Markets

Is Tremendous Micro Laptop Inventory a Purchase Now?

Shares of Tremendous Micro Laptop (NASDAQ: SMCI) have gone on a curler coaster trip up to now this 12 months. The AI server producer’s inventory racked up good points of greater than 300% in lower than three months at the start of 2024, however it’s down 29% since hitting an all-time excessive within the first half of March.

However now, Supermicro inventory appears to be gaining momentum as soon as once more because it . This surge was pushed by the newest earnings reviews from main (AI) gamers resembling Broadcom and Oracle. Whereas Broadcom raised its forecast for AI chip gross sales for the present fiscal 12 months, Oracle identified that it’s constructing extra cloud computing capability to cater to the huge demand it is seeing.

These developments bode effectively for Supermicro, whose AI servers are used for mounting chips used for coaching and deploying AI fashions in knowledge facilities. Nonetheless, the inventory’s newest surge means it has practically tripled in 2024 already. So is it too late for traders to purchase Supermicro inventory? Let’s discover out.

Supermicro is not costly regardless of its spectacular surge

Supermicro inventory is at the moment buying and selling at 4.3 instances gross sales. That is decrease than the U.S. know-how sector’s common of seven.8, suggesting the inventory is undervalued. A giant cause Supermicro’s price-to-sales ratio is engaging proper now could be the very fact its share worth good points have been backed by excellent development on the corporate’s prime line.

Extra particularly, Supermicro’s fiscal 2024 Q3 income tripled 12 months over 12 months to $3.85 billion. Moreover, the corporate has elevated its fiscal 2024 income steerage to $14.9 billion from the sooner expectation of $14.5 billion (each figures on the midpoint of their respective ranges). The up to date steerage means Supermicro’s prime line is on monitor to greater than double from the earlier fiscal 12 months.

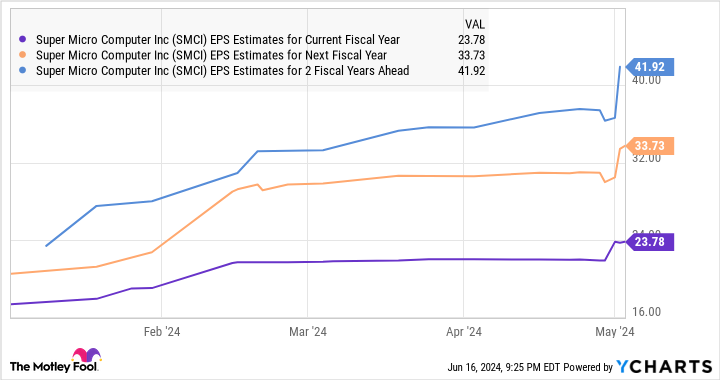

Furthermore, the corporate’s strong gross sales development can also be translating right into a wholesome enchancment in its earnings. Its backside line grew fourfold within the earlier quarter to $6.65 per share. The corporate at the moment sports activities an earnings a number of of 43, a small low cost to the U.S. tech sector’s common price-to-earnings (P/E) ratio of 45. Nonetheless, its ahead earnings a number of of 21 signifies its bottom-line development is about to take off.

One other a number of that tells us that Supermicro is attractively valued is its worth/earnings-to-growth ratio. The PEG ratio takes into consideration an organization’s potential earnings development. As a rule of thumb, a PEG ratio of lower than 1 means a inventory is undervalued primarily based on the potential development it’s anticipated to ship, and that is exactly the case for Supermicro:

That is not stunning as Supermicro’s earnings are anticipated to develop at an annual charge of 62% over the subsequent 5 years, powered by large spending on AI servers.

Greater spending on AI infrastructure goes to be an enormous catalyst

The most recent earnings reviews from Oracle and Broadcom inform us that AI infrastructure spending is rising at a powerful tempo. Oracle, for example, is “working as rapidly as we will to get cloud capability constructed out given the enormity of our backlog and pipeline.” Broadcom, however, identified that hyperscale cloud computing suppliers are “accelerating their investments” to enhance the efficiency of their knowledge facilities.

That is the rationale the AI server market is forecast to develop from a dimension of $31 billion in 2023 to a whopping $430 billion by 2033. That is a compound annual development charge (CAGR) of 30%. Supermicro is rising at a quicker tempo than the AI server market total, suggesting it’s the firm of selection for knowledge middle operators to deploy AI servers.

Supermicro’s technique of rapidly churning out cost-efficient server options for fashionable AI chips from main chipmakers appears to be enjoying a key function in serving to it achieve an even bigger share of the AI server market. Furthermore, the corporate’s deal with rapidly including extra manufacturing capability can also be permitting it to make an even bigger dent on this house.

All this means shares of Supermicro might proceed heading increased in the long term. The AI inventory carries a median 12-month worth goal of $1,030 per share amongst 20 analysts protecting it, which represents a 22% achieve from present ranges.

Buyers who have not purchased this high-flying inventory but ought to nonetheless think about doing so — it is not too late.

Must you make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for traders to purchase now… and Tremendous Micro Laptop wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $808,105!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Oracle. The Motley Idiot recommends Broadcom. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

ASML inventory dips as Morgan Stanley cuts score

Morgan Stanley analysts lowered their score on ASML Holding (ASML) shares from Obese to Equal-weight, and reduce the worth goal from €925 to €800, citing “late-cycle dynamics” that might affect the corporate’s earnings progress prospects in 2025 and 2026.

ASML shares slipped greater than 1% in premarket buying and selling Friday.

The downgrade displays issues over a number of headwinds, together with a doable slowdown in semiconductor spending.

Roughly 46% of ASML’s system gross sales within the second quarter of 2024 are anticipated to return from DRAM, a phase that might weaken in line with Morgan Stanley’s evaluation. This anticipated decline in DRAM spending is a part of a broader apprehension concerning a downturn within the semiconductor cycle.

Then again, Morgan Stanley acknowledges areas of energy for ASML, together with Excessive Bandwidth Reminiscence (HBM) utilized in AI chips and spending on new know-how nodes, notably at TSMC (TSM).

Nonetheless, the agency additionally factors to dangers corresponding to a slowdown in Intel’s (NASDAQ:) foundry sector and issues over China’s semiconductor capability spending as we strategy 2026.

The valuation of ASML has been a spotlight for buyers, with the inventory’s price-to-earnings ratio peaking at 30-35x in July 2024 and the current de-rating of ASML’s inventory “indicative of late-cycle share worth motion,” analysts famous.

They keep that ASML is a progress cyclical firm with high-quality earnings however warning towards overly optimistic expectations earlier than the order guide cycle reaches its peak.

Wanting forward, Morgan Stanley sees a chance for ASML’s valuation to enhance by November 2024, coinciding with the corporate’s Capital Markets Day. Nevertheless, any re-rating is anticipated to be restricted to mid-cycle multiples, factoring within the dangers anticipated for 2026.

Markets

2 Magnificent Progress Shares Simply Upgraded by Wall Avenue Analysts to Purchase Now

Shares of Shopify (NYSE: SHOP) and Axon Enterprise (NASDAQ: AXON) have moved in reverse instructions this 12 months. The previous has fallen 4%, whereas the latter has gained 48%. Each shares just lately had their raised by Wall Avenue analysts.

On Sept. 17, Dominic Ball at Redburn Atlantic upgraded Shopify from impartial to purchase and raised his worth goal to $99 per share. That forecast implies a 32% upside from the corporate’s present share worth of $75.

On Sept. 12, Trevor Walsh at JMP Securities on Axon Enterprise to $430 per share. That forecast implies a 12% upside from its present share worth of $383.

Here is what buyers ought to learn about Shopify and Axon.

1. Shopify

Shopify supplies a turnkey resolution for commerce. Its platform helps retailers handle gross sales and stock throughout bodily and digital storefronts, together with on-line marketplaces, social media, and customized web sites. Shopify additionally supplies adjoining service provider companies, like fee processing, logistics, and advertising and marketing software program.

Analysis firm Gartner acknowledged Shopify as a frontrunner in its newest report on digital commerce. Analysts cited strong performance throughout retail and wholesale, momentum with bigger retailers, and speedy innovation as key strengths. Equally, Forrester Analysis acknowledged Shopify as a frontrunner in its newest report on wholesale commerce, citing its broad capabilities and synthetic intelligence (AI) instruments as key differentiators.

Shopify reported good second-quarter monetary outcomes regardless of the unsure financial backdrop. Income elevated 21% to $2 billion because of sturdy gross sales progress in subscription software program and service provider companies. In the meantime, non-GAAP earnings elevated 85% to $0.26 per diluted share. Momentum with massive, worldwide, and offline retailers — three areas the place Shopify has centered its assets — was notably encouraging.

Wall Avenue expects Shopify’s adjusted earnings to extend at 25% yearly by way of 2026. That consensus estimate makes the present valuation of 73 instances adjusted earnings look somewhat dear, however Shopify warrants a premium. Its retail e-commerce market share is 10% within the U.S. and 6% in Western Europe, and it has hardly tapped what administration sees as an $849 billion addressable market.

Affected person buyers can take into account shopping for a small place in Shopify inventory in the present day. If shares pull again, use the chance to construct an even bigger place by way of dollar-cost averaging.

2. Axon Enterprise

Axon is a public-safety firm that sells {hardware} and software program to legislation enforcement, federal businesses, and industrial enterprises. Its portfolio contains performed power gadgets (Tasers), physique cameras, and in-car cameras, which combine with its software program for digital proof administration, report writing, and real-time operations.

Axon has lengthy dominated the marketplace for performed power gadgets — a lot in order that the Taser model identify has grow to be synonymous with the product class. Accordingly, the corporate has a buyer relationship with a “substantial variety of state and native legislation enforcement businesses in the US.” That has helped Axon safe a management place in physique cameras and digital proof administration software program.

Axon reported sturdy monetary ends in the second quarter. Income elevated 34% to $504 million, pushed by notably sturdy gross sales progress in software program and companies, and non-GAAP web earnings elevated 9% to $1.20 per diluted share. The one disconcerting metric was the 41% enhance in working bills that dragged on the underside line, however Axon is spending cash on product growth that ought to reinforce its market management.

As an example, the corporate just lately launched a generative AI service referred to as Draft One which makes use of video knowledge from Axon physique cameras to draft police reviews. CEO Rick Smith just lately informed analysts, “Our prospects’ response to Draft One is healthier than something I’ve seen.” He additionally expressed confidence that Axon will outline the general public security class of generative AI software program as a result of it has the biggest sensor ecosystem and, subsequently, essentially the most strong knowledge.

Wall Avenue expects Axon’s adjusted earnings to extend at 20% yearly by way of 2025. That consensus estimate makes the present valuation of 85 instances earnings look dear, however buyers will possible have to pay a premium to personal a bit of this firm. Axon is a frontrunner in its core product classes, and the corporate has hardly tapped what administration sees as a $77 billion addressable market.

Affected person buyers ought to take into account shopping for a small place in the present day. Shares will most likely pull again sooner or later, and buyers can use that chance to construct a big place.

Do you have to make investments $1,000 in Shopify proper now?

Before you purchase inventory in Shopify, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Shopify wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $694,743!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Axon Enterprise and Shopify. The Motley Idiot has positions in and recommends Axon Enterprise and Shopify. The Motley Idiot recommends Gartner. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Indonesia shares decrease at shut of commerce; IDX Composite Index down 1.50%

Lusso’s Information – Indonesia shares have been decrease after the shut on Friday, as losses within the , and sectors led shares decrease.

On the shut in Jakarta, the fell 1.50%.

One of the best performers of the session on the have been Sariguna Primatirta PT (JK:), which rose 0.39% or 5.00 factors to commerce at 1,280.00 on the shut. In the meantime, Victoria Care Indonesia Tbk Pt (JK:) added 535.00% or 535.00 factors to finish at 635.00 and Arwana Citramulia Tbk (JK:) was up 475.00% or 570.00 factors to 690.00 in late commerce.

The worst performers of the session have been Prasidha Aneka Niaga Tbk (JK:), which fell 97.03% or 2,911.00 factors to commerce at 89.00 on the shut. Indospring Tbk (JK:) declined 96.69% or 8,702.00 factors to finish at 298.00 and Logindo Samudramakmur Tbk (JK:) was down 96.57% or 2,704.00 factors to 96.00.

Falling shares outnumbered advancing ones on the Jakarta Inventory Trade by 392 to 254 and 191 ended unchanged.

Crude oil for November supply was down 0.48% or 0.34 to $70.82 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.51% or 0.38 to hit $74.50 a barrel, whereas the December Gold Futures contract rose 0.79% or 20.75 to commerce at $2,635.35 a troy ounce.

USD/IDR was down 0.20% to fifteen,153.55, whereas AUD/IDR fell 0.25% to 10,321.14.

The US Greenback Index Futures was up 0.10% at 100.42.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024