Markets

Higher Synthetic Intelligence (AI) Inventory: Nvidia vs. Tremendous Micro Pc

Amid the continuing synthetic intelligence (AI) increase, shares of Nvidia (NASDAQ: NVDA) and Tremendous Micro Pc (NASDAQ: SMCI) have set the inventory market on hearth in 2024, racking up good points of 166% and 197%, respectively, as of this writing. Because of the booming demand for the AI-enabling {hardware} they promote, they’ve skilled gorgeous accelerations of their income and earnings progress.

Nvidia’s dominance within the AI chip market has translated into phenomenal progress, and Tremendous Micro Pc is not far behind. Knowledge heart operators are flocking to its modular server options to mount the AI chips that Nvidia and different firms promote. Nevertheless, if you’re wanting so as to add an to your portfolio and wish to select between considered one of these two, which one do you have to be shopping for proper now?

The case for Nvidia

Nvidia reportedly managed a whopping 94% of the AI chip market on the finish of 2023. The corporate’s outcomes for the primary quarter of its fiscal 2025 (which ended on April 28) recommend that its dominance has it on track for one more 12 months of terrific progress.

Income rose a shocking 262% 12 months over 12 months to $26 billion. Its spectacular pricing energy led to a 461% surge in adjusted earnings to $6.12 per share. Administration’s income steering of $28 billion for the present quarter means that its high line is on monitor to leap 107% 12 months over 12 months, which might be an acceleration from the 101% progress it delivered in the identical interval final 12 months.

Nevertheless, rising progress avenues within the nascent AI market point out that Nvidia may find yourself doing even higher than that. As an illustration, governments throughout the globe are reportedly pouring big quantities of cash into AI infrastructure, and sovereign investments in AI expertise are anticipated to contribute $10 billion to Nvidia’s high line this fiscal 12 months, as in comparison with nothing within the earlier one.

Extra particularly, governments want to make giant language fashions (LLMs) in native languages primarily based on country-specific knowledge. On Nvidia’s Might convention name, administration identified that Japan, France, Italy, and Singapore are already investing in AI infrastructure. It expects extra nations to affix the bandwagon. “The significance of AI has caught the eye of each nation,” mentioned CFO Colette Kress.

Saudi Arabia, for example, is reportedly trying to make investments $40 billion in AI initiatives, whereas China’s AI-focused spending is forecast to exceed $38 billion by 2027. In the meantime, key Indian firms akin to Tata Group and Reliance Industries are counting on Nvidia’s chips to coach LLMs.

In brief, Nvidia’s buyer base is diversifying past which have been deploying its chips in giant numbers to coach and deploy AI fashions. Spending on AI chips is predicted to develop greater than 10-fold over the following decade, producing $341 billion in income in 2033 in comparison with $23 billion final 12 months. The stage appears set for Nvidia to keep up its large progress because it takes strong steps to make sure that it stays the dominant participant on this area.

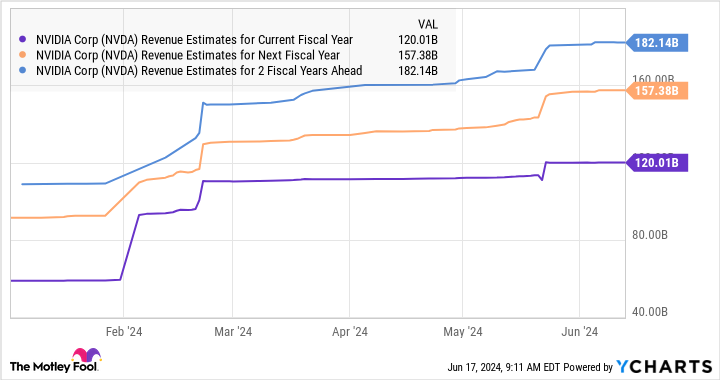

That is why analysts forecast that the corporate’s high line will continue to grow at a wholesome tempo from fiscal 2024’s studying of practically $61 billion.

So, Nvidia ought to stay a high AI inventory because the race to develop AI purposes by firms and governments alike has created a secular progress alternative.

The case for Tremendous Micro Pc

Supermicro’s progress is entwined to some extent with that of Nvidia. Knowledge heart operators require server rack options of the kind that Supermicro sells to mount the processors bought by Nvidia and different chipmakers. So, it’s not stunning that demand for Supermicro’s servers has merely taken off.

In its fiscal 2024 third quarter, which ended March 31, its income jumped 200% 12 months over 12 months. Non-GAAP web earnings per share, in the meantime, jumped by a whopping 307%. So, Supermicro is not all that far behind Nvidia in the case of how AI has supercharged its fortunes. The corporate is guiding for income of $14.9 billion within the present fiscal 12 months, which ends this month. This might be a giant bounce over the $7.1 billion in income it reported in its fiscal 2023.

Extra importantly, analysts expect its high line to just about double over the following couple of fiscal years.

The great half is that Supermicro can maintain a wholesome tempo of progress past the following couple of fiscal years. That is as a result of the demand for AI servers is predicted to increase at a compound annual fee of 25% by way of 2029. The market is predicted to generate annual income of virtually $73 billion after 5 years, up from $17.5 billion in 2022.

Supermicro is rising at a quicker tempo than the AI server market proper now. Because it seems, its progress is quicker than that of extra established firms akin to Dell Applied sciences, which has bought $3 billion value of AI servers previously three quarters. Supermicro generated $9.6 billion in income previously three quarters and will get greater than half its income from promoting AI-related server options.

Supermicro has been in a position to make a dent within the AI server market regardless of the presence of larger gamers. Additionally, with the strikes that the corporate has been making to extend its production-utilization fee and its manufacturing capability, it may nook an even bigger share of the AI server market sooner or later.

Like Nvidia, even Supermicro seems to be like a strong long-term AI play. However is it value shopping for over Nvidia?

The decision

Each Nvidia and Supermicro are high-growth firms benefiting massive time from the proliferation of AI. So buyers’ selection about which inventory they might wish to purchase proper now’s going to boil right down to the valuation. Supermicro is considerably cheaper than Nvidia so far as their earnings and gross sales multiples are involved.

Nevertheless, by way of the value/earnings-to-growth (PEG) ratio, the story is a little more attention-grabbing. That metric is a forward-looking valuation decided by dividing an organization’s trailing earnings a number of by the earnings progress that it’s anticipated to ship over a future interval. Any (constructive) PEG ratio beneath 1 is seen by most buyers as indicating a discount inventory. And on that metric, each Nvidia and Supermicro are undervalued.

So by not less than one forward-looking measure, each Nvidia and Supermicro are engaging buys proper now for anybody wanting so as to add a progress inventory to their portfolios. Extra importantly, each these firms appear able to delivering the excellent progress that the market expects from them, due to the profitable alternatives they’re sitting on. And that is why buyers can think about shopping for both inventory, regardless of the terrific good points they’ve clocked to date this 12 months.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $830,777!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

The place Will Plug Energy Be in 3 Years?

It isn’t exhausting to color a rosy image for like Plug Energy (NASDAQ: PLUG). In accordance with a latest report by international consultancy McKinsey & Co, “international clear hydrogen demand is projected to develop considerably by 2050, however infrastructure scale-up and know-how developments are wanted to fulfill projected demand.” As an organization that gives that infrastructure and know-how, Plug Energy is within the driver’s seat to fulfill this progress in demand that might be sustained for many years.

With a of simply $1.8 billion, there’s actually loads of upside potential to Plug Energy inventory. Deloitte, one other international consultancy, predicts that the worldwide marketplace for hydrogen might attain $1.4 trillion by 2050. However what in regards to the subsequent three years? The true progress potential of Plug Energy inventory would possibly shock you.

Hydrogen demand continues to be in its infancy

Whereas wind and solar energy get a lot of the consideration, hydrogen energy has a big alternative to assist the world transition away from fossil fuels. That is as a result of hydrogen gas is especially good at decarbonizing what economists name “exhausting to abate” sectors. Asphalt, cement, metal, transport, aviation — these are only a few areas the place changing fossil fuels with renewable vitality stays very troublesome.

Hydrogen gas is a viable substitute for 2 causes. First, it has a a lot larger vitality density than batteries. This makes it an appropriate possibility for trucking and aviation, the place hauling voluminous, heavy batteries is not sensible. Moreover, sectors like steelmaking, cement manufacturing, and petrochemical require very excessive temperatures to function, typically in extra of 1,000 levels. Hydrogen can create this degree of excessive warmth, whereas electrical energy — whether or not produced by clear or soiled types of vitality — struggles.

If we need to decarbonize hard-to-abate sectors of the economic system, hydrogen has a powerful case. However demand continues to be very a lot in its infancy. There is a cause why analysis from Deloitte and McKinsey & Co focuses on timelines all the best way out to 2050 — it is going to take that a lot time for the hydrogen economic system to take off.

Hydrogen gas on the whole nonetheless is not cost-competitive with fossil fuels. And hydrogen will be produced with cleaner or dirtier strategies, that means {that a} transition to hydrogen gas will not essential decarbonize the sector in query. Plus, hydrogen requires numerous infrastructure — every little thing from manufacturing and transportation to distribution. It additionally wants a fleet of finish customers prepared to simply accept it as a gas supply.

Hydrogen gas has numerous promise. However there are clear hurdles that make this a multi-decade story. Do not anticipate this equation to alter over the subsequent three years.

Will Plug Energy have the ability to trip the clear vitality tidal wave?

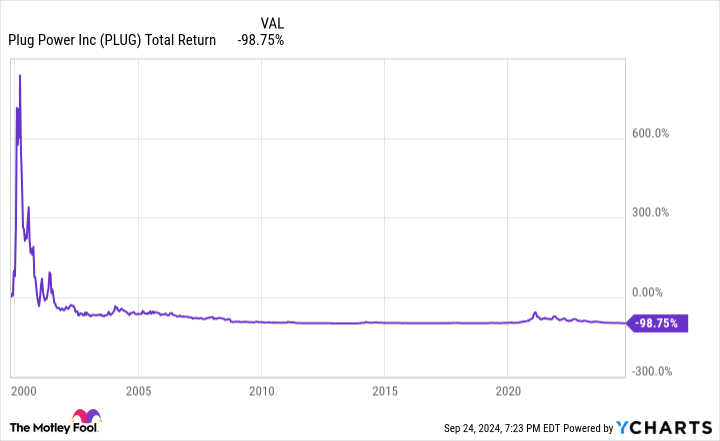

There is not any doubt that Plug Energy has an early begin. The corporate was began in 1997, and went public in 1999 on the top of the dot-com bubble. Suffice it to say, it has been an extended journey. Lengthy-term buyers have not been that happy. If you happen to had invested within the firm throughout its IPO, you’d have simply 1.25% of your unique capital left.

The difficulty going through Plug Energy over the subsequent few years isn’t any totally different than the challenges which have plagued the corporate since its founding. Hydrogen energy, for all its promise, continues to be forward of its time, and an inflection level is nowhere shut. Goldman Sachs estimates Plug Energy’s fairness period — or the weighted common period of its money flows — to be roughly 26 years.

That is a very long time to be ready. And in the course of the interim, anticipate heavy dilution. Over the previous couple of many years, Plug Energy shares have struggled as a result of an absence of profitability, but in addition because of the huge share dilution essential to maintain the corporate afloat.

Over the subsequent three years, there aren’t many main catalysts to look ahead to. Elevating capital will proceed to be a problem, and anticipate administration to proceed touting the potential of the hydrogen economic system as a complete. However even when the hydrogen economic system does unexpectedly take off, there isn’t any assure that Plug Energy’s know-how specifically will win.

The place will Plug Energy be in three years? Probably in the identical place it’s immediately: Struggling for financing, hoping {that a} hydrogen inflection level arrives a lot earlier than anticipated.

Must you make investments $1,000 in Plug Energy proper now?

Before you purchase inventory in Plug Energy, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Plug Energy wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Freight market inexperienced shoots fade heading into October

Chart of the Week: Nationwide Truckload Index (Linehaul Solely), Van Outbound Tender Rejection Index – USA : NTIL.USA, VOTRI.USA

Spot charges excluding the full estimated value of gas (NTIL) have fallen 3% because the begin of August. Dry van tender rejection charges (VOTRI), which measure the proportion of hundreds that carriers are unable to cowl for his or her clients, are averaging about 30 foundation factors decrease. In different phrases, the market that seemed to be exhibiting indicators of tightening in the summertime has reversed course over the previous quarter.

For these much less acquainted with the U.S. freight market, spot charges usually enhance when it is more difficult to discover a truck to cowl freight and reduce when it’s simpler. The spot market is the Wild West of the trucking market. It represents essentially the most excessive ranges of volatility and the polarized edges of the business.

Spot charges are very helpful in near-term traits however lose worth when trying over the course of a number of years as a result of inflation and mixing. Working prices for carriers have elevated greater than 30% over the previous 5 years, placing invisible upward stress on charges. Sadly for a lot of carriers, they haven’t been in a position to move alongside a lot of those prices as a result of a particularly aggressive atmosphere. A flood of recent entrants throughout the pandemic period is essentially guilty.

Service particulars evaluation of internet modifications in Federal Motor Service Security Administration energetic working authorities reveals there was report progress of fifty% in newly registered service of property working authorities from 2020 into the center of 2022. This fee of progress quadrupled the speed that occurred available in the market from 2018-19. The results of that was additionally a powerful extended market downturn, leading to quite a few service exits.

The pandemic demand bubble has been bursting for over two and a half years for the home transportation market. Greater than 200 carriers per week are leaving the house internet of entrants. The gross majority of those exits are small fleets and owner-operators consisting of fewer than 5 vans and most with lower than three years of expertise.

To date, the deterioration in capability has solely resulted in a couple of short-lived intervals of slight market vulnerability.

Final yr’s refrigerated (reefer) trucking market was the primary to indicate indicators of tightening. Spot (RTI) and rejection charges (ROTRI) jumped in entrance of Labor Day and rode a curler coaster into January earlier than falling again to report lows. The reefer market has since recovered in a extra sustainable method however has stumbled over the previous week.

The dry van market, which represents the majority of the for-hire trucking market exercise, additionally has had a couple of moments. The polar plunge of arctic air in January pushed spot and rejection charges again to Christmas ranges as shippers had been stalled for a couple of days.

Over the summer season, spot and rejection charges spiked as an surprising influx of imports hit the West Coast, placing a pressure on service networks. There was ample slack in capability to get well, nonetheless, and now the market is trending softer after exhibiting growing indicators of vulnerability.

Hurricanes and strikes

Hurricane Helene landed as a significant Class 4 storm, with a lot of its impression on infrastructure hitting the inland markets within the Southeast.

Atlanta’s outbound rejection charges plummeted in entrance of the storm, whereas inbound rejection charges jumped. This might result in some stage of short-lived disruption however in all probability not a market breaker like Harvey was in 2017.

The Worldwide Longshoremen’s Affiliation strike additionally has some potential relying on whether or not it happens and for a way lengthy, however many shippers have been getting ready for this for a number of months now.

Is that this the brand new regular?

The attainable excellent news for transportation service suppliers is that whereas the spot market has collapsed and most of the disruptive occasions have pale within the close to time period, rejection charges are nonetheless trending greater over the course of a yr. The probability of a sustained market flip this fall has pale, however that doesn’t take away the potential of a powerful shift in 2025.

Capability exits at its quickest tempo over the winter. If this development continues and the market stays tender by way of the vacations, the probability of a extreme provide shock will increase considerably.

Definitively, this market just isn’t sustainable. It would shift. The truth that capability continues to exit at report ranges tells you that provide is diving towards demand on the curve. The timing is at all times essentially the most difficult factor to foretell and the shift will in all probability happen when many have lowered their guard.

And who can blame them, as this has been the longest, most extreme freight recession in trendy occasions.

Concerning the Chart of the Week

The FreightWaves Chart of the Week is a chart choice from that gives an fascinating information level to explain the state of the freight markets. A chart is chosen from 1000’s of potential charts on to assist members visualize the freight market in actual time. Every week a Market Knowledgeable will publish a chart, together with commentary, dwell on the entrance web page. After that, the Chart of the Week will probably be archived on FreightWaves.com for future reference.

SONAR aggregates information from a whole bunch of sources, presenting the information in charts and maps and offering commentary on what freight market specialists need to know in regards to the business in actual time.

The FreightWaves information science and product groups are releasing new datasets every week and enhancing the consumer expertise.

To request a SONAR demo, click on .

The publish appeared first on .

Markets

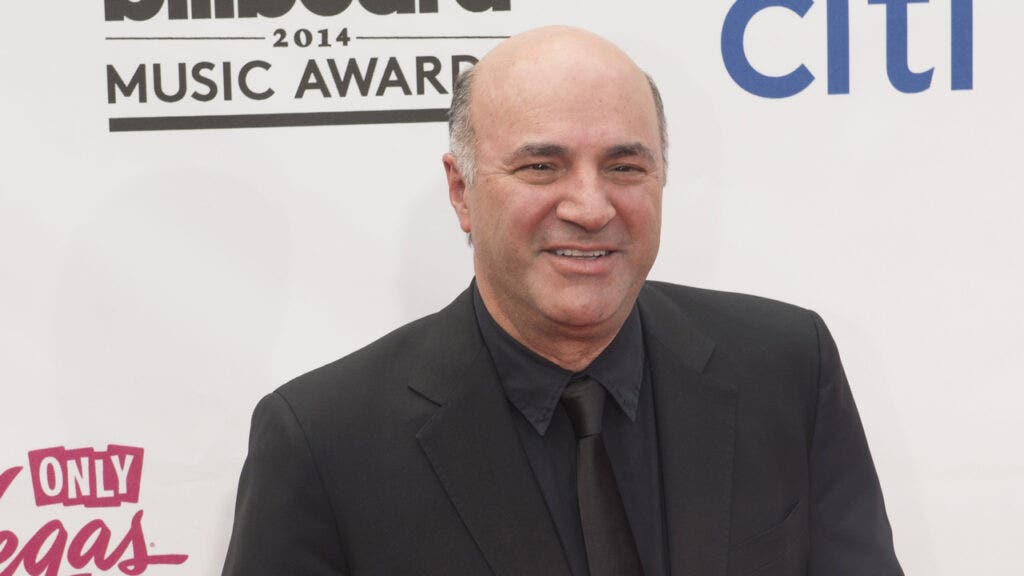

'You By no means Ask Me for Cash Once more': Kevin O'Leary Explains As a substitute Of Investing In Household Members' Companies, He Items Money With A Caveat

, a big-name investor identified for his no-nonsense method to enterprise, has a singular technique for coping with relations who ask him for cash. He is had his justifiable share of family coming to him with huge concepts and excessive hopes, on the lookout for a hefty funding. And with O’Leary’s monetary standing, it isn’t shocking. The Canadian enterprise proprietor and Shark Tank star has a internet price of round $400 million.

Do not Miss:

However whereas he is beneficiant, he is additionally obtained boundaries that assist maintain household and funds from clashing. In a brief YouTube video, O’Leary defined his actions when relations ask him for cash. He acknowledges the age-old reality: “More cash, extra issues.” O’Leary says, “It is a improbable factor but it surely makes your life difficult as a result of many individuals need a few of it from you at no cost – notably relations. It is a large concern.”

Trending: Amid the continued EV revolution, beforehand missed low-income communities

O’Leary clarifies that individuals come to anticipate one thing for nothing . And to deal with this, he is developed an easy technique that retains issues clear and avoids awkward Thanksgiving dinners.

When a member of the family approaches him for cash – whether or not it is to begin a restaurant or launch a brand new enterprise – he presents a one-time reward. Within the case he mentions, it is $50,000. Not a mortgage, not an funding, only a reward. However there is a catch: “You by no means ask me for cash once more. Ever.” O’Leary’s rule is easy: after that test, there will likely be no extra handouts, no future expectations, and no monetary entanglements. As he humorously provides, he arms over the cash after which “goes again to sprucing his eggs.” It is a clear break that leaves no room for future monetary disputes or awkward household interactions.

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

For many who do not have a portfolio like O’Leary’s, his method nonetheless presents a beneficial lesson. Setting clear boundaries is essential when lending or gifting cash to household. Getting caught up within the feelings and obligations that include serving to family members is straightforward, however issues can get messy with out clear guidelines. An excellent method for the remainder of us is likely to be to solely give what we will afford to lose – whether or not that is $50, $500, or $5,000 – and make it clear that it is a one-time deal. No loans, no strings, no awkward household gatherings.

Dealing with household and cash might be tough, however O’Leary’s method reveals that it is all about setting expectations and sticking to them. And perhaps, simply perhaps, it is also about having just a little humor to maintain issues from getting too tense.

It is at all times good to earlier than making huge selections, particularly when household is concerned. They might help you identify what makes essentially the most sense in your scenario and set the best boundaries. It isn’t simply in regards to the cash – it is about retaining relationships intact whereas making decisions that work for everybody. Just a little steerage can go a great distance in guaranteeing your funds and household ties keep sturdy.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and methods to achieve an edge within the markets.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook