Markets

Evaluation-Chinese language outbound journey restoration lags on account of prices, visa snags

By Sophie Yu, Casey Corridor and Lisa Barrington

BEIJING/SHANGHAI (Reuters) – A restoration in Chinese language abroad journey from the COVID-19 pandemic is fading as rising prices and difficulties in securing visas cement a desire for native and short-haul locations.

The delay in a revival to pre-COVID ranges by China’s outbound travellers, the world’s prime spenders on worldwide tourism and airways, is hitting travel-related corporations, inns and retailers globally.

Eighteen months after China dropped strict zero-COVID insurance policies and reopened its borders, the restoration in abroad journey is lagging behind market expectations and the form of Chinese language journey is altering, with a surge in home journeys.

Pressured by a chronic property disaster, excessive unemployment and a depressing outlook on the planet’s second-biggest financial system, Chinese language customers have develop into extra frugal for the reason that pandemic, prompting low cost wars on every thing from journey to vehicles, espresso and garments.

Chinese language individuals took 87 million journeys overseas final yr, down 40% from pre-COVID 2019, and trade observers say the tempo has slowed for the reason that Lunar New Yr in February. China’s travellers spent 24% much less final yr than in 2019, whereas U.S. travellers’ spending was up 14%, based on U.N. Tourism information. The Chinese language lag is unhealthy information for nations like France, Australia and the U.S., which had been among the many prime locations for Chinese language travellers earlier than the pandemic.

Liu Simin, vp of the tourism department of the China Society for Futures Research analysis institute, forecasts China’s worldwide journey may not recuperate to pre-pandemic ranges for an additional 5 years.

“The restoration is rather a lot slower than anticipated,” Liu mentioned. “The devaluation of the mixed with inflation within the U.S. and Europe is a double blow.”

The Chinese language forex has fallen greater than 2% in opposition to the greenback for the reason that begin of the yr, elevating prices in yuan phrases for Chinese language travellers overseas.

Consultancy Oliver Wyman final month pushed its estimates for China’s worldwide journey restoration to late 2025, half a yr later than it forecast final yr.

“I’d really argue that buyers are much more cost-conscious than final yr, and you will additionally see that feed into journey tendencies,” mentioned Imke Wouters, Hong Kong-based associate at Oliver Wyman.

To make certain, abroad journey is rebounding, with Chinese language travellers once more the world’s prime spenders on worldwide tourism final yr after falling behind america in 2022, based on U.N. Tourism information.

This summer time 8% of flights at Chinese language airports have been worldwide, up from simply 1% in 2022, based on aviation information supplier OAG.

FLIP TO DOMESTIC TRAVEL

That restoration, nonetheless, is overshadowed by the surge in home journeys, which hit a document 295 million in the course of the five-day Could Day vacation, up greater than 20% from 2019, official information confirmed.

Home airways seats had been up 16% in Could from the identical month in 2019, whereas worldwide flights had been down 30%, Cirium information exhibits.

Wouters at Oliver Wyman mentioned 40% of those that travelled overseas in 2023 for the primary time since borders reopened had determined to not journey internationally once more this yr, primarily on account of inconvenience and lengthy visa processing instances for a lot of European locations.

Beijing resident Wang Shu, 38, vacationed domestically after cancelling a visit to France as a result of he couldn’t get a visa, regardless of attempting to e book a visa appointment months forward.

“I attempted reserving the interview in late March, as I deliberate to attend the French Open tennis in late Could, however the earliest date that I might e book was June 19,” Wang mentioned.

Wang as a substitute vacationed in Changsha, the capital of Hunan province, recognized for its spicy meals.

“The meals was nice, I watched a live performance and spent one-tenth of the cash I might have spent in France,” he mentioned.

Australia’s prime supply of vacationers earlier than COVID, China is now quantity 4, with arrivals down 53% in March from March 2019, mentioned Margy Osmond, chief govt of Tourism & Transport Discussion board Australia.

Chinese language travellers to France, essentially the most visited nation on the planet, have reached solely 28.5% of 2019 ranges, based on airport operator ADP.

Capability on U.S.-China routes stays down greater than 80% from 2019 ranges, weighed by intensifying bilateral political tensions. The U.S. Nationwide Journey and Tourism Workplace expects Chinese language tourism to the U.S. to recuperate totally solely in 2026.

In contrast, nations with visa-free insurance policies have obtained sturdy development in Chinese language guests.

These embody Singapore, Malaysia, Thailand, the United Arab Emirates, Qatar and Saudi Arabia, the place flight capability has additionally elevated.

Switzerland, rising in recognition with high-end travellers on Journey.com, boasts a seven-day visa course of, mentioned Jane Solar, CEO of Journey.com Group.

Japan has additionally obtained a surge in Chinese language travellers this yr, boosted by a plunge within the yen’s worth.

“We’re not simply seeing a market re-growing, we’re seeing a market re-shaping,” Gary Bowerman, director of tourism intelligence agency Examine-In Asia, instructed an OAG webinar final month.

Markets

TSLA, RIVN, or LCID: Which U.S. EV Inventory Is the Prime Choose?

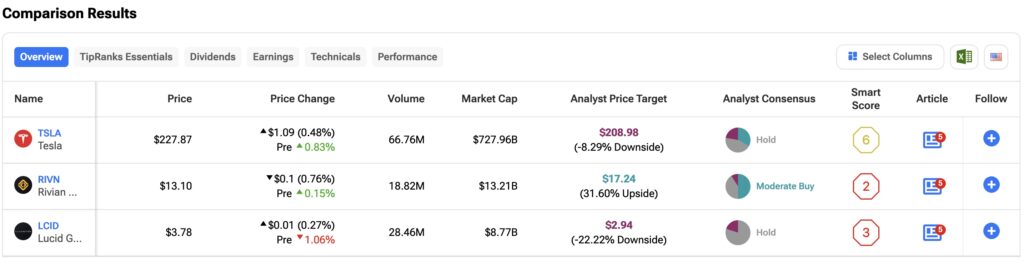

Within the extremely aggressive electrical car (EV) market, main gamers equivalent to Tesla , Rivian Automotive , and Lucid Group have encountered vital headwinds, with demand not assembly expectations. On this article, I’ll use the to clarify why I’m bullish on TSLA and RIVN, and bearish on LCID. I’ll additionally define why I take into account Tesla to be your best option among the many three automakers.

Regardless of a stretched valuation, I’m bullish on Tesla. The corporate’s shares at present commerce at a ahead P/E ratio of 97 instances future earnings estimates, which is about 15% under its five-year common. That is largely resulting from a considerable decline of over 40% within the share worth because it peaked in 2021, pushed by weaker-than-expected EV demand and elevated competitors. Nonetheless, Tesla stays the top-selling EV maker globally.

Tesla had aimed for 50% progress in car gross sales and manufacturing this 12 months however as an alternative has seen its income decline. In Q2, complete automotive income was $19.8 billion, down 7% from a 12 months in the past. Tesla’s quarterly manufacturing and supply figures in July confirmed 443,956 car deliveries, which was about 5% decrease than the earlier 12 months.

On the optimistic facet, Q2 noticed sturdy operational efficiency, with money from operations up 18% 12 months over 12 months to $3.61 billion, and free money circulation of $1.34 billion. This marks a rebound from Q1 of this 12 months when money from operations fell 90% to $242 million, and free money circulation declined to unfavourable $2.5 billion.

Is TSLA A Purchase, Maintain or Promote?

My bullish stance on Tesla isn’t primarily based on current outcomes however reasonably on its formidable progress forecasts. Tesla’s future is more and more tied to synthetic intelligence (AI), Robotaxis, and robotics. The corporate is ready to unveil its extremely anticipated Robotaxi on October 10, which might function a serious catalyst for the inventory.

Whereas some traders might not view Tesla as a serious AI participant, its massive put in base and vital involvement in AI are noteworthy. Dan Ives, a tech analyst at Wedbush Securities, argues that Tesla is probably the most undervalued AI firm. He believes Tesla might grow to be a trillion-dollar concern because it stabilizes demand and improves its pricing mannequin.

At present, Wall Avenue’s consensus on TSLA inventory is that it’s a Maintain. That is primarily based on 12 Purchase, 16 Maintain and eight Promote suggestions made within the final three months. of $208.98 implies potential draw back danger of 8.10%.

Rivian Automotive

Like Tesla, I’m additionally bullish on Rivian Automotive. That is primarily due to the corporate’s potential undervaluation vis-à-vis its formidable manufacturing targets. After dropping almost 90% of its worth since its 2021 preliminary public providing (IPO), Rivian now trades at a pretty worth primarily based on its money place.

With a market capitalization of $13.04 billion and $7.9 billion in money and short-term investments, greater than half of Rivian’s market worth is tied to its stability sheet. Nonetheless, primarily based on its electrical car gross sales, Rivian trades at a P/S ratio of two.5 instances, which, whereas decrease than Tesla, stays nearly 3 instances above the common for the automotive business.

That mentioned, the primary problem dealing with Rivian is reaching profitability and rising the manufacturing of its electrical car fashions. The corporate goals to provide as much as 215,000 autos yearly by 2026, up from 57,232 autos produced in 2023.

Is RIVN Inventory a Purchase?

Whereas I’m bullish on Rivian, it’s necessary to level out the dangers with this inventory. Rivian’s unprofitability is a priority. In Q2 of this 12 months, the corporate posted a internet lack of $1.45 billion, up from a $300 million loss a 12 months earlier. The corporate’s year-to-date loss now totals $2.9 billion. Nonetheless, as Wedbush analyst Dan Ives notes, Rivian’s main concern is its quarterly money burn of $800 million to $1 billion. This stays a priority as the corporate requires capital to scale manufacturing and meet demand. Extra not too long ago, a has eased dilution fears.

Wall Avenue is usually optimistic on RIVN, with 22 analysts score the inventory a Reasonable Purchase. That is primarily based on 11 Purchase, 9 Maintain and two Promote suggestions made up to now three months. The suggests 31.10% upside potential.

Relating to luxurious electrical car producer Lucid, I maintain a bearish place. That is due to the intense decline seen within the firm’s funds and market worth. The corporate’s market capitalization has declined to $8.34 billion from greater than $90 billion in 2021 when it went held its IPO. Regardless of the corporate’s decline, the valuation multiples nonetheless stay tough to justify.

Lucid trades at a 13 instances P/S ratio, almost double Tesla’s a number of and greater than six instances larger than Rivian’s. Moreover, the corporate reported a Q2 2024 internet lack of $643.3 million, translating to roughly $268,000 in losses per car bought, primarily based on the supply of two,394 autos through the quarter.

The state of affairs at Lucid could be extra dire if it weren’t for funding from Saudi Arabia’s Public Funding Fund (PIF). Due to that funding, Lucid holds $3.21 billion in money and short-term investments. This 12 months, the corporate raised a further $1 billion for the manufacturing of its new SUV referred to as “the Gravity.” Scheduled to launch in December this 12 months, the Gravity is predicted to be priced beneath $80,000, and will function a catalyst for LCID inventory.

Is LCID Inventory A Purchase, Maintain, or Promote?

My bearish view of Lucid is essentially resulting from its give attention to the slender and area of interest luxurious car market. Shoppers are clamoring for extra inexpensive EVs within the U.S. and elsewhere. Morgan Stanley analyst Adam Jonas my bearish outlook, noting Lucid’s issue in maintaining manufacturing prices under the promoting worth of its autos. This concern is additional exacerbated by the excessive value of its luxurious mannequin, the Lucid Air, which has a beginning worth of $69,900.

A complete of 10 Wall Avenue analysts have a consensus Maintain score on LCID inventory. That is primarily based on eight Maintain and two Promote suggestions made within the final three months. There aren’t any Purchase scores on the inventory. The implies draw back danger of 20.97% from the place the shares at present commerce.

Conclusion

I view Tesla as a high choose amongst this trio of main electrical car producers. The corporate has loads of progress potential with its Robotaxis, AI and robotics. Rivian Automotive can be a Purchase resulting from its upside potential and cheap valuation. I’m bearish on Lucid as a result of its valuation is simply too excessive and profitability stays a problem on the firm.

Markets

Japan shares larger at shut of commerce; Nikkei 225 up 1.67%

Lusso’s Information – Japan shares had been larger after the shut on Friday, as beneficial properties within the , and sectors led shares larger.

On the shut in Tokyo, the added 1.67%.

The perfect performers of the session on the had been Resonac Holdings Corp (TYO:), which rose 9.41% or 309.00 factors to commerce at 3,594.00 on the shut. In the meantime, Tokai Carbon Co., Ltd. (TYO:) added 7.02% or 61.10 factors to finish at 930.90 and Kawasaki Heavy Industries, Ltd. (TYO:) was up 6.26% or 319.00 factors to five,411.00 in late commerce.

The worst performers of the session had been Keisei Electrical Railway Co., Ltd. (TYO:), which fell 2.73% or 124.00 factors to commerce at 4,415.00 on the shut. NTT Knowledge Corp. (TYO:) declined 2.48% or 61.50 factors to finish at 2,418.50 and Kansai Electrical Energy Co Inc (TYO:) was down 2.37% or 57.00 factors to 2,349.00.

Rising shares outnumbered declining ones on the Tokyo Inventory Trade by 2389 to 1206 and 272 ended unchanged.

The , which measures the implied volatility of Nikkei 225 choices, was down 2.41% to 27.14.

Crude oil for November supply was down 0.10% or 0.07 to $71.09 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.13% or 0.10 to hit $74.78 a barrel, whereas the December Gold Futures contract rose 0.39% or 10.10 to commerce at $2,624.70 a troy ounce.

USD/JPY was down 0.50% to 141.91, whereas EUR/JPY fell 0.36% to 158.62.

The US Greenback Index Futures was down 0.17% at 100.15.

Markets

Trump Media inventory drops as lockup expiration set to provide the previous president clearance to promote shares

-

Trump Media inventory plummeted to its lowest ranges since its IPO on Thursday.

-

Shares dropped as a lot as 4% as a lockup interval was set to run out.

-

Following the lockup, Trump can dump his shares, although he is mentioned he would not promote.

Trump Media & Know-how Group shares dropped to their lowest degree because the firm went public earlier this 12 months as a .

The Reality Social mother or father firm’s shares slid as a lot as 4% on Thursday, dropping as little as $14.77 earlier than paring some losses.

The corporate went public in March, with shares spiking to all-time highs above $70 shortly after, earlier than steadily declining within the following months.

The newest decline has been fueled by investor concern over the lockup interval which prevents insiders from promoting, and which is ready to run out as quickly as Thursday afternoon, reported.

As soon as the lockup interval is over, the Republican presidential candidate has the all-clear to begin promoting his inventory. If he chooses to take action, it may very well be a significant headwind for traders, on condition that Trump owns a virtually 60% stake within the firm value $.

Trump mentioned final week he had no intention of promoting the inventory, which briefly calmed traders.

“No, I am not promoting. No, I find it irresistible,” the presidential candidate mentioned in a press convention final Friday, sparking a 25% rally in DJT shares.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now