Markets

Right here's the Synthetic Intelligence (AI) Progress Inventory Down 24% I Simply Added to My Portfolio

Sometimes, the market will put an excellent inventory on sale, and it is vital to acknowledge whether or not that sale is a shopping for alternative or a warning to traders.

The market might put a inventory on sale as a result of operations are deteriorating, competitors is consuming into its market share, or for a number of different authentic causes. Generally, although, the market finally ends up weighing near-term challenges far more closely than a constructive long-term outlook of an organization. And that may be an excellent alternative for traders.

Adobe (NASDAQ: ADBE) is one such firm that is seen its inventory overwhelmed down not too long ago. It is growing modern options and options utilizing to assist additional development in its market-leading software program suites. Regardless of the market sending shares greater after a robust second-quarter earnings report and improved outlook, the share value remains to be down 24% from the all-time excessive it reached on the finish of 2021. There’s nonetheless a chance for traders to purchase shares at present.

Injecting generative AI into every little thing it does

Adobe is a market chief in enterprise-level content-creation software program (Photoshop, Lightroom, Illustrator) and doc administration (Acrobat, Acrobat Signal), in addition to advertising and promoting options.

Its Artistic Cloud and Doc Cloud subscriptions present a secure supply of recurring income. The software program suites are requirements within the business, which creates two benefits.

Since everybody else is utilizing Adobe file codecs, there is a whereby individuals within the business want Adobe software program to work together with each other. A designer will ship an Adobe file to a consumer or one other designer. If they do not have Adobe’s software program, they may not be capable to work together with the design as supposed.

The second issue is that Adobe’s software program turns into very sticky. No supervisor goes to threat switching software program suites simply to save lots of a couple of bucks. It will require retraining employees, and it might lead to an inferior manufacturing. Whereas freelance designers may solely pay for a subscription once they have a necessity for Adobe’s software program, they’re unlikely to go away Adobe for good.

Adobe is utilizing AI to attract extra customers to its merchandise and improve annual-recurring income. Its generative AI is known as Firefly, and it is educated on Adobe’s proprietary-data set. It powers well-liked options like Generative Fill and Generative Increase in Photoshop, Textual content to Vector in Illustrator, and Take away Object in Lightroom.

Adobe gives restricted use of Firefly options without spending a dime, attracting new customers to its merchandise by way of its Adobe Categorical service. It is seen robust conversion to paid prospects, and it is seen a rise in income per consumer and renewals on account of Firefly.

It launched Acrobat AI Assistant in April, which may summarize a doc and reply questions primarily based on the knowledge within the doc. It provides the AEP AI Assistant within the Adobe Expertise Platform, which may help entrepreneurs automate duties, simulate outcomes, and generate new audiences to focus on.

Trending again in the appropriate path

Administration upset traders with its Q1 earnings launch. The most important purple flag was a slowdown in average-recurring income (ARR) development for its digital-media phase. It forecast simply $440 million in new ARR for Q2.

As talked about, Adobe’s merchandise are sticky, and it is drawing prospects in with new AI options. It blew its forecast out of the water with $487 million in net-new ARR for its digital-media phase. It additionally offered a robust forecast going ahead with $460 million in net-new ARR subsequent quarter and $1.95 billion for the complete 12 months.

Administration’s commentary on the Q2 earnings name suggests the brand new AI options are driving greater conversion charges from free Categorical customers, rising income per consumer because of premium options, and rising retention charges. That bodes effectively for long-term internet will increase in ARR.

Due to its subscription mannequin, Adobe generates constant free money stream each quarter. A one-time expense for the failed Figma acquisition weighed on free money stream final quarter, but it surely returned to regular ranges in Q2. It is utilizing that money to fund its $25 billion share-buyback program approved in March. It already purchased again $2.5 billion in Q2.

It isn’t too late to purchase Adobe inventory

Whilst you may not be capable to get pretty much as good of a value as earlier this month, it is not too late to purchase Adobe inventory.

Even after the surge in value following its Q2 earnings report, Adobe shares commerce for simply 25.5 occasions forward-earnings estimates. (A few of these estimates might obtain an upward revision after factoring in administration’s improved outlook.) That is a slight premium to the market common for a enterprise that ought to be capable to produce above-average earnings development.

Adobe’s a software program enterprise, and whereas it is investing closely in AI growth, it ought to be capable to improve its working margin because it positive factors scale and prospects pay extra for superior AI options. The affect of FireFly and its AI Assistants ought to drive robust top-of-funnel curiosity in its software program and better conversion charges, resulting in robust income development. Analysts at present count on annual earnings to develop a mean of twenty-two% by way of subsequent 12 months, however that could be low contemplating administration’s revised outlook.

So, even after a slight restoration, it is not too late to purchase shares of Adobe.

Do you have to make investments $1,000 in Adobe proper now?

Before you purchase inventory in Adobe, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for traders to purchase now… and Adobe wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $830,777!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has positions in Adobe. The Motley Idiot has positions in and recommends Adobe. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

'You By no means Ask Me for Cash Once more': Kevin O'Leary Explains As a substitute Of Investing In Household Members' Companies, He Items Money With A Caveat

, a big-name investor identified for his no-nonsense method to enterprise, has a singular technique for coping with relations who ask him for cash. He is had his justifiable share of family coming to him with huge concepts and excessive hopes, on the lookout for a hefty funding. And with O’Leary’s monetary standing, it isn’t shocking. The Canadian enterprise proprietor and Shark Tank star has a internet price of round $400 million.

Do not Miss:

However whereas he is beneficiant, he is additionally obtained boundaries that assist maintain household and funds from clashing. In a brief YouTube video, O’Leary defined his actions when relations ask him for cash. He acknowledges the age-old reality: “More cash, extra issues.” O’Leary says, “It is a improbable factor but it surely makes your life difficult as a result of many individuals need a few of it from you at no cost – notably relations. It is a large concern.”

Trending: Amid the continued EV revolution, beforehand missed low-income communities

O’Leary clarifies that individuals come to anticipate one thing for nothing . And to deal with this, he is developed an easy technique that retains issues clear and avoids awkward Thanksgiving dinners.

When a member of the family approaches him for cash – whether or not it is to begin a restaurant or launch a brand new enterprise – he presents a one-time reward. Within the case he mentions, it is $50,000. Not a mortgage, not an funding, only a reward. However there is a catch: “You by no means ask me for cash once more. Ever.” O’Leary’s rule is easy: after that test, there will likely be no extra handouts, no future expectations, and no monetary entanglements. As he humorously provides, he arms over the cash after which “goes again to sprucing his eggs.” It is a clear break that leaves no room for future monetary disputes or awkward household interactions.

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

For many who do not have a portfolio like O’Leary’s, his method nonetheless presents a beneficial lesson. Setting clear boundaries is essential when lending or gifting cash to household. Getting caught up within the feelings and obligations that include serving to family members is straightforward, however issues can get messy with out clear guidelines. An excellent method for the remainder of us is likely to be to solely give what we will afford to lose – whether or not that is $50, $500, or $5,000 – and make it clear that it is a one-time deal. No loans, no strings, no awkward household gatherings.

Dealing with household and cash might be tough, however O’Leary’s method reveals that it is all about setting expectations and sticking to them. And perhaps, simply perhaps, it is also about having just a little humor to maintain issues from getting too tense.

It is at all times good to earlier than making huge selections, particularly when household is concerned. They might help you identify what makes essentially the most sense in your scenario and set the best boundaries. It isn’t simply in regards to the cash – it is about retaining relationships intact whereas making decisions that work for everybody. Just a little steerage can go a great distance in guaranteeing your funds and household ties keep sturdy.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and methods to achieve an edge within the markets.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

A Few Years From Now, You'll Want You'd Purchased This Undervalued Excessive-Yield Inventory

One of many largest temptations for dividend traders is reaching for yield. Principally, which means taking over dangerous investments simply to gather a bigger revenue stream. You will be higher off in the long term if you happen to err on the aspect of warning, significantly if you’ll want to reside off of the revenue you’re producing. That is why Enterprise Merchandise Companions (NYSE: EPD) is a high-yield funding you may want you’d purchased. A fast comparability to Altria (NYSE: MO) will assist clarify why.

Who wins the high-yield story, Altria or Enterprise?

Relating to yield, Altria’s 8.1% is a full proportion level increased than the distribution yield of Enterprise Merchandise Companions’ 7.1%. Each have elevated their dividends usually, so many traders would possibly default to the higher-yielding choice. However that is not essentially the most effective plan.

Altria, , comes with extra threat than it’s possible you’ll assume regardless of working in what is mostly thought of a dependable sector. That is as a result of its fundamental product is cigarettes. This enterprise has been in a secular decline for a very long time. Within the second quarter of 2024 alone, Altria’s cigarette volumes fell 13% 12 months over 12 months. That is not a fluke. Within the second quarter of 2023, volumes fell 8.7%. In the identical quarter of 2022, cigarette quantity was off by 11.1%. Any latest quarter and any latest full 12 months would have proven the identical horrible development.

The corporate has offset quantity declines with worth will increase, which has allowed it to proceed rising its dividend regardless of the clearly horrible course of its most essential enterprise line. There is a very actual probability that you’ll remorse shopping for this high-yield dividend inventory if it may possibly’t stem the bleeding not directly.

Enterprise is a completely completely different story.

Enterprise’s decrease yield comes with decrease threat

You possibly can simply argue that Enterprise comes with its personal dangers, on condition that it operates within the extremely risky vitality sector. And its midstream enterprise is immediately tied to demand for oil and pure gasoline, which is being pressured by the transfer towards cleaner options. Truthful sufficient, however what does Enterprise truly do?

As a midstream supplier, Enterprise owns important infrastructure belongings that assist transfer oil and pure gasoline around the globe. It typically fees charges for using its infrastructure, so the worth of vitality is much less essential than the demand for vitality. Demand for vitality tends to stay sturdy whatever the worth of oil and pure gasoline.

However here is the large truth — regardless of all of the hype round clear vitality, demand for oil and pure gasoline is predicted to stay sturdy for many years to come back. Actually, demand will doubtless improve for these fuels, with far dirtier coal bearing the brunt of the clear vitality change.

In different phrases, Enterprise’s enterprise is not as dangerous as it could appear. On prime of that, it is without doubt one of the largest midstream gamers in North America with an investment-grade-rated steadiness sheet. Whereas inner development choices are restricted, it has lengthy acted as an trade consolidator. It simply introduced plans to purchase Pinon Midstream for $950 million, for instance. Acquisitions are lumpy and unimaginable to foretell, however they provide Enterprise ample room for development on prime of the sluggish and regular worth will increase it is going to be in a position to extract from clients.

In order for you a excessive yield from a rising enterprise, Enterprise is the higher choice when in comparison with Altria and its declining core enterprise. Certain, you may hand over a proportion level of yield, however as Altria continues to wrestle, that final level will can help you sleep at evening if you happen to purchase Enterprise.

Enterprise’s yield nonetheless appears low-cost

Here is essentially the most fascinating half: Enterprise’s 7.1% dividend yield is above its 10-year common yield of 6.3%. So regardless of the restoration from pandemic lows, it nonetheless seems to be undervalued. A rising enterprise, a financially robust firm, and an undervalued worth all make Enterprise a high-yield inventory you may remorse lacking out on. Particularly whenever you evaluate it to different high-yield decisions with equally excessive, however far riskier, yields.

Must you make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Altria Group wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

If You Purchased 1 Share of Nvidia at Its IPO, Right here's How Many Shares You Would Personal Now

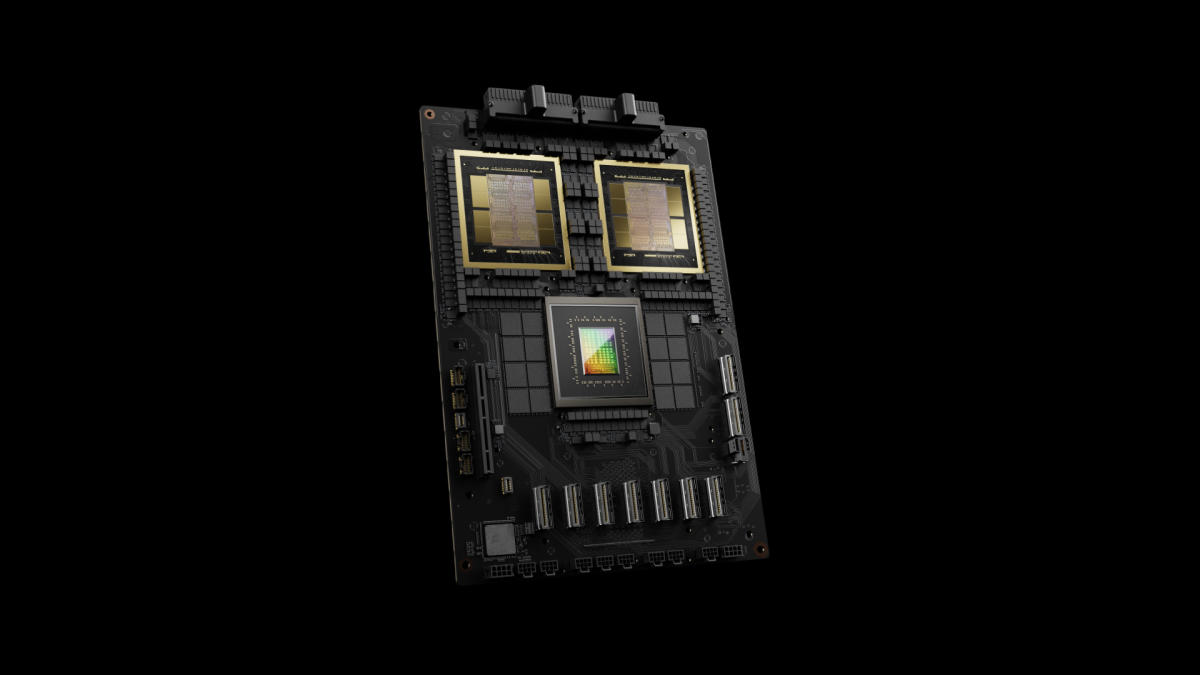

Since its IPO in January 1999, Nvidia (NASDAQ: NVDA) has established itself as one of many world’s most profitable firms. It has been notably adept at adapting its expertise to increase into new markets.

The corporate pioneered the that revolutionized the gaming business, turning boxy figures into lifelike pictures. The key to its success was parallel processing, which allowed the chips to conduct a large number of mathematical calculations concurrently. Nvidia’s processors are actually used for product design, autonomous methods, cloud computing, information facilities, synthetic intelligence (AI), and extra.

The flexibility to adapt its expertise has been a boon to shareholders. Even when buyers did not get in on the IPO itself, Nvidia shares fell beneath their challenge worth quite a few occasions in early 1999. For buyers lucky sufficient to get shares at (or beneath) the $12 IPO worth, the inventory has returned 493,940%.

Multiplying like rabbits

Whereas a single share of inventory may appear inconsequential at first look, one share of the proper inventory can have a huge effect on an investor’s success. In Nvidia’s case, the corporate’s efficiency and hovering inventory worth have resulted in quite a few inventory splits, turning one share into many extra.

Here is a listing of Nvidia’s inventory splits over time:

-

2-for-1 cut up, June 27, 2000

-

2-for-1 cut up, Sept. 12, 2001

-

2-for-1 cut up, April 7, 2006

-

3-for-2 cut up, Sept. 11, 2007

-

4-for-1 cut up, July 20, 2021

-

10-for-1 cut up, June 10, 2024

Because of the a number of inventory splits, an investor who purchased only one share of Nvidia inventory close to its IPO in 1999 would now be the proud proprietor of 480 shares.

Nevertheless, it took an excessive amount of self-discipline and self-control to carry Nvidia for greater than 25 years and reap this windfall. The inventory has misplaced greater than half its worth on quite a few events, which despatched fair-weather buyers scrambling for the exits.

That stated, take into account this: A $1,000 funding in Nvidia made in early 1999 would now be value greater than $4.9 million.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook