Markets

Is It Too Late to Purchase NVDA Inventory?

Nvidia (NASDAQ: NVDA) shares are using excessive on the seas of synthetic intelligence (AI). The chip designer took an early lead within the AI {hardware} race, resulting in unimaginable enterprise outcomes and skyrocketing inventory costs.

The inventory traded at a $14 per share when OpenAI launched the ChatGPT generative AI engine, powered by hundreds of Nvidia AI accelerator chips. At the moment, Nvidia’s share worth has soared to $131. With a $3.2 trillion , it is one of many three most useful firms within the inventory market.

Did you miss the boat on Nvidia’s AI-based alternative, or can the inventory proceed to rise from this lofty plateau? Let’s discover out.

Nvidia’s upsides

Nvidia’s monetary success is indeniable. Revenues greater than tripled year-over-year within the final two earnings studies. Free money flows are persistently rising by about 500% in the identical time-frame. Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) are nonetheless extra worthwhile than Nvidia, however the chip knowledgeable is catching up.

Many market observers wish to level out that the generative AI revolution is just getting began. ChatGPT is lower than two years outdated. Solely a few tech giants have provide you with comparably highly effective giant language fashions (LLMs) up to now, although many are engaged on their very own long-term generative AI plans. Till additional discover, Nvidia’s accelerator chips are the gold commonplace towards which different options should be measured. In case you’re constructing a robust AI system, Nvidia’s options are the default and the business commonplace. Others should develop after which show some type of distinctive benefit earlier than profitable AI contracts towards Nvidia’s killer merchandise.

Think about Nvidia sustaining its lead because the generative AI market grows. It is not exhausting to see the inventory hovering even larger over the following few years.

Nvidia’s potential downsides

However, the nice monetary information and an entire lot of forward-looking expectations are already priced into Nvidia’s inventory. Shares are altering palms at shiny valuation ratios resembling 82 instances free money move and 40 instances gross sales — ranges normally reserved for small-cap start-ups with extra sizzle than substance.

On the similar time, Nvidia would not stand unchallenged within the AI accelerator market. Arch rival Superior Micro Gadgets (NASDAQ: AMD) has its Intuition line of cost-effective AI chips. The Intel (NASDAQ: INTC) Gaudi collection boasts spectacular efficiency per watt of electrical energy. And that is simply the highest of a giant heap. There’s multiple technique to design an AI-crunching system, and rival options could provide compelling options for particular use circumstances. Who’s to say that Nvidia will grasp on to its market-defining lead in the long term?

Individually, the problems of excessive valuation and robust competitors ought to be sufficient to offer most buyers pause earlier than slamming that “purchase” button on Nvidia inventory. Collectively, it is a high-wire act with a good distance down. Nvidia’s inventory is priced for perfection and any misstep — resembling a serious AI contract misplaced to Intel or AMD — will most likely end in a fast and painful worth drop.

Do you have to purchase, promote, or maintain Nvidia?

I am not saying it’s best to promote each Nvidia share proper now and by no means look again. The corporate might very effectively stave off the military of rivals and proceed to innovate on a hard-to-match degree. Certainly, a little bit of Nvidia publicity might serve your portfolio effectively through the years.

In the meantime, I extremely advocate taking some income off the desk by promoting a portion of your long-term Nvidia holdings. The features are greater than substantial and I am certain yow will discover extra steady and safe methods to take a position that cash within the AI market.

So on the size of purchase, promote, or maintain, I see Nvidia as a inventory to carry for the long term. I might somewhat promote a couple of shares than purchase extra at these nosebleed-inducing share costs. Your mileage could range, relying in your urge for food for market danger and AI-driven pleasure. Be happy to do your personal analysis and attain totally different conclusions. Simply do not say I did not warn you if or when Nvidia’s large worth correction comes.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $802,591!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has positions in Intel and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Apple, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, quick August 2024 $35 calls on Intel, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

5 huge analyst AI strikes: SK Hynix hit by double downgrade; ADI named Prime Semis Choose

Lusso’s Information — Listed below are the largest analyst strikes within the space of synthetic intelligence (AI) for this week.

Lusso’s Information subscribers at all times get first dibs on market-moving AI analyst feedback. Improve immediately!

William Blair begins ARM, AVGO protection at Purchase

In the course of the week, William Blair analysts have initiated protection on Arm Holdings (NASDAQ:) with an Outperform score, voicing confidence within the firm’s potential for sturdy earnings per share (EPS) development and inventory worth appreciation over the approaching years.

The agency pointed to a number of development drivers for Arm, together with “1) increased Common Promoting Costs (ASPs) pushed by improved monetization and better worth IP; 2) share features in newer markets like knowledge middle; 3) tailwinds from AI driving increased demand for general compute; and 4) a brand new improve cycle in cellular/PCs.”

Whereas Arm’s inventory trades at a premium in comparison with its friends, William Blair believes that is justified by the corporate’s strong development outlook, which is predicted to change into clearer within the monetary forecasts for 2026 and 2027.

Their discounted money move evaluation signifies round 35% upside potential for Arm’s shares, supported by sustained income development and rising profitability over the following decade.

In a separate observe, William Blair additionally assigned an Outperform score to Broadcom (NASDAQ:), noting the corporate’s strategic growth into software program as a solution to buffer towards the cyclical nature of the semiconductor trade.

The agency believes that the chipmaker is positioned for continued development, pushed by AI-related demand in networking and customized chip segments, together with the shift to subscription-based fashions in its VMware (NYSE:) division.

Analysts highlighted that almost two-thirds of VMware clients have transitioned to subscriptions, a major rise from the 30% seen previous to the acquisition.

In addition they famous that AVGO is buying and selling at a price-to-earnings ratio of 26x and an enterprise worth to free money move ratio of 22x based mostly on their 2025 projections, barely under the median of its friends.

“We see room for a number of growth because the sustainability of development in networking, buyer AI chips, and software program turns into clearer,” the observe states.

Morgan Stanley double-downgrades SK Hynix on cloudy outlook past This autumn

Shares of SK Hynix (KS:) dropped on Thursday following a double downgrade from Morgan Stanley, with analysts shifting their score from Chubby to Underweight.

In a observe, analysts remarked that “the solar continues to be shining” for the corporate in the intervening time. They predict 2024 shall be one other sturdy 12 months for SK Hynix, pushed by rising DRAM costs heading into the fourth quarter, which ought to result in “distinctive near-term earnings.”

Nonetheless, the outlook past the fourth quarter seems much less favorable. Whereas the long-term potential for DRAM, notably resulting from AI-driven demand from knowledge facilities, continues to be promising, the agency famous that cyclical shortages are coming to an finish.

“Wanting previous 4Q24, we see sustained dangers to the highest line and EPS as development slows, pricing falls, and rising competitors in high-bandwith reminiscence (HBM) challenges sustainable long-term margins,” the analysts added.

Along with downgrading the inventory, Morgan Stanley additionally minimize its worth goal for SK Hynix by greater than half, decreasing it from 260,000 to 120,000 Korean gained.

Citi names Analog Units its new high semis decide

In a analysis observe launched Tuesday, Citi analysts named Analog Units (NASDAQ:) as their new high decide within the semiconductor sector.

The choice follows Citi’s replace to its semiconductor inventory rating desk, which included a worth goal adjustment for Micron Know-how (NASDAQ:) and an improve of Texas Devices (NASDAQ:). The agency maintains a constructive outlook on the semiconductor trade as a complete.

Citi highlighted ADI’s decrease draw back threat within the automotive sector in comparison with different analog semiconductor makers, notably following the corporate’s latest earnings report.

This diminished threat, based on Citi, makes ADI well-positioned amid ongoing market uncertainties, main the agency to rank it on the high of its semiconductor inventory desk.

“ADI is our high decide,” Citi analysts acknowledged, including that they see “decrease draw back threat in Autos versus different analog names given they’ve simply introduced earnings.”

Broadcom and AMD (NASDAQ:), each key gamers within the AI sector, stay in Citi’s second and third spots, respectively.

AI revolution commerce receives a lift after Fed minimize: Wedbush

Wedbush analysts mentioned that they consider the AI revolution commerce has gained momentum following the Federal Reserve’s 50 foundation level price minimize, signaling a positive atmosphere for Massive Tech and AI shares.

Wedbush views this aggressive price minimize, alongside a dovish dot plot extending into 2025, as making a “very bullish backdrop” for the tech sector.

The Fed’s transfer marks a momentous shift, as many traders had been ready for this sign to totally interact with tech development shares main into 2025.

The agency identified that the broader know-how sector has remained resilient, with latest earnings stories, equivalent to these from Oracle, indicating that the AI revolution is getting into its software program and software section.

Latest observations from Asia counsel the tech provide chain is making ready for vital growth, spurred by an anticipated $1 trillion in AI capital expenditures within the coming years.

Nvidia (NASDAQ:) stays on the forefront of this revolution, with its GPUs being described by Wedbush because the “new oil and gold” of the IT trade.

With the Federal Reserve’s rate-cutting cycle now underway and AI tech spending starting to speed up, Wedbush analysts proceed to carry a bullish outlook for tech shares, anticipating additional features into 2025.

Melius Analysis upgrades Oracle inventory to Purchase

In the meantime, analysts at Melius Analysis have upgraded Oracle Company (NYSE:) from Maintain to Purchase, setting a worth goal of $210.

They emphasize that Oracle founder Larry Ellison and CEO Safra Catz usually are not solely leveraging their affect but additionally taking a extra strategic method with partnerships, positioning Oracle’s AI-first Cloud as a key development driver.

Ellison’s sturdy connections within the tech world, together with entry to GPUs and agreements with Cloud CEOs, alongside together with his friendship with buyer Elon Musk, have performed a job, Melius’s crew notes.

Whereas Oracle’s inventory is up 54% year-to-date, the agency’s analysts consider this improve may not be late, suggesting the inventory may very well be in the midst of a bigger transfer.

“We see near $8.50 by way of an EPS run price inside 2 years—and with our largest worries muted—we discover it arduous to not put a 25x a number of on an organization set to develop quicker than Salesforce (NYSE:) and Adobe (NASDAQ:),” they mentioned.

Markets

Chinese language Bitcoin firm mines one-third of all blocks in a day, dethrones US

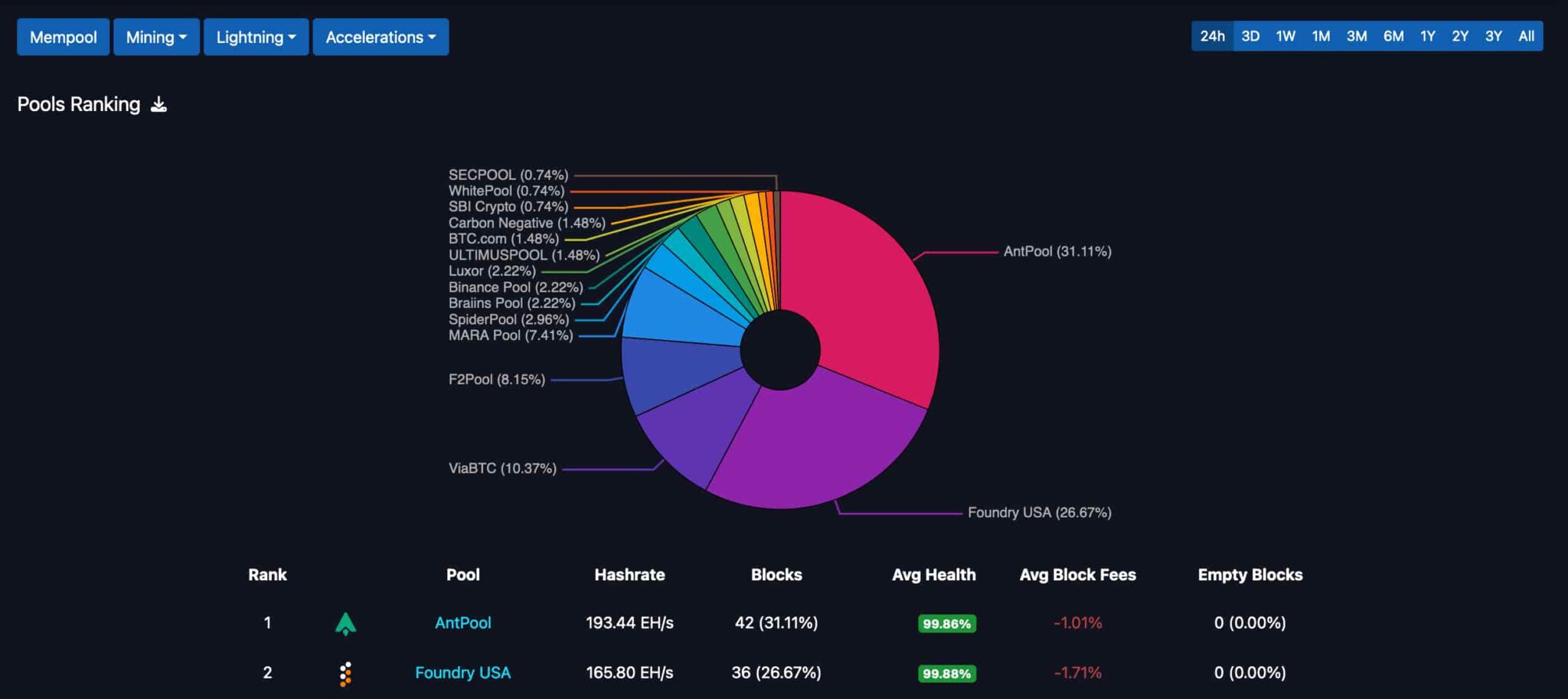

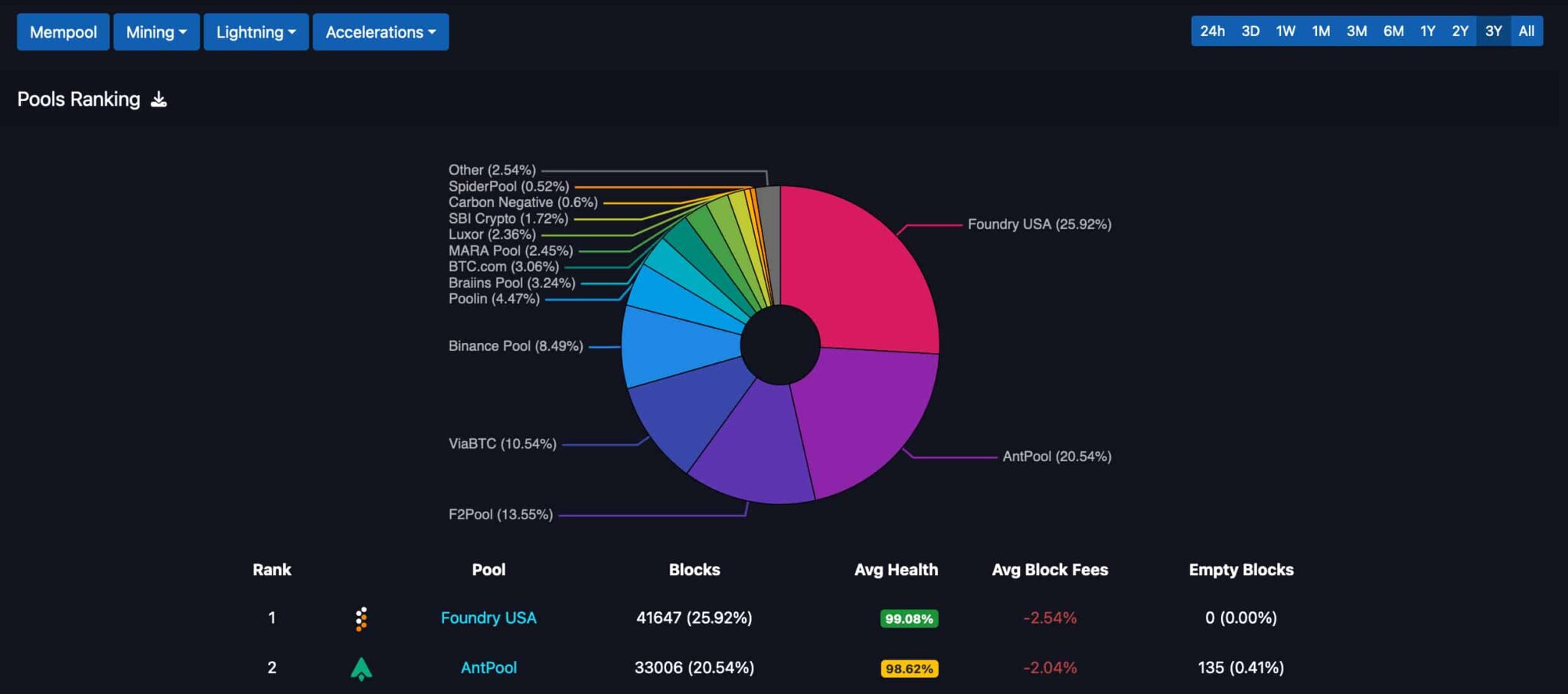

The Bitcoin (BTC) mining race intensified between China and the USA, lately dominated by the previous in a shift. AntPool mined practically one-third of all newly issued BTC within the final 24 hours, concentrating block manufacturing and mining rewards.

Finbold retrieved information from mempool.area on September 22, accounting for Bitcoin’s day by day block discovery amongst mining firms and swimming pools. By the point of this writing, AntPool had mined 42 blocks out of 135, whereas Foundry USA found 36.

Notably, the primary two leaders have been dominating the mining race for years, placing a major distance towards their opponents. ViaBTC, for instance, mined solely 10% of the blocks on this interval, whereas F2Pool and MARA acquired lower than that.

The state of Bitcoin mining has raised centralization considerations amongst specialists, researchers, and builders, as Finbold reported.

Bitcoin mining centralization considerations and penalties

These considerations reached some extent the place a Bitcoin Core developer, Luke Sprint Jr., warned of BTC transactions requiring at the least two hours to be thought-about safe – making the present market requirements of 30 to 60 minutes an outdated security measure.

Nonetheless, the Bitcoin mining centralization may very well be even worse than what floor information suggests, in line with a good BTC researcher. A examine revealed by pseudonymous analyst b10c (@0xb10c) in April signifies that AntPool centralizes most mining exercise past block discovery.

Along with an investigation by Mononaut, the analysts discovered information displaying that at the least six Bitcoin mining swimming pools share each the identical custodian and block template to AntPool, suggesting closed-door agreements hardly noticed at first look.

All in all, the Bitcoin mining race intensifies between the 2 main world economies, the USA and China. Whereas the North American consultant leads the long-term scene, the Chinese language firm AntPool grows its presence within the brief time period.

From an funding perspective, Bitcoin mining centralization may problem the cryptocurrency’s worth proposition, doubtlessly impacting the value of BTC in the marketplace.

Markets

The potential investor upside of a Google breakup — if John Rockefeller is any information

Google’s (, ) authorized troubles might drive it to unload a few of its prized companies, however traders fearful about that consequence might discover some consolation in what occurred to John Rockefeller’s Customary Oil greater than a century in the past.

The empire that managed almost all US oil manufacturing throughout America’s industrial revolution needed to break up into 34 smaller firms after the Supreme Courtroom in sided with the Justice Division in an antitrust problem.

The divestiture of these firms made Rockefeller the richest man on the planet. However it additionally made different shareholders in these new firms richer too, in accordance with authorized consultants.

The businesses grew to become giants corresponding to Chevron () and Exxon Mobil () that also rule the business at this time.

“[T]he market cap whole for all these firms elevated about five- to six-fold primarily based on what the valuation was thought for Customary Oil,” mentioned Boston School Regulation Faculty antitrust regulation professor David Olson.

New administration and efficiencies that adopted the breakup helped the smaller firms flourish, added antitrust litigation legal professional Barry Barnett.

Within the case of Google, present shareholders might profit as a scaled-back firm tends to spice up innovation and customer support, Barnett mentioned. Google’s search engine, for instance, might begin producing extra related outcomes and change into extra useful to advertisers.

“The individuals who personal the corporate usually are not going to lose,” Barnett mentioned.

Not everybody agrees with this rosy view. One analyst at Evercore ISI lately lowered a value goal on Alphabet, Google’s mum or dad firm, after rereading a federal choose’s in opposition to the corporate handed down in August.

US District Courtroom Decide Amit Mehta, who determined the case, sided with the US Justice Division’s claims that Google’s Search enterprise was an unlawful monopoly that it abused to maintain rivals at bay.

Mehta additionally agreed with the DOJ’s accusations that Google illegally monopolized the marketplace for on-line search textual content promoting.

“[W]e imagine a ‘worst case’ state of affairs is a extra doubtless state of affairs than the market assumes,” Evercore’s analyst wrote within the be aware.

It’s not but recognized what treatments the choose might approve because of his ruling.

They may vary from an outright breakup of Google to forcing the corporate to make its search engine knowledge, its “index,” out there to rivals.

It may be pressured to finish the kinds of agreements that received Google into hassle with regulators, that safe its search engine as a default on cellular units and web browsers.

George Alan Hay, Cornell College regulation and economics professor and former DOJ antitrust division chief, mentioned the DOJ is more likely to request “some type of divestiture” the place Google is discovered to have violated the regulation.

“It could be important. It wouldn’t be backbreaking,” he mentioned. “Google might survive.”

One concern for stockholders is {that a} breakup might have an effect on Google’s large revenue engine. In 2023, Google Search generated greater than $175 billion in income.

Coupled with Google’s YouTube advertisements and Google community income, each of which it promotes on its basic search engine, promoting on the platforms accounted for a staggering $237 billion of the corporate’s $307 billion in whole income.

In October 2020, when the DOJ and states filed go well with, Google’s annual income was roughly half of that, totaling $162 billion.

Not all breakups of enterprise empires have led to optimistic outcomes, at the very least within the instant aftermath.

Contemplate the breakup of the AT&T () telecom community within the Eighties that adopted seven years of litigation with the DOJ.

The Justice Division sued AT&T in 1974, searching for a breakup of its cellphone service and cellphone gear monopolies. It received most of what it wished in 1984 following athat created plenty of regional firms.

However AT&T misplaced important long-distance income to newcomers MCI and Dash. From 1984 to 1996, its share of whole long-distance income .

However Barnett mentioned he expects a breakup of Google to influence its shareholders the way in which that Customary Oil’s breakup did.

“So when you’re an Alphabet shareholder, this can be good for you.”

Alexis Keenan is a authorized reporter for Lusso’s Information. Observe Alexis on X .

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately