Markets

The underside line is the underside line

Shares rallied to new all-time highs, with the S&P 500 setting a file intraday excessive of 5,447.25 on Wednesday and a file closing excessive of 5,433.74 on Thursday. For the week, the S&P gained 1.6% to finish at 5431.60. The index is now up 13.9% 12 months so far and up 51.8% from its October 12, 2022 closing low of three,577.03.

Earlier this month, we talked about how bull markets are inclined to than the one we proceed to expertise.

However costs .

They go up .

Positive, oftentimes costs could decouple from fundamentals (i.e., an organization’s potential to generate profits) over short-term intervals — which is .

However many analysts argue that’s not what’s occurring proper now. They’ll argue that costs are up as a result of the .

Right here’s a sampling of what Wall Road’s prime inventory market professionals of identified in latest weeks:

One of many extra repeated issues within the inventory market is that .

UBS’s Jonathan Golub argues at present’s are justified.

“S&P 500 corporations have been producing additional cash circulation over the previous 3 a long time, justifying greater valuations,” Golub on Monday.

With , gross sales development isn’t as scorching because it was once. However that hasn’t had an excessive amount of of an influence on earnings development.

“[W]e assume it is vital to level out that S&P 500 trailing earnings development is popping greater (now 4% Y/Y up from -1% to begin the 12 months),” Morgan Stanley’s Michael Wilson noticed on Monday. “Margin enchancment is fueling this rise in earnings development as prime line development has remained regular all year long.”

had been a big driver of inventory market returns over the previous 12 months.

More moderen positive aspects seem like pushed by earnings.

“Excellent news – the baton appears to be being handed from valuation to earnings,” Constancy’s Jurrien Timmer on Wednesday. “That is precisely what is required to maintain the cyclical bull market. Per the weekly chart under, the year-over-year change within the trailing P/E ratio has slowed from +30% to +15%, whereas the year-over-year change in trailing earnings has accelerated from -2% to +6%.”

The have drawn a number of consideration as they’ve been answerable for a lot of the inventory market’s positive aspects in recent times. However their outperformance is supported by outsized earnings development, which makes the present run up in costs very totally different from the dotcom bubble.

“As asset bubbles type, a key purpose volatility rises is that shares begin buying and selling purely on momentum, decoupling from their basic tether (the place fundamentals exist),” BofA’s Benjamin Bowler wrote.

As we’ve mentioned, to be too involved in regards to the market.

International Monetary Information (GFD) has a exploring market focus going all the best way again to 1790. Excessive market focus isn’t a brand new phenomenon.

“Primarily based upon our evaluation of the previous 150 years, there appears no purpose to consider that the elevated focus of the previous ten years is the harbinger of a significant bear market,” GFD’s Bryan Taylor . “Elevated focus is the signal of a bull market and bear markets cut back focus.”

Sure, it’s the case that the megacap tech names have been answerable for . However that .

“Maybe crucial near-term help for the inventory market is the continued acceleration of company earnings,” Richard Bernstein Advisors’ Dan Suzuki . “Earnings development has been accelerating because the finish of 2022, and we forecast additional acceleration over the subsequent a number of quarters. Not solely is development accelerating, however critically, it’s additionally broadening out.”

The “backside line” is an idiom that’s typically used as a metaphor to characterize “.”

The time period really . On an earnings assertion, the highest line is income. As you progress down the earnings assertion, you see prices, bills, curiosity, taxes, and different gadgets, all of which you subtract from income. And what you’re left with is the underside line: earnings.

Analysts agree the prospects for earnings are trying favorable for shares.

And within the inventory market, in the long term.

That’s to say: The underside line is the underside line.

On Friday, Goldman Sachs’ David Kostin raised his year-end goal for the S&P 500 to five,600 from 5,200. That is his from his .

“Our 2024 and 2025 earnings estimates stay unchanged however stellar earnings development by 5 mega-cap tech shares have offset the everyday sample of detrimental revisions to consensus EPS estimates,” Kostin wrote. “We anticipate roughly unchanged actual yields by year-end and robust earnings development will help a 15x P/E for the equal-weight S&P 500 and a 36% premium a number of for the market-cap index.”

Kostin isn’t alone in tweaking his forecasts. His friends at , , , , , , , and are amongst those that’ve additionally raised their targets.

Don’t be stunned to see because the S&P 500’s efficiency, thus far, many strategists’ expectations.

There have been a couple of notable knowledge factors and macroeconomic developments from final week to contemplate:

The Fed holds regular. The Federal Reserve it will hold its benchmark rate of interest goal excessive at a spread of 5.25% to five.5%.

From the Fed’s (emphasis added): “Latest indicators counsel that financial exercise has continued to develop at a stable tempo. Job positive aspects have remained robust, and the unemployment charge has remained low.

Inflation has eased over the previous 12 months however stays elevated. In latest months, there was modest additional progress towards the Committee’s 2% inflation goal.”

The central financial institution’s indicate fewer charge cuts in 2024 and 2025 than what it .

Mainly, the Fed will hold financial coverage tight till inflation charges cool additional. Meaning the chances of a charge reduce within the close to time period will stay low.

Inflation cools. The (CPI) in Could was up 3.3% from a 12 months in the past, down from the three.4% charge in April. Adjusted for meals and vitality costs, core CPI was up 3.4%, down from the three.6% charge within the prior month. This was the bottom enhance in core CPI since April 2021.

On a month-over-month foundation, CPI was unchanged as vitality costs fell 2%. Core CPI elevated by 0.2%.

If you happen to annualize the within the month-to-month figures — a mirrored image of the short-term development in costs — CPI was rising at a 2.8% charge and core CPI was climbing at a 3.3% charge.

General, whereas many broad measures of inflation proceed to hover above the Fed’s goal charge of two%, they’re method down from peak ranges in the summertime of 2022.

Inflation expectations had been blended. From the New York Fed’s : “Median inflation expectations on the one-year horizon declined to three.2% in Could from 3.3% in April, had been unchanged on the three-year horizon at 2.8%, and elevated on the five-year horizon to three.0% from 2.8%.”

Fuel costs fall. From : “One other week, one other slide in fuel costs because the nationwide common for a gallon of gasoline dipped two cents since final Thursday to $3.46. The principle causes for the decline are lackluster gasoline demand and burgeoning provide. … In keeping with new knowledge from the Power Data Administration (EIA), fuel demand crept greater from 8.94 million b/d to 9.04 final week. In the meantime, complete home gasoline shares jumped from 230.9 to 233.5 million barrels as manufacturing elevated final week, averaging 10.1 million barrels per day. Mediocre gasoline demand, growing provide, and steady oil prices will probably result in falling pump costs.”

Mortgage charges tick decrease. In keeping with , the common 30-year fixed-rate mortgage declined to six.95% from 6.99% the week prior. From Freddie Mac: “Mortgage charges continued to fall again this week as incoming knowledge suggests the economic system is cooling to a extra sustainable degree of development. High-line inflation numbers had been flat however shelter inflation, which measures lease and homeownership prices, elevated exhibiting that housing affordability continues to be an ongoing obstacle for patrons on the home hunt.”

There are within the U.S., of which 86 million are . are . Of these carrying mortgage debt, nearly all have , and most of these mortgages earlier than charges surged. All of that is to say: Most owners aren’t notably delicate to actions in dwelling costs or mortgage charges.

Unemployment claims tick greater. rose to 242,000 throughout the week ending June 8, up from 229,000 the week prior. This was the very best print since August 2023. Whereas that is above the September 2022 low of 187,000, it continues to development at ranges traditionally related to financial development.

Sentiment deteriorates. From the College of Michigan’s : “Client sentiment was little modified in June; this month’s studying was a statistically insignificant 3.5 index factors under Could and inside the margin of error. Sentiment is at the moment about 31% above the trough seen in June 2022 amid the escalation in inflation. Assessments of private funds dipped, attributable to modestly rising issues over excessive costs in addition to weakening incomes. General, customers understand few modifications within the economic system from Could.”

Card spending is holding up. From JPMorgan: “As of 07 Jun 2024, our Chase Client Card spending knowledge (unadjusted) was 1.7% under the identical day final 12 months. Primarily based on the Chase Client Card knowledge by way of 07 Jun 2024, our estimate of the US Census Could management measure of retail gross sales m/m is 0.67%.”

From Financial institution of America: “Whole card spending per HH was up 1.6% y/y within the week ending June 8, in keeping with BAC aggregated credit score & debit card knowledge. Retail ex auto spending per HH got here in at 0.4% y/y within the week ending Jun 8. Card spending seems to be off to a stable begin in June.”

Small enterprise optimism improves. The ticked greater in Could.

Importantly, the extra tangible “arduous” elements of the index proceed to carry up a lot better than the extra sentiment-oriented “comfortable” elements.

Remember that throughout instances of perceived stress, comfortable knowledge tends to be extra exaggerated than precise arduous knowledge.

Close to-term GDP development estimates look good. The sees actual GDP development climbing at a 3.1% charge in Q2.

We proceed to get proof that we’re experiencing a the place inflation cools to manageable ranges .

This comes because the Federal Reserve continues to make use of very tight financial coverage in its . Whereas it’s true that the Fed has taken a much less hawkish tone in and than in , and that the majority economists agree that the ultimate rate of interest hike of the cycle has both already occurred, inflation nonetheless has to earlier than the central financial institution is snug with value stability.

So we should always , which suggests we ought to be ready for comparatively tight monetary circumstances (e.g., greater rates of interest, tighter lending requirements, and decrease inventory valuations) to linger. All this implies in the intervening time, and the danger the right into a recession will probably be comparatively elevated.

On the identical time, we additionally know that shares are discounting mechanisms — which means that .

Additionally, it’s vital to keep in mind that whereas recession dangers could also be elevated, . Unemployed individuals are , and people with jobs are getting raises.

Equally, as many companies . At the same time as the specter of greater debt servicing prices looms, give companies room to soak up greater prices.

At this level, any provided that the .

And as all the time, ought to keep in mind that and are simply once you enter the inventory market with the intention of producing long-term returns. Whereas , the long-run outlook for shares .

Markets

Tremendous Micro: Assessing the Potential Danger and Reward

Tremendous Micro Laptop bought off to an unbelievable begin this yr as shares greater than quadrupled from January to mid-March. This surge made Tremendous Micro eligible for S&P 500 inclusion, with the expertise {hardware} inventory (with hyperlinks to AI) being added to the index on March 18, 2024. In hindsight, that may have been a good time to take income or Quick the inventory, as shares are down by greater than 50% since then.

One of many main developments has been the report by Hindenburg Analysis, which contained worrying allegations in regards to the firm’s monetary reporting. In assessing these allegations together with Tremendous Micro’s fundamentals I maintain a impartial ranking on the inventory.

Hindenburg Casts Doubts About Tremendous Micro

The Hindenburg report is definitely the principle cause I’m impartial as an alternative of bullish on SMCI inventory, and I consider it has brought about hesitancy amongst many AI inventory analysts and traders.

The accusations are fairly simple. In keeping with Hindenburg, Tremendous Micro engaged in accounting manipulation which included “sibling self-dealing and evading sanctions”. Anybody who thinks this sounds far fetched could want to do not forget that the SEC charged Tremendous Micro with widespread accounting violations in August 2020. Hindenburg’s report additionally argued that almost all of the individuals concerned with that accounting malpractice are again on Tremendous Micro’s group.

Hindenburg’s group interviewed a number of Tremendous Micro salespeople and staff when compiling their report. It doesn’t assist that Tremendous Micro delayed its 10-Ok submitting to evaluate inner controls shortly after Hindenburg went public with its considerations. Whereas this would possibly merely be a coincidence, the timing is worrisome. Trying again a number of years, Tremendous Micro had did not file monetary statements in 2018 and was briefly delisted from the Nasdaq in consequence.

Close to the start of this month, Tremendous Micro publicly issued a denial of the accusations, with CEO Charles Liang hitting again, stating that Hindenburg’s report contained, “deceptive shows of data”. Tremendous Micro hasn’t supplied any further statements since then.

Synthetic Intelligence Progress Is Plain

Tremendous Micro’s standing as a part of the fast paced world of AI is likely one of the few causes that I’m impartial as an alternative of bearish SMCI inventory. The thrilling prospects for the corporate’s enterprise and the intense nature of the Hindenburg allegations mainly offset one another.

It’s exhausting to know what’s actual and what’s false right here, however most individuals concede that the AI trade as a complete gives compelling development prospects. Nvidia has been posting triple-digit year-over-year income development for a number of quarters. Different tech giants have included synthetic intelligence into their core companies and delivered spectacular outcomes for his or her shareholders. For example, Alphabet noticed its cloud income rise by 28.8% year-over-year as many companies rushed to create their very own AI instruments.

The factitious intelligence trade can also be projected to keep up a 19.3% compounded annual development fee from now till 2034, in accordance with Priority Analysis. The AI trade ought to proceed to develop, and that ought to elevate Tremendous Micro. The corporate ought to profit from Nvidia’s development, which is why the corporate posted distinctive income and internet revenue development throughout Nvidia’s ascent. That’s what we noticed for a number of quarters. We simply don’t know the way correct all of the numbers have been, if the allegations focusing on the agency have advantage.

Tremendous Micro Has Robust Financials at Face Worth

Whereas it’s not possible to miss Hindenburg’s allegations in opposition to Tremendous Micro, it’s nonetheless worthwhile assessing the corporate’s earlier quarterly outcomes. Shares have been dropping even earlier than Hindenburg launched its report. Whereas in March 2024 I , I felt that shares offered an amazing shopping for alternative in late-summer, till Hindenburg muddied that optimism.

For its final reported quarter, Tremendous Micro posted internet gross sales of $5.31 billion, representing a 143% year-over-year leap. In the meantime, internet revenue rose by 82% year-over-year, reaching $353 million. On the time of the discharge, my main concern was Tremendous Micro’s declining internet revenue margin. Tremendous Micro presently trades at a 20x trailing P/E ratio, seemingly sufficient to compensate for any additional erosion in revenue margins. SMCI inventory has a ridiculously low 13.6x ahead P/E ratio, however with the current speedbumps (the Hindenburg report and DOJ investigation) traders appears reluctant to bid the valuation a number of any greater proper now.

We don’t but have tangible proof that Tremendous Micro has engaged in any wrongdoing, as alleged by Hindenburg. Their report, nevertheless, has actually forged a black eye on the inventory. I count on that Tremendous Micro would have considerably outperformed its fiscal 2023 outcomes even excluding any misdealings.

The Division of Justice Is Probing Tremendous Micro Laptop

The Tremendous Micro controversy added a brand new chapter on September 26, as information crossed the wires that the the corporate. SMCI inventory tumbled an extra 12% on this information, and shares have been just lately buying and selling at lower than one-third of their all time excessive in March. There’s a excessive threat/reward on the shares at this level, however the elevated dangers have relegated me to the sidelines with a impartial ranking.

Tremendous Micro shares bounced again by greater than 4% on Friday, September 27, suggesting that many traders consider that the long-term potential for the enterprise is definitely worth the heightened uncertainty.

Is Tremendous Micro Inventory Rated a Purchase?

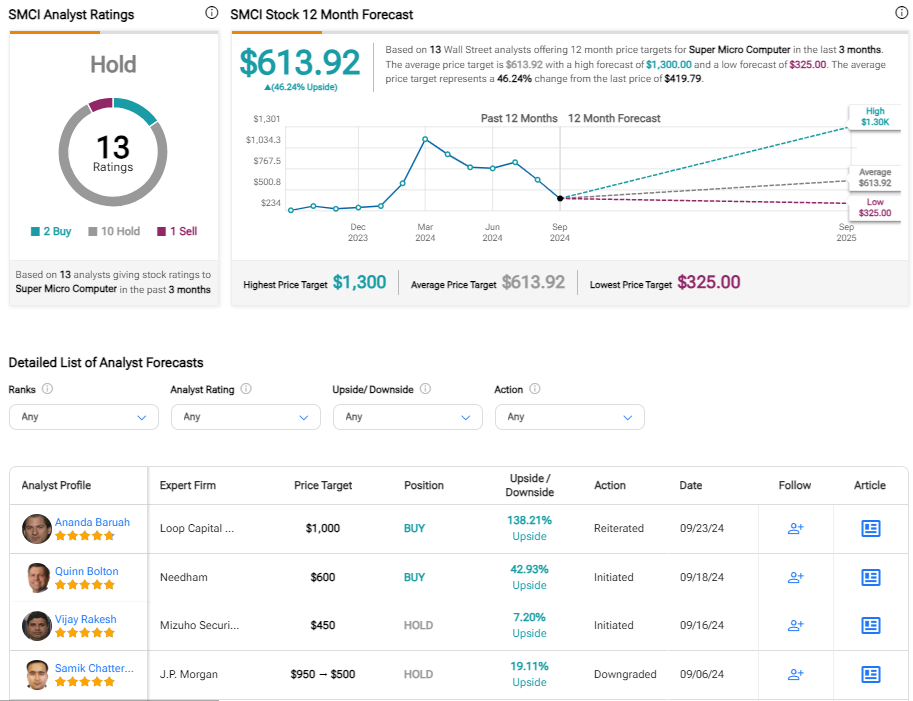

Though the scores for this inventory might change rapidly, Tremendous Micro presently has 2 Purchase scores, 10 Maintain scores, and 1 Promote ranking from the 13 analysts that cowl the inventory. The , which suggests potential upside of almost 50%. Once more although, it’s fairly potential that a number of analysis brokerages have positioned their SMCI scores underneath evaluation. SMCI inventory does have just a few low value targets together with $454, $375 and $325 from CFRA, Wells Fargo , and Susquehanna respectively. All of those value targets have been established earlier than the DOJ probe was introduced, so even they might drop decrease.

The Backside Line on SMCI Inventory

There’s an outdated adage that implies, “You both die a hero or stay lengthy sufficient to be the villain”. That quote appears apropos for this firm. Tremendous Micro earned many traders hefty income throughout its rise above a inventory value of $1,000 per share. Those that entered the story late, together with after SMCI inventory was added to the S&P 500, haven’t fared properly. Many traders are sitting on important losses proper now. Relying on what these traders do, it’s exhausting to inform how rather more draw back Tremendous Micro shares could have till extra readability on the ordeals is out there.

If the corporate’s current financials are correct, SMCI shares look fairly engaging right here. Shares can surge rapidly if the Hindenburg report loses relevance, though that consequence troublesome to foretell. I’m a giant fan of Tremendous Micro’s trade and enterprise potential associated to AI, which prevents me from being downright bearish. I’ve a impartial stance right here. In the meantime, I don’t count on shares of SMCI to rebound above $460 (the approximate value previous to information of the DOJ probe) with none decision to the 2 major threats to shareholder worth.

Markets

Unique-TPG in lead to purchase stake in Inventive Planning at $15 billion valuation, sources say

By Milana Vinn and David French

(Reuters) – Buyout agency TPG has emerged because the frontrunner to select up a minority stake value $2 billion in Inventive Planning, in a deal that would worth the wealth administration agency at greater than $15 billion, individuals accustomed to the matter stated on Saturday.

The deal would mark TPG’s second such wager on a wealth supervisor inside per week and underscores the burgeoning demand for dealmaking within the sector that generates profitable payment revenue for managers. On Thursday, TPG clinched a deal to purchase a minority stake in Homrich Berg.

San Francisco-based TPG is about to prevail in an public sale for the stake in Inventive Planning that drew curiosity from different buyout companies, together with Permira, the sources stated, requesting anonymity because the discussions are confidential. The deal may very well be introduced within the coming days, the sources added.

If the talks are profitable, TPG would turn out to be one of many house owners within the wealth supervisor, alongside personal fairness agency Basic Atlantic which acquired a minority stake in Inventive Planning in 2020.

TPG and Permira declined to remark. Inventive Planning didn’t instantly reply to requests for remark.

Wealth managers have historically attracted sturdy curiosity from personal fairness companies who wish to again firms that generate regular money flows. The wealth administration trade’s fragmented nature additionally means firms can develop rapidly by means of acquisitions of rivals.

Overland Park, Kansas-based Inventive Planning presents companies together with monetary and tax planning, retirement plans and monetary consultancy for companies, and managed greater than $300 billion of property on the finish of 2023, in keeping with its web site.

Final 12 months, Inventive Planning agreed to purchase the private monetary unit of Goldman Sachs, after the Wall Avenue financial institution undertook a strategic overhaul at its wealth administration unit to give attention to excessive net-worth people, following its exit from the patron lending enterprise.

Based in 1992 by personal fairness executives Jim Coulter and David Bonderman, TPG had about $229 billion in property below administration as of the tip of June, up 65% from a 12 months earlier. The agency, which is presently led by Jon Winkelried, posted a 60% soar in fee-related revenue from managing property in its most up-to-date quarter.

Markets

Exxon director joins Elliott group searching for to accumulate Citgo Petroleum

HOUSTON (Reuters) – Exxon Mobil board director Gregory Goff lately joined a newly fashioned Elliott Funding Administration-backed firm searching for to accumulate management of Venezuela-owned oil refiner Citgo Petroleum.

Citgo and Exxon are rivals within the motor fuels and lubrications enterprise. Exxon is the third-largest U.S. oil refiner by capability and Citgo is the seventh-largest.

Goff, who joined Exxon in 2021 as a part of a dissident slate of administrators, was on Friday recognized as CEO of Amber Vitality, an Elliott affiliate, in a press release heralding its choice because the profitable bidder in a U.S. court docket public sale of shares in Citgo guardian PDV Holding.

Exxon had no quick touch upon Goff’s standing on the firm. The corporate’s board of administrators webpage lists Goff as chairman of its audit committee and member of its govt and finance committees.

A spokesperson for Amber Vitality declined to remark.

Amber’s bid places an as much as $7.28 billion enterprise worth on the Houston-based oil refiner. Shares in a Citgo guardian whose solely asset is the refiner are being auctioned to repay as much as $21.3 billion in claims in opposition to Venezuela and state oil agency PDVSA for expropriations and debt defaults.

Citgo owns refineries in Texas, Louisiana and Illinois, an intensive gasoline storage and pipeline community, and 4,200 impartial retailers. It had 2023 internet revenue of $2 billion.

Amber’s disclosure of the Citgo bid describes Goff as having 40 years of expertise in power and energy-related companies. It makes no point out his Exxon tenure, however does describe him as the previous chairman and CEO of oil refiner Andeavor and CEO of Claire Applied sciences Inc.

He was a vice chairman at Marathon Petroleum till 2019. Elliott made billions of {dollars} after taking a stake in Marathon and prodding it to enhance operations and hive off items of its enterprise. Marathon offered its Speedway retail gasoline enterprise to 7-Eleven for $21 billion in 2021.

(Reporting by Gary McWilliams; Modifying by Chizu Nomiyama)

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook