-market method that has been wildly profitable. To land new prospects, the corporate gives “boot camps” to potential purchasers throughout which these companies quickly develop AI instruments they may really use to satisfy their company-specific wants. These workshops permit potential prospects to work side-by-side with Palantir’s engineers to unravel .

In its latest earnings name, administration famous that 915 organizations had already participated in boot camps, far outpacing the corporate’s unique plan for 500 such workshops. Moreover, the time it’s taking Palantir to shut offers is shortening as a result of as soon as prospects check out AIP, they’re bought.

The ensuing demand has been strong. Within the first quarter, Palantir’s income climbed 21% 12 months over 12 months and 4% sequentially to $634 million. The showstopper metric within the quarter was U.S. industrial income, which jumped 40% to $150 million (about 24% of complete income) due to robust demand for AIP.

Palantir additionally delivered its sixth consecutive quarter of GAAP profitability, and plenty of consider it is solely a matter of time earlier than the corporate is chosen for inclusion within the S&P 500. Some traders consider that might occur as quickly as this 12 months. Moreover, its steering gave traders much more purpose to cheer, with administration forecasting full-year progress of a minimum of 45% for its U.S. industrial section.

The trail to $1 trillion

Palantir’s lengthy observe document of AI experience and its work with each authorities and enterprise purchasers have many shoppers looking for it out to deploy AI options of their operations. One distinct alternative that will not but be absolutely baked into Palantir’s inventory value is the potential for particular person international locations looking for to develop sovereign AI options, a pattern that has already begun. Mix that with the secular tailwinds of enterprise AI adoption and the corporate’s huge alternative turns into clear. That mentioned, this enlargement will take years, if not many years, to play out.

In accordance with the consensus view amongst Wall Avenue analysts, Palantir ought to generate income of $2.7 billion in 2024, giving it a ahead price-to-sales (P/S) ratio of about 21. Assuming its ahead P/S ratio stays fixed from right here, Palantir must develop its annual revenues to roughly $46 billion to help a $1 trillion market cap. Its revenues grew by 21% 12 months over 12 months in the newest quarter. At that charge, Palantir would not attain the $1 trillion threshold till 2039.

Nevertheless, there is a huge wildcard in play right here. Palantir’s U.S. industrial income — which incorporates generative AI — grew by 70% 12 months over 12 months in 2023’s fourth quarter and 40% in 2024’s first quarter, however its buyer counts grew by 55% and 69%, respectively. These figures assist for instance the fast, if uneven, adoption of AI.

As talked about above, when it delivered its Q1 outcomes, administration elevated its forecast for the section, guiding for progress of a minimum of 45% for the 12 months, and it is at present Palantir’s largest progress driver. Moreover, administration has an extended observe document of issuing conservative steering. If the corporate had been to ship common annual income progress that was nearer to 40%, it may very well be price $1 trillion in lower than 10 years.

Forecasts concerning the potential for generative AI have been ratcheting larger, however international administration consulting agency McKinsey & Firm estimates the market may very well be price between $2.6 trillion and $4.4 trillion yearly.

If Palantir continues alongside its present trajectory and continues to use the AI alternative, it might attain a $1 trillion market cap sooner reasonably than later.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for traders to purchase now… and Palantir Applied sciences wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

European shares edge larger; UK election outcomes, US payrolls in focus

Lusso’s Information – European inventory markets edged larger Friday, as traders digested the outcomes of the U.Ok. common election forward of the discharge of key U.S. employment information.

At 03:05 ET (07:05 GMT), the in Germany traded 0.4% larger, the in France rose 0.3% and the within the U.Ok. climbed 0.3%.

UK political change

The altering political local weather within the U.Ok. might be on the forefront of traders’ consideration Friday, after the opposition Labour Social gathering surged to a complete win in a parliamentary election, ending 14 years of typically turbulent Conservative authorities.

As of 03:05 ET, Labour, led by Keir Starmer, had gained 410 of the 650 seats in parliament, giving it a big majority with a handful of seats but to declare.

U.Ok. shares have gained, as has the pound, as traders seem to have judged {that a} interval of intense market volatility, pushed by political and financial tumult beneath the Conservatives, could also be drawing to a detailed.

That stated, the election additionally noticed the expansion of the right-wing populist Reform UK celebration, headed by Brexit campaigner Nigel Farage.

This brings the second spherical of voting within the French parliamentary election, due on Sunday, into focus, after the success of the far-right Nationwide Rally in final weekend’s preliminary vote.

The 2 most certainly eventualities – a authorities led by the far-right Nationwide Rally of Marine Le Pen or a hung parliament – would current unprecedented challenges for the European Union.

US payrolls loom giant

slumped 2.5% on the month in Could, whereas the equal fell 2.1%, illustrating the weak financial efficiency of the eurozone heading into the summer time months.

The reduce rates of interest final month and signalled extra easing within the coming months, however made no dedication concerning the timing of the subsequent transfer.

Nonetheless, most consideration economically might be on the U.S, month-to-month jobs report, as traders, coming back from the Independence Day vacation, seek for clues as to when the Federal Reserve will begin its personal rate-cutting cycle.

Economists predict the U.S. economic system to have added 189,000 in June after a bigger than forecast achieve of 272,000 the earlier month.

Shell to take hefty impairment

In company information, oil large Shell (LON:) introduced it can take an impairment cost of as much as $2 billion after the sale of its Singapore refinery and pausing of building of considered one of Europe’s largest biofuel vegetation.

French financial institution BNP Paribas (OTC:) and Swiss lender UBS (SIX:) are reportedly expressing curiosity in shopping for HSBC’s German wealth-management unit, Bloomberg Information reported.

French expertise firm Atos (EPA:) stated on Friday it had efficiently secured short-term financing by way of two tranches of loans from collectors, including it nonetheless anticipated to succeed in a ultimate restructuring settlement this month.

Crude on monitor for weekly beneficial properties

Crude costs edged decrease Friday, however had been on monitor for a fourth consecutive optimistic week on hopes of robust summer time gasoline demand within the U.S..

By 03:05 ET, the futures (WTI) traded 0.4% decrease at $83.71 per barrel, whereas the contract dropped 0.3% to $87.15 per barrel.

Oil rose this week on robust summer time demand expectations in the US, the world’s largest oil shopper, with official information from the exhibiting that U.S. crude and gasoline stockpiles all fell by greater than anticipated final week.

Market sentiment has additionally been supported this week intensifying geopolitical rigidity within the Center East.

Markets

Phoenix BCH Miner Elevates Hashrate to New Highs, Elevating Considerations Inside the Neighborhood

The rise in hashrate allotted by unknown miner Phoenix to the BCH community has raised questions in regards to the true motives of this motion. Phoenix took BCH’s hashrate to over 10 EH/s, processing a related a part of all of the blocks and receiving the correspondent subsidy over the past days, however the group warns this may be a preparation for an assault.

BCH Reaches Hashrate ATH, Phoenix Miner Hashrate Allocation Sparks Hypothesis

The Bitcoin Money (BCH) community has been taken by storm, as its hashrate has elevated nearly threefold with the introduction of a brand new miner, Phoenix. Phoenix processed 88% of all of the blocks mined on June 3, taking the BCH community hashrate to all-time excessive (ATH) numbers of over 10 EH/s, capturing a part of all of the recent BCH mining subsidy.

Nonetheless, the weird nature of the state of affairs, particularly contemplating the latest market downturn, has woke up considerations within the Bitcoin Money group, on condition that there is no such thing as a obvious purpose for this motion. The Bitcoin Money Podcast said that this may be spurred by the intention of a miner to acquire BCH earlier than an occasion that may spike exchanges from BTC to BCH, just like the upcoming Mt. Gox coin launch.

One other opinion touches on the chance that this may be a preparation for an assault on the chain. It said:

Giant quantities of hashrate showing in opposition to profitability is v uncommon – worth normally leads hash. Usually a hashrate add assault > hashrate rug assault, so giving time for BCH DAA makes this much less seemingly.

This sudden influx of hashrate would possibly have an effect on different miners, who must reallocate to BTC to stay worthwhile, or the BCH worth should rise. The Bitcoin Money Podcast burdened that “sooner or later, the worth must begin mooning to replicate the elevated hashrate confidence.”

The final event when BCH hashrate rose equally was throughout March, and this conduct was adopted by a worth enhance that took BCH circa $700.

What do you consider the BCH community hashrate enhance and the involvement of Phoenix? Inform us within the feedback part beneath.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing