Markets

Citigroup is 'not the monetary grocery store of the previous': Fraser

Citigroup () CEO Jane Fraser informed buyers Tuesday that an empire her financial institution amassed within the Nineties isn’t any extra.

“We’re not the monetary grocery store of the previous,” Fraser mentioned throughout an occasion in New York Metropolis. “As an alternative, our imaginative and prescient is concentrated.”

Citigroup is paring again its ambitions, shedding companies and chopping again headcount because it tries to revive its inventory value and take away many years of bloat.

Its newest efforts to persuade buyers that it’s on track got here Tuesday as Fraser and different financial institution executives made a collection of investor shows centered totally on its multinational providers division, which helps firms transfer cash world wide.

CFO Mark Mason in his presentation referred to 2024 as an “inflection yr” and mentioned by 2026 Citigroup plans to develop its full-year income by a minimum of $6 billion whereas decreasing its bills by a minimum of $500 million.

“We’re decided to be the preeminent banking accomplice for establishments with cross-border wants, a worldwide chief in wealth, and a valued private financial institution right here in our residence market,” Fraser mentioned. “We have made vital strides.”

Citigroup’s inventory rose Tuesday. It’s up almost 17% because the starting of the yr and has outperformed a wider banking business index ().

The makeover underneath Fraser, who took over as boss in March 2021, started roughly two years in the past as she tried to focus the corporate on serving massive, multinational firms, shed what wasn’t worthwhile, and function extra effectively.

That meant pulling again from client banking in varied elements of the world. It additionally meant chopping jobs and reorganizing enterprise traces as a part of an inner restructuring that Fraser referred to as the “most consequential” change to how Citigroup operated in almost twenty years.

The technique amounted to an unwinding of a “monetary grocery store” that claimed to supply any and all providers wanted by customers, companies, and governments.

The excessive level of that mannequin was an era-defining 1998 merger between Citicorp and Vacationers engineered by Sandy Weill. The deal shattered a Despair-era division between retail banking and funding banking and cemented Citigroup’s standing because the world’s largest monetary establishment.

Within the many years since, the colossus constructed by Weill proved to be too complicated and unwieldy to handle successfully, and the 2008-2009 monetary disaster dealt one other blow to its sweeping ambitions.

The corporate started to slowly unwind elements of the empire, a course of that Fraser accelerated. She determined to exit Citigroup’s municipal bond and distressed debt companies and reorganized the corporate into 5 divisions.

Fraser and her deputies spent a lot of Tuesday speaking about a kind of divisions — providers — that Fraser has billed as the corporate’s “crown jewel.”

The division helps massive multinational firms similar to Amazon (), Alphabet () and a few governments handle or transfer cash internationally.

These choices can take the type of Treasury and money administration, cross-border settlement, digital funds, and securities providers like foreign money hedging. The division strikes almost $5 trillion — the equal of Germany’s GDP — day by day.

“This can be a enterprise that’s powering world commerce,” Fraser mentioned. “Nobody else can compete with our world attain. Nobody else can match our merchandise, our providers, and our digital capabilities, and nobody else is bringing improvements to the market on the fee that we’re.”

Each Fraser and Mason additionally acknowledged the financial institution nonetheless has work to do to bolster its regulatory and compliance features.

On Monday, the Wall Avenue Journal reported that the FDIC is prone to vote Thursday to downgrade Citi’s so-called dwelling will — a plan for the way to wind down the financial institution in case of a catastrophe — resulting from shortcomings in its information administration methods.

Fraser didn’t focus on the particular report however mentioned, “We acknowledge there are locations the place progress has been too gradual, so now we have intensified our efforts in areas similar to regulatory processes and the associated information remediation.”

Mason added that “we will spend no matter it takes to deal with the consent orders and modernize the agency, as that is an extremely vital physique of labor and demanding to our long-term success.”

David Hollerith is a senior reporter for Lusso’s Information protecting banking, crypto, and different areas in finance.

.

Markets

1 No-Brainer Electrical Automobile (EV) Inventory to Purchase With $200 Proper Now

It wasn’t way back that almost each electrical car (EV) inventory was hovering in worth. In 2021, for instance, business hype was at a fever pitch. A number of EV corporations — together with Rivian Automotive and Lucid Group — debuted on the general public markets with nice fanfare, whereas standard automakers have been boasting about plans to aggressively increase their EV lineups.

So much has modified since then. And after a steep business sell-off, it is time to go cut price buying. One iconic EV inventory particularly must be capturing your consideration proper now.

Is that this well-known EV inventory lastly a cut price?

Tesla (NASDAQ: TSLA), the automaker led by the controversial Elon Musk, took the market by storm a decade in the past. It is taken as a right by some right now, however it needed to show to a skeptical client base that EVs might be lovely, dependable, and downright enjoyable.

Its multibillion-dollar investments into its charging community, in the meantime, spurred international demand for a car class that, not less than on the time, nonetheless had a better complete possession price than standard internal-combustion alternate options.

Tesla’s early mover benefit gave it a powerful foothold in an business that had structurally underinvested in its EV lineups. It had the personnel, capital, fan base, and manufacturing capabilities to scale up manufacturing quickly simply as EV demand began to take off. From 2018 to 2022, for example, gross sales grew by an astounding 357%.

However then a curious factor occurred. EV gross sales within the U.S. continued to climb, however slower than anticipated. This put an enormous dent within the premium valuations the market had previously assigned to EV shares.

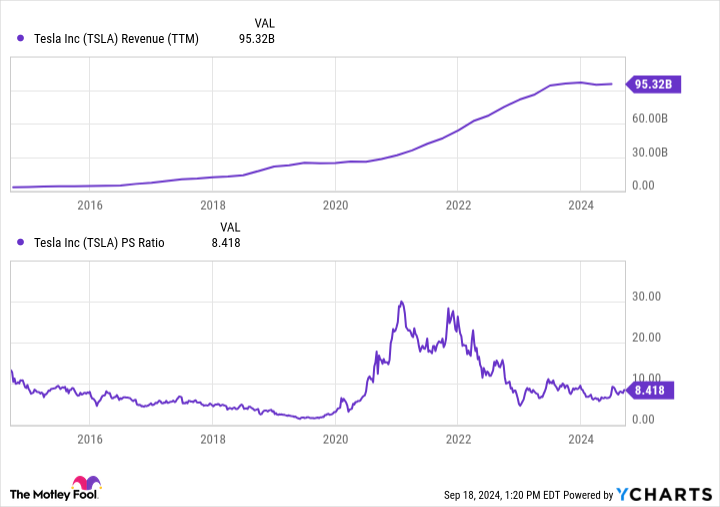

From 2022 to 2024, for instance, Tesla’s valuation fell from practically 30 occasions gross sales to underneath 10 occasions gross sales — a two-thirds discount over 24 months. Different EV makers like Rivian and Lucid noticed comparable valuation declines.

Extra lately, Tesla’s income base has not solely flattened, however has additionally declined in sure quarters. To be honest, the inventory continues to be comparatively costly at 8.4 occasions gross sales. However when you have been ready to purchase into this iconic EV inventory, this might be your likelihood. One statistic particularly ought to get you excited.

Tesla continues to be the king of EVs

Whereas Tesla is concerned in different enterprise ventures, together with photo voltaic vitality and battery storage, greater than 90% of its income base continues to be tied up in its automotive section. Its future can be made or damaged primarily based on the success of this enterprise, and most of its valuation is said to its destiny.

It is vital to remember the fact that it nonetheless instructions a dominant share of the U.S. EV market. Varied estimates peg it with a 50% to 80% market share.

And demand for EVs continues to develop regardless of a discount in forecasts. Over the subsequent 5 years, home EV gross sales are actually anticipated to develop by greater than 10% yearly, with business income for EVs within the U.S. surpassing $150 billion by 2029.

Globally, EV gross sales are anticipated to prime $1 trillion by 2029. That is excellent news contemplating Tesla has a projected 39.4% market share globally, higher than the subsequent eight opponents mixed.

Put merely, the EV market continues to be Tesla’s to lose. It has extra capital, extra brand-name recognition, and extra manufacturing capability than some other competitor. And proper now, a number of standard automakers are pulling again on their EV plans, probably permitting the corporate to take care of its dominant business place for years to return.

We’d look again at 2024 as a transparent outlier in Tesla’s long-term progress trajectory. Gross sales are anticipated to say no by 8.2% this 12 months. However in 2025, analysts predict a rebound, with income leaping by 15.8%.

Is the inventory nonetheless costly at 8.4 occasions gross sales? Completely. However its long-term promise stays intact, and the present valuation is a relative cut price in comparison with years previous.

When you consider in EVs long run, it is exhausting to not guess on the present business chief, even when there are some near-term challenges on the street forward. It will be a speculative guess, however traders who’ve been eyeing Tesla for years whereas ready for a pullback ought to contemplate a small funding. If shares proceed to say no, it might be a main alternative for .

Do you have to make investments $1,000 in Tesla proper now?

Before you purchase inventory in Tesla, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for traders to purchase now… and Tesla wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

High Bitcoin Miners Revolutionize North America’s Crypto Panorama in 2024

- Marathon Digital’s hash price grew by 142% in Q1 2024, driving a 223% income enhance to US$165.2 million.

- Marathon Digital plans to double its hash price to 50 EH/s by the top of 2024 by new ASIC miners and acquisitions.

- Riot Platforms and Core Scientific, regardless of challenges, stay key gamers, with Riot growing its income to US$79.3 million.

Marathon Digital and prime rivals are driving a Bitcoin mining growth in 2024, setting new data in North America. With huge expansions and cutting-edge tech, main the following crypto revolution.

Marathon Digital to Lead Bitcoin Mining Development by 2024

Marathon Digital Holdings (NASDAQ), one of many main bitcoin mining firm , reported a progress of 142% within the hash rater throughout Q1 of the 12 months 2024 This surge within the international locations output manufacturing, complemented by a 28% enhance within the amount of Bitcoin produced to 2811 BTC, has pushed the overall revenues of Marathon to 165.2 million {dollars}, 223% leap. The agency commenced buying and selling on NASDAQ as one of many earliest cryptocurrency-mining corporations and is decided to develop the most important and best mining firm in North America.

Core Scientific Platforms Improve Capability

Core Scientific of bitcoin miners in North America. The corporate managed to hunt the safety of Chapter 11 in direction of the top of the 12 months 2022 as a result of monetary troubles. However, the corporate has gone by restructuring efficiently and hopes to be again on NASDAQ 2024. Core Scientific contain in self-mining and provides amenities for internet hosting and continues to function within the ecumenical bitcoin mining trade.

Riot Platforms Enlargement of its Mining Enterprise

Riot Platforms (NASDAQ) is on a mining degree enlargement spree, its weakest space being in Texas. Such community challenges noticed a decline of 36 % in Bitcoin manufacturing for Q1 2024; nonetheless, as was famous by a rise within the firm’s whole revenues precipitated the rise in Bitcoin costs. The corporate is progressing as deliberate on this sense, in self-mining hash price capability which is presently focused at an end-of-2024 degree of 31 EH/s, earlier than rising to 41 EH/s in 2025. Riot’s Corsicana facility is anticipated to rank among the many largest bitcoin mining facilities on the planet.

Cipher Mining Proceed Development

Cipher Mining (NASDAQ) joins the remaining within the Bitcoin mining sector in January 2024 bitcoin as self-mining .The corporate elevated self-mining capability as much as 7.7 EH/s, and it’s focused to go as much as 9.3EH/s by finish of September 2024. The corporate additionally plans on increasing, in makes an attempt to keep up its place within the trade and doesn’t count on to lower its enlargement.

The Authorities concentrates on moral mining – Hive Digital Applied sciences

Hive Digital Applied sciences as a Bitcoin miner on the amenities situated in Sweden, Canada and Iceland. In April 2024, Hive had collected 2400 Bitcoins, with its machine’s mining price being 5.0 EH/s. The mining phase additionally stays in focus, and the corporate continues into mining adopting inexperienced applied sciences.

Markets

Southwest Airways warns employees of 'robust selections' forward, Lusso’s Information experiences

(Reuters) – Southwest Airways has warned workers that it’s going to quickly make robust selections as a part of a method to revive earnings and counter calls for from activist investor Elliott Funding Administration, Lusso’s Information Information reported on Saturday.

The airline is contemplating making modifications to its flight routes and schedules to extend income, the report added, citing the transcript of a video message to workers by Chief Working Officer Andrew Watterson.

“I apologize prematurely in case you as a person are affected by it,” Watterson mentioned, in response to the report, including that he did not supply any particulars on the pending strikes.

Southwest didn’t instantly reply to a Reuters request for remark.

The airline has been struggling to seek out its footing after the COVID-19 pandemic, partly as a result of Boeing’s plane supply delays and industry-wide overcapacity within the home market.

It plans to supply assigned and extra-legroom seats to draw premium vacationers and begin in a single day flights. It would current the small print to traders on Sept. 26.

Earlier this week, Reuters reported that Elliott, which owns 10% of Southwest’s frequent shares, informed one of many firm’s high unions it nonetheless needs to switch CEO Robert Jordan, even after the service pledged to shake up its board.

(Reporting by Surbhi Misra in Bengaluru; Modifying by Paul Simao)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024