Markets

That is when it’s best to contemplate promoting Nvidia inventory

Lusso’s Information — Nvidia (NASDAQ:) inventory retains on rising because the market rallies to a sequence of recent all-time highs on the again of renewed September Fed pivot hopes after information posted better-than-expected numbers.

However amidst the seemingly endless Nvidia rally, buyers who picked up the inventory early within the yr are actually confronted with one of the tough decisions for buyers – simply when is the precise time to promote the golden goose?

That is one more facet of your investments the place our state-of-the-art stock-picking software can assist you outperform for lower than $9 a month.

And, in response to its newest rebalance at the beginning of June the reply is: not but.

The truth is, our premium customers who acquired the tip to carry on to the AI large on the primary buying and selling day of June, are actually reaping the rewards with a considerable 20.3% acquire on the inventory alone.

Even higher, our long-term customers who acquired the tip to purchase the inventory in November final yr and maintain it till now are swimming in a life-changing 223% acquire.

However that can ultimately change. Quickly sufficient, it would inform its customers to bag beneficial properties on Nvidia similar to it did with a number of different shares earlier than they tanked. That can probably be the precise time to start out taking earnings.

One related instance is Vistra Vitality Corp (NYSE:), which rallied 94.86% inside the technique and dropped 13% since our AI bought it at the start of this month.

So, if you wish to know the precise time to promote Nvidia, subscribe right here for $9 a month and let the facility of AI drive your earnings to unseen ranges.

Whereas these beneficial properties are spectacular, maybe much more crucial is our AI’s capacity to inform simply when to promote the inventory. Powered by state-of-the-art elementary fashions, our AI updates its customers with the highest picks and sells each month.

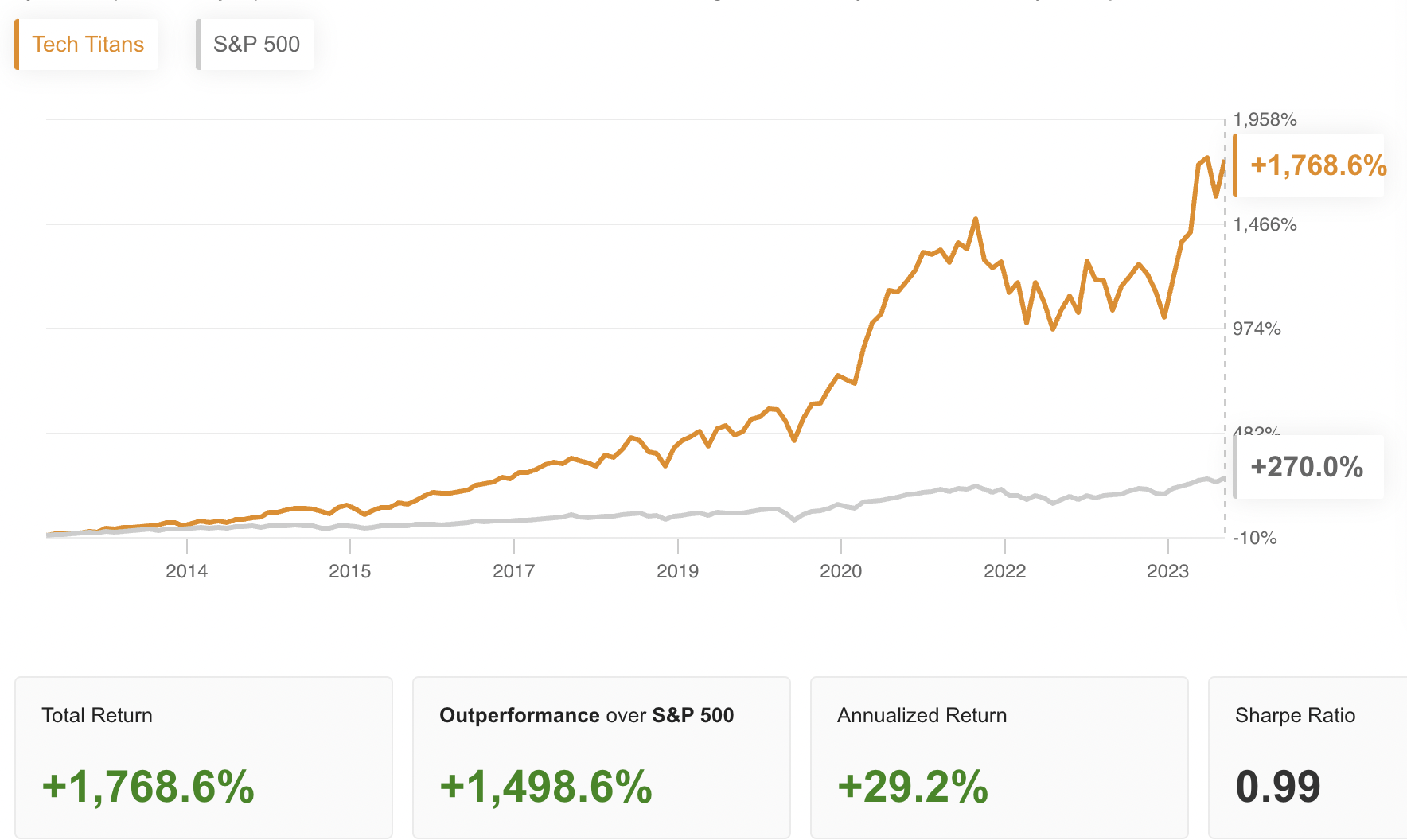

That is the precise methodology that pushed our real-world efficiency to a stable beat over the since our official launch in October. See the information under (per funding technique):

- Tech Titans: +71.14%

- Beat the S&P 500: +34.63%

- High Worth Shares: + 32.06%

- S&P 500: 29.15%

That is no backtest. That is the real-world efficiency unfolded proper in entrance of our eyes.

The key behind our AI’s high efficiency is that, not like the whole lot else on the market, our methods are forward-looking and never a momentum indicator.

Powered by the historical past of the inventory market in information, our AI is designed to select shares earlier than they rally – thus not attempting to chase the market. No bag-holding, simply best-in-breed recent inventory selecting.

The truth is, our backtest recommend that buyers who observe the methods over the long term will get even higher outcomes. See under:

Supply: ProPicks

This means a $100K principal in our technique would have changed into an eye-popping $1,868,000 by now.

Wonderful, proper?

Subscribe now for lower than $9 a month and prepare for a market-beating June efficiency

*And because you made all of it the way in which to the underside of this text, we’ll offer you a particular 10% additional low cost on all our plans with the coupon code PROPICKS20242!

Markets

Nio launches Onvo L60, inventory to ‘rise in absolute phrases over the subsequent 15 days,’ analysts say

Nio (NYSE:) on Thursday unveiled its new electrical SUV, the Onvo L60, priced decrease than what the market anticipated.

Shares in Nio jumped greater than 7% Thursday.

“NIO’s share value ought to react positively to the superior price-performance of L60. Nevertheless, with demand seemingly much less of a doubt now, well timed demand achievement would in flip change into the important thing concern – possible a very good drawback to have,” Morgan Stanley analysts commented.

Following a greater than 20% surge in NIO’s inventory month-to-date, in comparison with a 1% acquire for the Nasdaq, expectations for order consumption have elevated considerably.

In keeping with Morgan Stanley analysts, for NIO to see additional substantial re-rating, it can require sturdy execution in scaling up manufacturing and sustaining a optimistic buyer expertise amidst the inflow of orders, which they spotlight as “essential to show NIO is structurally on the rise.”

Nio’s aggressive pricing technique ought to assist the Onvo supply goal of 20,000 items within the fourth quarter, analysts added, with the possible upbeat demand anticipated to place strain on the corporate’s ramp-up tempo.

In a separate notice, Morgan Stanley analysts stated they imagine Nio’s share value “will rise in absolute phrases over the subsequent 15 days.”

NIO launched the ONVO L60 at a lower-than-expected MSRP of RMB 206,900, which features a 60kWh battery and is RMB 13,000 decrease than the pre-sale value. The BaaS mannequin, excluding the battery pack, is RMB 57,000 cheaper, priced at RMB 149,000.

Morgan Stanley analysts imagine that this aggressive pricing, together with extra incentives similar to an early fowl low cost of as much as RMB 4,000 and an area authorities trade-in subsidy of RMB 10,000, is anticipated to drive larger order conversions and enhance gross sales.

The analysts estimate a 70% to 80% likelihood of this optimistic situation taking part in out.

Markets

The Fed Simply Reduce Curiosity Charges: 3 Shares to Purchase Hand Over Fist

4-plus years handed with out an interest-rate minimize from the . That modified Wednesday when the Fed lowered charges by an unexpectedly giant 0.5%.

Traders’ preliminary reactions have been muted. Nonetheless, the inventory market soared on Thursday as they digested the influence of the massive price minimize. Even higher, the indicated that rates of interest may very well be decreased by one other 0.5% by the tip of the yr.

The Fed’s transfer may very well be simply the ticket to inject extra oomph into the bull market that started in late 2022. And it presents an excellent alternative for buyers. Listed here are three shares to purchase hand over fist.

1. Dominion Vitality

Utility shares are often boring. They plod alongside, primarily attracting earnings buyers. Nonetheless, it has been a a lot completely different story for a lot of utilities in 2024. Dominion Vitality (NYSE: D) is a good instance. The inventory has jumped greater than 20% yr so far.

I believe the Fed’s price cuts will increase Dominion Vitality’s share value much more. Decrease charges translate to decrease borrowing prices. That is nice information for Dominion, which has roughly $8.3 billion in debt reaching maturity over the following three years and a $6 billion credit score facility.

Bond yields additionally fall when charges decline, spurring many buyers to hunt larger earnings. Dominion Vitality seems to be like an excellent different, with its ahead dividend yield of round 4.7%.

The inventory is even an unlikely technique to revenue from the unreal intelligence (AI) increase. Dominion Vitality serves Northern Virginia, a area that is the world chief in knowledge facilities.

2. D.R. Horton

D.R. Horton (NYSE: DHI) hasn’t wanted decrease rates of interest to ship scorching good points. Shares of the homebuilder have soared near 30% this yr after skyrocketing 70% in 2023.

Make no mistake about it, although: Price cuts will assist D.R. Horton significantly. Mortgage charges often fall in lockstep with rates of interest, and once they do, new homes are extra inexpensive. That is music to D.R. Horton shareholders’ ears.

D.R. Horton ranks as the biggest homebuilder within the U.S. primarily based on quantity. The corporate operates in 121 markets in 33 states and closed on a whopping 94,255 houses in the course of the 12 months ending June 30, 2024. If any inventory advantages from decrease mortgage charges ensuing from the Fed’s transfer, D.R. Horton will.

There’s additionally a serious long-term tailwind for D.R. Horton. Fannie Mae estimates the nation wants round 4.4 million new houses, which is near Zillow‘s current 4.5 million estimate. The one answer to this scarcity is constructing new houses.

3. Realty Revenue

Realty Revenue (NYSE: O) hasn’t been an enormous winner in 2024. Its share value is in optimistic territory yr so far, however not by a lot. Nonetheless, this actual property funding belief (REIT) has been sizzling over the past 12 weeks, with a lot of the momentum as a result of anticipation of interest-rate cuts.

REITs are just like utility firms in some methods. Each sometimes tackle debt to fund growth and infrequently supply juicy dividends. Consequently, REIT shares and utility shares are usually extremely delicate to rates of interest.

I believe decrease charges will make Realty Revenue much more enticing to earnings buyers who’re dumping bonds. The REIT’s ahead dividend yield is 5.2%, and Realty Revenue pays its dividends month-to-month. Even higher, the corporate has elevated its dividend for 27 consecutive years.

Like Dominion Vitality, Realty Revenue ought to profit from the surge in AI demand. The corporate views the information middle market as a profitable development alternative. It is also seeking to increase in Europe, which has an estimated complete addressable market of $8.5 trillion.

Do you have to make investments $1,000 in Dominion Vitality proper now?

Before you purchase inventory in Dominion Vitality, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Dominion Vitality wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $694,743!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Dominion Vitality and Realty Revenue. The Motley Idiot has positions in and recommends Realty Revenue and Zillow Group. The Motley Idiot recommends Dominion Vitality. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

ASML inventory dips as Morgan Stanley cuts score

Morgan Stanley analysts lowered their score on ASML Holding (ASML) shares from Obese to Equal-weight, and reduce the worth goal from €925 to €800, citing “late-cycle dynamics” that might affect the corporate’s earnings progress prospects in 2025 and 2026.

ASML shares slipped greater than 1% in premarket buying and selling Friday.

The downgrade displays issues over a number of headwinds, together with a doable slowdown in semiconductor spending.

Roughly 46% of ASML’s system gross sales within the second quarter of 2024 are anticipated to return from DRAM, a phase that might weaken in line with Morgan Stanley’s evaluation. This anticipated decline in DRAM spending is a part of a broader apprehension concerning a downturn within the semiconductor cycle.

Then again, Morgan Stanley acknowledges areas of energy for ASML, together with Excessive Bandwidth Reminiscence (HBM) utilized in AI chips and spending on new know-how nodes, notably at TSMC (TSM).

Nonetheless, the agency additionally factors to dangers corresponding to a slowdown in Intel’s (NASDAQ:) foundry sector and issues over China’s semiconductor capability spending as we strategy 2026.

The valuation of ASML has been a spotlight for buyers, with the inventory’s price-to-earnings ratio peaking at 30-35x in July 2024 and the current de-rating of ASML’s inventory “indicative of late-cycle share worth motion,” analysts famous.

They keep that ASML is a progress cyclical firm with high-quality earnings however warning towards overly optimistic expectations earlier than the order guide cycle reaches its peak.

Wanting forward, Morgan Stanley sees a chance for ASML’s valuation to enhance by November 2024, coinciding with the corporate’s Capital Markets Day. Nevertheless, any re-rating is anticipated to be restricted to mid-cycle multiples, factoring within the dangers anticipated for 2026.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024