Markets

The Nasdaq Is Hovering, however These 3 Shares Are Close to Their 52-Week Lows

If you happen to’re searching for good offers within the inventory market, you could need to think about presently underperforming investments with numerous long-term upside. One technique to spot most of these shares is to slender your search to those which are close to their 52-week lows. Usually, there’s some dangerous information or a troubling outlook concerned with these firms, which may make them dangerous buys. But when they show their doubters unsuitable, they might offer you better-than-expected returns.

Intel (NASDAQ: INTC), Cisco Techniques (NASDAQ: CSCO), and PepsiCo (NASDAQ: PEP) are all down yr to this point, however they nonetheless may develop into good investments to carry within the years forward.

1. Intel

Intel is proof that merely being a chipmaker is not a recipe for a surging share worth this yr, regardless of all of the hype round synthetic intelligence (AI). With its shares down by 40% since January, it is clear traders aren’t excited concerning the firm’s prospects.

Its income development fee was a reasonably modest 9% within the first quarter. Extra regarding, nonetheless, was its internet lack of $437 million — although that was at the least an enormous enchancment from the prior-year interval, when Intel booked a internet lack of $2.8 billion.

I am optimistic that Intel can flip issues round given the necessity for the U.S. to construct up its home chip manufacturing capability. Presently, U.S. tech firms are closely depending on abroad foundries, and the federal government is offering huge incentives and help to make it simpler for home firms to achieve this space and grow to be important suppliers of chips sooner or later.

It’s going to require some persistence, however with Intel’s administration centered on lowering prices and pursuing the alternatives in manufacturing laptop chips, this might make for a terrific contrarian funding to hold on to, supplied that you simply’re OK with accepting some danger. Presently, the is buying and selling inside a greenback of its 52-week low of $29.73.

2. Cisco Techniques

Networking and IT infrastructure big Cisco may make for a superb long-term purchase. As firms improve their infrastructure to fulfill the rising wants of their AI-powered computer systems, demand for Cisco’s services and products will possible rise. It gives options that cater to rising AI traits, together with AI-powered safety and software program choices to assist companies get essentially the most out of their next-gen applied sciences.

The issue is that it might take some time for a lot of that demand to materialize as a result of firms are possible being selective about what they’re spending cash on within the present high-interest-rate surroundings. Holding prices down will stay a precedence for companies till borrowing circumstances enhance. In the interim, Cisco might have a troublesome street forward. The corporate’s product revenues declined by 19% to only over $9 billion in its fiscal third quarter, which ended April 27.

At a time when traders are centered on shares which are already benefiting from AI’s development, Cisco merely is not standing out. Nevertheless, which will change, and shopping for the inventory earlier than that occurs may result in some nice returns for traders in the long term. Cisco hit a brand new 52-week low this week, and its worth might worsen earlier than it will get higher.

3. PepsiCo

Elevating costs has allowed PepsiCo to ship robust returns amid inflation. Nevertheless, as inflation cools down and the corporate’s upcoming quarters are measured in opposition to the spectacular comparable numbers from these prior durations, it appears possible that PepsiCo’s development fee will decelerate.

Within the fiscal quarter that ended March 23, the corporate’s revenues rose by simply 2% to $18.3 billion. That is not the kind of development that excites traders, particularly for a inventory that is buying and selling at 25 occasions . A yr in the past, revenues have been rising at a fee of greater than 10%.

However costs are sticky and whereas they have been fast to rise, they might not come down a lot from their present ranges. And at increased worth factors and higher margins, PepsiCo could possibly be poised for continued development in the long term as customers come to just accept the brand new elevated costs for the corporate’s merchandise. And as demand will increase as financial circumstances enhance, PepsiCo ought to get again to rising at a better fee.

There’ll possible proceed to be some softness within the quick time period, however this inventory can present traders with nice worth in the long term. PepsiCo is buying and selling simply 6% above its 52-week low of $155.83 per share. And with a dividend that yields 3.3% at as we speak’s share worth, traders might need to purchase it not just for its decreased worth but in addition to lock in that beneficiant yield.

Must you make investments $1,000 in Intel proper now?

Before you purchase inventory in Intel, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for traders to purchase now… and Intel wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $802,591!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Cisco Techniques. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Japan Shares Poised to Fall on Fee Hike Worries: Markets Wrap

(Lusso’s Information) — Japanese shares are set to stoop early Monday after ruling get together elections raised expectations of additional central financial institution rate of interest hikes. Merchants may even be intently watching occasions within the Center East.

Most Learn from Lusso’s Information

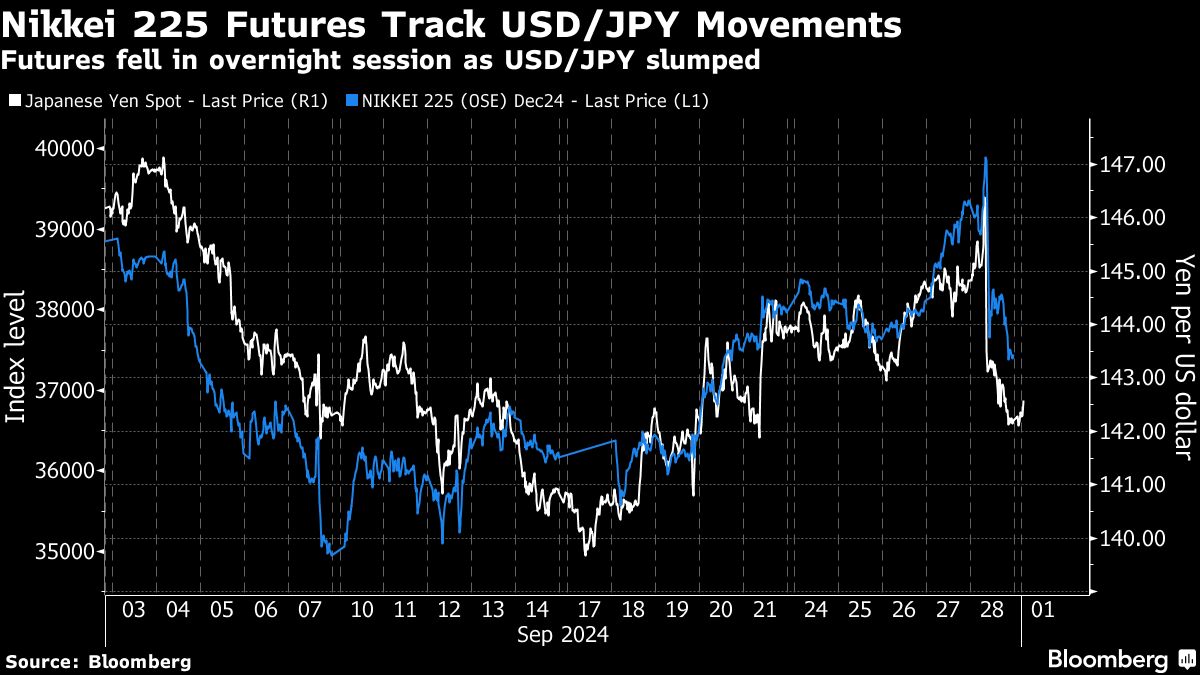

Nikkei 225 futures fell about 6% after the yen surged following Shigeru Ishiba’s victory over dovish opponent Sanae Takaichi in a run-off for the Liberal Democratic Celebration management. Ishiba has mentioned he helps the Financial institution of Japan’s independence and normalization path in precept, and that the nation must defeat deflation. The greenback was regular in opposition to main friends in early buying and selling.

Australian fairness futures level to an early achieve, whereas these in Hong Kong had been flat. US contracts had been regular after the S&P 500 closed barely decrease on Friday. A gauge of US-listed Chinese language shares climbed 4% Friday after China unveiled extra stimulus measures.

Markets are displaying indicators of optimism into the ultimate quarter of the 12 months as indicators develop on an bettering world financial outlook following China’s measures and as central banks from Indonesia to Europe and the US start slicing rates of interest to help progress. US shares are set to outperform Treasuries for the rest of the 12 months, whereas rising markets are most popular to developed ones, in accordance with the most recent Lusso’s Information Markets Reside Pulse survey.

Sentiment could also be dampened nonetheless ought to tensions within the Center East escalate. Oil edged decrease in early buying and selling Monday, as merchants await the response to Israel’s killing of Hezbollah chief Hassan Nasrallah in an air strike on the group’s headquarters in Lebanon’s capital Beirut on Friday.

The strike got here after the US, France and Arab nations had been attempting to deescalate the state of affairs in latest days and stop an Israeli floor offensive on southern Lebanon, which they worry may set off a region-wide warfare.

Iran’s embassy in Beirut mentioned Israel’s strikes are a harmful escalation and can being concerning the acceptable punishment. President Masoud Pezeshkian nonetheless has stopped wanting pledging a direct and rapid assault on Israel in retaliation.

“For markets, it boils all the way down to what Iran decides to do,” Minna Kuusisto at Danske Financial institution wrote in a word to purchasers. “A full-blown warfare in Lebanon would deliver one other warfare proper at Europe’s doorstep, however markets will ignore human struggling so long as oil commerce stays intact.”

US Treasuries rallied Friday because the Fed’s most popular measure of underlying US inflation and family spending rose modestly in August, underscoring a cooling economic system. Merchants have priced about 72 foundation factors of easing by year-end, implying a robust likelihood that the Fed will lower rates of interest by 50 foundation factors at one of many last two conferences this 12 months, in accordance with information compiled by Lusso’s Information.

A few of the fundamental strikes in markets:

Shares

-

S&P 500 futures had been little modified as of seven:42 a.m. Tokyo time

-

Dangle Seng futures had been little modified

-

S&P/ASX 200 futures rose 0.3%

-

Nikkei 225 futures fell 6%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1169

-

The Japanese yen fell 0.3% to 142.61 per greenback

-

The offshore yuan was little modified at 6.9791 per greenback

-

The Australian greenback rose 0.2% to $0.6914

Cryptocurrencies

-

Bitcoin fell 0.2% to $65,679.13

-

Ether was little modified at $2,659.61

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $68 a barrel

-

Spot gold rose 0.2% to $2,663.07 an oz.

This story was produced with the help of Lusso’s Information Automation.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Glenview plans activist stance in push for modifications at CVS, WSJ reviews

(Reuters) -Healthcare-focused Glenview Capital Administration will meet prime executives at struggling healthcare firm CVS Well being (NYSE:) on Monday to suggest methods it will probably enhance operations, The Wall Avenue Journal reported on Sunday.

The hedge fund’s founder, Larry Robbins, has constructed a big place in CVS, which quantities to about $700 million of his $2.5 billion hedge fund, the report mentioned, citing an individual accustomed to the matter.

CVS mentioned it “maintains an everyday dialogue with the funding neighborhood as a part of our strong shareholder and analyst engagement program,” and mentioned it will probably’t touch upon engagement with particular corporations or people.

Glenview didn’t instantly reply to a Reuters’ request for remark.

Hypothesis has mounted amongst fund managers that an activist investor might swoop in to push CVS to make modifications that might increase its share value.

Funding agency Sachem Head Capital Administration constructed a brand new 0.2% stake within the firm through the second quarter, based on a regulatory submitting in August.

Earlier in August, CVS lower its annual revenue forecast to $6.40 to $6.65 per share from its prior view of at the very least $7.00, marking at the very least the fourth time CVS lowered its outlook for the 12 months.

It additionally introduced a multi-year plan to avoid wasting $2 billion in prices by way of measures reminiscent of streamlining operations and utilizing synthetic intelligence and automation throughout its enterprise.

Markets

5 Key Charts to Watch in World Commodity Markets This Week

(Lusso’s Information) — London Steel Alternate’s annual LME Week gathering is underway, bringing collectively merchants and analysts amid copper’s newest upswing. Sugar futures are on observe for his or her greatest month since January. And US utilities are outshining different trade teams within the S&P 500, thanks partly to AI demand.

Most Learn from Lusso’s Information

Listed below are 5 notable charts to think about in international commodity markets because the week will get underway.

Copper

Copper has been on a roller-coaster journey this 12 months, with a surge of funding and a significant brief squeeze in New York driving costs to a document in Could. Buyers then pulled of their horns as doubts in regards to the Chinese language economic system rose to the fore. The newest positioning knowledge indicators that they’re not chasing the rally as exhausting as they did final time round.

Vitality Investments

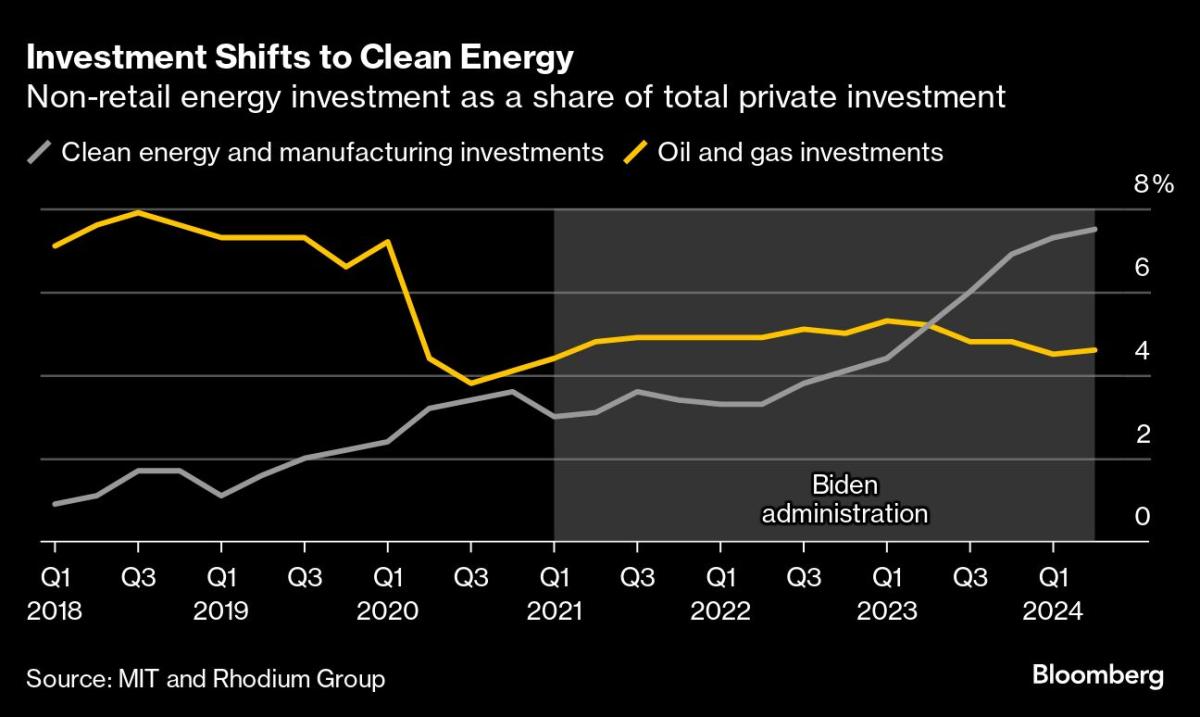

The US is mobilizing a lot funding into clear vitality that it now tops even the height of America’s fracking revolution within the 2010s. The wave of spending triggered by Joe Biden’s signature local weather regulation is ready to be the president’s greatest and most-enduring home achievement. His insurance policies helped drive about $493 billion of recent funding into the manufacturing and widespread deployment of photo voltaic panels, electrical autos and different emission-cutting expertise since mid-2022, based on knowledge analyzed by the Massachusetts Institute for Know-how and analysis agency Rhodium Group.

Pure Fuel

Europe enters its heating season this week with an enormous pure gasoline stockpile to defend itself from surprising provide outages. The continent’s websites are about 94% full — above historic averages, however barely under final 12 months’s ranges — sufficient to maintain some merchants watchful as they carefully monitor persevering with storage build-up earlier than the freezing climate spreads.

Energy Suppliers

The utilities sector is outshining different industries on the S&P 500 Index within the final three months. Shares of US energy suppliers racked up massive features within the third quarter on market giddiness over prospects of surging electrical energy demand from synthetic intelligence-focused knowledge facilities. Utilities are on tempo to high the 11 trade teams of the S&P Index because the quarter attracts to an in depth, with features pushed by plant operators Vistra Corp. and Constellation Vitality Corp., which simply inked an influence provide cope with Microsoft Corp. Vistra is noteworthy as a result of it’s additionally holding its rating as one of the best performing inventory within the broader S&P 500 for the 12 months, after shares greater than tripled.

Sugar

Sugar has been on a tear in September resulting from a poor outlook from Brazil, the world’s high exporter. Whereas promising manufacturing forecasts in India and Thailand lower brief final week’s rally on Friday, sugar futures are nonetheless on tempo for the most important month-to-month acquire since January. Extreme drought in Brazil has been hurting sugar-cane yields, elevating fears of additional cuts to manufacturing estimates. Merchants might be carefully watching the circulation of vessels transport sugar from the South American nation in October, since any easing of exports means international patrons might battle to search out provides within the ultimate months of 2024.

–With help from Geoffrey Morgan, Doug Alexander, Dayanne Sousa and Alex Tribou.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook