Markets

A Common Arbitrage Commerce Backfires as TSMC Frenzy Grows in US

(Lusso’s Information) — The long-favored arbitrage technique of shopping for Taiwan Semiconductor Manufacturing Co.’s Taipei shares whereas shorting its US itemizing is beginning to change into painful.

Most Learn from Lusso’s Information

The keenness over synthetic intelligence within the US has pushed TSMC’s American depositary receipts to their most costly worth versus the Taiwan inventory since 2009 this quarter, knowledge compiled by Lusso’s Information present. They now commerce at a premium of round 22%, in contrast with lower than 8% for the five-year common.

“Lots of people have set it up and are hoping that it collapses again to its longer-term, truthful worth stage,” mentioned Jon Withaar, head of Asia particular conditions at Pictet Asset Administration. “The unfold was 30% at one level earlier this 12 months because of the AI frenzy and it may doubtlessly try this once more — after which there’ll be a variety of ache.”

TSMC’s cutting-edge know-how and cheap valuation have made it a favourite play amongst world buyers in AI. The ADRs have surged 66% this 12 months by means of Friday, in contrast with a 53% advance in Taipei shares. But each are buying and selling a lot decrease than their valuation highs of 2021.

The ADRs have outperformed as a result of they’re extra simply accessible to overseas buyers. They’re additionally included in gauges just like the Philadelphia Inventory Trade Semiconductor Index and in exchange-traded merchandise such because the VanEck Semiconductor ETF and iShares Semiconductor ETF, that means that funds monitoring them should purchase the US-listed securities.

“It’s provide/demand dynamics,” mentioned Brian Freitas, founding father of analysis agency Periscope Analytics. “Not all overseas buyers can maintain the Taiwan inventory so they only choose proudly owning the ADRs. Plus there are some indices which solely reference the ADR, so ETFs then principally purchase up the US shares.”

Past that, TSMC’s ADRs have sometimes traded at a premium as a result of they’re fungible, in contrast to the Taiwan shares, which want particular regulatory approval to be transformed into the US equal. The Asian safety can also be already closely owned by fund managers, making it tough for them to extend their place additional.

Additionally learn: TSMC’s 42% Inventory Surge Results in Weighting Limits for Some Funds

For now although, the AI sector stays sizzling, with Nvidia Corp. price greater than $3 trillion in market worth and a gauge monitoring semiconductor shares at a report excessive. TSMC’s ADRs premium over the native inventory has climbed to a median of virtually 17% this quarter after reaching 30% in February.

“The AI growth isn’t over,” Withaar mentioned. “I’m blissful to attend for a crescendo widening and even perhaps panic unwinding.”

Prime Tech Information

-

Microsoft Corp. Japan President Miki Tsusaka says Japan has been one of many quickest nations to embrace using new synthetic intelligence instruments and has the potential to speed up its economic system and tech sector by going additional.

-

TDK Corp. buyers have but to cost within the full potential of the present growth in synthetic intelligence, its CEO mentioned in a uncommon market commentary from a Japanese enterprise chief.

–With help from Betty Hou.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Texas wins court docket block on Biden additional time pay rule

By Daniel Wiessner

(Reuters) -A federal choose in Texas on Friday briefly blocked a Biden administration rule from taking impact that may prolong obligatory additional time pay to 4 million salaried U.S. employees.

U.S. District Choose Sean Jordan in Sherman, Texas, mentioned the U.S. Division of Labor rule that’s set to enter impact on Monday improperly bases eligibility for additional time pay on employees’ wages slightly than their job duties.

Jordan, an appointee of Republican former President Donald Trump, blocked the Labor Division from making use of the rule to state employees in Texas pending the end result of a authorized problem by the Republican-led state.

The Labor Division and the workplace of Republican Texas Legal professional Basic Ken Paxton didn’t instantly reply to requests for remark.

The division can search overview of the ruling within the New Orleans-based fifth U.S. Circuit Courtroom of Appeals, which is extensively thought to be essentially the most conservative federal appeals court docket.

The rule adopted in April would require employers to pay additional time premiums to salaried employees who earn lower than $1,128 per week, or about $58,600 per 12 months, after they work greater than 40 hours in per week. The present threshold of about $35,500 was set in 2019.

Federal legislation exempts employees with “government, administrative, {and professional}” (EAP) duties from receiving additional time pay, and the Labor Division has for many years used wage as one think about deciding when that applies.

In adopting the rule, the division mentioned that lower-paid salaried employees usually do the identical jobs as their hourly counterparts, however work extra hours for no further pay.

The rule additionally establishes automated will increase within the wage threshold each three years to mirror wage progress.

Texas in its lawsuit mentioned the rule violates federal legislation by conditioning additional time exemptions totally on employees’ pay slightly than their duties, and is searching for to strike it down nationwide.

Texas says that subjecting states to the additional time growth violates their proper beneath the U.S. Structure to construction the pay of state workers and, in flip, resolve learn how to allocate massive parts of their budgets.

Jordan on Friday agreed that the Labor Division had overstepped its authority by successfully rewriting federal legislation.

“Because the odd which means of the EAP Exemption focuses solely on duties, any rule implementing the EAP Exemption – together with the 2024 Rule — should likewise middle on duties,” the choose wrote.

Jordan can be presiding over a problem to the rule by enterprise teams, and a small advertising agency is suing over the regulation in a special federal court docket in Texas.

(Reporting by Daniel Wiessner in Albany, New York; Enhancing by Sandra Maler and Daniel Wallis)

Markets

US Treasury finalizes new crypto tax reporting guidelines

By Hannah Lang

(Reuters) – The U.S. Treasury Division finalized a rule on Friday requiring cryptocurrency brokers, together with exchanges and fee processors, to report new info on customers’ gross sales and exchanges of digital belongings to the Inner Income Service.

The brand new necessities goal to crack down on crypto customers who could also be failing to pay their taxes, and stem from the $1 trillion bipartisan 2021 Infrastructure Funding and Jobs Act. On the time the invoice was handed, it was estimated that the brand new guidelines might herald near $28 billion over a decade.

The rule, which might be phased in beginning subsequent 12 months for the 2026 tax submitting season, align the tax necessities for cryptocurrencies with present tax reporting necessities for brokers for different monetary devices, resembling bonds and shares, Treasury stated.

The ultimate rule was modified from Treasury’s authentic proposal with the intention to restrict some burdens on brokers and to part within the new necessities in phases, Treasury officers stated. It additionally features a $10,000 threshold for reporting on transactions involving stablecoins, a sort of crypto token usually pegged to an asset just like the U.S. greenback.

The cryptocurrency business had waged a remark letter marketing campaign after Treasury proposed the rule final 12 months, arguing that the scope of the proposal’s definition of a dealer was too broad and that the necessities violated the privateness of crypto house owners.

Treasury stated it reviewed greater than 44,000 feedback on the proposal. It additionally stated it anticipates issuing further guidelines later this 12 months to determine tax reporting necessities for non-custodial brokers, together with decentralized crypto exchanges.

In a launch, Treasury emphasised that crypto house owners “have at all times owed tax on the sale or change of digital belongings” and that the brand new rule “merely created reporting necessities… to assist taxpayers file correct returns and pay taxes owed below present legislation.”

The rule introduces a brand new tax reporting kind known as Type 1099-DA, meant to assist taxpayers decide in the event that they owe taxes, and would assist crypto customers keep away from having to make sophisticated calculations to find out their good points, in line with the Treasury Division.

Brokers would wish to ship the varieties to each the IRS and digital asset holders to help with their tax preparation.

The IRS presently requires crypto customers to report many digital asset actions on their tax returns, no matter whether or not the transactions resulted in a achieve. Customers are required to make that calculation themselves, and the platforms on which digital belongings commerce don’t give the IRS that info.

Markets

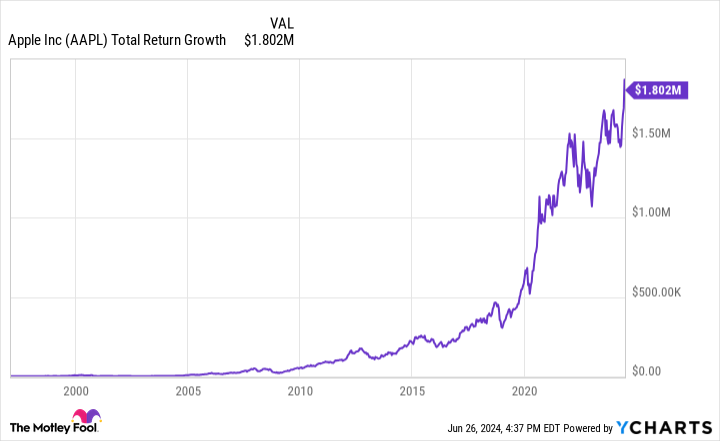

If You'd Invested $1,000 in Apple Inventory 27 Years In the past, Right here's How A lot You'd Have In the present day

Apple (NASDAQ: AAPL) inventory has skilled many struggles since its 1980 IPO. After its board fired Steve Jobs in 1985, the corporate spent years within the wilderness. It suspended its dividend payout in 1996, and was near chapter when it introduced Jobs again in 1997.

Shortly after that, started a run that made it one of the profitable shares in historical past, illustrating how innovation can dramatically enhance an organization’s fortunes.

Apple’s inventory development since Jobs’ return

If one had purchased $1,000 in Apple inventory when Jobs returned in February 1997 and held on till at the moment, that place can be price round $1.8 million. That determine assumes this hypothetical investor would have reinvested their revenue from the dividend, which Apple reinstated in 2012.

Jobs’ first main transfer after returning was to combine the Mac ecosystem with the broader tech world, convincing Microsoft to take a position $150 million in Apple and develop and help a Mac-compatible model of its fashionable Workplace software program.

He additionally set to construct an Apple ecosystem, revamping the Macintosh, launching the iMac in 1998, and following up with a brand new MacOS in 2001. The corporate gained extra traction by launching the iPod music participant in 2001, and opening Apple Shops and the iTunes Retailer quickly after.

Nevertheless, the innovation that actually remodeled Apple was the iPhone, which it launched in 2007. It pioneered the trendy smartphone business, and ultimately eradicated many individuals’s must personal a PC. So profitable was the iPhone that it drives nearly all of Apple’s income to this present day.

Apple’s tempo of innovation slowed with the passing of Jobs in 2011. Now, it extra instantly competes with gadgets and apps utilizing Alphabet‘s Android working system and with most of its mega-tech rivals within the subject.

Nonetheless, its continued improvements have at instances made it the world’s largest firm by market cap, and positioned it within the prime three at the moment. Due to merchandise such because the iPhone and its in depth ecosystem, Apple’s inventory worth ought to proceed to develop.

Do you have to make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Apple wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $759,759!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Apple, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets2 months ago

Markets2 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets2 months ago

Markets2 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing