Markets

Does My Retirement Revenue Rely as Revenue for Social Safety?

Deciding when to take Social Safety advantages is without doubt one of the most necessary inquiries to reply in planning your retirement technique. Second to that’s understanding what may improve—or cut back—your profit quantity. Does retirement revenue depend as revenue for Social Safety? No, however working whereas claiming advantages might shrink the quantity that you simply’re capable of gather. Speaking to a may help you to maximise Social Safety advantages in retirement.

Understanding Social Safety Advantages

retirement advantages are designed to offer a complement supply of revenue to eligible seniors. You possibly can start taking Social Safety retirement advantages as early as 62, although doing so can cut back the quantity you obtain. Ready till age 70 to start taking advantages, in the meantime, can improve your profit quantity.

based mostly in your earnings historical past. Particularly, Social Safety considers earned revenue, wages and internet revenue from self-employment. If any cash is withheld out of your wages for Social Safety or FICA taxes, then your wages are coated by Social Safety because you’re paying into the system.

Once you apply for advantages, Social Safety makes use of your common listed month-to-month earnings to resolve how a lot you qualify for. This common relies on as much as 35 years of your listed earnings and it’s used to calculate your main insurance coverage quantity (PIA). The PIA determines the advantages which might be paid out to you when you retire.

Does Retirement Revenue Rely as Revenue for Social Safety?

Retirement revenue doesn’t depend as revenue for Social Safety and gained’t have an effect on your profit quantity. Particularly, the Social Safety Administration excludes the next from revenue:

None of those are thought of earnings for Social Safety functions. Once more, Social Safety solely appears at cash that you simply truly earn from working a job or being self-employed. That signifies that you possibly can gather Social Safety advantages whereas additionally taking withdrawals from a or particular person retirement account (IRA) or receiving funds from an annuity. gained’t have an effect on your Social Safety advantages or eligibility for Medicare both.

With a reverse mortgage, you faucet into your own home fairness however as a substitute of creating funds to a lender, the lender makes funds to you. You don’t need to pay something again in direction of the reverse mortgage so long as you’re dwelling within the house. Many retirees select to complement Social Safety advantages with a reverse mortgage.

Does Working in Retirement Scale back Social Safety Advantages?

might cut back your month-to-month funds, relying in your age and earnings.

Underneath Social Safety guidelines, you’re thought of to be retired as soon as you start receiving advantages. In the event you’re beneath full retirement age however nonetheless working, Social Safety can deduct $1 out of your profit funds for each $2 you earn above the annual restrict. For 2023, the restrict is $21,240.

Within the yr you attain your (FRA), the deduction modifications to $1 for each $3 earned above a unique annual restrict. For 2023, the restrict is $56,520. When you attain your full retirement age, your advantages are now not diminished no matter how a lot you earn. Social Safety may also recalculate your profit quantity so that you simply get credit score for any months that your advantages have been diminished due to your earnings.

Coordinating Retirement Withdrawals and Social Safety

Deciding when to take Social Safety advantages begins with contemplating your different sources of retirement revenue. For instance, that may embrace:

You would additionally add a right here, although it’s technically not a retirement account. An HSA allows you to lower your expenses on a tax-advantaged foundation for healthcare bills however when you flip 65, you’ll be able to withdraw cash from it for any motive and not using a tax penalty. You’ll, nevertheless, pay unusual revenue tax on the distribution.

From a tax perspective, it normally is sensible to start out with taxable accounts first, then tax-advantaged accounts for withdrawals, leaving Roth and Roth-designated accounts final. In doing so, you permit your Roth investments to proceed rising tax-free till you want them.

When it comes to when to take Social Safety advantages, delaying normally is sensible if you happen to’re hoping to get a bigger payout or you may have different sources of revenue to depend on. You may also think about pushing aside taking advantages if you happen to plan to proceed working up till your full retirement age, as that would let you declare a bigger profit quantity.

A monetary advisor may help you construct an environment friendly plan for coordinating your retirement revenue.

Creating A number of Streams of Revenue for Retirement With out Affecting Social Safety

Since retirement revenue doesn’t depend as revenue for Social Safety, it might be to your benefit to have a couple of supply that you may depend on. You may already be contributing to your 401(ok) at work however you possibly can add an IRA into the combo for extra financial savings.

Whether or not it is sensible to decide on a can rely on the place you count on to be tax-wise when you retire. You may select a standard IRA if you happen to count on to be in a decrease tax bracket down the road however may gain advantage from claiming deductible contributions now. Then again, a Roth IRA could be preferable if you happen to’d like to have the ability to withdraw cash tax-free in retirement.

An annuity is an alternative choice if you happen to’d like to take a position cash now to generate assured revenue later. When contemplating an annuity, it’s necessary to learn the way various kinds of annuities work and what they’ll value.

Actual property could be one other risk if you happen to’re in search of a passive revenue possibility that gained’t have an effect on your Social Safety advantages. You would or , however proudly owning property straight isn’t a requirement. You can even revenue by means of actual property funding trusts (REITs), actual property crowdfunding platforms or actual property mutual funds.

Speaking to a can provide you a greater concept of easy methods to create a number of streams of revenue for retirement, with out affecting your Social Safety advantages. An advisor also needs to find a way that can assist you formulate a method for getting probably the most advantages attainable for your self and your partner if you happen to’re married.

Backside Line

Retirement revenue gained’t have an effect on your Social Safety advantages, however revenue earned from working might. In the event you plan to attract Social Safety whereas working, it’s useful to know what that may imply to your advantages payout. Getting an early begin with saving and investing for might let you delay taking Social Safety so that you simply’re capable of declare a bigger profit.

Retirement Planning Suggestions

-

Working with a monetary advisor may help you to fine-tune your retirement plan. Discovering a monetary advisor doesn’t need to be arduous. matches you with as much as three vetted monetary advisors who serve your space, and you’ll have a free introductory name along with your advisor matches to resolve which one you’re feeling is best for you. In the event you’re prepared to seek out an advisor who may help you obtain your monetary targets, .

-

for retirees who’ve substantial revenue from wages, self-employment, curiosity and dividends. In the event you’re working whereas claiming advantages or incomes curiosity and dividend revenue, you will have to pay taxes on a few of your advantages, relying on how a lot revenue you may have.

-

Take a look at our free for a fast estimate on what you’ll be able to count on based mostly in your age, anticipated retirement and sources of revenue.

-

Preserve an emergency fund readily available in case you run into surprising bills. An emergency fund ought to be liquid — in an account that is not liable to vital fluctuation just like the inventory market. The tradeoff is that the worth of liquid money may be eroded by inflation. However a high-interest account lets you earn compound curiosity. .

Photograph credit score: ©iStock.com/SrdjanPav, ©iStock.com/AJ_Watt, ©iStock.com/RollingCamera

The publish appeared first on .

Markets

Billionaires Warren Buffett, David Tepper, and Terry Smith Are Sending a Very Clear Warning to Wall Avenue — Are You Paying Consideration?

For the higher a part of two years, the bulls have been firmly in management on Wall Avenue. A resilient U.S. economic system, coupled with pleasure surrounding the rise of synthetic intelligence (AI), have helped carry the ageless Dow Jones Industrial Common (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-focused Nasdaq Composite (NASDAQINDEX: ^IXIC) to a number of record-closing highs in 2024.

Nevertheless, . A number of the most distinguished and broadly adopted billionaire cash managers, together with Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) Warren Buffett, Appaloosa’s David Tepper, and Fundsmith’s Terry Smith, have been sending an ominous warning to Wall Avenue with their buying and selling exercise.

A few of Wall Avenue’s prime buyers are retreating to the sidelines

Though no cash supervisor is a carbon copy of one other, Buffett, Tepper, and Smith are lower from related cloths. Whereas they could have completely different areas of experience or dabble in funding areas the opposite two might not — e.g., David Tepper tends to be a little bit of a contrarian and is not afraid to put money into distressed property, together with debt — all three are typically affected person buyers who deal with finding undervalued/underappreciated firms that may be held for lengthy durations of their respective funds. It is a actually easy system that is labored nicely for all three billionaire buyers.

When Type 13Fs are filed with the Securities and Change Fee every quarter, skilled and on a regular basis buyers flock to those stories to see which shares, industries, sectors, and developments have been piquing the curiosity of Wall Avenue’s brightest funding minds. Nevertheless, the newest spherical of 13Fs had a shock for buyers who intently observe the buying and selling exercise of Buffett, Tepper, and Smith.

The June-ended quarter marked the seventh consecutive quarter that Warren Buffett was a internet vendor of shares. Jettisoning greater than 389 million shares of prime holding Apple throughout the second quarter, and north of 500 million shares, in mixture, since Oct. 1, 2023, has led to a cumulative $131.6 billion in internet inventory gross sales for the reason that begin of October 2022.

Regardless of advocating that buyers not guess in opposition to America, and emphasizing the worth of long-term investing, Buffett’s short-term actions have not lined up together with his long-term ethos.

However he is not alone.

David Tepper’s Appaloosa closed out June with a 37-security funding portfolio price round $6.2 billion. Through the second quarter, Tepper and his workforce added to 9 of those positions and diminished or utterly bought his fund’s stake in 28 others, together with Amazon, Microsoft, Meta Platforms, and Nvidia. Tepper dumped 3.73 million shares of Nvidia, equating to greater than 84% of Appaloosa’s prior place.

U.Ok. inventory picker extraordinaire Terry Smith ended June with a 40-stock portfolio price roughly $24.5 billion. He added to his stakes in simply three of those 40 shares — Fortinet, Texas Devices, and Oddity Tech — whereas decreasing his fund’s place within the different 37.

These affected person and traditionally optimistic buyers are sending a message that is undeniably clear: Worth is difficult to return by proper now on Wall Avenue.

Shares are traditionally dear — and that is an issue

Though “worth” is a very subjective time period, one valuation device factors to shares being at considered one of their priciest ranges in historical past, relationship again to the 1870s. I am speaking concerning the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also called the cyclically adjusted price-to-earnings ratio (CAPE ratio).

Most buyers are in all probability aware of the standard P/E ratio, which divides an organization’s share value into its trailing-12-month earnings per share (EPS). Whereas the P/E ratio tends to work fairly nicely for mature companies, it falls quick for development shares that reinvest plenty of their money move. It can be adversely impacted by one-off occasions, such because the COVID-19 lockdowns.

The Shiller P/E ratio is predicated on common inflation-adjusted EPS over the past 10 years. Taking a decade’s price of earnings historical past into consideration means short-term occasions do not adversely have an effect on this valuation mannequin.

As of the closing bell on Sept. 16, the S&P 500’s Shiller P/E stood at 36.27, which is just under its 2024 excessive of roughly 37, and greater than double the 153-year common of 17.16, when back-tested to 1871.

To be truthful, the Shiller P/E has spent a lot of the final 30 years above its historic common as a result of two elements:

-

The web democratized the entry to data, which gave on a regular basis buyers extra confidence to take dangers.

-

Rates of interest spent greater than a decade at or close to historic lows, which inspired buyers to pile into higher-multiple development shares that may profit from low borrowing prices.

However when examined as a complete, there are solely two different durations all through historical past the place the S&P 500’s Shiller P/E supported the next degree throughout a bull market. It peaked at 44.19 in December 1999, simply previous to the dot-com bubble bursting, and briefly topped 40 throughout the first week of January 2022.

Following the dot-com bubble peak, the S&P 500 shed simply shy of half of its worth, whereas the Nasdaq Composite misplaced greater than three-quarters earlier than discovering its footing. In the meantime, the 2022 bear market noticed the Dow Jones, S&P 500, and Nasdaq Composite all lose at the least 20% of their worth.

In 153 years, there have solely been six events the place the S&P 500’s Shiller P/E has surpassed 30 throughout a bull market, together with the current. Following all 5 earlier cases, the minimal draw back within the S&P 500 has been 20%, with the Dow Jones Industrial Common dropping as a lot as 89% throughout the Nice Despair.

The purpose is that prolonged inventory valuations can solely be sustained for therefore lengthy. Despite the fact that Warren Buffett would by no means guess in opposition to America, and Terry Smith is at all times looking out for undervalued property, neither billionaire cash supervisor feels compelled to place their capital to work. Actually, Berkshire Hathaway was sitting on a file $276.9 billion in money on the finish of June, and Buffett nonetheless is not a purchaser of shares… aside from shares of his personal firm.

Briefly, a few of Wall Avenue’s most-successful long-term, value-seeking buyers need little to do with the inventory market proper now, and it is a very clear warning that buyers ought to be being attentive to.

The place to take a position $1,000 proper now

When our analyst workforce has a inventory tip, it could actually pay to hear. In spite of everything, Inventory Advisor’s whole common return is 762% — a market-crushing outperformance in comparison with 167% for the S&P 500.*

They simply revealed what they imagine are the for buyers to purchase proper now…

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Amazon and Meta Platforms. The Motley Idiot has positions in and recommends Amazon, Apple, Berkshire Hathaway, Fortinet, Meta Platforms, Microsoft, Nvidia, and Texas Devices. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Traders ought to de-risk forward of US elections, BCA says

Lusso’s Information — Because the U.S. prepares for the extremely anticipated 2024 elections, BCA Analysis advises traders to take precautionary measures and de-risk their portfolios.

The monetary panorama is clouded by financial slowdown, geopolitical tensions, and the chance of market volatility within the lead-up to November.

Whereas BCA assigns a slight benefit to the Democrats, the margin is slim, and the opportunity of market disruptions stays excessive. Traders ought to act with warning, positioning themselves defensively to mitigate potential dangers.

A significant concern outlined by BCA Analysis is the looming risk of a recession.

“Unemployment is rising and has triggered the “Sahm Rule,” suggesting that recession is coming,” the analysts stated.

Whereas unemployment charges stay manageable in key states, an sudden spike may create a ripple impact, triggering a market selloff.

The U.S. inventory market, which usually peaks six months earlier than a recession, may see a pointy correction as early as September or October.

This mirrors the sample seen throughout earlier downturns, such because the 2008 monetary disaster, when an financial shock coincided with a significant fairness market collapse.

“For now, favor US property over international, US bonds over shares, defensive fairness sectors over cyclicals, well being care over different defensives, and aerospace/protection over different cyclicals,” the analysts stated.

The reasoning is simple. During times of financial contraction, industries that provide important providers or are supported by authorities spending typically carry out extra robustly.

Moreover, with rising recessionary pressures, U.S. bonds are prone to outperform equities, positioning fixed-income property as a safer choice for preserving capital.

Past financial considerations, geopolitical instability provides one other layer of uncertainty. BCA’s report highlights how rising tensions with each Russia and China may affect international markets.

Russia, particularly, poses a singular danger resulting from its potential for financial retaliation, equivalent to proscribing oil or uranium exports. These strikes may ship shockwaves by international vitality markets, driving up costs and including additional pressure to an already fragile international economic system.

China, grappling with its personal financial slowdown, presents structural dangers that would reverberate throughout the worldwide monetary system. Traders ought to pay attention to these geopolitical flashpoints, as any escalation in these areas may additional destabilize markets.

Including to those considerations is the prospect of so-called “October surprises.” BCA identifies a number of potential disruptions that would emerge simply earlier than the election.

Amongst these are sharp will increase in unemployment, bursts of social unrest, or perhaps a vital geopolitical occasion like a border disaster or terrorist assault.

Every of those eventualities has the potential to shift voter sentiment and affect the market, making it crucial for traders to anticipate and react to those potentialities.

BCA stresses that any of those occasions, notably in the event that they catch the market off guard, may drive fairness volatility to new highs.

The uncertainty surrounding the result of the election itself additionally contributes to market volatility.

As per BCA’s projections, Democrats maintain a 55% likelihood of securing the White Home, however the race is much from settled.

A Republican sweep would doubtless result in a really completely different set of outcomes, together with main tax cuts, main tariff hikes, main immigration curbs, and better odds of a regional warfare within the Center East

On the flip aspect, a Democratic win would convey gridlock, minor tax will increase, marginal fiscal enchancment, nuclear brinksmanship with Russia, and coalition-building towards China. Europe, Canada, Mexico, and Japan would see political danger premiums fall not in absolute phrases however relative to a Trump victory.

Amidst this political uncertainty, BCA urges traders to arrange for heightened market fluctuations whatever the election end result.

With neither get together having a transparent benefit, the danger of sudden disruptions—whether or not financial, political, or geopolitical—stays a severe concern. Due to this fact, de-risking is a great technique.

Markets

Prediction: This Will Be Nio's Subsequent Large Transfer

It could be laborious for buyers to get enthusiastic about an organization that has misplaced almost $1.5 billion from its operations within the first half of this 12 months. In actual fact, Chinese language electrical automobile (EV) maker Nio (NYSE: NIO) has by no means made a revenue.

That helps clarify why the inventory has misplaced greater than 80% of its worth over the previous three years. However there was additionally some significant and constructive information in Nio’s second-quarter report. That enterprise momentum has translated to the inventory value, as Nio’s American depositary shares have surged greater than 40% within the final month.

The is now at about $11 billion, and the maker ended the quarter with $5.7 billion in money and equivalents. That makes now a superb time to have a look at what Nio’s subsequent huge transfer will probably be and whether or not it is a inventory that must be in your portfolio.

A step towards earnings

One of the crucial notable achievements from Nio in Q2 was to considerably enhance its automobile revenue margin. Automobile margin, which is predicated on income and price of recent automobile gross sales, was 12.2% within the quarter, in comparison with simply 6.2% within the prior-year interval. That was helped by income that just about doubled 12 months over 12 months.

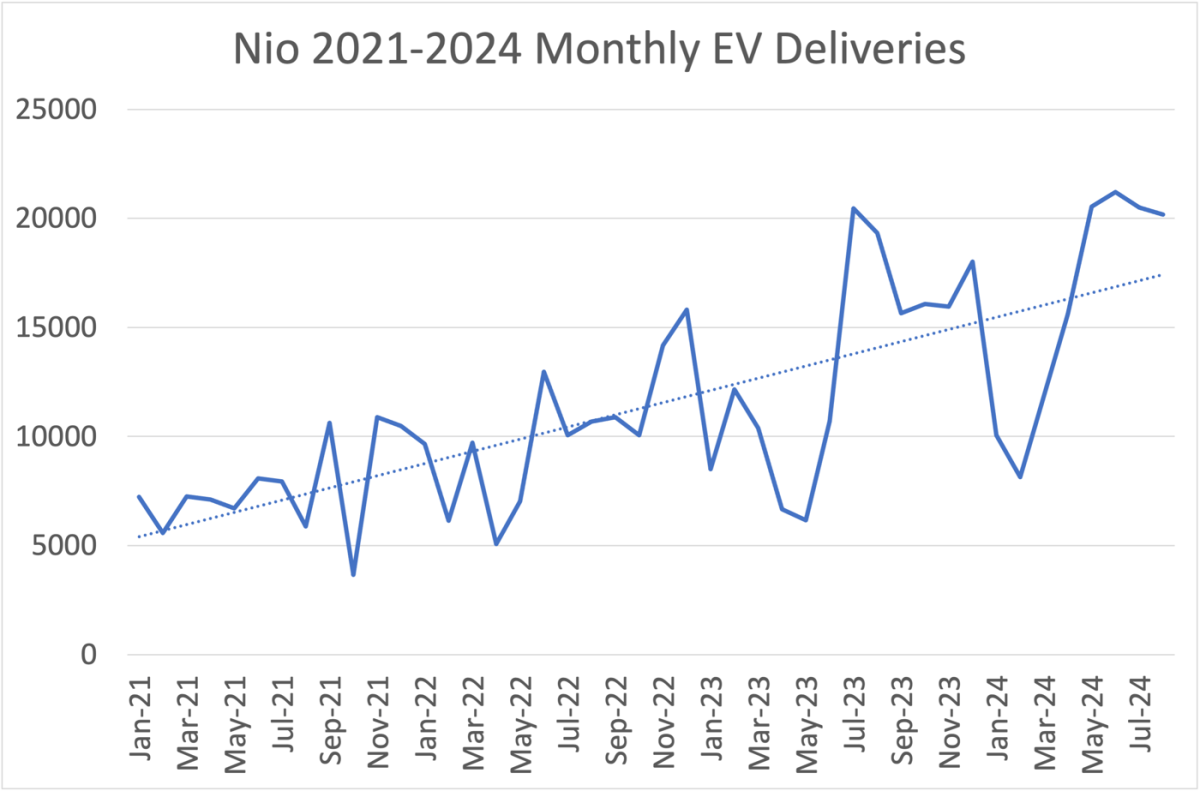

After years of suits and begins, it seems that Nio is lastly hitting its stride in automobile manufacturing and gross sales development. That comes as international competitors has grown within the EV sector. Nio has offered over 20,000 EVs for 4 consecutive months for the primary time. That has aided in gaining market share and boosting margins.

The corporate simply set a brand new quarterly file with greater than 57,000 models shipped. It additionally supplied steering for third-quarter automobile deliveries in a variety of 61,000 to 63,000 EVs. Nio’s CEO William Li famous that the corporate’s Q2 gross sales quantity led it to securing greater than 40% of market share inside China for EVs priced above the equal of about $42,000. And Nio has a plan to maintain increasing. Its concentrate on the luxurious finish of the market has helped it compete towards Chinese language EV chief BYD, which claims the lion’s share of the lower-priced Chinese language EV market.

Addressing vary anxiousness

Nio has been a pacesetter in China and elsewhere in working to broaden battery charging and its distinctive battery swapping know-how. Nio’s battery swap stations give EV consumers the choice to decrease the upfront automobile price by paying a month-to-month subscription for its Battery as a Service (BaaS) plan. Drivers can use its swap stations to switch drained batteries with freshly charged ones, a course of that takes solely minutes.

Final month, Nio introduced a brand new plan to strengthen its charging and battery swapping community throughout China. Its “Energy Up Counties” plan will speed up the buildout of these networks.

As of Aug. 31, Nio had over 2,500 battery swap stations globally, with over 800 strategically positioned on China’s expressways. With over 577,000 Nio automobiles on the roads, it has supplied battery swaps greater than 50 million occasions. Its new plan will lead to energy swap stations being accessible in hundreds of Chinese language counties by the tip of subsequent 12 months. It additionally plans to construct a brand new manufacturing facility to create as much as 1,000 energy swap stations yearly.

Mass market model

Nio’s new Onvo model may also make the most of the increasing charging and swapping networks. Onvo is Nio’s new entry-level EV model that seeks to faucet extra of a mass market and tackle Tesla‘s Mannequin Y. The Onvo L60 mid-size SUV has a beginning value of about $30,000.

That model, mixed with Nio’s current and rising charging know-how and infrastructure, could possibly be the subsequent driver for Nio’s enterprise and the inventory. Traders who’re prepared to be aggressive may add Nio inventory now, anticipating its subsequent section of development with Onvo. In any other case, look ahead to indicators that Onvo is gaining traction to be considerably extra conservative and nonetheless doubtlessly get forward of Nio’s subsequent huge transfer.

Must you make investments $1,000 in Nio proper now?

Before you purchase inventory in Nio, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Nio wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in BYD Firm, Nio, and Tesla. The Motley Idiot has positions in and recommends BYD Firm and Tesla. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024