Markets

3 Tech Shares You Can Purchase and Maintain for the Subsequent Decade

Wanting on the inventory market over the previous decade, you will see that many top-performing shares have been tech corporations. Latest developments have made tech shares extremely enticing and pushed their valuations up — a lot in order that seven of the world’s 10 most precious corporations are within the tech sector.

No matter how spectacular many beneficial properties have been, it is necessary to recollect the worth of persistence in investing. The main focus ought to all the time be on the long run.

Whereas the previous decade has been profitable for a lot of buyers in tech shares, the following decade might be simply as promising. The next three corporations are ones buyers ought to contemplate shopping for and holding for the following decade. There will definitely be bumps alongside the best way, however there is a good probability you will look again and be glad you invested in them now.

1. Snowflake

Snowflake (NYSE: SNOW) operates a cloud-based information platform that enables customers to combination, analyze, and share information throughout numerous platforms. Traders had a lot of excessive expectations for the corporate across the time of its preliminary public providing (), however since then, it has been a narrative of highs and lows.

In its fiscal 2025 first quarter (which ended April 30), Snowflake generated $829 million in income, which beat the consensus estimate. Nevertheless, the corporate got here up wanting earnings estimates, and the inventory continued the slide that started in March.

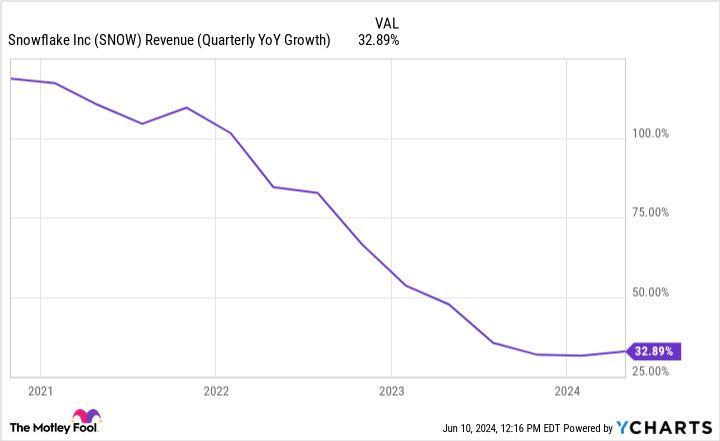

Sure, Snowflake’s year-over-year income progress has slowed, however its remaining efficiency obligation — income it could actually count on beneath present contracts — is up 46% from final 12 months to $5 billion, and administration famous that after a interval when some have been hesitating to take action, extra of its prospects are starting to make longer-term commitments.

Snowflake famous on its final earnings name that it expects margins to say no within the subsequent 12 months because it spends considerably on new graphics processing items (GPU) to assist its AI initiatives, however that seems to be a obligatory funding in infrastructure for it to realize what it calls “significant income technology” within the subsequent few years.

Like many different tech corporations, Snowflake is betting massive on AI and hoping to drive progress and bolster its choices by means of the rising know-how. Add that to the projected progress of the massive information business, and Snowflake’s long-term worth proposition turns into intriguing, particularly contemplating its valuation is now near the bottom it has been since its IPO.

2. CrowdStrike

There are numerous advantages to the world changing into extra digitally linked, however one notable draw back is that it will increase the alternatives for hackers to conduct cyberattacks. The worldwide annual price of cyberattacks in 2017 was round $700 billion. In accordance with a forecast by the researchers at Statista, by 2028, that annual price can be over $13.8 trillion. That is the place CrowdStrike (NASDAQ: CRWD), one of many world’s premier cybersecurity corporations, comes into the image.

CrowdStrike was one of many pioneers of AI-native cybersecurity options and has shortly turn into a go-to supplier for lots of the world’s high corporations, together with 62 members of the Fortune 100. Though AI has attracted mainstream consideration prior to now couple of years, CrowdStrike has been utilizing it for its safety options from the start, giving it a knowledge benefit over different cybersecurity corporations that got here later to the AI social gathering.

The effectiveness of CrowdStrike’s platforms may be seen in its buyer progress and retention. Round 65% of its prospects use 5 or extra of its modules (software program designed for a particular perform), 44% use six or extra, 28% use seven or extra, and the variety of offers involving eight or extra modules grew by 95% 12 months over 12 months final quarter. This has additionally propelled CrowdStrike’s financials.

Cybersecurity is now a non-negotiable expense for a lot of companies globally, and the quantity ought to solely enhance. With a price-to-sales ratio of round 23.5, CrowdStrike trades at a premium to its friends, however for buyers who’ve time on their aspect, its progress charge and progress alternatives make {that a} justifiable premium to pay.

3. Microsoft

Having been round for many years, Microsoft (NASDAQ: MSFT) stands out from the opposite two corporations on this checklist, however even because the world’s most precious public firm, it nonetheless has a number of room for progress.

One key motive to carry onto Microsoft’s inventory for the following decade is the best way the corporate is intertwined with the worldwide enterprise world.

Take into consideration all of the services that Microsoft presents that many companies depend on of their day by day operations — Workplace merchandise (Excel, Phrase, Outlook, Groups, and so forth.), Azure, Home windows, and dozens of different enterprise options.

Its place as a core provider of companies to the worldwide enterprise world insulates Microsoft from the impacts of financial downturns in comparison with lots of its tech counterparts and offers it long-term stability. When financial situations are lower than very best, it is a lot simpler to delay upgrading units or in the reduction of on promoting than it’s to cancel your cloud service, cease utilizing important productiveness instruments, or do with out IT infrastructure assist.

Microsoft’s significance to the worldwide enterprise world ensures will probably be a dominant participant within the tech area for a while.

Must you make investments $1,000 in Snowflake proper now?

Before you purchase inventory in Snowflake, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Snowflake wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $802,591!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has positions in Microsoft. The Motley Idiot has positions in and recommends CrowdStrike, Microsoft, and Snowflake. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

What the Fed resolution means for markets, past the close to time period

Lusso’s Information — The Federal Reserve’s resolution to chop rates of interest by 50 foundation factors has sparked a powerful motion within the markets, however many surprise what the much-anticipated dovish shift means past the near-term response.

The Fed’s transfer on Sept. 19 was extensively anticipated, with the central financial institution additionally promising a further 50 foundation factors of cuts earlier than the 12 months’s finish. This initially triggered a rally, sending the to new all-time highs earlier than a “sell-the-news” response pushed markets barely decrease by the tip of the day.

Within the brief time period, this dovish transfer has left markets in a typically constructive place. The most important danger elements stay potential adverse financial information, however the present financial calendar is gentle till early October.

With out the specter of important earnings studies or main financial releases, buyers look like working in an atmosphere that’s “1) easing Fed, 2) slowing however ‘OK’ financial information, and three) typically strong earnings,” Sevens Report stated in a latest observe.

Cyclical sectors, together with vitality, supplies, shopper discretionary, and industrials, are anticipated to outperform, whereas know-how could lag within the close to time period.

Nevertheless, the longer-term implications of the Fed’s resolution could also be extra advanced. The important thing query for buyers is whether or not the Fed acted in time to stave off a broader financial slowdown.

Based on the Sevens Report, if the speed cuts are well timed, they might result in falling yields, robust earnings progress, and optimistic financial tailwinds. This may seemingly lead to continued upward momentum for shares, with the potential for the S&P 500 to hit 6,000.

“I say that confidently as a result of the Fed slicing in time would create this macroeconomic final result: 1) Falling yields, 2) Continued very robust earnings progress, 3) Optimistic financial tailwinds, 4) The outstanding existence of the Fed put and 5) Expectations of accelerating progress sooner or later,” President of Sevens Report wrote within the observe.

However, if the Fed’s actions had been too late to stop an financial downturn, the market might face important dangers.

In such a situation, the S&P 500 might fall to round 3,675, marking a pointy decline of over 30% from present ranges. This draw back danger mirrors market corrections seen in earlier downturns, reminiscent of these in 2000 and 2007.

Because the markets digest the Fed’s strikes, future financial information will grow to be essential in figuring out whether or not the central financial institution’s coverage was efficient.

Extra concretely, buyers might want to maintain an in depth eye on upcoming releases to gauge whether or not the Fed has efficiently navigated the financial system away from a recession or if additional challenges lie forward.

Markets

Former Monero Developer Launches New Crypto Mining App

Riccardo “Fluffypony” Spagni, a former Monero developer, has launched a brand new mining app known as Tari Universe. The app goals to make mining accessible to everybody utilizing a user-friendly interface. Nevertheless, Spagni faces authorized troubles associated to fraud and forgery prices. Regardless of the alleged crimes occurring over a decade in the past, South African authorities solely took motion in 2021.

Democratizing Crypto Mining

Riccardo “Fluffypony” Spagni, a former lead maintainer of the privateness blockchain Monero, has launched a brand new mining utility known as Tari Universe. The app goals to “democratize” cryptocurrency mining through the use of an ASIC-resistant hashing algorithm that permits customers to mine tokens with atypical computer systems.

In latest remarks following the launch of the app, Spagni said his aim is to make mining extra accessible to everybody.

“We wished to create an expertise the place the know-how fades into the background. Tari Universe is about empowering customers with out overwhelming them,” the previous Monero developer mentioned.

In the meantime, Spagni mentioned potential customers can enhance their waitlist place by visiting the Tari Universe web site and welcoming pals to hitch.

Spagni is selling the layer one protocol regardless of dealing with fraud and forgery prices pressed by his former employer, Cape Cookies. A Mybroadband report in June mentioned Spagni defrauded Cape Cookies of roughly $83,400 between Oct. 1, 2009, and June 8, 2011. Nevertheless, South African authorities didn’t take motion till August 2021 once they requested U.S. authorities to apprehend him.

Since his arrest and subsequent switch to South African authorities, Spagni has maintained his innocence, even making an attempt to have the arrest warrant put aside. Nevertheless, the South African Supreme Courtroom of Enchantment denied this request.

Markets

2 Shares That May Soar in 2025, In keeping with This Metric

Nvidia (NASDAQ: NVDA) and Meta Platforms (NASDAQ: META) have rocketed larger this 12 months. However these firms are benefiting from highly effective developments in knowledge middle spending and digital promoting that might ship their share costs to new highs in 2025.

These shares commerce at comparatively low in comparison with Wall Road’s 2025 earnings estimates, which might arrange one other monster run for traders subsequent 12 months. This is how these shares can ship.

1. Nvidia

Nvidia continues to report phenomenal development, as knowledge facilities transition from conventional computing to accelerated computing techniques to deal with workloads. Demand for the corporate’s graphics processing models (GPUs) has been off the charts, which despatched the top off 161% during the last 12 months.

The inventory’s ahead P/E is 28 primarily based on subsequent 12 months’s earnings estimate, which is simply too low, given Wall Road’s estimate calling for 40% earnings development subsequent 12 months and 36% over the following a number of years. The inventory at the moment trades at a P/E of 53 on trailing-12-month earnings. If the inventory is buying and selling on the identical trailing P/E and Nvidia stays on observe to satisfy subsequent 12 months’s earnings estimate, the share value might climb over $200.

The inventory pulled again during the last month amid issues concerning the delay of Nvidia’s new Blackwell computing platform. However demand developments look very favorable. Administration expects to start producing income from Blackwell within the fourth quarter, and that might be additive to demand for its current-generation chip.

Importantly, administration pointed to quite a lot of workloads driving development for its knowledge middle enterprise. Prospects are shopping for its {hardware} for generative AI mannequin coaching and inferencing, along with growth of cutting-edge AI fashions. Demand is coming from shopper web providers and 1000’s of start-ups constructing AI purposes throughout healthcare, promoting, and schooling.

Nvidia inventory was buying and selling at an identical P/E in December earlier than the inventory doubled in 2024. The present valuation suggests it might repeat that efficiency once more because it launches Blackwell.

2. Meta Platforms

Digital promoting is making up a rising share of complete advert spending, and this continues to gasoline development for Fb proprietor Meta Platforms. The social media inventory is up greater than 80% during the last 12 months, however nonetheless trades at a really engaging valuation that may assist extra positive aspects in 2025.

Meta shares commerce at a ahead P/E of twenty-two on subsequent 12 months’s earnings estimates. That is nicely beneath Meta’s common P/E during the last 10 years of 38. The inventory might climb as a lot as 50% if the inventory’s P/E closes a few of that hole. Analysts anticipate Meta’s earnings to develop at an annualized price of 17% over the long run, which justifies a better P/E.

Meta has an extended runway of development in digital promoting, and the corporate’s investments in AI will assist unlock that potential. In early 2023, Meta introduced Llama, a big language mannequin that may interpret a string of phrases to finish a textual content. It is already launched Llama model 3.1, which is having an influence on its income development.

Llama is the know-how behind Meta AI, a private assistant that has improved the person expertise on Meta’s social media platforms. Meta AI is driving larger person engagement and upside in promoting income. Meta’s income grew 22% 12 months over 12 months in Q2.

Given the expansion alternative, Meta plans to take a position closely in AI infrastructure. Meta is a extremely worthwhile enterprise with $49 billion in free money move. It may afford to take a position aggressively in AI and acquire a technological edge. Given these benefits, the inventory appears conservatively valued and deserving of a better valuation.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Meta Platforms and Nvidia. The Motley Idiot has positions in and recommends Meta Platforms and Nvidia. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately